The MaxDividends Macro Report is your monthly deep dive into global dividend trends — packed with data, insights, and analysis from the most dividend-focused team and community in the world.

💬 Like, share, and repost to spread the dividend mindset!

Hey Dividend Investors!

Our latest MaxDividends Macro Report for September 2025 is here — packed with insights designed to keep your income stream rising.

We track thousands of dividend stocks across the globe, crunching an ocean of data every single week. Every chart, every table you see here represents countless hours of analysis and careful review by the MaxDividends team.

And the best part — all of this work is distilled and delivered exclusively to you. Clear, actionable, and focused on what matters most: building lasting, growing dividend income for your future.

We’re the most dividend-focused community on Earth — and you’re right in the center of it.

The MaxDividends Macro Report: Dividend Eagles Deliver $105B YTD

Dividend Eagles: 3 Top-Performing Dividend Stocks of the Month

Updated Dividend Eagles Top Stocks List

The Most Notable Dividend Increases

Dividend Macro Highlights:

Global Dividend Trends

US Dividend Trends

⭐ My Personal Stock Watchlist for September 2025

Dividend Eagles: 3 Top-Performing Dividend Stocks of September

The "Dividend Eagles List" comprises approximately 100 of the most reliable dividend-paying companies in the U.S. market, each boasting over 15 consecutive years of increasing dividends.

These companies have been meticulously selected based on stringent criteria established by the MaxDividends team.

🥉 +5.63% GRC The Gorman Group

Pumping the World’s Flow, Sustaining Dividends

The Gorman-Rupp Company isn’t a name most people recognize, but its products are critical to everyday life. The company designs and manufactures pumps and pumping systems used in water, wastewater, flood control, agriculture, industry, and municipal infrastructure. From moving clean drinking water to powering fire protection systems and storm drainage, Gorman-Rupp is a behind-the-scenes enabler of essential services.

Founded in 1933, the business has built its reputation on reliability, engineering quality, and serving mission-critical markets. Its wide product range — from small utility pumps to massive flood-control units — gives it a steady role in global infrastructure and industrial applications.

The company has increased its dividend for more than 50 consecutive years, earning the rare title of Dividend King. The yield is modest, typically around the 1.5–2% range, but the consistency and safety behind it matter more. With a conservative payout ratio and strong cash generation, GRC has plenty of room to keep rewarding shareholders.

While the business is somewhat cyclical — tied to infrastructure budgets and industrial spending — the long-term demand for water systems, municipal utilities, and replacement equipment provides a reliable tailwind.

🥈 +6.71% PRI Primerica Inc

Financial Empowerment for Main Street, Growing Payouts

Primerica isn’t a household name in every home—but the company is deeply involved in financial services for middle-income families. It acts as a distributor of term life insurance, mutual funds, annuities, auto/home insurance, debt management, and related products through a network of licensed representatives. Its mission: to help everyday households gain financial stability through education and affordable protection.

Founded in the late 1970s (as A.L. Williams) and later rebranded as Primerica, the company evolved into a hybrid model combining insurance sales with financial advice. Over time it has expanded into investments, credit solutions, and insurance distribution in both the U.S. and Canada. The use of a multi-level marketing (MLM) structure means that a significant part of its growth depends on recruiting agents along with selling products.

The current annual dividend is about $4.16 per share, yielding roughly 1.4–1.6 %. Its payout ratio is low — under 20 % — suggesting the company retains ample earnings for reinvestment or growth. Over the past decade, the dividend has been increased consecutively (13+ years of raises), signaling a commitment to rewarding shareholders.

🥇 +8.14% KLAC KLA Corporation

Inspecting Chips, Rewarding Investors

KLA Corporation sits at the heart of the semiconductor supply chain—not as a chipmaker, but as a crucial enabler. The company designs, produces, and supports process control, metrology, inspection, and yield-management systems used by semiconductor fabs throughout the the world. In effect, KLA ensures that chips are manufactured with precision, low defect rates, and consistency. Its tools and software help fabs catch flaws early, measure tiny features, and push throughput.

Formed via the merger of KLA and Tencor (hence “KLA-Tencor” in its past), the company has evolved into one of the foremost suppliers of equipment and analytics for wafer fabrication, reticle processing, and packaging lines. Over time, it’s carved a strong niche with high technical barriers, long replacement cycles, and deep integration into the semiconductor ecosystem.

