🎓 MaxDividends Academy Case Study: Johnson & Johnson (JNJ)

A step-by-step company analysis that teaches you how to apply the MaxDividends strategy in real life.

MaxDividends Mission: Helping people build growing passive income, retire early, and live off dividends.

This series is part of the MaxDividends Academy — where we teach our proven secret Five-Pillar Formula in practice. Each lesson breaks down a real company, showing how to spot lasting dividend payers and avoid traps, step by step.

Learn Dividend Investing One Stock at a Time

🎓 MaxDividends Academy Case Study: Johnson & Johnson (JNJ)

Hey — Max here 💪

Before we dive in, let me say a few words.

What you’re about to see comes from our Premium section — the top-tier content where we break down, step by step, how to spot the best dividend gems out there. How to find the future Dividend Kings… and sleep well at night knowing your income is built on rock-solid foundations.

It’s the kind of timeless investing wisdom that’s been proven over generations — translated into simple, practical actions and tools that actually work. And today, we’re sharing that knowledge with you.

In the next issues, we’ll also explore exclusive dividend ideas and standout companies — names still flying under the radar, but with every chance to become tomorrow’s household brands, the ones paying dividends for the next 50+ years.

And here’s the best part — you’ll be among the first to know them, spot them, and, with the right mindset, invest before the crowd does.

When you think of dividend reliability, Johnson & Johnson is one of the first names that comes to mind. It’s not just a healthcare giant — it’s a Dividend King, with over 60 straight years of raises. Few companies in the world can match that record.

In this Deep Dive, I’ll put J&J under the MaxDividends Five-Pillar Formula — the same simple checklist I use to spot businesses that can keep paying (and growing) dividends through recessions, pandemics, and whatever the market throws at us.

This is the kind of company that shows why dividend investing works: durable products, steady cash flow, and a culture of rewarding shareholders.

The question is — does J&J fit my / your plan right now, or not?

👉 Let’s break it down step by step.

💡 How This Company Makes Money?

Do I clearly understand how Johnson & Johnson earns its money — and does the business make sense to me?

Johnson & Johnson makes money by selling products that people and hospitals use every single day — and in most cases, they have to. The business runs across three main areas:

Pharmaceuticals: Prescription drugs that treat cancer, immune disorders, and other serious conditions. This is the biggest driver of sales.

Medical Devices: Tools, implants, and surgical equipment used in hospitals and operating rooms worldwide. Once a hospital adopts J&J devices, it usually sticks with them for years.

Consumer Health: This is where most of us know the company best. Everyday brands like:

Tylenol for headaches

Band-Aid for cuts

Listerine for mouthwash

Johnson’s Baby products used by families everywhere

The strength of J&J is diversification. No single product makes or breaks the company, and demand is global and recurring. People need medicine, surgery, and basic healthcare products no matter what the economy looks like.

That combination — essential products, recurring demand, and global reach — is why Johnson & Johnson has been able to deliver stable, predictable cash flow for decades.

Is This a Good Stock to Buy Long Term?

Has the company shown the kind of consistency and resilience I want to see?

Our approach is simple but powerful: stick with reliable, resilient businesses that raise their dividends year after year. The longer you hold, the more income flows into your pocket—steadily, predictably, and without you having to lift a finger. That’s the compounding power behind our strategy.

The MaxDividends Strategy Checklist – Simple Steps to Pick the Right Stocks

Step 1: Dividend History

Our filter: Companies with 15+ years of consistent dividend growth.

