🎓MaxDividends Academy Case Study: BlackRock Inc (BLK)

A step-by-step company analysis that teaches you how to apply the MaxDividends strategy in real life.

MaxDividends Mission: Helping people build growing passive income, retire early, and live off dividends.

This series is part of the MaxDividends Academy — where we teach our proven secret Five-Pillar Formula in practice. Each lesson breaks down a real company, showing how to spot lasting dividend payers and avoid traps, step by step.

⭐️ Your Premium Hub | 🎬 MaxDividends App: 2-Minute Video

Learn Dividend Investing One Stock at a Time

🎓 MaxDividends Academy Case Study: BlackRock Inc (BLK)

Hey — Max here 💪

Before we dive in, let me say a few words.

What you’re about to read comes from our Premium section — the top-tier content where we break down step by step how to uncover the best dividend gems, spot tomorrow’s Dividend Kings, and create a rock-solid passive income stream you can truly count on.

This is timeless investing wisdom, battle-tested across decades, boiled down into simple, actionable steps and tools that deliver results. Today, it’s all yours.

In future issues, we’ll uncover exclusive dividend picks and hidden gems — companies flying under the radar with massive potential to become tomorrow’s icons and 50-year dividend payers.

The best part? You’ll get them first. Spot the opportunities early, ahead of the herd, and — with the right approach — position yourself to invest before the crowds pile in.

When you think of asset management and the future of investing, BlackRock is the undisputed giant — the world’s largest money manager with $11.5+ trillion in AUM, powering iShares ETFs, institutional portfolios, and Aladdin risk tech that runs global finance.

It’s also a dividend powerhouse with 15+ years of consecutive increases, explosive growth from passive investing tailwinds, and a capital return machine blending buybacks, hikes, and tech-driven margins.

The real question is not whether BlackRock is a great company.

The question is: Does BLK fit your plan right now — or is it one to watch and wait for?

In this Deep Dive, BLK goes through the MaxDividends Five‑Pillar Formula — the same simple checklist used to find businesses that can keep paying (and growing) dividends through market crashes, rate hikes, and economic shifts.

The same simple formula I just used for BlackRock works for any stock. No hype, no noise — just clear steps that let you see whether a company truly fits your plan.

And the best part? This isn’t theory. It’s all already built into the MaxDividends app: the Financial Score, the MaxRatio, the Top Dividend Eagles list, and even my own personal shortlist. Everything in one place, ready whenever you are.

👉 Let’s break it down step by step.

How This Company Makes Money?

Do I clearly understand how BlackRock earns its money — and does the business make sense?

BlackRock earns its money in a simple, scalable way: by managing assets for clients worldwide and charging fees on the capital they entrust — from ETFs and mutual funds to institutional mandates and technology solutions. The core engines:

1️⃣ Asset Management & ETFs

BlackRock runs a global platform of index funds, active strategies, and the iShares ETF franchise across equities, bonds, alternatives, and multi‑asset solutions. Management and advisory fees on trillions of dollars in client assets are the primary source of revenue, with scale and product breadth driving steady, recurring fee income.

2️⃣ Technology & Aladdin Platform

Through its Aladdin risk‑management and portfolio‑analytics platform, BlackRock licenses software and data tools to asset managers, insurers, pension funds, and large institutions. These technology and services fees are high‑margin, sticky revenues that deepen client relationships and add diversification beyond pure asset‑based fees.

3️⃣ Institutional & Wealth Solutions

BlackRock designs custom investment solutions for pensions, sovereign wealth funds, endowments, insurers, and wealth managers. Mandates for liability‑driven investing, model portfolios, and outsourced CIO services generate long‑term contracts and stable fee streams tied to sophisticated client needs.

4️⃣ Performance Fees & Other Income

On certain strategies, BlackRock earns performance fees when returns exceed agreed benchmarks, adding an upside lever in strong markets. Securities lending, advisory work, and other capital‑markets activities contribute additional, but smaller, revenue lines.

The key strength is that BlackRock sits at the crossroads of global savings, ETF growth, and institutional demand for scalable, data‑driven solutions — all powered by recurring fee income on massive, diversified assets under management.

This isn’t a complex black box — it’s a high‑scale, high‑margin fee and technology platform riding long‑term trends in investing and retirement savings.

👉 And yes — this business model is clear, durable, and makes perfect sense.

Is This a Good Stock to Buy Long Term?

Has the company shown the kind of consistency and resilience a long‑term dividend strategy needs?

Our approach is simple but powerful: stick with reliable, resilient businesses that raise their dividends year after year. The longer you hold, the more income flows into your pocket — steadily, predictably, and without you having to lift a finger. That’s the compounding power behind our strategy.