Dividend One-Pager of the Month

A Proven Dividend Eagle 🦅

50+ consecutive years of dividend increases

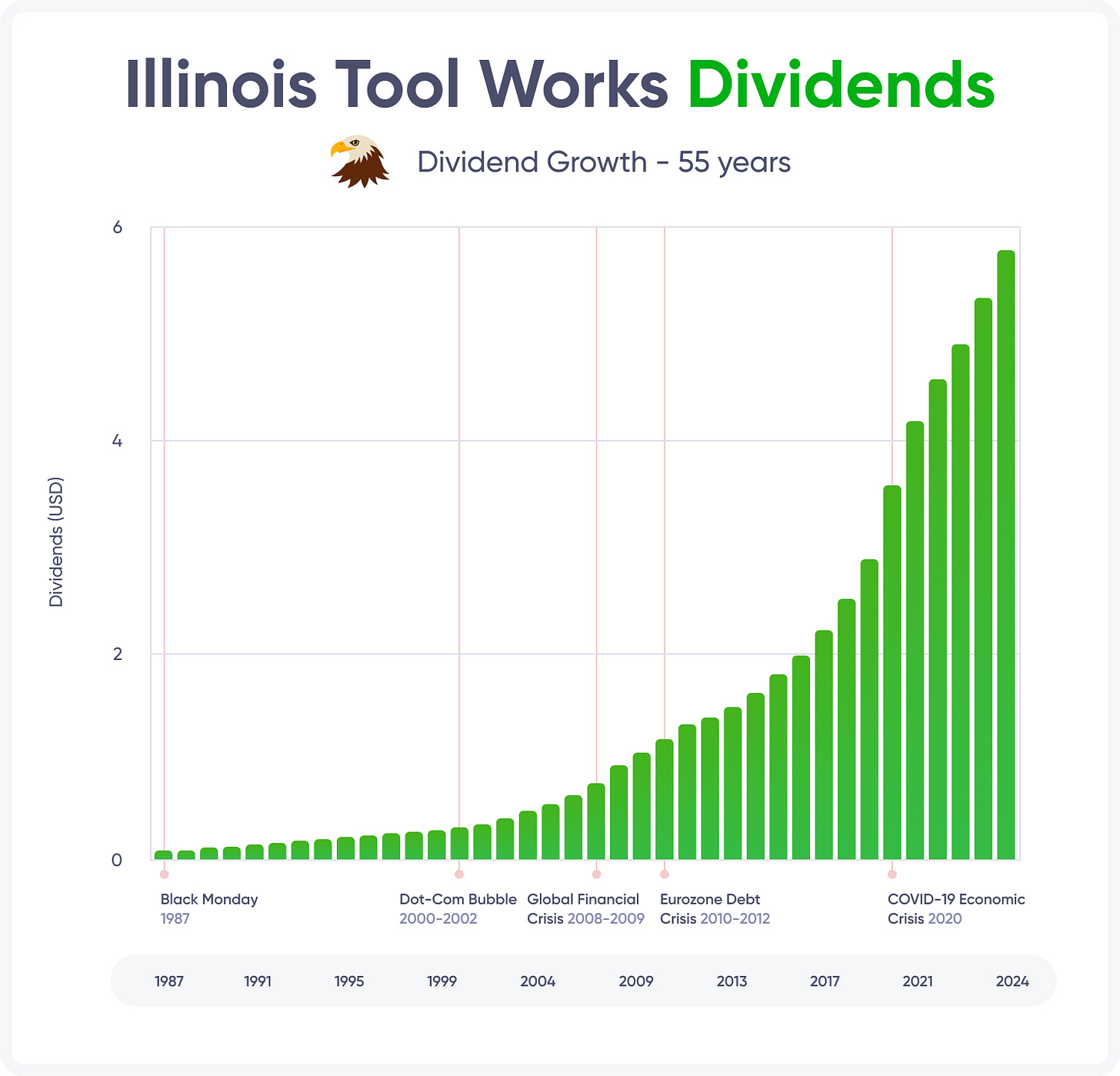

Illinois Tool Works Inc. (NYSE: ITW) demonstrates a consistent and reliable dividend policy, which underscores its financial stability and commitment to returning value to shareholders. Recently, the company’s Board of Directors announced a 7% increase in the quarterly dividend — to $1.61 per share, equivalent to an annual dividend of $6.44 per share. This step continues the company’s long-standing tradition of increasing payouts:

ITW has been raising dividends for 51 consecutive years, and its dividend yield is approximately 2.47%. Dividends are paid quarterly, with the nearest ex-dividend date on September 30, 2025, and the payment date on October 10, 2025. The payout ratio is at a level of about 51.65–53.58%, indicating a balanced approach between distributing profits to shareholders and reinvesting in business growth.

The average annual dividend growth rate in recent years has been about 7%, reflecting the company’s ability to generate stable cash flow and earnings. Such consistent dividend growth makes ITW an attractive asset for income investors focused on long-term and reliable payments.

The Most Notable Dividend Increases of the Month

Realty Income (O) - Dividend Increase: +3.65%

25+ consistent years of dividends

Realty Income has declared 132 dividend increases since our NYSE listing in 1994.

Realty Income (NYSE: O) is a U.S.-based REIT that invests in free-standing, single-tenant commercial properties under long-term NNN leases across the United States, the United Kingdom, and six other European countries. It’s famously known as “The Monthly Dividend Company,” delivering that dependable rental income through a widely diversified property footprint.

In Q2 2025 (three months ended June 30, 2025), Realty Income posted total revenue of $1,410.4 million, up compared to $1,339.4 million a year earlier, underlining a solid topline uptick. Net income available to common stockholders reached $196.9 million, reflecting steady operational performance and rent resilience even amid market headwinds.

Microsoft Corp (MSFT) - Dividend Increase: +9.60%

20+ consecutive years of dividends. Proven Dividend Eagle 🦅

Microsoft Corporation (NASDAQ: MSFT) is a global technology leader with operations spanning cloud computing, productivity software, personal computing, AI, and enterprise services. Its key products include Microsoft 365, Azure and Windows; it operates in a large number of markets worldwide, including the U.S., Europe, and Asia.