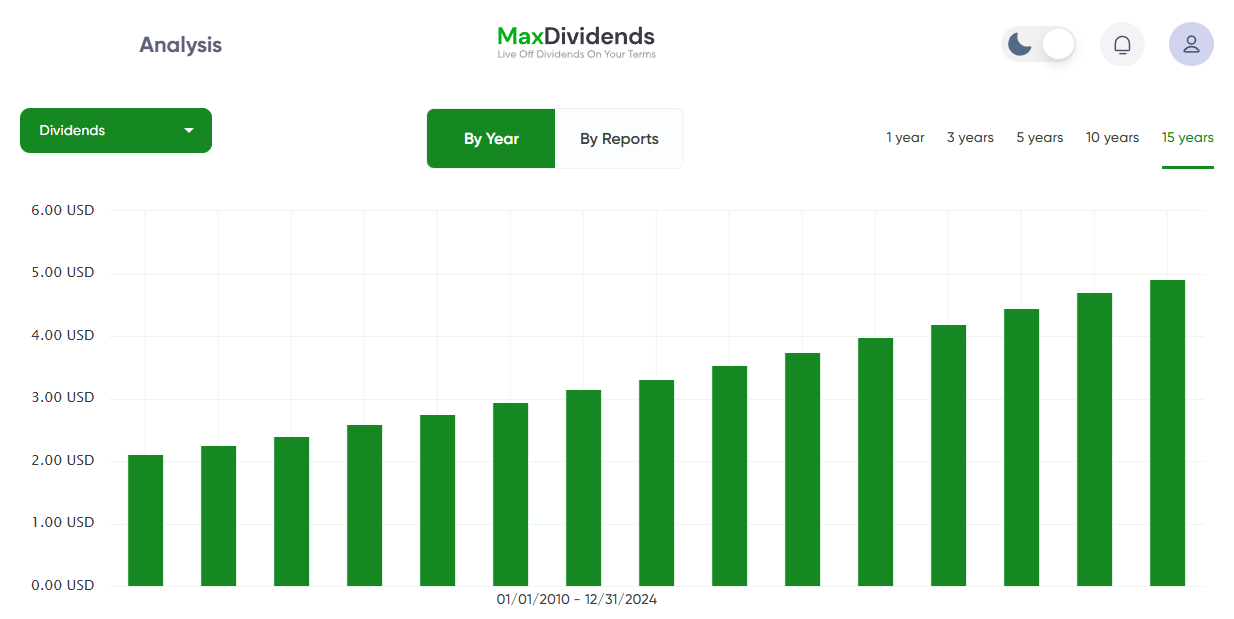

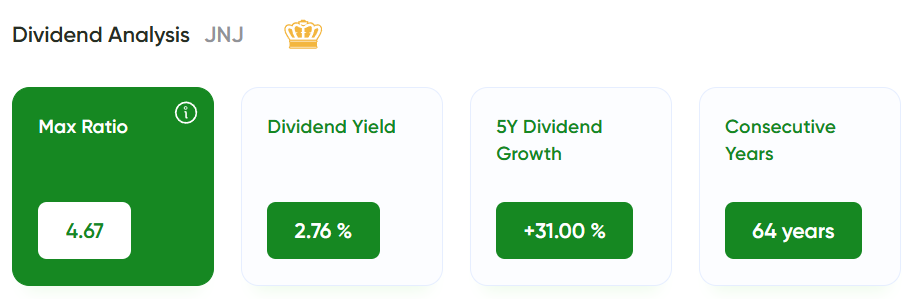

Johnson & Johnson doesn’t just clear this bar — it sets the gold standard. The company has paid dividends for more than 80 years straight and has raised them for 62 consecutive years.

That makes J&J one of the rare Dividend Kings, a title given only to companies with 50+ years of nonstop dividend increases.

Over the past decade, J&J’s average annual dividend growth has been in the mid-single digits (around 6–7% per year).

✅ Step 1 passed — Johnson & Johnson isn’t just a Dividend Eagle. It’s a full-blown Dividend King 👑 — over 60 years of raises, proving unmatched consistency and a shareholder-first culture.

Step 2: The Five-Pillar Secret Formula

1️⃣ Sales Growth – The Foundation of a Strong Business

Over the last decade, Johnson & Johnson grew revenue from about $70B in 2015 to nearly $89B in 2024. The engine here is pharmaceuticals, with medical devices adding resilience, and consumer health brands providing a steady baseline.

✅ Sales Growth Passed — durable demand across medicines, devices, and household brands keeps the top line moving up, year after year.

