☕️ Sunday Coffee: A Look Back at 2025 — and What We’re Building Next

2025 was a turning point.

MaxDividends Mission: Helping people build growing passive income, retire early, and live off dividends.

My personal life & business column — a mix of life moments, investing insights, and reflections on long-term wealth building.

Dear friends,

Happy Sunday. Grab a coffee and take a breath — this one is worth reading slowly.

I want to use today’s note to do two things: first, look back at what 2025 really meant for MaxDividends, and second, clearly share where we’re headed in the first quarter of 2026.

No hype. Just facts, direction, and why this project exists.

The Year MaxDividends Stood on Its Own

2025 was a turning point.

MaxDividends became a fully independent project. We moved to our own home at maxdividends.app and made a clear decision: this is no longer a side product or an experiment. It’s a long-term system built for dividend investors like you — and like me.

The idea behind dividend investing didn’t come from theory. It came from a simple realization inside our team:

Growing, reliable dividend income brings a level of confidence that price charts never will. It doesn’t replace investing. It completes it.

You still own great businesses. You still care about fundamentals and long-term value.

But now, your portfolio rewards you every quarter, year after year — not someday, but along the way.

MaxDividends used to live inside BeatMarket, our B2B analytics platform for advisors and institutions. In 2025, we deliberately separated the paths.

BeatMarket stays B2B. MaxDividends is built for individual investors — people building income, families, real goals, real expenses.

The goal is simple: Build a growing passive income and live off dividends over time — together, transparently, and without noise.

2025: The App - Built for Dividend People, Not Traders

Once we went independent, the next step was obvious: the app.

Not because it’s trendy — but because it’s practical. One-tap access. Clear numbers. No clutter.

Throughout 2025, we iterated heavily on what I call Dividend Mode.

Most broker apps and analytics tools weren’t built for us. They focus on price, charts, short-term movement. Dividend investors need different numbers:

income today

next payments

future income

dividend growth expectations

payout safety

We spent this year refining the first screen, dividend analytics, and portfolio views to show what actually matters — and to show it simply, even when the underlying logic is complex.

2025: Dividend Data - The Hardest, Most Important Work

This was the core focus of 2025. Let me be very honest with you.

Yes, Bloomberg is widely regarded as having solid data — and it also costs hundreds of thousands of dollars per year for what we would need. And that’s just one provider. At scale, costs easily approach seven figures.

That model doesn’t work for a project like ours — and it shouldn’t.

Instead, we built something much harder:

multiple raw data providers

automation

technology

manual verification

moderation layers

We clean, normalize, and verify dividend data until it reaches Bloomberg-level quality — at the cost of a cup of coffee per month for you.

And here’s why that matters:

Splits? We adjust instantly.

Dividend increases or cuts? Reflected immediately — not weeks later.

Special dividends? Separated, so you see the real picture.

Future payments? Verified against official sources.

Since July 2025, every future dividend payment in our system goes through full verification. In 2026, you’ll see that confirmation directly inside company analytics.

When you plan income, you deserve real numbers — not placeholders.

2025: The Book - Putting the Philosophy on Paper

In 2025, we turned the MaxDividends philosophy into a real book and published it on Amazon.

I recently received my own hardcover copy. It’s not marketing — it’s a practical playbook. Rules. Strategy. Examples. Clear language.

I keep it nearby as a reference. I hope it becomes the same for you.

2025: Buy / Hold / Sell — With Data Behind It

This year we launched the Dividend Eagles Buy / Hold / Sell list.

It’s a clean roadmap:

what we’re buying

what we’re holding

what no longer belongs in a dividend income portfolio

No guessing. No ambiguity.

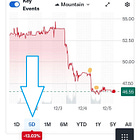

2025: Stock Scoring & Dividend Behavior

Since September, we’ve been tracking every dividend increase and cut among U.S. companies that have paid dividends for 10 years or more without interruption.

For each event, we record:

the MaxDividends Financial Score at the time of the increase

the score at the time of a cut or suspension

and the size of the dividend change

Why do we do this?

Because when your goal is growing passive income, there are really only two situations where selling a company makes sense.

First — when a company meaningfully cuts or cancels its dividend.

Second — when the business stagnates for an extended period, even if the dividend hasn’t been cut yet. In those cases, capital is often better redeployed into stronger businesses.

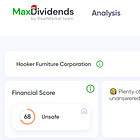

To evaluate business quality in a clear and consistent way, we use a single metric:

the MaxDividends Financial Score.

It’s a composite score based on multiple financial factors, calculated using our internal formula. The maximum score is 99.

The higher the score, the stronger and more predictable the business

The lower the score, the less certain future results become

Within the MaxDividends framework, companies with a score below 80 already require closer, more careful analysis.

We believe this is a transparent and practical way to show why financial quality matters when making dividend decisions.

Here’s what the data shows so far.