For its fourth fiscal quarter ended June 30, 2025, Microsoft reported revenue of $76.4 billion, up 18% year-over-year, and net income of $27.2 billion, an increase of 24% YoY. The margin performance was strong, driven by contribution from cloud & AI segments, and operating income grew 23%.

Microsoft pays an annual dividend of $3.32 per share, yielding approximately 0.65%, with a dividend payout ratio of 24.34%. The company has increased its dividend for 20 consecutive years.

JP Morgan (JPM) - Dividend Increase: +7.10%

15+ consecutive years of dividends. Proven Dividend Eagle 🦅

JPMorgan Chase & Co. is one of the biggest financial services firms globally, offering banking, investment banking, asset & wealth management, consumer & community banking, payments and markets operations. It operates mainly in the U.S. but also has significant international exposure, especially in capital markets and global finance.

In Q2 2025, JPMorgan reported revenue of $44.9 billion, down about 11% YoY. Net income was $15.0 billion, down from a higher figure a year ago, but still solid given margin pressures and deposit cost headwinds.

The company pays an annual dividend of $5.60, yielding 1.78%. Dividend Increase Track Record is 15 years, 5-Year Dividend Growth is +39.00%, Dividend Payout Ratio is 28.73%.

The Most Solid Recent Dividend Hikes

Goldman Sachs Group (GS) +33.33%

McKesson Corp (MCK) +15.49%

Cintas Corp (CTAS) +15.38%

Community Trust (CTBI) +12.77%

Cummins Inc (CMI) +9.89%

Dividend Macro Highlights: Global Dividend Trends

The macro report is updated quarterly

Global: Latest Dividend Data

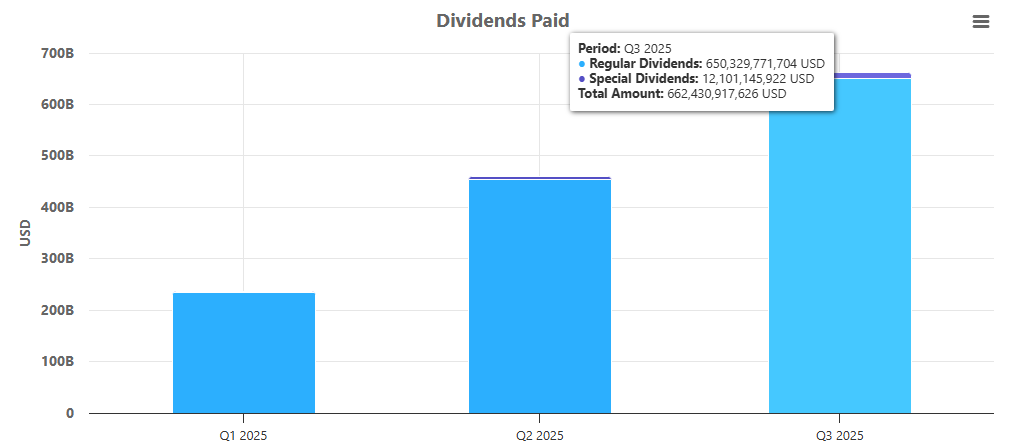

The global cumulative dividend payout for Q3 2025 continued the upward trend seen in Q2 2020.

This indicates that most dividend-paying companies have weathered the impact of the 2020 crisis and successfully adapted their businesses to the new reality.

Global Total Quarterly Dividend Payments (US$ Billions)

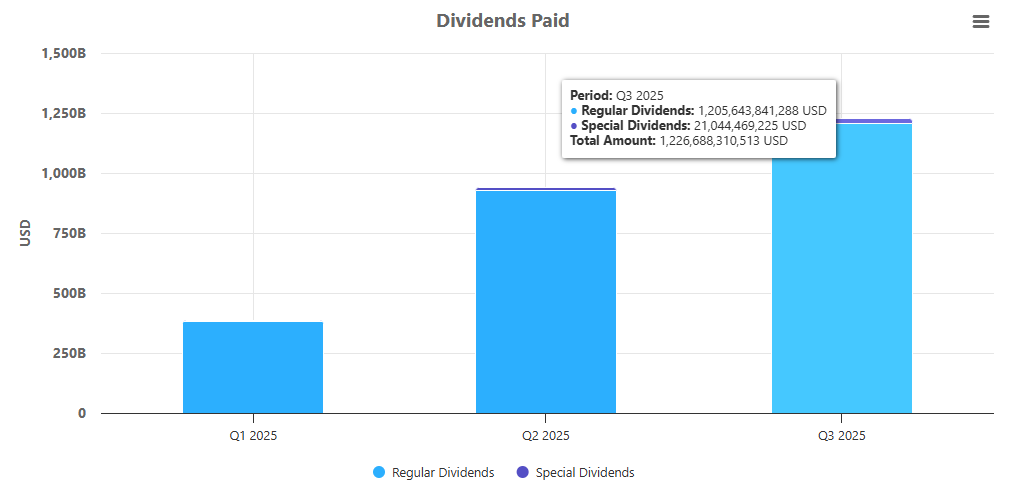

Companies paid out $640.5 billion in dividends in the second quarter of 2025. As of now, companies have already paid out $280.4 billion in the third quarter. This figure is expected to increase by the end of the quarter (Figure 1)