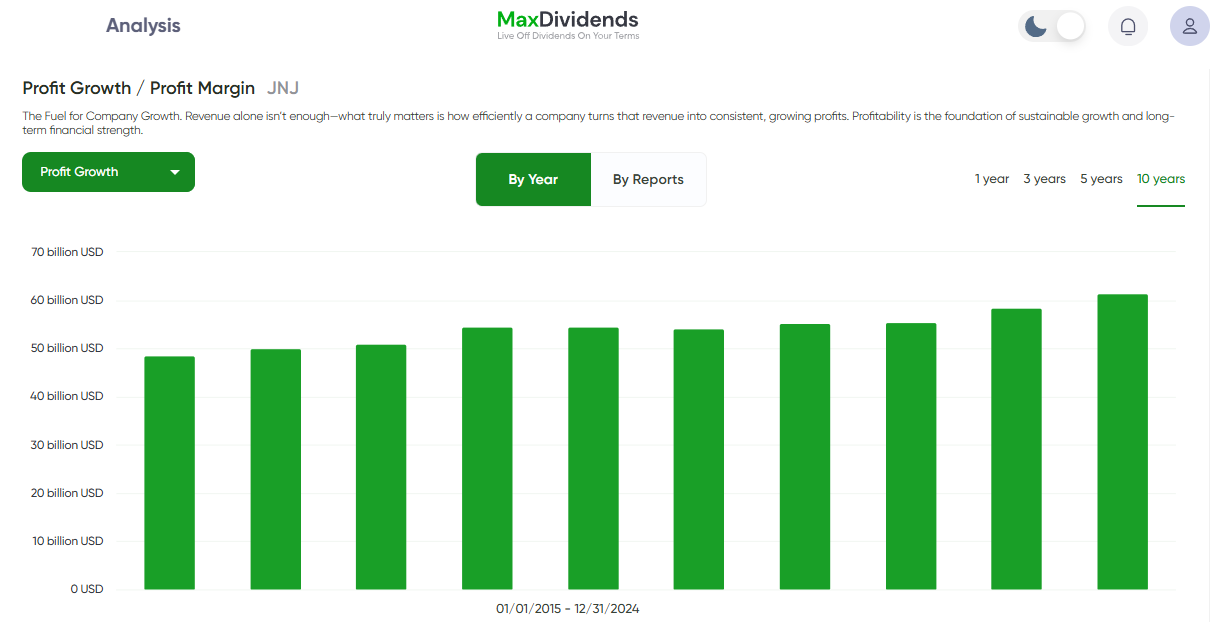

2️⃣ Profit Growth – The Fuel for Dividend Growth

Profits at Johnson & Johnson have grown steadily alongside sales. Operating income rose from around $48B in 2015 to more than $61B in 2024, even as the company spun off its consumer health unit. Margins remain healthy, backed by high-value pharmaceuticals and medical devices that deliver consistent earnings power.

✅ Profit Growth Passed — profitability is solid, consistent, and well-supported by J&J’s diversified healthcare portfolio.

3️⃣ Net Income – True Measure of Strength

Johnson & Johnson’s bottom line has stayed strong and dependable. Even through COVID and inflation shocks, J&J kept delivering billions in profits year after year.

✅ Net Income Passed — J&J proves its resilience with consistent profits across all market cycles, exactly the kind of stability dividend investors count on.

4️⃣ Dividend Payout Safety – Protecting Passive Income

Johnson & Johnson keeps its dividend payout conservative. The TTM payout ratio sits around 55%, with a 5-year average close to 60%.

J&J’s business stability makes this payout level safe. Even in downturns, people still need medicine, surgeries, and consumer health products, which helps keep the cash flowing to cover dividends comfortably.

✅ Dividend Payout Safety Passed — sustainable payout, backed by durable cash flows and decades of proof that dividends come first.