The MaxDividends Strategy Checklist – Simple Steps to Pick the Right Stocks

Step 1: Dividend History

Our filter: Companies with 15+ years of consistent dividend growth.

BlackRock not only qualifies — it shows a clean, stair‑step pattern of rising dividends in every single year on the 15‑year chart, with the annual payout climbing from roughly $4 per share to just over $20 by 2024.

This kind of steady, uninterrupted growth is exactly what long‑term dividend investors want to see: no cuts, no freezes, just a persistent upward slope that signals strong cash generation and disciplined, shareholder‑oriented capital returns.

✅ Step 1 passed — BlackRock clearly behaves like a true Dividend Eagle, with a long, consistent track record of dividend raises that reflects a resilient business model and a management team committed to sharing its growth with investors through all phases of the market cycle.

Step 2: The Five-Pillar Secret Formula

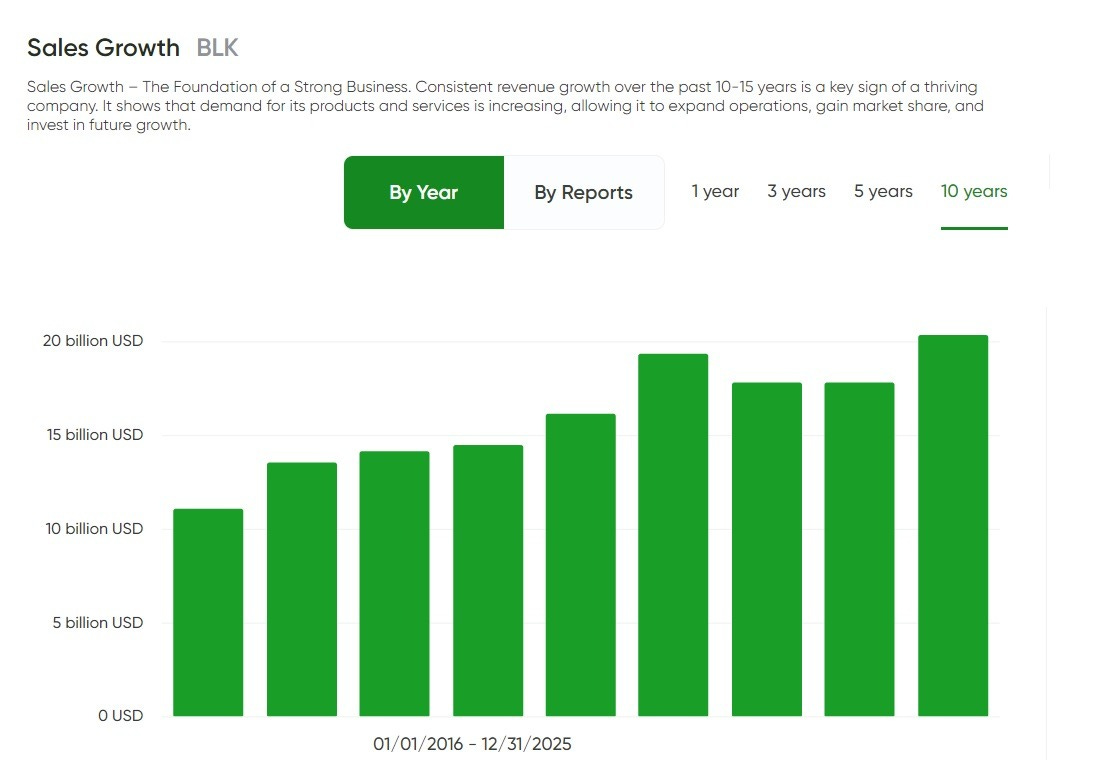

1️⃣ Sales Growth – The Foundation of a Strong Business

Over the past decade, BlackRock increased its revenue from roughly the low‑teens billions in 2015 to just over $20 billion by 2024, as shown on the chart — a clear, steady climb in its fee and services income base. The growth engine here is its global asset‑management platform, with iShares ETFs, institutional mandates, and Aladdin technology all helping expand scale and deepen relationships with clients worldwide.

The chart also highlights that sales never dipped meaningfully over the 10‑year window; instead, they moved upward in a measured fashion, even through market volatility and macro shocks. This reflects durable demand for BlackRock’s products and solutions, tied to long‑term savings, retirement assets, and institutional risk management that continue regardless of short‑term economic noise.

✅ Sales Growth Passed — structural tailwinds in ETFs, institutional outsourcing, and investment technology keep BlackRock’s top line trending higher, underscoring its central role in the global asset‑management ecosystem.

