Rentokil - Still Bugged by Execution

Performance review FY24, North America Challenges, DCF Valuation

Dear all,

You already know how much I value predictable and growing passive income through dividend investing. But if there’s one thing I’ve learned along the way, it’s that understanding the big picture is just as important as picking the right stocks.

That’s why today, I want to introduce you to someone whose work I personally find interesting: long-term investors — StockOpine.

Welcome to StockOpine — A Research-Driven Investing Newsletter with 9,000+ Subscribers

At StockOpine, we share in-depth research on what we call “quality companies”—industry leaders or disruptors with wide moats, strong financials, and durable business models. Our long-term, fundamentals-first approach helps investors cut through the noise and focus on sustainable compounding.

We invest the time, so you can save hours. Each month, we deliver detailed stock deep dives, industry overviews, valuation updates, and more—arming you with the insights to make informed investment decisions.

Join thousands of investors who trust StockOpine to guide their journey toward quality, clarity, and returns.

Rentokil has been part of our portfolio for a year now, and unfortunately, it has been one of our underperformers (down 19% since we initially bought it in March 2024), primarily due to the integration challenges following its acquisition of Terminix in October 2022. Despite these setbacks, Rentokil remains the largest pest control company globally, operating in a highly resilient industry with attractive consolidation opportunities and long-term secular tailwinds.

In this article, we’ll review Rentokil’s financial performance for FY24, evaluate the company's progress in North America, and update our DCF valuation.

But first, let’s revisit the key challenges Rentokil has faced since acquiring Terminix at the end of 2022.

The original integration plan, rolled out in 2023, aimed to consolidate approximately 600 branches into 400 larger, more standardized locations by 2025. This strategy was designed to enhance route density, streamline operations, and better allocate overhead across brands. The acquisition targeted $200 million in net cost synergies by 2026, with a goal of expanding adjusted operating margins by ~100 basis points annually over the following three years. Management also projected medium-term organic revenue growth of at least 5% and operating margins exceeding 19% by FY25 - though this margin target was later deferred to FY26.

However, the integration did not go as planned. Operational disruptions and underperformance in lead generation efforts weighed on growth in the region. Despite increased investment in sales and marketing, Rentokil struggled to drive meaningful lead conversions in North America. This led to multiple downward revisions in guidance over the past two years, which ultimately pressured the stock.

Source: Koyfin (affiliate link with a 20% discount for StockOpine readers)

As a result, Rentokil closed FY24 with an adjusted operating margin of 15.4% and organic revenue growth of 2.8% (both well below initial expectations). While the company maintained its medium-term organic growth target, it officially withdrew its FY26 margin guidance. Instead, Rentokil now aims to exceed a 20% North America operating margin by FY27 (compared to 17.1% in FY24).

Despite some operational progress, we believe management may once again be overly optimistic with its targets, as achieving a three-percentage-point margin expansion over the next three years appears ambitious given the ongoing challenges.

Contents:

Performance Update

Valuation

Conclusion

1. Performance Update

Source: Company filings, StockOpine analysis

Following a challenging year, Rentokil reported FY24 revenue of £5.6 billion at constant exchange rates, up 3.9% year-over-year. Group organic revenue growth came in at 2.8%, falling short of management’s medium-term target of 4.5%–6.5%, and down from 4.9% in FY23. The deceleration was largely driven by ongoing weakness in North America, which accounts for approximately 60% of total revenue. Organic growth in the region was 1.5%, modestly ahead of revised guidance (~1%), but continued to reflect persistent challenges in customer acquisition and lead generation.

In contrast, the International segment performed relatively well, with total revenue growth of 8.2% and organic revenue growth of 4.7%. All regional markets contributed positively.

Source: Company filings, StockOpine analysis

On the profitability side, Rentokil delivered an adjusted operating margin of 15.4%, slightly below the 15.5% guidance provided in the September 2024 trading update and meaningfully lower than the 16.7% reported in FY23. Adjusted operating profit was primarily impacted by the underperformance in North America, where adjusted operating margin declined from 18.7% in FY23 to 17.1% in FY24.

a. North America

Source: Company filings, StockOpine analysis

Rentokil’s efforts to reinvigorate growth in North America through the RIGHT WAY 2 plan which included increased investments in marketing and sales did not yield the expected results. Organic revenue growth remained below expectations, hindered by continued lead generation challenges.