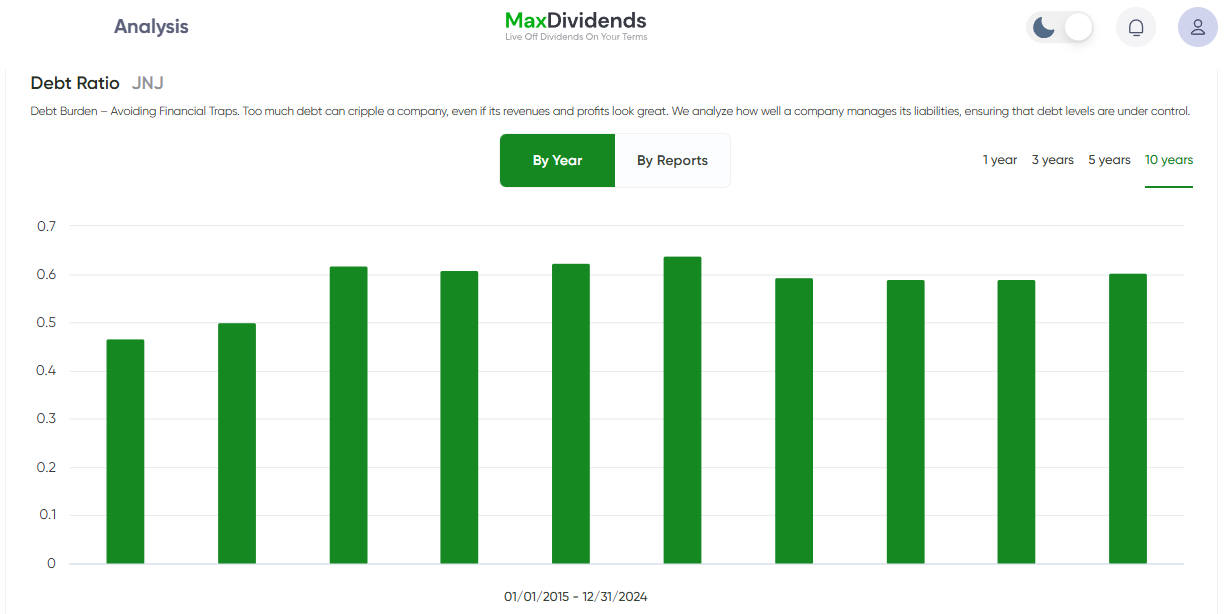

5️⃣ Debt Burden – Avoiding Financial Traps

Johnson & Johnson does carry debt, but it’s very manageable compared to its size and cash generation. The company’s debt-to-equity ratio sits around 0.6, well below risky levels. Backed by strong free cash flow and a rock-solid credit rating (one of the highest in corporate America), J&J has no problem servicing obligations while still funding dividends and new investments.

✅ Debt Burden Passed — conservative leverage, excellent balance sheet strength, and virtually no financial red flags.

Bottom Line: The Company Financial Condition?

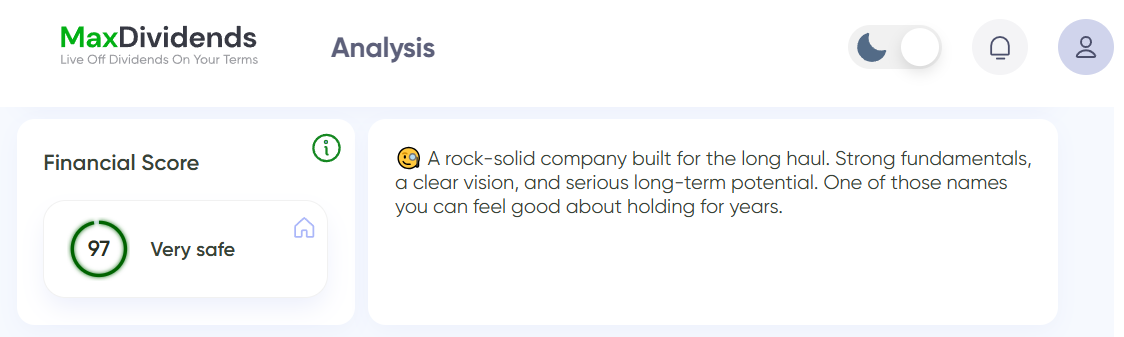

Financial Score 90+ ✅

Think of it as a quick health check for any company. The higher the score, the stronger and safer the business. A score of 90+ means it’s rock-solid and built to last.