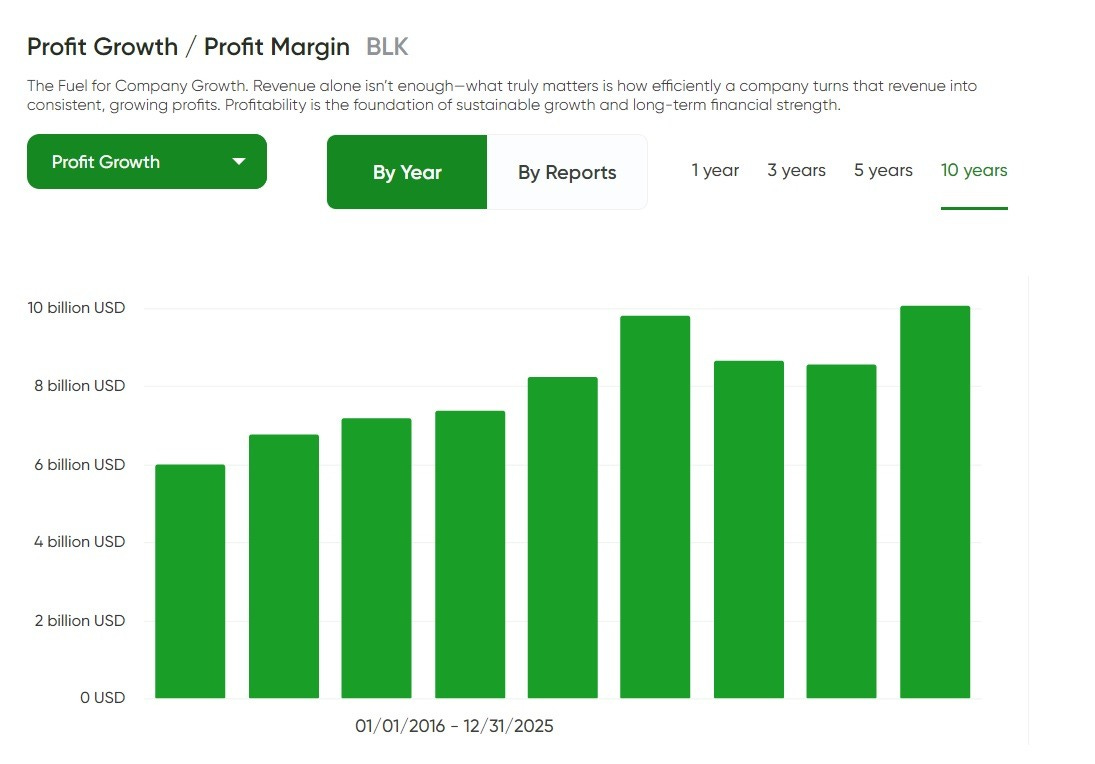

2️⃣ Profit Growth – The Fuel for Dividend Growth

Profits at BlackRock have risen steadily alongside revenue, with only minor bumps that mirror broader market cycles and asset‑price volatility. The chart shows operating profit growing from roughly $6 billion in 2015 to around $10 billion by 2024, reflecting the firm’s ability to scale fees, control costs, and expand higher‑margin businesses like ETFs and technology services.

The bar pattern highlights a clear step‑up in profitability in the later years, with profit levels holding near recent peaks even after periods of market stress — a sign that diversified AUM, global client base, and Aladdin’s tech revenues help cushion downturns. BlackRock continues to convert a growing slice of its top line into earnings, giving it ample capacity to fund rising dividends, buybacks, and reinvestment in future growth.

✅ Profit Growth Passed — profitability has expanded meaningfully over the decade, and despite market headwinds, BlackRock keeps compounding its earnings power on a very large base, fully supporting ongoing dividend growth.

3️⃣ Net Income – True Measure of Strength

BlackRock’s bottom line shows a clear story of durable, compounding earnings power rather than wild swings. Net income has climbed from a little over $3.3 billion in the early part of the decade to roughly $6.3 billion by 2024, with only modest pauses along the way that reflect global market volatility rather than company‑specific weakness.

The chart highlights several periods where profits stepped up decisively and then held those higher levels, even after bouts of macro stress and risk‑off markets. That pattern tells you BlackRock can absorb drawdowns in asset prices, keep clients on platform, and continue generating billions in true after‑tax earnings to support dividends and buybacks.

✅ Net Income Passed — BlackRock demonstrates resilient, growing profits across market cycles, exactly the kind of steady earnings power long‑term dividend investors rely on when they want their income stream to be built on rock‑solid foundations.

