2 Dividend Kings Worth a Closer Look Today

Today, we’re breaking down two companies that stand out from the crowd: tobacco giant Altria and retail powerhouse Target

MaxDividends Mission: Helping & Supporting Everyone in Building a Growing Passive Income, Retiring Early, and Living Off Dividends.

For dividend investors seeking opportunities with strong growth potential, MaxDividends Stock Ideas offers a daily, in-depth look at companies worth considering for a dividend portfolio.

Scroll Down to Read. No access yet? Check your status & upgrade to Premium to join the movement. Exclusive insights await inside!

Intro

💡 Invest in companies you believe in - W. Buffett

Dividend stocks are like reliable old friends—they pay you consistently, don’t cause drama, and rarely let you down. But even among the steady performers, some can still surprise you.

Take Altria, for example—a company that’s been rewarding shareholders for decades, despite lawsuits, regulations, and shifting public sentiment. Or Target, the retail chain that didn’t just survive the Amazon era but thrived in it by mastering the art of omnichannel sales.

There’s more to both stories than meets the eye. And if you think you already know everything about these dividend kings, think again. Here’s why these two stocks deserve a spot on your watchlist right now.

1. Altria Group

Altria Group, Inc. is an American company that manufactures and sells tobacco products through its subsidiaries. Its main products include Marlboro cigarettes, Black & Mild cigars and pipe tobacco, smokeless and chewing tobacco under the brands Copenhagen, Skoal, Red Seal, and Husky, as well as nicotine pouches under the on! brand and NJOY ACE e-cigarettes.

The company operates primarily in the United States, distributing its products through wholesalers and large retail chains. Founded in 1822, Altria is headquartered in Richmond, Virginia. It is considered financially stable and profitable, showing consistent growth and offering an attractive dividend yield.

History of the Company

Altria Group, Inc. traces its roots back to 1847, when George Weyman founded Philip Morris & Co. Ltd. in London. The business expanded to the United States in the early 20th century and grew into one of the leading tobacco companies in the country.

In 1985, Philip Morris Companies Inc. was established as a holding company, and in 2003, it was renamed Altria Group, Inc. to reflect its broader business portfolio beyond tobacco. With a history spanning over 175 years, Altria remains a dominant force in the U.S. tobacco industry while investing in smoke-free alternatives and emerging markets.