“clearly, we're not delivering the levels of organic growth that we expect. And our main challenge is lead generation and we're implementing the key changes that I've just outlined. Post integration, we remain committed to delivering 1.5x market organic growth in North America Pest Control over the medium term. We expect North America margins to exceed 20% in 2027.” Andrew Ranson, CEO

“Through our RIGHT WAY 2 plan, in 2024, we deployed sales, marketing and customer experience initiatives to reinvigorate growth, but they are not yet delivering the levels of organic growth that we expect” Paul Edgecliffe, CFO

Management also acknowledged that a portion of the investments made in 2024 did not produce the intended returns and announced plans to reallocate those funds toward new strategies in 2025.

On top of the challenges, North America is undergoing leadership changes. Brad Paulsen, who was appointed CEO of North America in December 2023, has resigned to pursue other opportunities and will depart the company in April 2025. His short tenure raises concerns and further underscores the difficulties Rentokil continues to face in the region. It has been rumored that activist hedge fund Trian Partners played a role in Paulsen’s departure, reportedly pressuring for him to step down. The company has appointed Alain Moffroid as Interim North America CEO who has been with the company for 12 years, as his successor.

On a slightly more encouraging note, North America organic growth showed sequential improvement.

H1 2024: 1.3%

H2 2024: 1.8%

Q4 2024: 2.3%, up from 1.4% in Q3

Despite this gradual improvement, growth remains well below that of the key competitor Rollins, which reported 10.3% revenue growth for FY2024 and 10.4% in Q4 2024, highlighting Rentokil’s underperformance in the region.

b. Branch consolidation

Rentokil has adjusted its original branch consolidation plan. Instead of reducing to 400 large branches, the company is now pursuing a hybrid model, maintaining larger branches while also adding smaller, cost-efficient “satellite” branches to improve proximity and brand visibility. This shift has resulted in an increase in the expected total number of branches to over 500. Management stated that the results from the satellite branches are positive so far with the company currently operating 22 satellite branches, and the number is expected to grow.

Additionally, Rentokil revised its brand strategy to keep 9 of the strong regional brands, in addition to the national Rentokil and Terminix brands. Those brands have strong local recognition and will operate as stand-alone brands, reducing the need for full integration with Terminix branches.

Source: Rentokil Earnings Presentation 2024

Despite this revised scope, the integration is still scheduled for completion by the end of 2026.

In the second half of the year 58 Terminix branches with revenues of $373 million were migrated onto Rentokil’s unified IT systems. This brought the total number of branches operating under the new back-office infrastructure to 250.

Additionally, the company began testing full integration initiative including rerouting, rebranding, and new pay structures across 9 branches in Q4, followed by the full integration of an additional 41 branches. Management cited encouraging early results, noting that 15% of Terminix branches are now fully integrated.

“I do think it’s worth remembering our journey in North America from where we started in 2022 - a highly fragmented network of over 70 systems, over 80 brands, different pay and benefit structures, multiple vendors, no uniform customer experience. Since then, we’ve made significant progress - just a few examples on the screen – we’ve got a fully aligned back-office set of functions, we’ve got a single management team; we’ve introduced Rentokil’s laser focus on colleague experience and colleague retention; we’ve rolled out a single people management system; we’ve set the innovation centre up and running; and the first branch system integrations executed successfully last year.” Andy Ransom, CEO

Source: Rentokil Earnings Presentation 2024

Looking ahead, once integration is completed in 2026, Rentokil expects to realize $100 million in cost reductions by 2027 compared to 2024 cost levels (equivalent to ~3% of North America sales). These savings will stem from branch right-sizing and improved route density, with a significant boost expected in technician productivity and overall operational efficiency.

Upgrade to paid

c. 'THE RIGHT WAY 2' strategy

Launched in 2023, ‘THE RIGHT WAY 2’ strategy was designed to improve performance in Rentokil’s North American operations, focusing on key areas such as colleague retention, lead generation, customer retention, and marketing effectiveness.