4️⃣ Dividend Payout Safety – Protecting Passive Income

BlackRock keeps a disciplined dividend payout ratio that signals both safety and room to grow. Over the last decade, the chart shows the payout ratio generally moving in a band of roughly 40–55%, with most recent years clustering around the low‑ to mid‑50s — comfortably below red‑zone territory and well within what’s sustainable for a mature, cash‑rich asset manager.

This is exactly what dividend investors like to see: BlackRock returns a generous slice of earnings to shareholders while still retaining plenty of profit to invest in new products, technology, and strategic initiatives, and to buffer against weaker markets. Because fee income is tied to long‑term savings and institutional mandates, cash generation is resilient enough to support this payout range without stretching the balance sheet.

✅ Dividend Payout Safety Passed — a balanced, sustainable payout ratio backed by strong, recurring cash flows and a clear track record of prioritizing dividend growth without sacrificing reinvestment or financial flexibility.

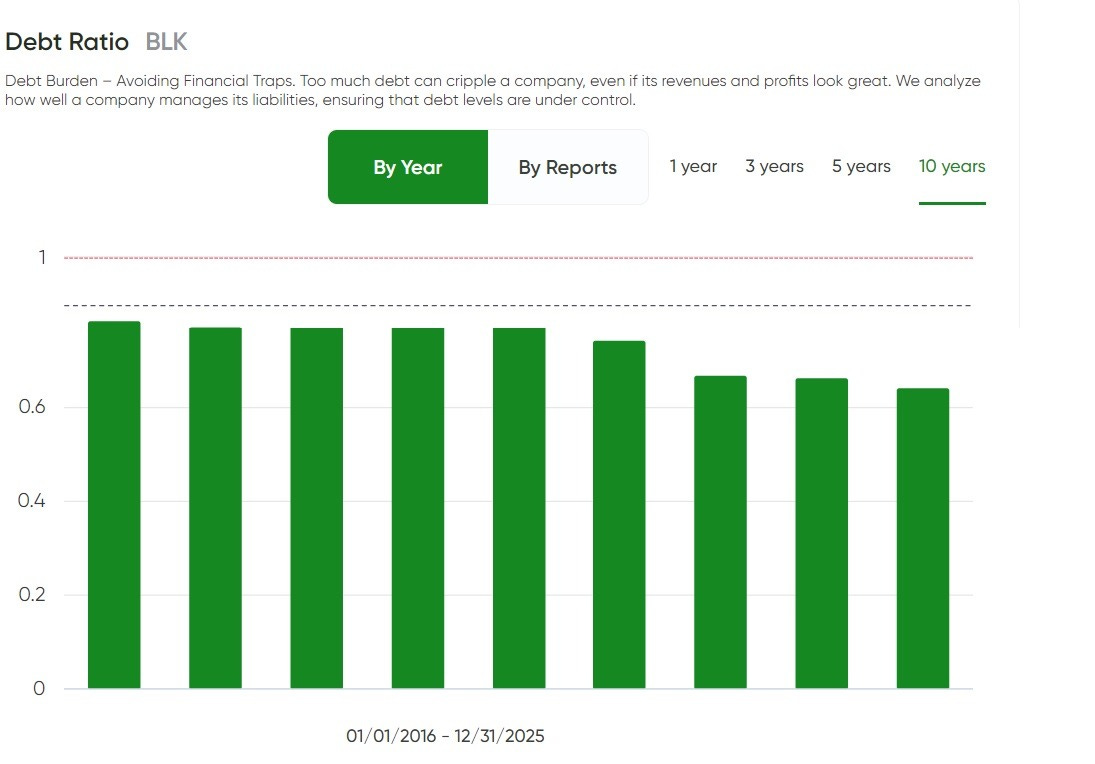

5️⃣ Debt Burden – Avoiding Financial Traps

BlackRock does use debt, but at a level that looks both measured and very manageable relative to its earnings power and cash flow. Over the past decade, the debt ratio has trended down from the mid‑0.8s toward the low‑0.6s, staying comfortably below the 1.0 line that would hint at balance‑sheet strain.

This steady decline is reassuring: BlackRock hasn’t binged on cheap debt in good years, nor has it had to lever up aggressively in tougher markets. For a fee‑based asset manager with strong, recurring cash flows and a capital‑light model, this sub‑0.7 range is conservative, leaving plenty of room to fund dividends, buybacks, and strategic investments without stressing the balance sheet.