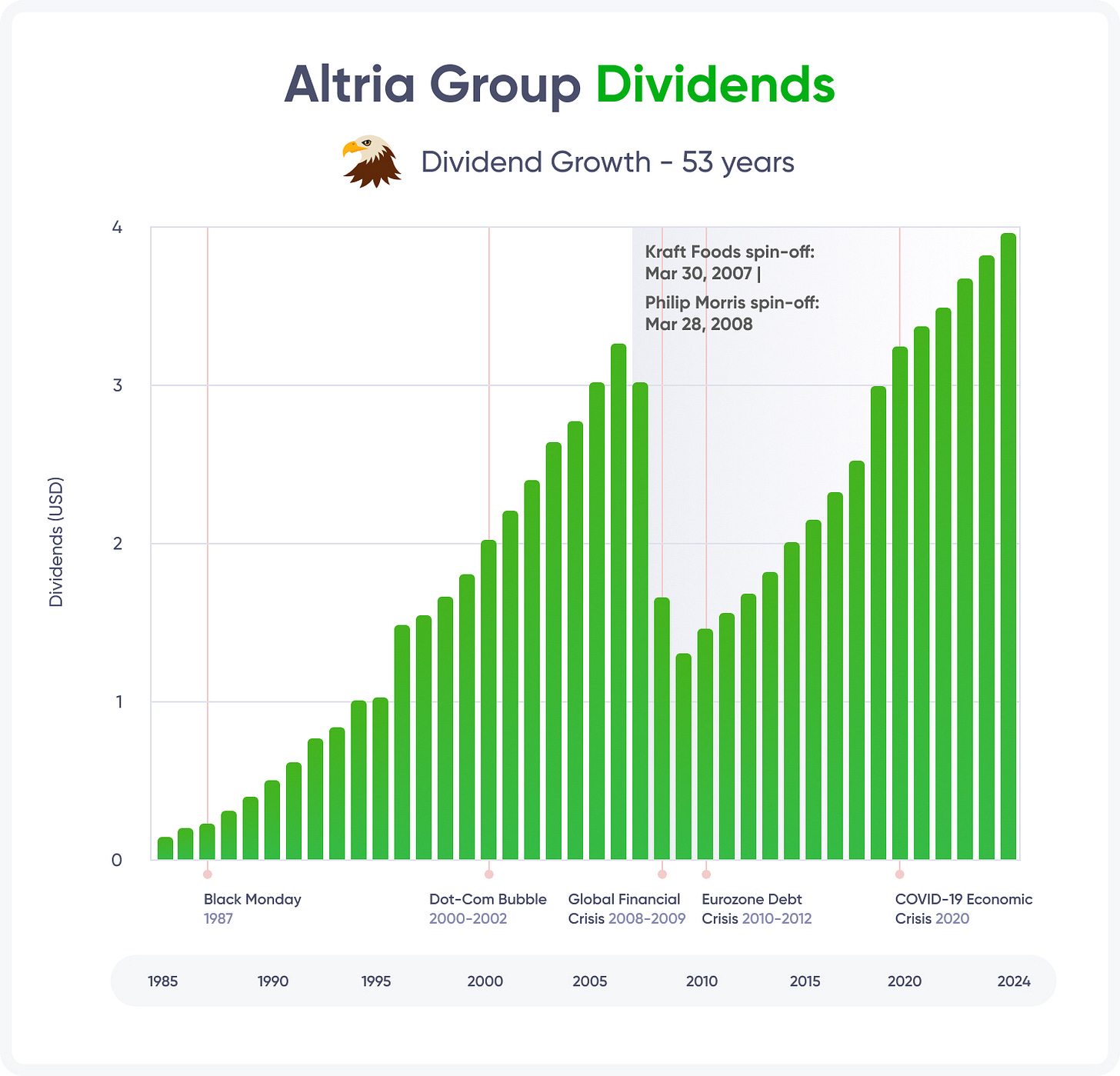

A Proven Dividend King 👑

Altria Group, Inc. has firmly established itself as a proven dividend performer, often referred to as a "Dividend King" due to its consistent and generous shareholder payouts. With 55 consecutive years of dividend payments and dividend growth, Altria demonstrates a strong commitment to returning value to investors.

The company's current forward annual dividend yield stands at 6.80%, with a forward dividend of $4.08 per share. Its MaxRatio of 10.90% indicates a projected double-digit dividend yield on cost over the next 10 years, based on its historical dividend CAGR and current financial health.

These metrics highlight the company's resilience and appeal to long-term income-focused investors.

Between 2006 and 2008, Altria executed two spin-offs, distributing shares of Kraft’s and Philip Morris. There was no actual reduction in dividends.

Despite a nominal dividend reduction in 2009, Altria retained its status as a "Dividend King" because:

The dividend cut was technical in nature and reflected changes in the company’s structure, not a deterioration of its financial condition.

The company resumed annual dividend increases after 2009, maintaining a consistent track record of shareholder payouts.

Therefore, the 2009 dividend reduction should be seen as part of an adjustment to a new corporate structure, rather than a break in the tradition of dividend growth.