U.S. Dividend Landscape

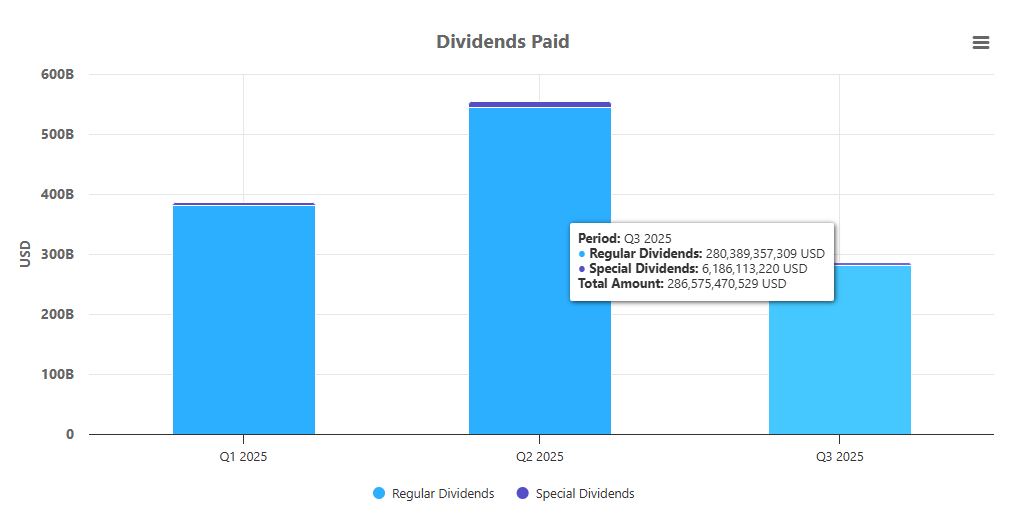

The chart shows total dividend payments by US companies in 2025, broken down by quarter. Q1 and Q2 delivered strong payouts of around $230–240B each. For Q3, the figure reflects partial data so far, with regular dividends making up the bulk and special dividends adding only a small share.

Cumulative dividends paid by US companies in 2025

Dividends paid by US companies in 2025 show steady growth as the year progresses. Cumulative payouts reached about $235B by Q1, $460B by Q2, and climbed to over $660B by Q3 to date. Regular dividends account for nearly all of the total, with special dividends making up only a small fraction.

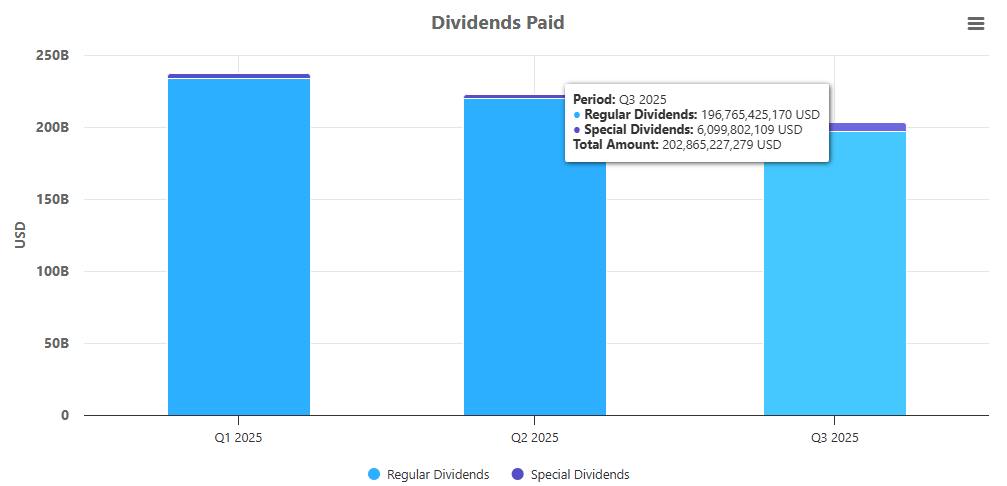

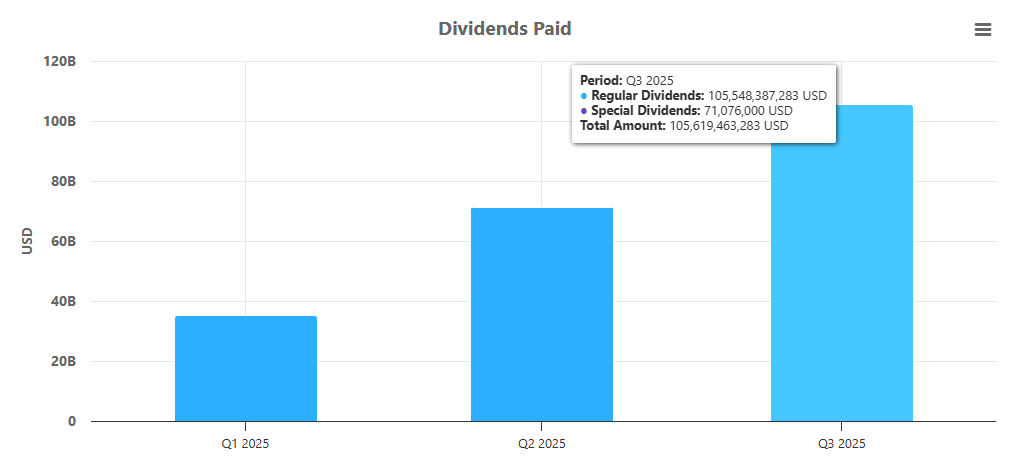

Cumulative dividends paid by US Dividend Eagles in 2025

Dividend Eagles — companies with 15+ years of consecutive dividend growth — have already distributed over $105B in dividends year-to-date 2025. Payouts are compounding quarter by quarter: around $35B by Q1, nearly $70B by Q2, and just over $105B so far in Q3.