✅ Debt Burden Passed — conservative leverage, a solid balance sheet, and no signs of financial risk that could threaten dividend sustainability or long‑term compounding.

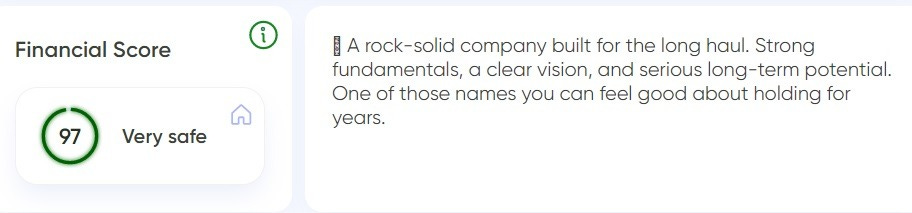

Bottom Line: The Company Financial Condition?

Financial Score 90+ ✅

Think of BlackRock’s financial score as a quick health check for the business. The higher the number, the stronger and safer the company. A score above 90 (BLK sits at 97) signals a rock‑solid, long‑term franchise you can feel comfortable holding for years.

MaxDividends Five-Pillar Secret Formula. Step 2 - ✅

By our Five-Pillar Secret Formula, BlackRock ranks as one of the most robust dividend payers available to long-term income investors — durable revenue growth across market cycles, consistently rising profits, a disciplined and sustainable payout ratio, and conservative use of debt. It clears every quality hurdle with room to spare.

The Financial Score inside MaxDividends is powered by these same five pillars, giving you a fast, one-glance way to evaluate any company through the full depth of our framework.

✅ Passed: BlackRock (BLK) — Proven Dividend Eagle 🦅

Does It Fit My Plan?