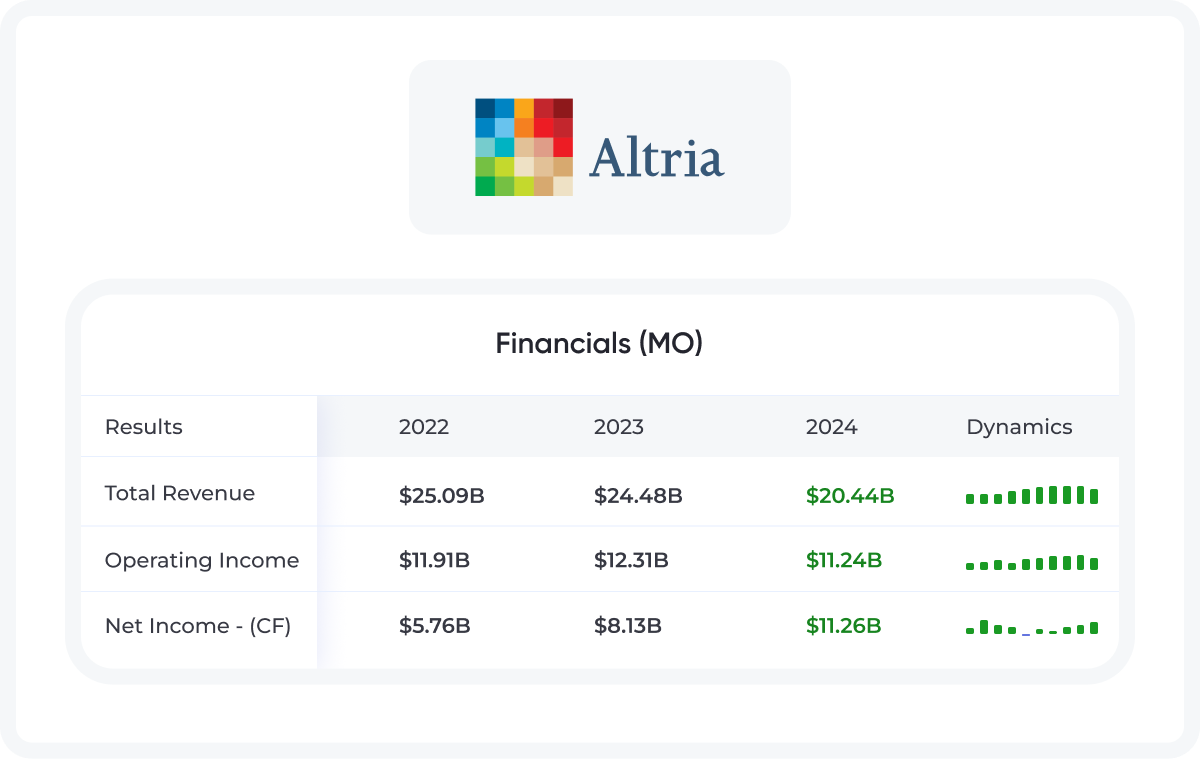

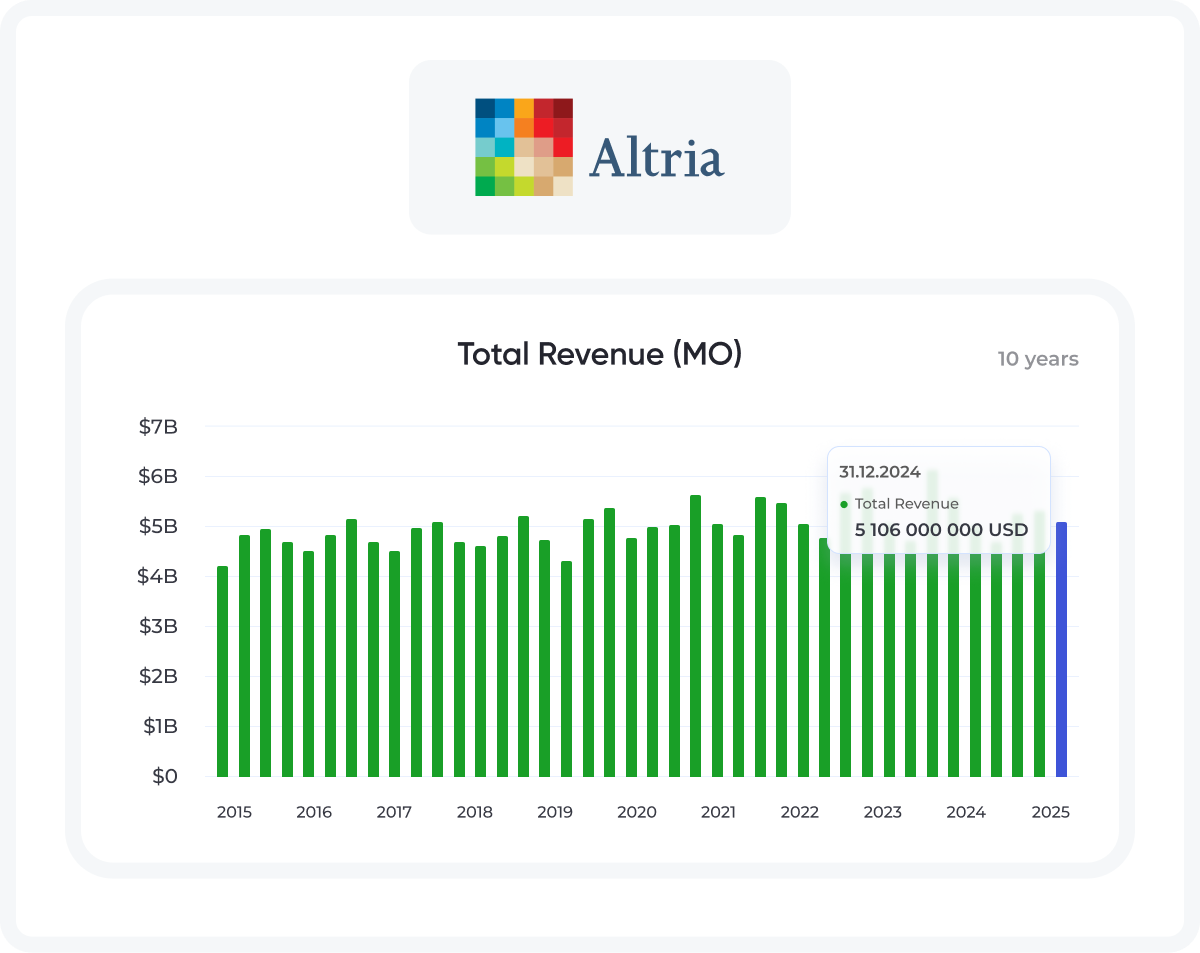

Financial Statement

If you want to stay on top of your portfolio's health, don't forget to check in on the financials of the companies you've invested in. The better shape they’re in, the better your results will be. Keep an eye on their quarterly and annual reports to see how they're performing.