MaxDividends Five-Pillar Secret Formula. Step 2 - ✅

By our Five-Pillar Secret Formula, Johnson & Johnson stands out as one of the strongest Dividend Eagles on the planet — steady sales growth, consistent profits, safe payout policy, and a rock-solid balance sheet. It checks every box with ease.

The Financial Score inside MaxDividends is built on these very same five pillars, giving you a quick, one-glance way to review any company with the full depth of our proven framework behind it.

✅ Passed: Johnson & Johnson - Proven Dividend Eagle 🦅

Does It Fit My Plan?

Finding the Right Role for Every Dividend Stock - MaxRatio

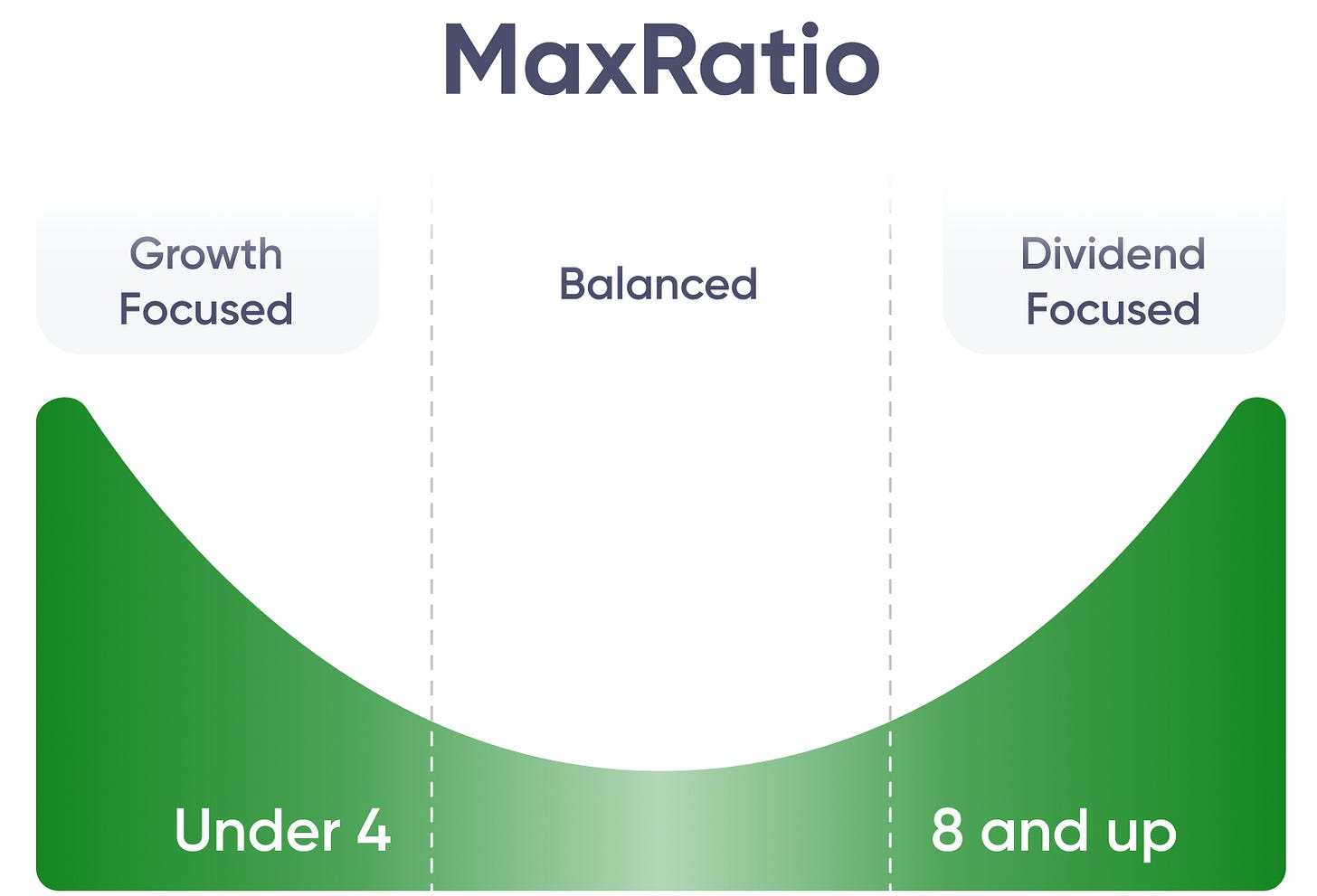

Not every dividend stock serves the same purpose — and that’s the beauty of building a portfolio with intention. Some companies are best at growing capital, others strike a balance between growth and income, and a few are built to deliver steady cash right now.

That’s where MaxRatio comes in. It’s a simple metric we created at MaxDividends to help investors cut through the noise and quickly see what a stock is really giving them.

MaxRatio looks at three things: the dividend yield, the pace of dividend growth, and the company’s overall financial strength.

Put together, it shows whether a stock belongs in your portfolio as a growth play, a balanced compounder, or an income leader.

🚀 Growth Eagles (MaxRatio under 4) — Capital growth first. Dividends may be small today, but they’re proof the business is profitable and resilient. These names build wealth over the long haul while quietly compounding income in the background.

⚖️ Balanced Eagles (MaxRatio 4–8) — The best of both worlds. They pay you now and raise those checks steadily year after year, compounding both wealth and income together.