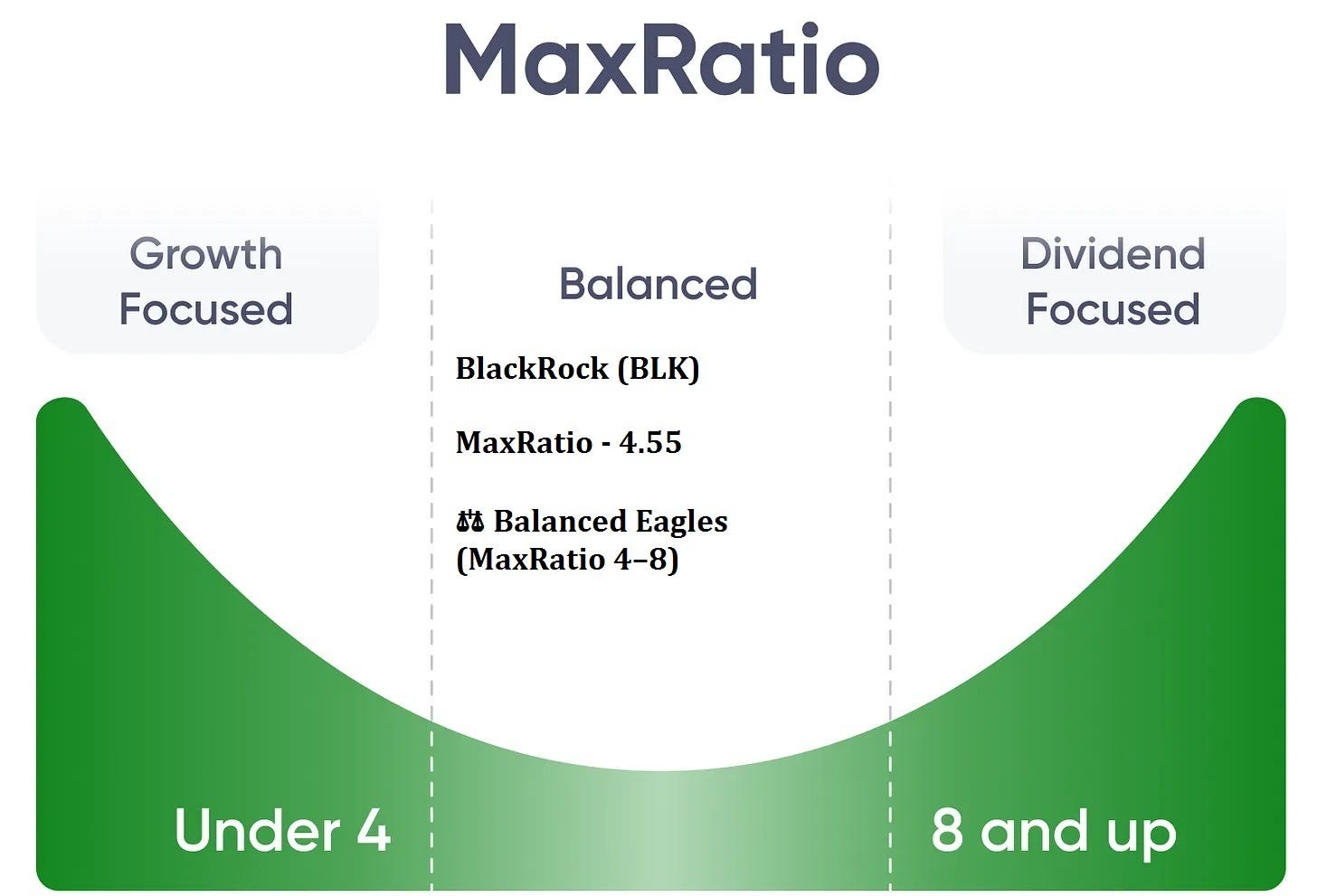

Finding the Right Role for Every Dividend Stock – MaxRatio

Dividend-paying stocks are not all built for the same purpose — and that variety is exactly what allows you to design a portfolio that matches your goals. Some businesses are geared toward rapid capital growth, others aim for a balanced mix of price appreciation and income, and a smaller group is focused almost entirely on delivering steady cash today.

That’s where MaxRatio steps in. It strips away the noise and shows what a stock is really offering by combining three pillars: the yield you’re locking in now, the pace of dividend growth, and the company’s overall financial strength.

Taken together, these factors clarify whether a stock belongs in your portfolio as a growth engine, a steady compounder of both capital and income, or a dedicated income workhorse.

🚀 Growth Eagles (MaxRatio under 4) — Capital gains come first. Yields tend to be modest, but they reflect a solid, resilient business, setting you up for substantial long-term wealth while dividends quietly build tomorrow’s income.

⚖️ Balanced Eagles (MaxRatio 4–8) — The best of both worlds. You receive a meaningful payout today, and those checks rise consistently over time, compounding your capital and your cash flows together.

💵 Income Eagles (MaxRatio 8+) — Designed for cash generation. These names offer high current yields with modest, dependable growth, ideal when your priority is straightforward, reliable income.

MaxRatio’s single purpose is to help you assign each dividend stock to the right role, so you can assemble a portfolio that truly reflects your objectives — whether that’s maximum growth, a balance of gains and income, or the highest possible passive cash flow right now.

Let’s Take BlackRock (BLK)

In the MaxDividends app, you can jump into the Company Analytics section and instantly see both the Financial Score and MaxRatio for any stock you’re researching — no spreadsheet work required.

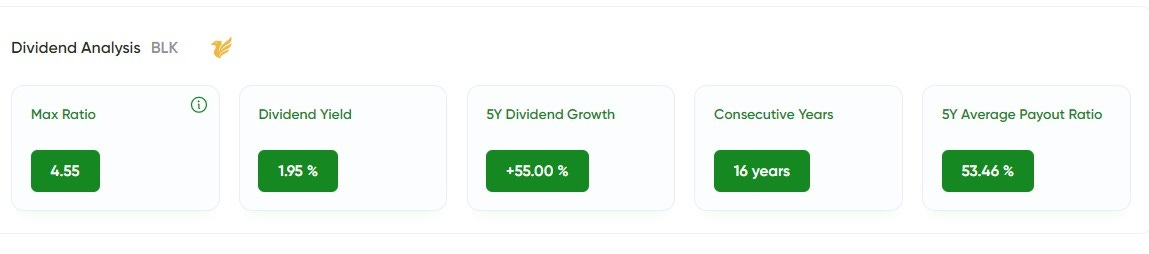

With a MaxRatio of 4.08, a 1.92% dividend yield, and a powerful +44% cumulative dividend growth over the past 5 years, BlackRock slots neatly into the ⚖️ Balanced Eagle category.

That means BLK is built to do two things at once: grow your capital and steadily lift your income. The starting yield won’t top any high‑yield lists, but the combination of reliable payouts and strong growth turns into serious compounding over time as each raise stacks on top of the last.

This profile fits investors who want a high‑quality core holding that quietly builds wealth while upgrading their dividend checks year after year — not a flashy lottery ticket, but a dependable compounder at the heart of a long‑term dividend portfolio.

💵 Is the Stock Undervalued Today?

Cheaper than competitors?

⚠️ According to the MaxDividends App, BlackRock (BLK) currently screens as Overvalued relative to its peers. That means investors are paying a noticeable premium versus other asset managers in the same sector.

