A 50% Dividend Cut and an 18% Drop — The Lesson Every Income Investor Needs

A step-by-step company analysis that teaches you how to apply the MaxDividends strategy in real life.

MaxDividends Mission: Helping people build growing passive income, retire early, and live off dividends.

This series is part of the MaxDividends Academy — where we teach our proven secret Five-Pillar Formula in practice. Each lesson breaks down a real company, showing how to spot lasting dividend payers and avoid traps, step by step.

Learn Dividend Investing One Stock at a Time

🎓 MaxDividends Academy Case Study: Alexandria Real Estate (ARE)

Your Wake-Up Call as a Dividend Investor

Hey — Max here 💪

Today, we’re breaking down a very real and very painful dividend lesson — one that quietly unfolded over the past year and caught many income investors off guard.

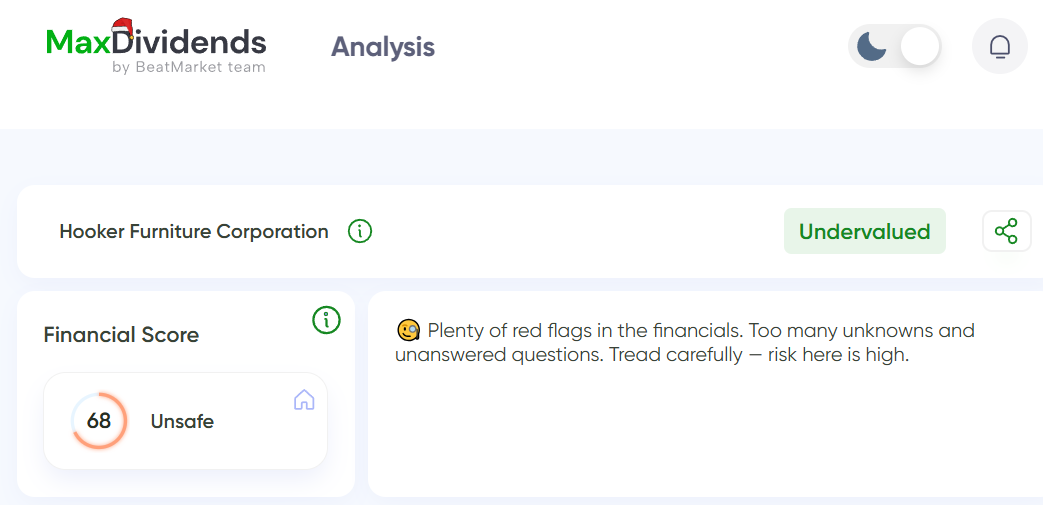

We’re talking about Hooker Furnishings (HOFT).

A company that looked safe. A company with a long dividend history. A company many investors trusted — right up until they shouldn’t have.

🪑 The “Safe” Dividend Illusion

Before the trouble began, Hooker Furnishings checked many boxes investors like to see:

• 9 consecutive years of dividend increases

• 20+ years of dividend payments without a cut

• A familiar consumer brand

• A steady income profile

Back in December 2024, HOFT was still trading around $25 per share.

Everything looked fine. But under the surface — it wasn’t.

🚨 The Warning Signal We Couldn’t Ignore

By December 2024, MaxDividends already flagged HOFT as risky.

📉 Financial Score: 68

That’s deep in the danger zone.

For context:

Below 80 → elevated risk

Below 70 → dividend danger

90+ → where truly safe dividend companies live

In plain English:

👉 dividend safety was already compromised

👉 fundamentals were deteriorating

👉 this was no longer a “hold and forget” income stock

At that point, a disciplined dividend investor had a clear choice:

❌ hope

❌ wait

❌ assume the past will protect the future

—or—

✔️ protect capital

✔️ rotate into a stronger dividend business

At the core of MaxDividends is our Financial Score — a simple number that tells you when a dividend is safe… and when it isn’t.

Behind it is a data-driven system tracking financial strength, cash flow quality, payout discipline, and dividend safety across 19,000+ companies worldwide — updated continuously inside the MaxDividends App. It flags trouble before dividend cuts and price drops hit the headlines.

And the best part?

👉 The entire app — including all Financial Scores — is completely free for Premium members. One tool. Total clarity. No surprises.

💥 The Dividend Cut — 50% Gone

On December 11, 2025, the risk became reality.

Hooker Furnishings cut its dividend by 50%, down to $0.115.

For income investors, that’s not a small adjustment. That’s a hard break in trust.

Dividend cuts don’t happen by accident — they’re the final step after fundamentals have already weakened.

📉 The Market Reacts — Immediately

And just like always, the market responded fast.

Between December 10 and December 11:

📉 Share price dropped from $10.90 → $8.88

📉 That’s an 18% loss in almost one day

Let’s put that into real numbers.

Imagine you owned:

• $10,000 in HOFT

→ You lost ~$1,800 overnight

• $50,000 invested

→ ~$9,000 gone

• $100,000 invested

→ ~$18,000 erased

Not over years. Not over months. In one day.

🔍 The Hard Truth

This wasn’t unpredictable.

The Financial Score of 65 told the story months earlier — when the stock was still near $25 and investors still felt comfortable collecting dividends.

That’s the real lesson here:

Dividend history doesn’t protect you.

Fundamentals do.

☕ A Simple Question

If a $200 per year tool helps you avoid losing $1,800… $9,000… or $18,000 —

is that a good trade for protecting your financial future?

And now the bigger question…

⚠️ What If You Own More Stocks Like This Right Now?

Most investors do.

Without realizing it.

Here’s the uncomfortable truth:

• Many dividend stocks look “safe” right until they aren’t

• Dividend cuts usually come after fundamentals break

• Price drops follow immediately

And without a system like Financial Score, you’re reacting after the damage — not before.

🛡️ Dividend Investing Isn’t About Chasing Yield

It’s about protecting capital and income.

One smart decision — made early — can save you years of dividend income.

Sometimes, that clarity is worth far more than a cup of coffee.

Protecting your wealth is often as simple as making one informed decision at the right moment.

And sometimes…

the value of that decision is worth far more than a cup of coffee.

With respect for your financial well-being,

Max