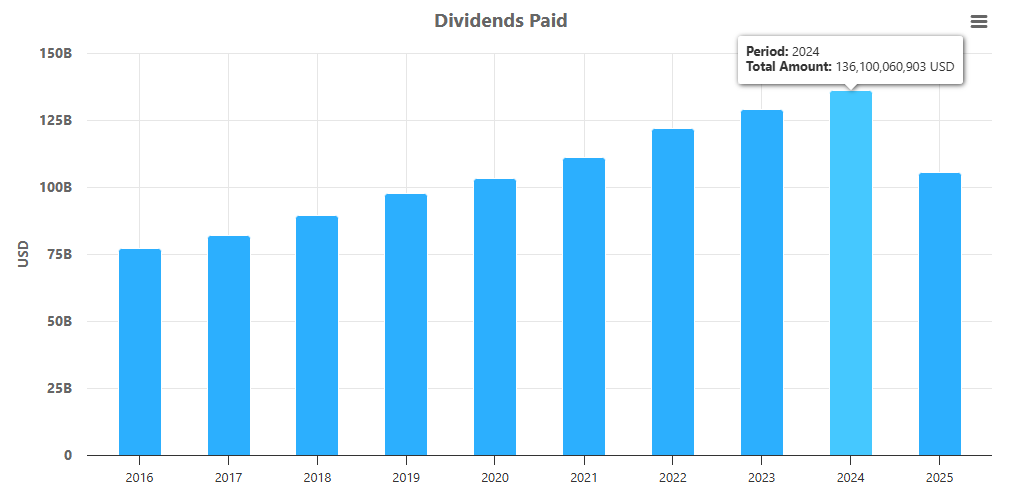

Proof That Dividend Eagles Deliver, Year After Year

Over the past decade, US Dividend Eagles — companies with 15+ years of consecutive dividend increases — have nearly doubled their annual payouts, climbing from around $75B in 2016 to more than $136B in 2024. That’s pure cash returned to shareholders, without even counting the effect of reinvestment.

📊 This chart makes the MaxDividends concept crystal clear: when you own businesses that never stop paying and keep raising the bar every single year, your income stream snowballs in front of your eyes. These are not flashy promises — they are the most reliable wealth-building machines in the market.

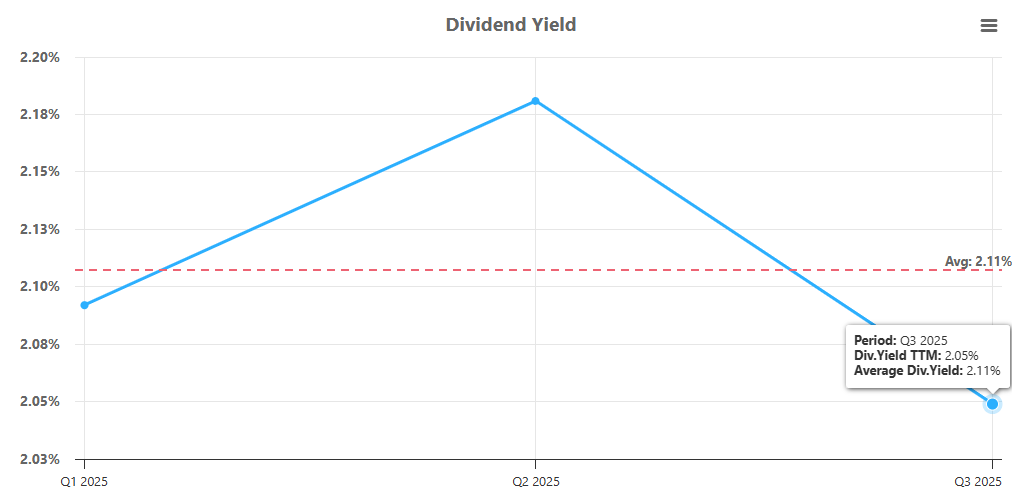

Average Dividend Yield of Dividend Eagles, Q3 2025

In 2025, the average dividend yield of Dividend Eagles has hovered around 2.1%. Yields peaked at 2.18% in Q2 before easing to 2.05% in Q3, slightly below the long-term average of 2.11%. The stability of these yields underscores the reliability of Dividend Eagles as consistent income generators for long-term investors.