Here is a quick dive into Altria Group over last years

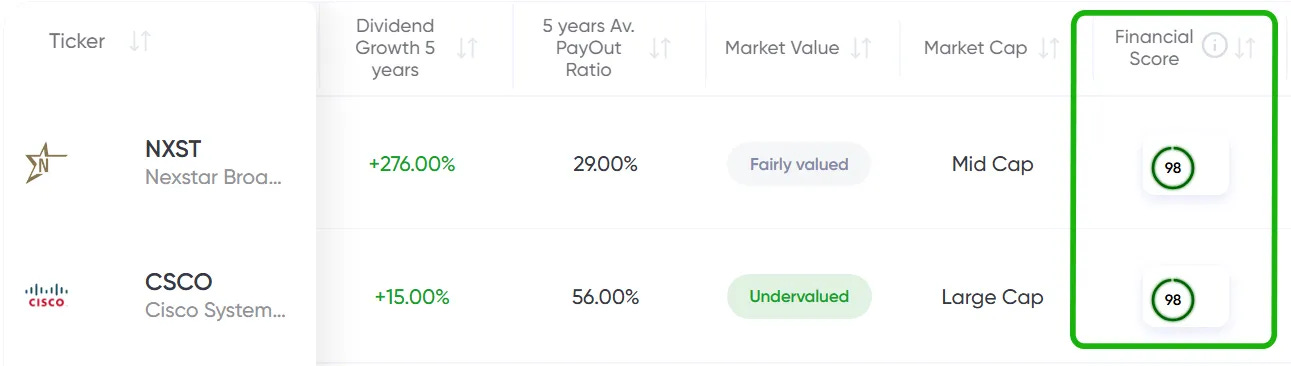

The strongest and most stable companies tend to have a Financial Score of 80+, with the very best ones hitting 90+. If you see that score start to dip below 80, that’s your cue to consider jumping ship before things get worse.

