🎓 MaxDividends Academy Case Study: Alexandria Real Estate (ARE)

A step-by-step company analysis that teaches you how to apply the MaxDividends strategy in real life.

MaxDividends Mission: Helping people build growing passive income, retire early, and live off dividends.

This series is part of the MaxDividends Academy — where we teach our proven secret Five-Pillar Formula in practice. Each lesson breaks down a real company, showing how to spot lasting dividend payers and avoid traps, step by step.

Learn Dividend Investing One Stock at a Time

🎓 MaxDividends Academy Case Study: Alexandria Real Estate (ARE)

Your Wake-Up Call as a Dividend Investor

Hey - Max here 💪

Today inside the MaxDividends Academy Case Series, we’re breaking down a real situation that every dividend investor needs to understand.

We’re looking at Alexandria Real Estate (ARE) — a company many income investors owned for years, collecting regular dividend checks. Fourteen straight years of dividend raises. A classic income-focused business.

And then… something happened.

Let’s imagine you own $10,000 worth of ARE shares.

Now here’s what took place just a few days ago.

💥 The Dividend Cut — A 45% Shock

At the latest earnings announcement, the company cut its dividend by 45%.

That means your dividend income was instantly sliced in half.

If you’re a dividend investor, cuts like this aren’t just “unpleasant.”

They’re a 100% clear warning:

👉 Something is wrong inside the business.

👉 Dividend safety is gone.

👉 Uncertainty has arrived — and uncertainty kills passive income.

When a company cuts dividends after years of increases, the responsible move is simple:

❌ stop hoping

❌ stop guessing

❌ stop waiting

✔️ sell the stock and move your capital to a stronger, healthier business.

But here’s where things get even more important.

📉 What Happens When a Dividend Company Cuts Payouts?

Investors sell.

Every time.

It’s almost automatic.

Imagine Coca-Cola announcing a 90% dividend cut tomorrow.

What would happen?

The stock would fall — hard.

Dividend cuts trigger instant sell-offs because the entire investor base suddenly loses trust.

So what happened to ARE?

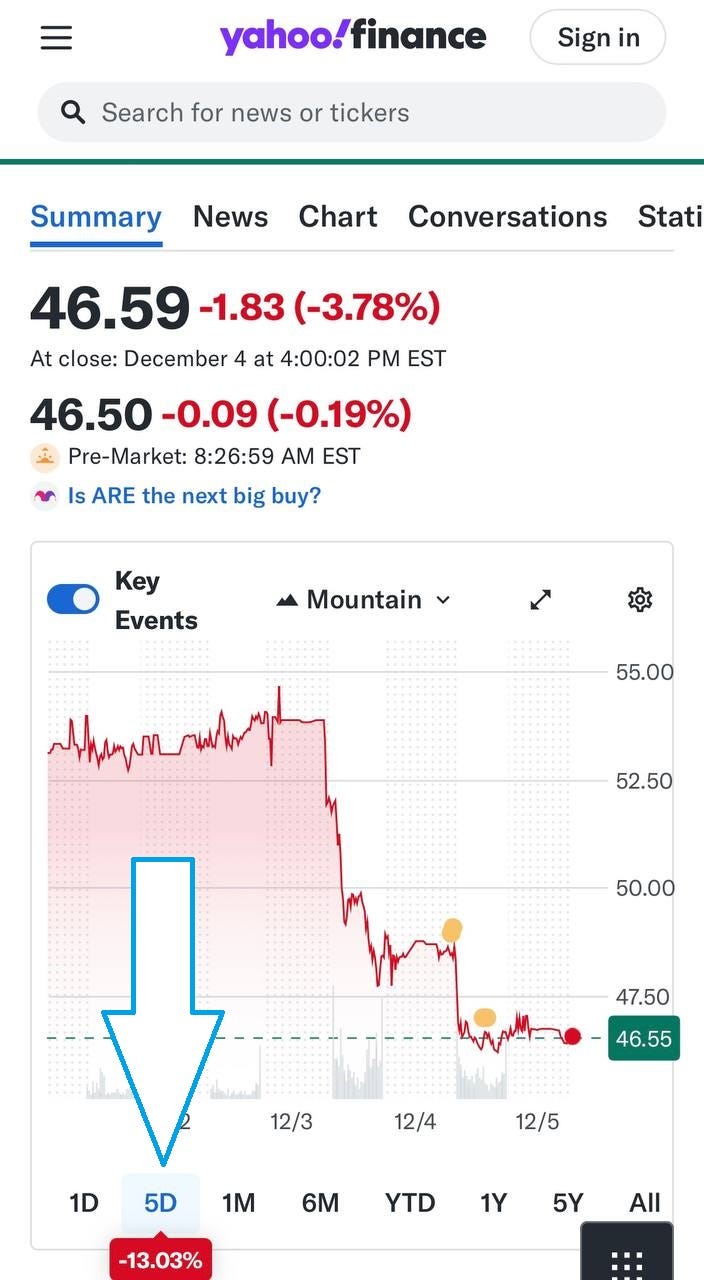

Exactly that. The stock dropped >8% in one day.