🥇 Top 5 Dividend Eagles by Total Payouts (2025 YTD)

These are the heavyweights — the Dividend Eagles returning the most cash to shareholders right now:

Microsoft (MSFT) — 💵 $25.38B in dividends

Johnson & Johnson (JNJ) — 💵 $9.24B

Procter & Gamble (PG) — 💵 $7.66B

Home Depot (HD) — 💵 $6.85B

Coca-Cola (KO) — 💵 $6.61B

📊 Together, just these five companies alone have distributed over $55 billion in dividends so far — a powerful reminder of what it means to own reliable, world-class businesses that never stop paying.

And that’s exactly what the Dividend Eagles List is all about. 🦅 It’s our curated lineup of 100+ U.S. companies that have raised dividends for 15+ consecutive years — the strongest, most consistent payers in the market. These aren’t just stocks; they’re proven wealth-building machines built on financial stability, resilience, and decades of shareholder commitment.

👉 The full, always-updated Dividend Eagles List is available inside the MaxDividends App — exclusive to our community.

Created by the MaxDividends Team. Available only on MaxDividends. Exclusive.

U.S. Dividend Landscape - (S&P 500)

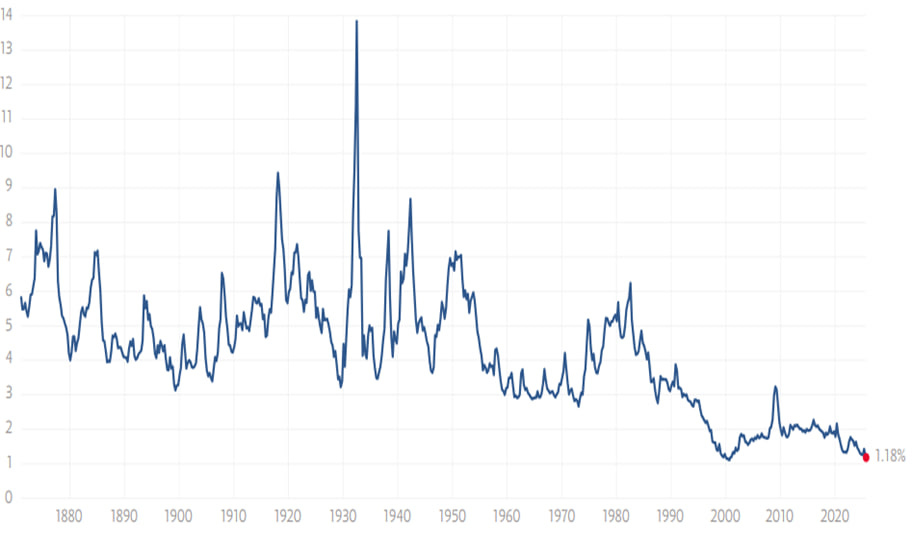

The S&P 500 dividend yield has been cut in half over the past decade. It now stands at 1.18%, which means stock prices relative to dividends are higher than usual. As a result, the dividend yield is at record lows.

S&P 500 Historical Dividend Trends

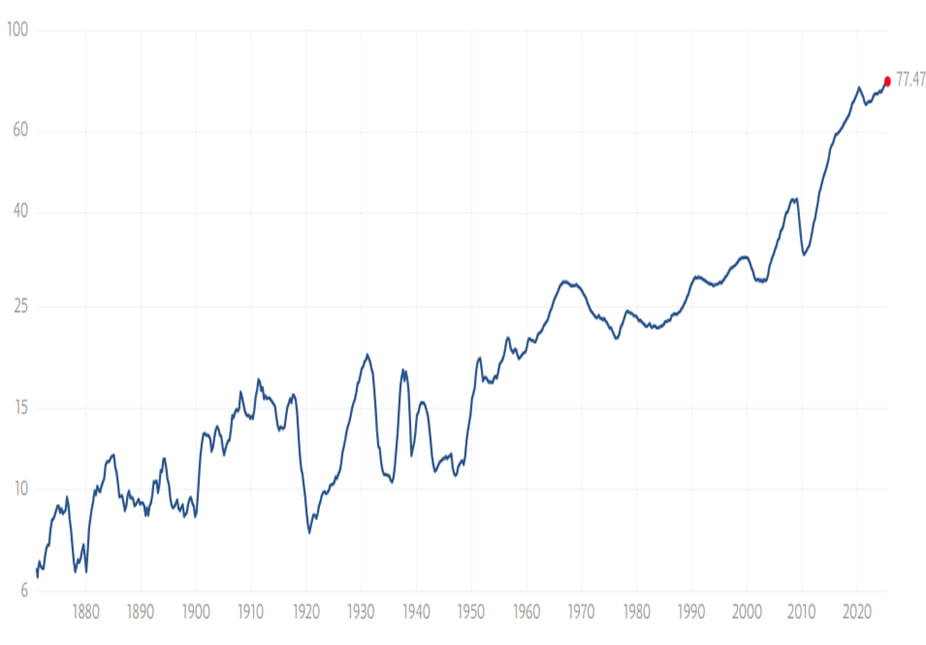

Historical dividends from stocks that are part of the S&P 500 Index are shown in Figure 5. The data is adjusted for inflation.