👉 Learn More about Financial Score

Our Paid Members get access to a curated watchlist of 19,000 companies worldwide, all scored by our team on a regular basis. Companies like Altria Group are on that list, too.

Future Growth Prospects for Altria Group

Altria Group, Inc. is strategically positioned to pursue future growth through targeted investments and portfolio diversification. The company’s growth roadmap emphasizes international market expansion, digital innovation, and product development, backed by significant financial commitments.

In 2025, Altria plans to increase its R&D investment to $512 million and launch nine new products, aiming to capture an additional 2.8% market share. A $250 million allocation is directed toward entering high-potential emerging markets, while $125 million supports digital transformation efforts. Additionally, with a $1.2 billion budget earmarked for strategic acquisitions, Altria is actively exploring partnerships to enhance its competitive edge.

Projections for 2025 include a revenue growth rate of 4.5%, a 5.6% increase in EPS, and a 3.4% boost in operational efficiency. Combined with improved scores in technology integration and market adaptability, Altria’s future outlook signals strong, sustainable growth potential.

With MaxDividends, it's easier than ever to access top dividend companies, track your results, and explore new dividend ideas.

The MaxDividends Top Stocks List features ~100 of the most reliable dividend companies in the U.S. market, each with 15+ years of consecutive dividend increases. These stocks are carefully selected based on MaxDividends' strict criteria for consistency and reliability.

Dividend Kings represent the elite tier of dividend growth stocks. With 50+ years of consecutive dividend increases, these companies offer unparalleled income stability, making them a top choice for investors seeking long-term reliability in an unpredictable market.

With 25+ years of consecutive dividend increases, Dividend Aristocrats are among the strongest dividend growth stocks. These companies have a proven track record of not only maintaining but consistently increasing their dividends, often outperforming the broader market over time.

2. Target Corporation

Target Corporation is a leading U.S. general merchandise retailer, operating both physical stores and digital platforms like Target.com. The company offers a broad assortment of products, including clothing and accessories for all ages, beauty and personal care items, groceries, electronics, home goods, furniture, and household essentials.

Founded in 1902 and headquartered in Minneapolis, Minnesota, Target is known for its strong brand partnerships, private labels, and consistent dividend history, making it a well-established player in the consumer defensive sector.

History of the Company

Target Corporation traces its origins back to 1902, when George Dayton founded the company as Goodfellow Dry Goods in Minneapolis, Minnesota. It was later renamed the Dayton Company, and in 1962 the first Target store opened as a discount division of Dayton's Department Store.

The concept proved successful, leading to rapid expansion throughout the United States. By 2000, the company officially became Target Corporation, reflecting its focus on the retail chain. As of 2024, Target has been in operation for over 120 years, evolving into one of the largest and most recognizable discount retailers in the U.S., with nearly 2,000 stores nationwide.