In plain English: at today’s prices, BLK trades above the group average, so you’re paying more per dollar of earnings than you would for comparable companies in its industry.

Cheaper than its own history?

⚠️ Expensive vs. its own 10-year average.

Over the past decade, BlackRock (BLK) has usually traded at a P/E multiple around 21.25. Today, the ratio sits closer to 28.65, putting the stock noticeably above its long‑term average valuation.

In plain English: investors are paying more than they typically have for each dollar of BlackRock’s earnings — a sign the market places a premium on its scale and growth, but this is not a bargain entry point right now.

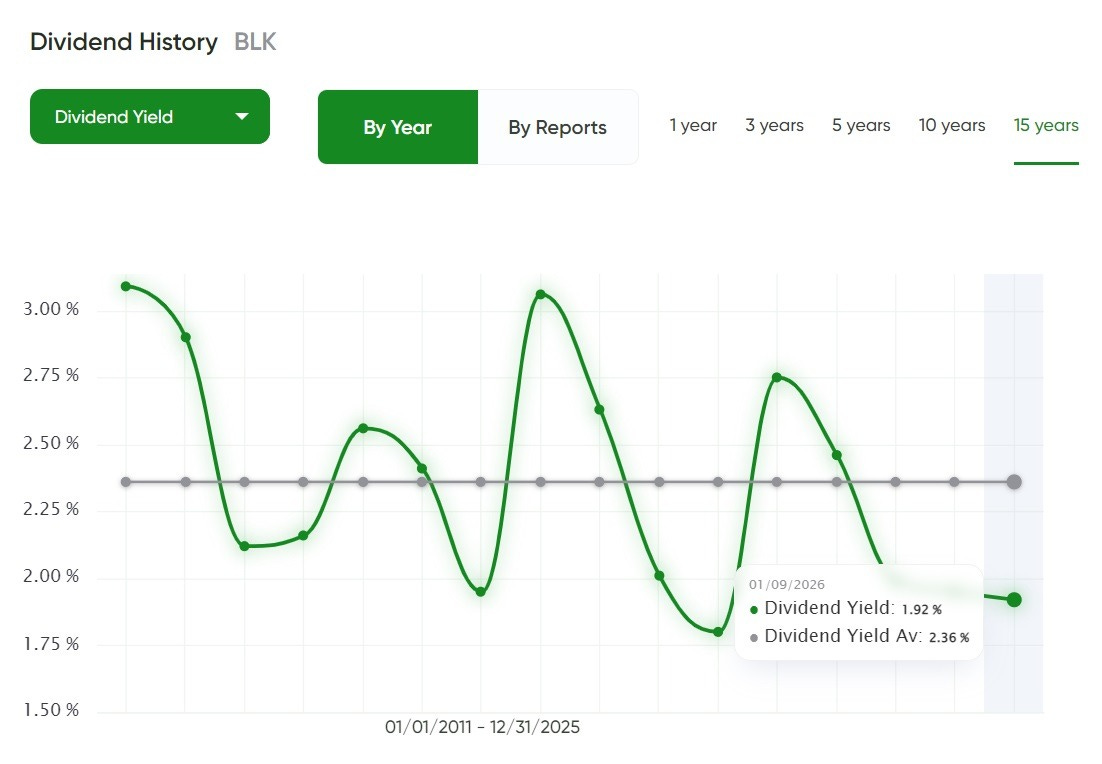

Better Yield Than Usual?

⚠️ Yield slightly below its 10-year average.

Today BlackRock’s dividend yield sits around 1.92%, versus a 15‑year average near 2.36%, meaning the current yield is a bit leaner than usual at today’s price.

In plain English: you’re accepting a lower starting yield than the long-term norm — not ideal for pure income seekers, but potentially acceptable if you believe BLK’s dividend growth and compounding can more than make up for the lower entry yield over time.

Analyst Consensus

⚠️ Analysts see moderate upside potential for BlackRock as well.

BLK trades around a level that sits only slightly below the average analyst price target, implying just a moderate upside in the near term (~16%). BlackRock currently trades around $1,087/share, while the average analyst consensus target sits close to $1,250.

In plain English: the market already prices in most of BlackRock’s strengths, and the stock trades not far below what analysts consider fair value, leaving only limited room for capital appreciation.

Is This One for Me?

Here’s how Target stacks up under the MaxDividends lens:

How This Company Makes Money?

Do I clearly understand how BlackRock earns its money — and does the business make sense to me?