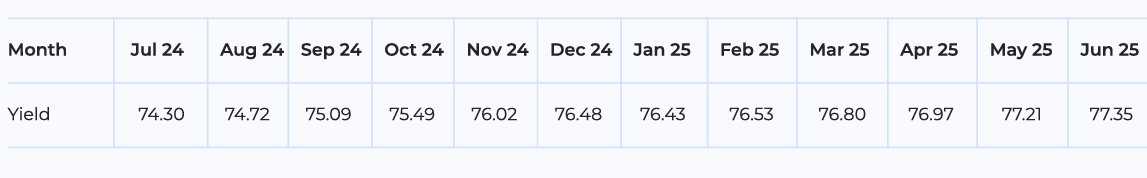

With the current inflation rate (Figure 4), there is a gradual acceleration in the growth of dividends on the S&P 500 Index. The previous peak was in May 2020, when the dividend was 73.09. Currently, this figure stands at 77.47.

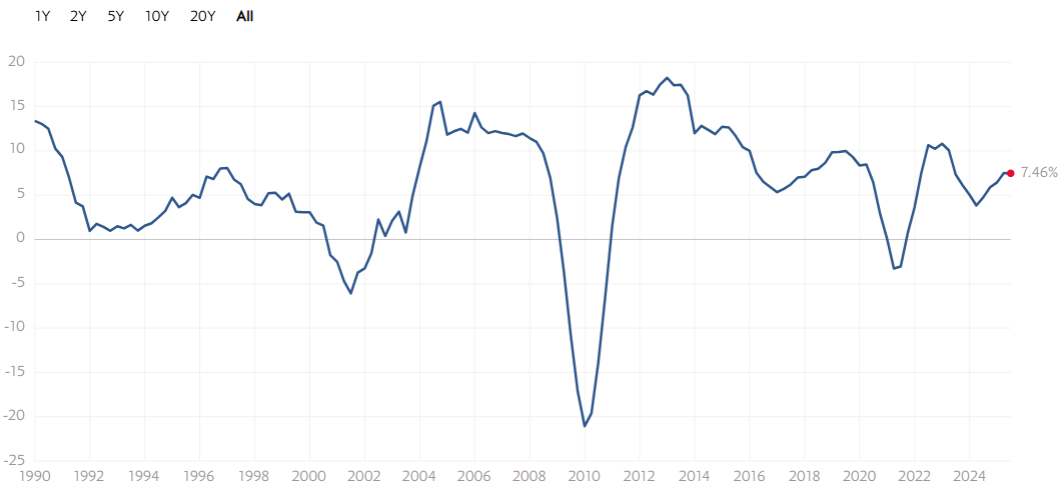

S&P 500 Dividend Growth

The S&P 500 dividend growth is shown in Figure 6. Over the past 32 years, the chart has been negative only three times, and all of those periods were linked to crises.

Over the past month, dividend growth has outpaced inflation, reaching 7.46%. The upward trend has continued over the past 12 months.

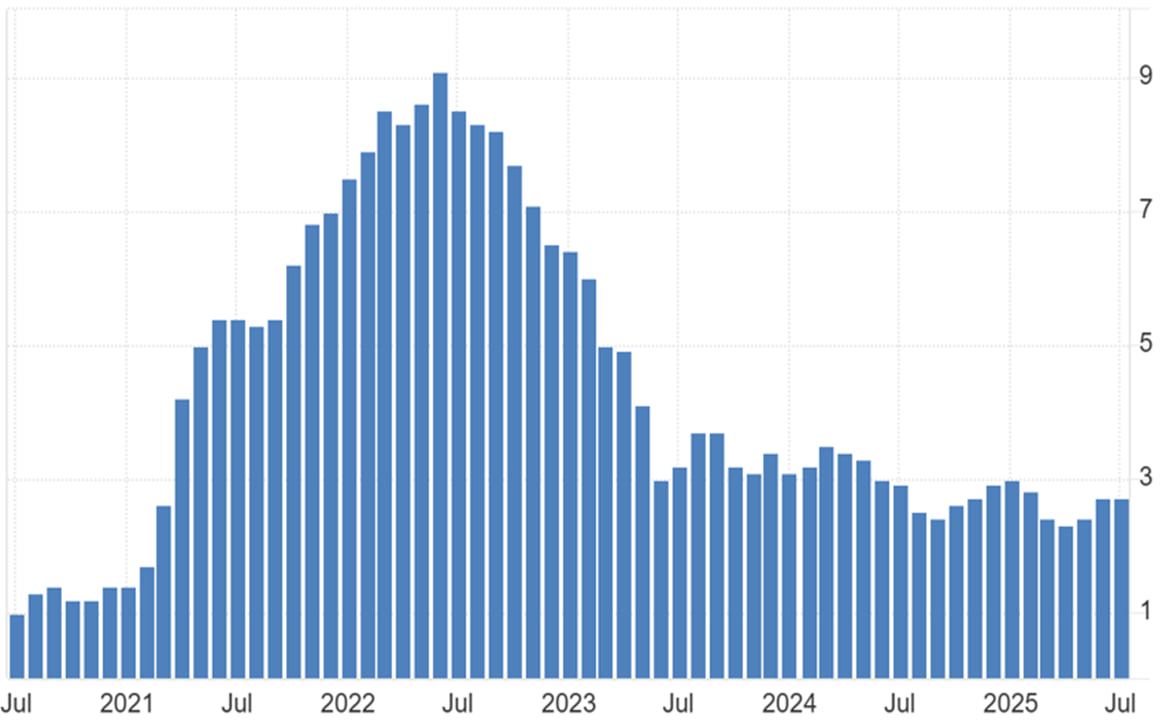

Inflation’s Impact on Dividends

Inflation has been rising faster than dividends have been increasing, leading to a correction in the S&P 500 dividend chart. Since mid-2022, inflation has been gradually declining, allowing the S&P 500 dividend chart to reflect growth. Since mid-2023, the pace of inflation’s decline has slowed significantly.