💵 Income Eagles (MaxRatio 8+) — The cash generators. High-yield stocks that put money in your pocket today and usually add a slow but steady growth layer on top. Perfect for reliable, no-drama income.

That’s why MaxRatio matters: it helps you assign the right role to each stock and build a portfolio that works for your goals, whether that’s wealth building, balanced growth, or pure income.

Let’s Take Johnson & Johnson

In the MaxDividends app, just head to the Company Analytics section. You can quickly check any stock you’re interested in — see the Financial Score and the MaxRatio in one place. It saves a ton of time.

With a MaxRatio of 4.67, a 2.8% dividend yield, and a 6% average annual dividend growth rate, Johnson & Johnson lands squarely in the Balanced Eagle ⚖️ category.

That means it quietly compounds both ways: moderate capital growth plus steady dividend increases. It’s not the flashiest stock, but it’s the kind of dependable compounder that strengthens the core of any dividend portfolio.

💵 Is the Stock Undervalued Today?

Cheaper than Competitors?

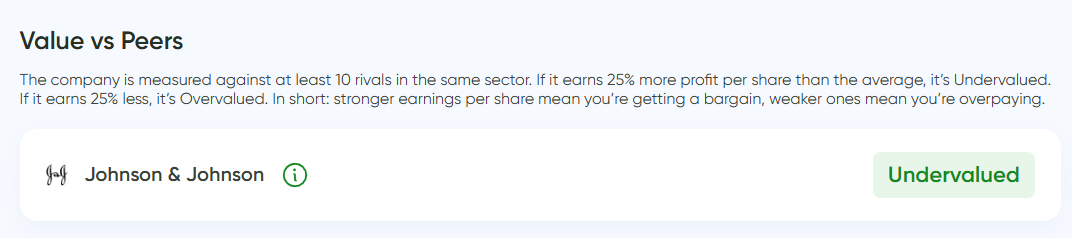

✅ According to the MaxDividends App, Johnson & Johnson is showing up as Undervalued compared to its peers. That means its earnings power is stronger than most companies in the healthcare sector at today’s price.

In plain English: you’re getting more profit for every dollar you invest compared to competitors. For a Dividend King with 60+ years of raises, that’s a rare opportunity.

Cheaper than Its Own History?

✅ Cheaper vs. its own 10-year average.

Over the past decade, J&J has usually traded at a P/E around 22. Today it’s closer to 20, which means the stock is slightly undervalued compared to its long-term history.