What We’ve Observed

Since launching dividend event monitoring in U.S. stocks:

138 total dividend events recorded

133 dividend increases

5 dividend cuts

Companies that raised dividends

Average Financial Score: 91

64 increases from companies with scores 90+

→ average increase: +7.96%56 increases from companies with scores 80–89

→ average increase: +5.22%13 increases from companies with scores below 80

→ average increase: +4.36%

In other words, about 90% of all dividend increases came from companies with scores above 80.

Companies that cut dividends

Average Financial Score: 74

Among companies with scores below 80:

18 total events

13 increases

4 cuts

That translates to a 24% probability of a dividend cut or suspension in this group.

Among companies with scores 80 and above:

120 dividend increases

only one dividend cut

That’s a cut probability of just 0.83% so far.

We’ll continue collecting and publishing this data and updating it quarterly. Later, we’ll also launch a public page where this tracking can be followed over time.

Why does this matter?

Because dividend investing isn’t just about yield — it’s about business quality first.

We’ve already broken this down in two real-world case studies:

More to come.

What We’re Building in Q1 2026

We think in decades — but we execute quarterly. Here’s what is publicly committed for Q1 2026:

1️⃣ REIT Payout Ratios via AFFO

REIT dividends shouldn’t be analyzed using EPS. We’re switching to AFFO-based payout ratios across 300+ REITs.

This gives you:

real safety margins

clearer risk signals

better dividend growth visibility

For many investors, this replaces $400–$500/year in extra tools — included inside MaxDividends.

2️⃣ MaxDividends Pulse

A simple 3-signal indicator inside company analytics.

One glance — and you know how we view this business today. Perfect for portfolios and watchlists. Less noise. More clarity.

3️⃣ Verified Future Dividends

Every future payment will show:

confirmed value

currency

source

proof of verification

Because these numbers aren’t abstract — they’re money you plan your life around. We’ll repeat this process every quarter: review progress → add value → publish the next goals.

The value will grow. The subscription price will not.

Thank you for being part of this journey.

If you ever want to support the project, the best way is simple: tell a friend, share your experience, invite another investor. Everyone deserves a future built on reliable, growing income.

Enjoy your Sunday coffee ☕

With respect for your well-being, Max

Final Thought

A good strategy matters — but environment and tools matter just as much. That’s why MaxDividends exists as more than content.

Inside the MaxDividends App, Premium members get:

• Clear filters for reliable dividend growers

• Financial strength and dividend safety insights

• Buy / Hold / Watch structure — no guesswork

• A clean system that reduces noise and emotion

And inside the MaxDividends Community, something even more important happens:

👉 You stay disciplined when markets get noisy

👉 You stop second-guessing every move

👉 You remain focused on income, not headlines

You’re no longer investing alone.

👉 Upgrade to Premium Today

Why Premium Matters (Honestly)

Free content shows the idea. Premium gives you the system.

With Premium, you get:

• Full access to the MaxDividends App

• Dividend Eagles (15+ years of raises)

• Clear portfolio logic and structure

• Real examples, real portfolios, real process

• A calm, focused community of like-minded investors

In short — you stop guessing and start executing.

And while the bankers are still trying to get to the golf course by 3PM... You’ll already be financially free—no tee time needed.

With MaxDividends Community you’ll always be part of a winning team and stop viewing the future as an uncertainty. Worry will fade, replaced by confidence and peace of mind. You’ll focus on doing what you love while your passive income continues to grow.

With respect for your well-being, Max

***

MaxDividends Idea

👉 My Own High Yield Dividend Growth Story

Retire Early and Live Off Dividends. $12,000 monthly for 120 months. No one wants to work forever.

MaxDividends Community

MaxDividends Mission: Helping people build growing passive income, retire early, and live off dividends.

Someone’s sitting in the shade today because someone planted a tree a long time ago. ― Warren Buffett.

Andy

“I really believe in your dividend system. I’m starting a little late, but I’m using this as a tool to teach my two sons so they can fully realize the gains from this opportunity.”John

“I am nearing retirement but am an inexperienced investor. I’m very happy to have your guidance on how to invest in dividend stocks to retire with!”Mark A.

“I want to get to the point where I can live off my dividend returns. Really looking forward to it!”FiveEights

“No time to do the groundwork myself.”Loui’S

“Your insights are sharp, well-researched, and refreshingly practical.”

We follow our time-tested strategy for tapping into overlooked dividend plays that can make your portfolio more resistant to recessions and other market panics and pack on consistent gains for years to come.

👉 Upgrade to Premium Today

Learn the MaxDividends Way

Start Here

🔑 Explore the Premium Hub (exclusive — upgrade to unlock)

Guides & Step-by-Step

Deep Insights

📖 I ❤️ Dividends: Why I Believe Dividend Investing Is the Best Strategy | E-Book

How Effective is the MaxDividends Strategy for Building Growing Passive Income

Help & Support

Got a question about dividends? Ask Max, your AI Dividend Assistant!

Didn’t get the answer you need? Reach out: max@maxdividends.app or team@maxdividends.app — we’ll help you out.