🟢 Yes: global asset management and investment technology. BlackRock collects fees on the trillions of dollars it manages through iShares ETFs, index funds, and institutional mandates, while its Aladdin platform and advisory services add high‑margin, recurring tech and solutions revenue. The model is straightforward, scalable, and tied to long‑term savings and retirement flows — a diversified fee engine powered by durable client relationships and recurring contracts.

Is This a Good Stock to Buy Long Term?

Has the company shown the kind of consistency and resilience I want to see?

🟢 Yes: 15+ consecutive years of dividend increases, a strong record of double‑digit dividend growth, and disciplined capital returns through multiple market cycles. BlackRock has navigated crises, low‑rate environments, and volatility while continuing to grow assets, earnings, and its payout, proving the franchise is adaptable, durable, and clearly committed to rewarding long‑term shareholders.

Is the Stock Undervalued Today? 💵

⚠️ Not really: according to the MaxDividends App, BlackRock is overvalued versus its peers and trading above its own 10‑year average P/E multiple. The current dividend yield (~1.92%) sits somewhat below its long‑term average. Taken together, that points to a quality business at a premium price rather than a clear value opportunity right now.

Does It Fit Your Plan?

Not every dividend stock serves the same purpose — and that’s the beauty of building a portfolio with intention.

⚪️ My strategy is built around stocks that either pay a solid dividend upfront and grow it steadily — or start with a reasonable yield but increase it at a rapid, compounding pace.

With a MaxRatio of 4.08, a current yield of 1.92%, and 16 consecutive years of dividend hikes, BlackRock fits cleanly into the Balanced Eagle ⚖️ category — a stock designed to grow both your capital and your income together over time. It’s a natural fit for investors who want stable, predictable dividend growth from a high‑quality business rather than purely maximizing today’s yield.

For my $12,000-a-month-in-120-months portfolio, I focus first on Dividend Eagles with MaxRatio 10+ — businesses that are truly built around dividends, either through fast payout growth or high current income with steady future growth.

For my kids’ portfolios, I prioritize a different slice of the same universe: Dividend Eagles with a capital-growth focus — companies that reinvest aggressively and compound value over decades.

Balanced dividend growers can be a perfect core for many investors. It all depends on your strategy.

Take Johnson & Johnson as an example. In the middle of last year, it was offering nearly a 4% dividend yield while still delivering moderate capital growth. That’s exactly the kind of high-quality, sleep-well-at-night business that fits beautifully into a long-term income plan.

Final Take

BlackRock has earned real respect for its ability to navigate crises, market volatility, and structural shifts in asset management while staying at the center of global investing. It’s exactly the kind of franchise we like to study, track, and eventually own in MaxDividends portfolios: a rare blend of scale, brand, and dividend discipline wrapped into one compounder.

That said, BlackRock doesn’t quite fit under current conditions for a fresh, aggressive buy. With the stock trading at a premium P/E versus its own history and peers, and a starting yield below its long‑term average, the risk‑reward skew is more “quality at a full price” than “quality on sale.”

The business checks every MaxDividends box — proven Dividend Eagle with 16 years of raises, strong profitability, and a very safe balance sheet — but from an entry‑point perspective, it sits on the watchlist rather than in the “back up the truck” zone. For now, it remains a candidate for balanced dividend portfolios, and if valuation cools off or yield drifts higher, it moves straight to the front of the line.

***

The same simple formula I just used for BlackRock works for any stock. No hype, no noise — just clear steps that let you see whether a company truly fits your plan.

And the best part? This isn’t theory. It’s all already built into the MaxDividends app: the Financial Score, the MaxRatio, the Top Dividend Eagles list, and even my own personal shortlist. Everything in one place, ready whenever you are.

MaxDividends is a treasure chest for dividend investors of any size and focus. Whether you’re after growth, balance, or pure income, you’ll find the tools and the community to back you up.

This series of case studies is here to show you just how simple — and powerful — dividend investing can be. One stock at a time, you’ll see the clarity, the confidence, and the peace of mind that comes from building your own growing stream of passive income.

With respect for your well-being,

Max

🎓 MaxDividends Academy Cases

Someone’s sitting in the shade today because someone planted a tree a long time ago. ― Warren Buffett.

Learn the MaxDividends Way

Start Here

🔑 Explore the Premium Hub (exclusive — upgrade to unlock)

Guides & Step-by-Step

Deep Insights

📖 I ❤️ Dividends: Why I Believe Dividend Investing Is the Best Strategy | E-Book

How Effective is the MaxDividends Strategy for Building Growing Passive Income

Help & Support

Got a question about dividends? Ask Max, your AI Dividend Assistant!

Didn’t get the answer you need? Reach out: max@maxdividends.app or team@maxdividends.app — we’ll help you out.