In plain English: investors are paying less than usual for each dollar of J&J earnings. For a Dividend King with over 60 years of raises, that looks like a fair entry point.

Better Yield Than Usual?

✅ Yield slightly above its 10-year average.

Today J&J’s dividend yield sits at 2.76%, compared to its 10-year average of 2.72%. That means investors are getting a touch more income than usual at the current price.

In plain English: you’re locking in a dividend yield that’s a little better than the long-term average — not a screaming bargain, but a small edge in your favor.

Analyst Consensus

⚠️ Analysts see the stock as slightly ahead of its target price.

J&J stock trades around $188/share, while the average analyst price target is about $184. That implies a small ~2% downside in the near term.

In plain English: analysts don’t see much capital appreciation from here — the stock already trades a bit above consensus.

Is This One for Me?

Here’s how the company stacks up under the MaxDividends lens:

How This Company Makes Money?

Do I clearly understand how Microsoft earns its money — and does the business make sense to me?

🟢 Yes: pharmaceuticals, medical devices, and everyday consumer health brands like Tylenol, Band-Aid, and Listerine — global, essential, and recurring.

Is This a Good Stock to Buy Long Term?

Has the company shown the kind of consistency and resilience I want to see?

🟢 Yes: 60+ years of dividend growth, rock-solid profits, and one of the strongest balance sheets in corporate America.

Is the Stock Undervalued Today? 💵

🟢 According to the MaxDividends App, Johnson & Johnson is showing up as Undervalued vs. peers, cheaper than its own 10-year average, and offering a dividend yield slightly above its historical norm.

Does It Fit Your Plan?

Not every dividend stock serves the same purpose — and that’s the beauty of building a portfolio with intention.

⚪️ My strategy is built around stocks that either pay a solid dividend upfront and grow it steadily — or start with a reasonable yield but raise it at a rocket-like pace. These are the companies that land in the MaxRatio 8+ group.

Final Take

I sincerely tip my hat to Johnson & Johnson and its ability to adapt and stay global for decades. It’s a fantastic example of the kind of businesses we look for, wait for, and love to add inside MaxDividends portfolios. A strong balance of capital growth and dividends in one package.

That said, in my case, J&J doesn’t quite fit under current conditions. The pace of dividend growth over the last 10 years, along with the current yield, just doesn’t leave enough room for me to start investing right now.

Respect to everyone who picked it up around $144/share — at those levels it was a far more attractive deal, and I even grabbed a few shares myself. But that was more of a test buy than a full investment.

All in all, it’s a great company — a true Dividend Eagle 🦅 that meets every MaxDividends quality standard. It’s an excellent choice for balanced dividend portfolios, but for now, I’m staying on the sidelines.

***

The same simple formula I just used for Microsoft works for any stock. No hype, no noise — just clear steps that let you see whether a company truly fits your plan.

And the best part? This isn’t theory. It’s all already built into the MaxDividends app: the Financial Score, the MaxRatio, the Top Dividend Eagles list, and even my own personal shortlist. Everything in one place, ready whenever you are.

MaxDividends is a treasure chest for dividend investors of any size and focus. Whether you’re after growth, balance, or pure income, you’ll find the tools and the community to back you up.

This series of case studies is here to show you just how simple — and powerful — dividend investing can be. One stock at a time, you’ll see the clarity, the confidence, and the peace of mind that comes from building your own growing stream of passive income.

With respect for your well-being,

Max

Someone’s sitting in the shade today because someone planted a tree a long time ago. ― Warren Buffett.

Learn the MaxDividends Way

Start Here

🔑 Explore the Premium Hub (exclusive — upgrade to unlock)

Guides & Step-by-Step

Deep Insights

📖 I ❤️ Dividends: Why I Believe Dividend Investing Is the Best Strategy | E-Book

How Effective is the MaxDividends Strategy for Building Growing Passive Income

Help & Support

Got a question about dividends? Ask Max, your AI Dividend Assistant!

Didn’t get the answer you need? Reach out: max@maxdividends.app or team@maxdividends.app — we’ll help you out.