A Proven Dividend King 👑

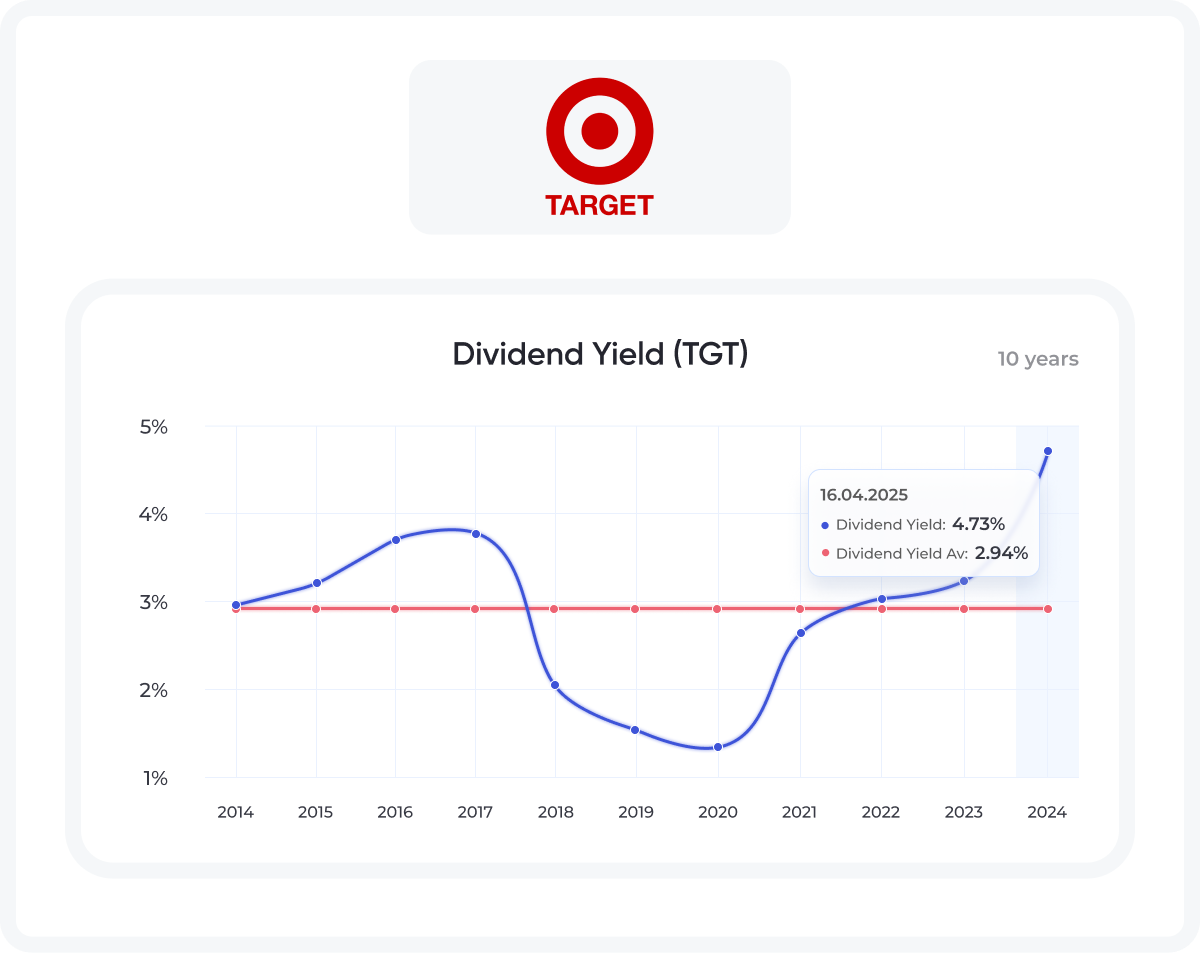

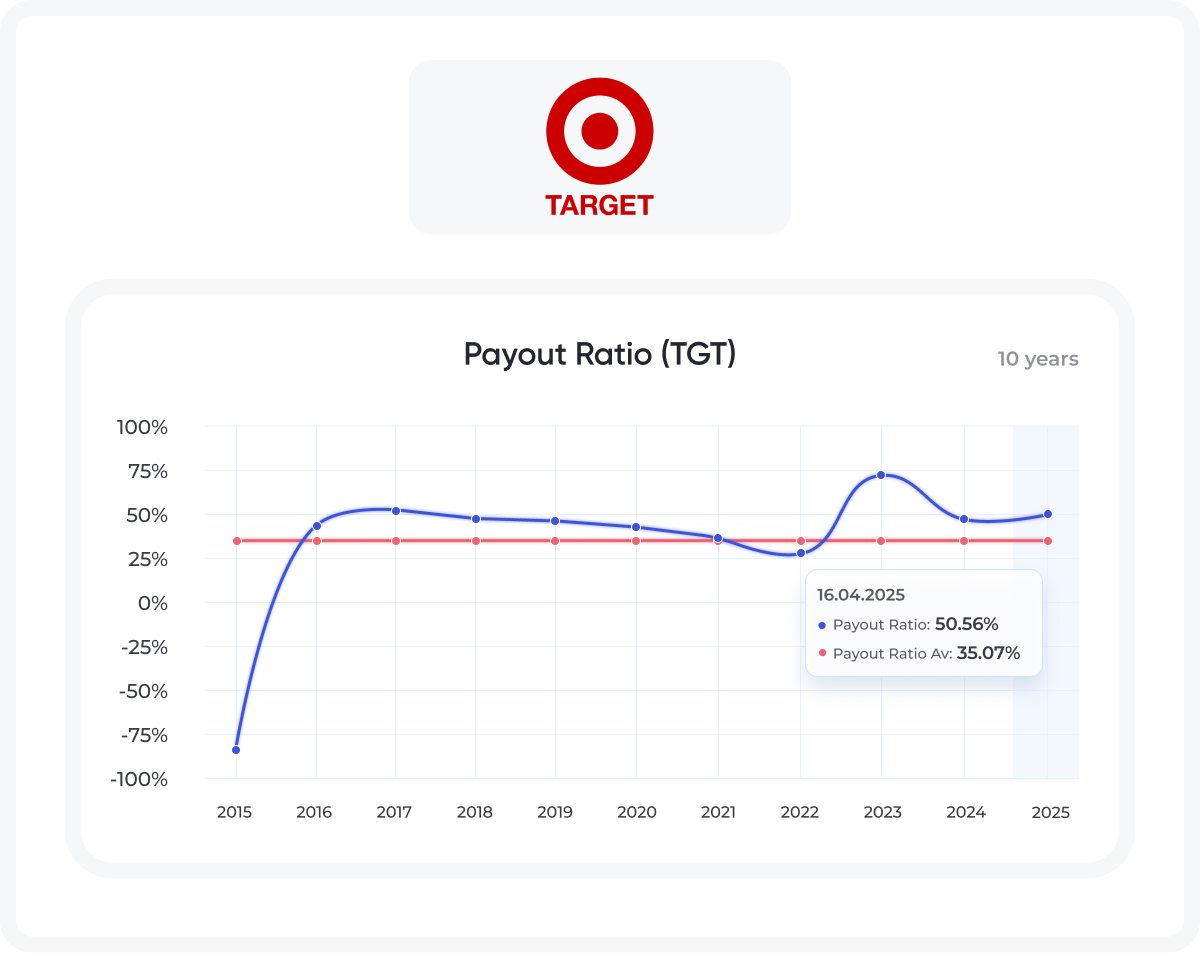

Target Corporation (TGT) has proven itself as a dividend aristocrat, with an impressive track record of paying dividends for 54 consecutive years. The company has consistently increased its dividend payout, with a 5-year CAGR of 11.30% and a 10-year CAGR of 8.86%. The forward annual dividend yield stands at 4.50%, with a forward annual dividend of $4.48 per share.

Target’s dedication to rewarding shareholders is evident in its 50+ consecutive years of dividend growth, backed by a payout ratio of 50.34%. The company’s dividend history is not only consistent but also robust, with the potential for double-digit dividend yield on cost over the next 10 years, estimated at 10.99%. Target’s commitment to dividends makes it a reliable investment for long-term income-seeking investors.