In terms of the progress of the program, here are the highlights for the year:

Colleague retention

North America retention improved by 4.2 percentage points to 79.4% (vs. 75.2% in FY2023).

At Terminix, where retention was just 62.4% at the time of acquisition, it has now improved to 76.3%.

Customer retention

Customer retention in North America also showed modest improvement, increasing from 79.5% in FY2023 to 80.1% in FY2024.

Lead Generation and Marketing

Lead generation remains a significant challenge and continues to weigh on growth. Despite increased investment in marketing and brand awareness, the results have not met expectations. As a result, management plans to redirect marketing spend toward new, more targeted strategies in 2025.

“there is still significant work to be done to improve our lead generation. We’ve made strong progress in securing five-star reviews from our customers, which recognise high service levels and serve as a critical component of Internet search visibility. Five-star reviews for Terminix increased by 150% in the year to 44,000. In parallel, we have augmented our paid search strategies to generate higher quality leads. This includes refining our bidding strategy for critical search terms. We have leveraged technician leads through our Trusted Advisor programme, creating a complementary stream of lead generation. We continue to enhance our approach with better data reporting, increased focus at a branch management level and training for all new technicians as part of their on-boarding. The participation rate for the Trusted Advisor programme increased from 40% at the start of the year to 50% among Terminix technicians, and from c.57% to c.73% among Rentokil technicians.”

New to our research? Explore our free deep dive on Adyen — Adyen: Simplifying Payments with Top-Notch Quality — to see the depth of insight you can expect as a premium subscriber.

To better understand Rentokil’s operating model, check out our February 2024 deep dive: Rentokil Initial: Potential Opportunity in Pest Control.

Please note: the valuation in that report has been updated in our latest analysis.🔒 The remaining part of the article is exclusive to StockOpine premium subscribers. Get access to our DCF valuation, price target, and conclusion for Rentokil — and see how we’re managing our position.

2. Valuation

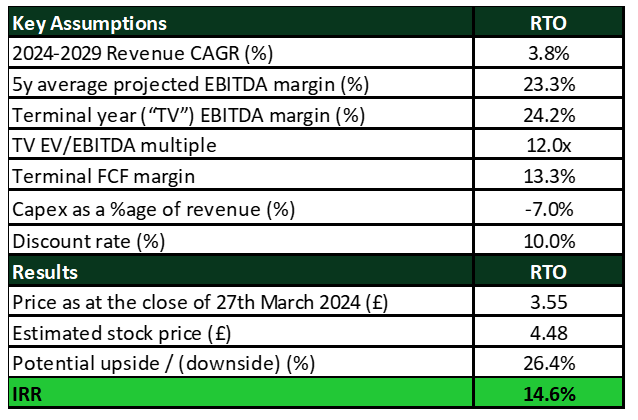

The stock price as of 27th March 2024 stands at £3.55 with a year-to-date return of -11%. The company's market capitalization is £8.9B and it trades at an EV/EBITDA TTM multiple of 10.6x. Based on our DCF valuation, the estimated price of Rentokil is £4.5, 26% higher than its current price, and an expected IRR over the projected period of 14.6%.

Source: StockOpine analysis

Revenue assumptions

To estimate fair value, we projected a revenue CAGR of 3.8%, with total sales reaching £6.6 billion by FY2029.

For FY2025, we estimate revenue of £5.6 billion, representing a 3% year-over-year increase, in line with analyst consensus.

From FY2026 onward, we apply a 4% annual growth rate, which is slightly below management’s medium-term organic growth guidance of 4.5%–6.5% and below industry forecasts of 5%–6%. While somewhat conservative, this accounts for recent execution missteps and the company’s ongoing integration challenges in North America.

Margin assumptions

We assumed an average adjusted EBITDA margin of 23.3%, rising to 24.2% by FY2029, both above the company’s three-year average of 22%.

For FY2025, we forecast an adjusted operating margin of 15.5%, flat compared to FY2024, implying no margin expansion in the near term. Adjusted for depreciation, the EBITDA margin was estimated at 21.2%, in line with current analyst estimates.