However, the ongoing downward trend in inflation continues to positively impact the growth of the S&P 500 dividend chart.

For your convenience, we have prepared a PDF version of the Dividend Macro Overview. You can download and review it at any time.

Bonus Part

My Personal Stock Watchlist — September 2025

A hand-picked list of the dividend stocks I’m actively tracking this month.

Each month I hand-pick a focused shortlist of dividend stocks worth watching. No guesswork, no hype — I screen thousands of companies and keep only the ones with strong balance sheets, reliable dividend growth, and long-term wealth-building potential.

This watchlist is where I’m putting my energy — a mix of high-yield opportunities and growth names with the power to multiply income streams over time. If you’re serious about building a future where dividends cover your lifestyle, this is where to start.

⭐️ Today’s Shortlist

FedEx (FDX)

Dividend Yield 2.49% | MaxRatio 10+ | Financial Score 97

FedEx Corporation is a global leader in transportation, e-commerce, and business services. Founded in 1971 and headquartered in Memphis, Tennessee, FedEx operates one of the world’s largest express delivery networks, serving customers across over 220 countries and territories.

Key Business Segments

FedEx Express – Provides time-definite international and domestic shipping services, specializing in overnight delivery and air cargo.

FedEx Ground – Offers cost-effective, day-definite delivery services for small packages across the U.S. and Canada.

FedEx Freight – Delivers less-than-truckload (LTL) freight services with nationwide coverage.

FedEx Services – Supports sales, marketing, IT, and customer service operations across all FedEx segments.

FedEx Logistics – Handles supply chain solutions including customs brokerage, warehousing, and trade management.

FedEx is known for its global reach, speed, and reliability—making it a critical partner for businesses of all sizes and a key player in global commerce.

Nexstar Media Group (NXST)

Dividend Yield 3.69% | MaxRatio 10+ | Financial Score 98

Nexstar Media Group is the largest local TV station owner in the U.S. Based in Irving, Texas, with additional operations in New York and Chicago, it owns nearly 200 stations nationwide and also runs networks like The CW, NewsNation, Antenna TV, and Rewind TV.

Key Business Segments

Local TV Stations – Operates nearly 200 stations across large and mid-sized markets, many affiliated with major networks.

The CW & Digital Networks – Runs The CW (75% ownership), plus classic TV networks and the national news network NewsNation.

Digital & Political Media – Owns The Hill and delivers streaming and mobile content to reach new audiences.

Acquisitions & Expansion – Announced a $6.2B deal to acquire Tegna, expanding reach to about 80% of U.S. TV households once closed.

Nexstar is known for its scale, reach, and disciplined growth strategy. With 12 straight years of dividend increases, a payout ratio in the mid-30% range, and strong expansion through acquisitions, it’s positioned as a dependable, growth-focused dividend stock.

Shoe Carnival (SCVL)

Dividend Yield 2.71% | MaxRatio 10+ | Financial Score 98

Shoe Carnival Inc. is a leading footwear retailer offering a wide selection of value-priced shoes for the entire family. Founded in 1978 and headquartered in Evansville, Indiana, the company operates over 400 stores across the United States and Puerto Rico, serving value-conscious consumers with an engaging in-store experience.

Key Business Segments

Retail Stores – Operates physical locations in high-traffic shopping areas, featuring name-brand athletic, casual, and dress footwear for men, women, and children.

E-Commerce – Sells merchandise through its website, combining convenience with promotional pricing and store pickup options.

Private Label Brands – Offers exclusive brands that help differentiate the product mix and support healthy margins.

Loyalty Program (Shoe Perks) – Drives repeat business with personalized promotions and member-only discounts.

Shoe Carnival is known for its upbeat store environment, value-driven pricing, and strong customer loyalty—positioning it as a go-to destination for affordable, brand-name footwear.

A complete list of my favorite stocks I’m currently tracking—only the best make it in.

Happy dividends for all the holders!

- Max & MaxDividends Team

MaxDividends Mission

Helping people build growing passive income, retire early, and live off dividends.

Someone’s sitting in the shade today because someone planted a tree a long time ago. ― Warren Buffett.

Great overview as always! HD maintaining that #4 spot among Dividend Eagles really undersores how reliable their cash generation is, especially considering the housing headwinds. The $6.85B in payouts YTD (September) compares well to other consumer discretionary names that got hit harder in the rate environment. What I find intersting is how HD's payout ratio stays disciplined even as they're deploying billions for SRS/GMS acquisitions. That tells you managment isn't sacrificing the dividend to chase growth - they're threading both needles at once. The broader Eagles data is solid too - seeing that group push past $105B YTD while maintaining 2.05% yield shows the consistency these companies bring during uncertain times. Really appreciate the depth you bring each month!