Let’s go back to our example:

You own $10,000 worth of shares

The stock falls 8%-10% in 24 hours

Your capital shrinks by ~$800-$1,000 — in one day

Imagine you had $100,000 invested instead.

Your loss? $8,000-$10,000 overnight.

That’s not a lesson — that’s a warning.

And now, here’s the part that matters most…

🔍 We Saw This Coming — 7 Months Ago

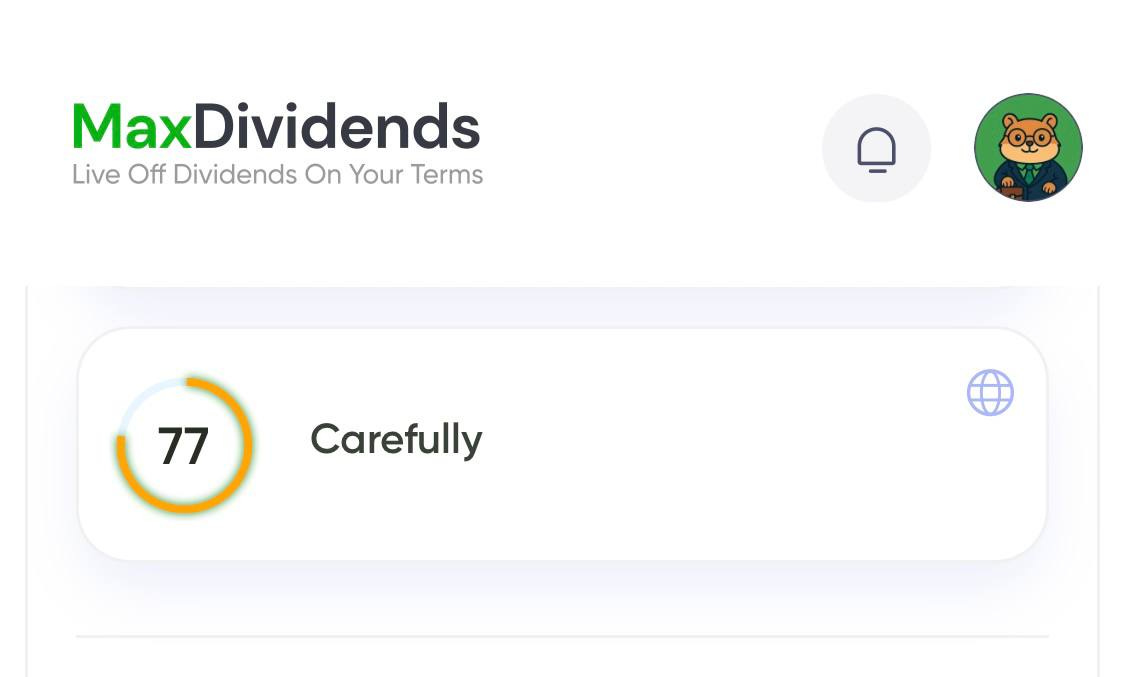

Inside MaxDividends, our Financial Score system already flagged ARE months before all this happened.

The company had a Financial Score of 76.

That’s far below our minimum healthy threshold of 80…

And nowhere near the recommended 90+ zone, where safe, high-quality dividend companies live.

In plain English:

👉 the warning signs were already there

👉 long before the dividend cut

👉 long before the price dropped

👉 long before investors lost thousands

We could’ve sold ARE half a year ago — and kept our capital safe.

Not only would we have avoided losing $800 on a $10,000 position…

We actually would’ve made a small profit selling back then:

around $150 gain on a $10,000 position

around $1,500 gain on a $100,000 position

One simple decision — made once — can save you thousands or even tens of thousands over your investing lifetime.

And it’s not luck.

It’s discipline — and having the right tools.

☕ A Simple Question

If a $200 per year subscription helps you avoid losing $8,000-$10,000 — is that a good trade for your financial security?

But let’s go even further.

📉 What If You Already Have Several Low-Score Companies in Your Portfolio Right Now?

Think about it:

You might own 3–5 companies with low Financial Scores right now…

but you wouldn’t know it without the MaxDividends App.

And here’s the hard truth:

50% of companies with a Financial Score under 70 will cut dividends within the next 12–18 months

When they cut, they typically drop 8–15% overnight

Losses multiply fast — especially for long-term investors

These losses can reach hundreds or thousands of dollars.

For some investors — tens of thousands.

All of it completely avoidable. If you simply knew the Financial Scores of the companies you already own.

Protecting your wealth is often as simple as making one informed decision at the right moment.

And sometimes…

the value of that decision is worth far more than a cup of coffee.

With respect for your financial well-being,

Max