We gradually expanded margins to reflect long-term efficiency gains, reaching 18.5% adjusted operating margin by FY29. This is below management’s latest margin target of >20% by FY27 in North America (implying >19% at Group level), reflecting our cautious stance following downward guidance revisions.

Free Cash Flow

To derive free cash flows to the firm, we deducted:

Capex at 4.3% of revenue, aligned with historical levels and FY2025 guidance.

Right-of-use (ROU) asset additions at 2.7% of revenue, primarily related to fleet and building leases.

After factoring in taxes and working capital needs, our model results in a terminal FCF margin of 13.3%, which compares favorably to the 5-year average of 10.7%.

Terminal Value and Multiples

For the terminal value, we applied a 12x EV/EBITDA multiple, down from the 15x used in our previous valuation, as we believe a premium multiple is not justified without evidence of improved execution. We consider multiple re-rating as upside potential, contingent on successful delivery of the integration plan:

This is below the 5-year average multiple of 15.1x, but above the current TTM multiple of 10.6x.

We believe the current multiple does not fully reflect Rentokil’s long-term potential, particularly if integration in North America progresses and growth re-accelerates.

To calculate the value per share we used the minimum required return that we aim to obtain from our investments (i.e., 10%), adjusted for net debt and non-operating assets / liabilities identified and thereafter divided the resulting value by the number of shares.

Based on these calculations and assumptions (which may not materialize), we estimate a value per share of £4.48, which is higher than the current price of £3.55, resulting to an IRR over the projected period of 14.6%.

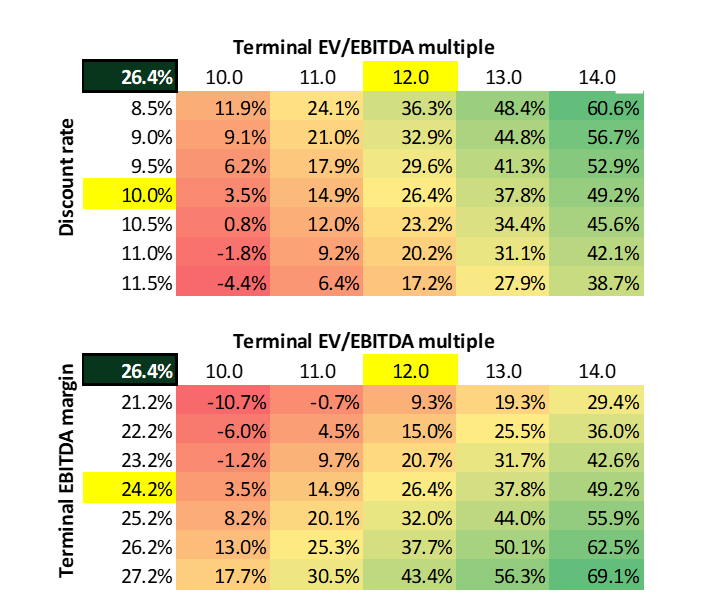

Sensitivity analysis

The below tables give an indication of the potential upside/(downside) compared to the current price (£3.55 as of 27th March 2024) when a) the terminal EBITDA multiple and the discount rate are changed and b) the terminal EBITDA multiple and EBITDA margin are changed.

3. Conclusion

While Rentokil’s post-acquisition journey has been marked by execution missteps, integration delays, and underwhelming performance in North America, we continue to believe in the company’s long-term potential. The pest control industry remains structurally attractive underpinned by recurring demand, consolidation tailwinds, and favorable unit economics.

Rentokil’s global leadership position, strong brand portfolio, and expanding presence in international markets provide a solid foundation for future growth. However, the North America business must show tangible progress, particularly in lead generation and operational efficiency, before we regain full confidence in Rentokil’s management.

At current levels, we believe the valuation is attractive relative to long-term fundamentals, but we are not adding to our position at this stage (currently at 5.85% allocation). Instead, we will closely monitor developments in North America, especially the execution of the RIGHT WAY 2 strategy and progress on integration milestones.

In our view, patience is warranted, and a clearer path to sustainable growth and margin recovery will be needed before we consider increasing our exposure.