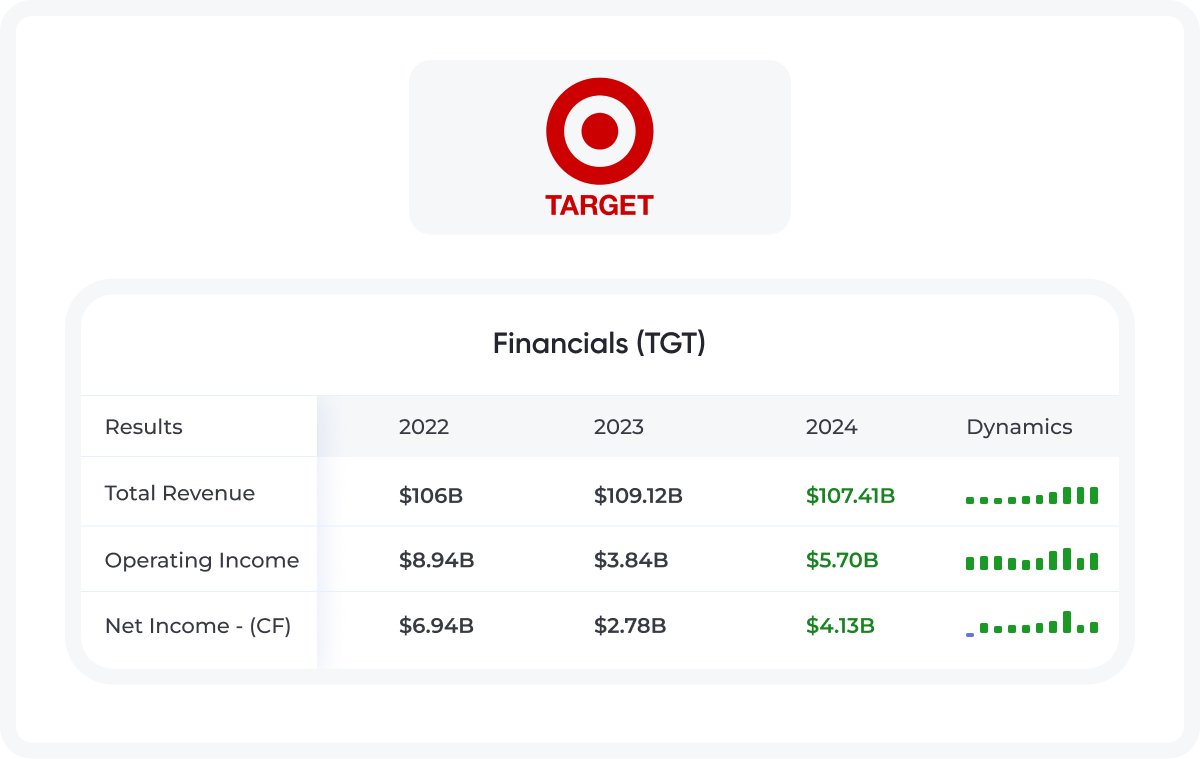

Financial Statement

Here is a quick dive into Target Corporation over last years

Future Growth Prospects for Target Corporation.

Target Corporation focuses on several key areas for growth, aiming to increase its market share and expand its presence. The company expects steady revenue growth, with a 2.3% increase projected for 2024, reaching $109.1 billion, and a 3% growth in 2025, totaling $112.4 billion.

One of the main focuses is expanding digital sales, with a $1.2 billion investment planned to boost online sales and enhance omnichannel fulfillment infrastructure. The company is also targeting the development of private label brands, aiming for a 15% market share increase, which will attract consumers seeking quality and affordable products. Additionally, Target is actively upgrading its omnichannel supply chain technologies to improve both online and offline operations.

Target also plans further expansion into international markets, investing $350 million to enter five new countries, along with investments in e-commerce development, expected to result in a 20% growth in online sales.

To strengthen its competitive position, Target is investing $500 million annually in supply chain optimization and utilizing personalized data to boost customer engagement. Its successful loyalty program, with 45 million active members, plays a key role in encouraging repeat purchases and customer loyalty.

Final Thoughts

At first glance, Altria and Target seem like polar opposites—one selling cigarettes in a declining industry, the other thriving in the cutthroat world of retail. But both share something powerful: an unshakable commitment to returning cash to shareholders, no matter what the market throws at them.

Altria’s sky-high yield comes with risks, but its pricing power and loyal customers make it a cash cow. Target, meanwhile, has proven it can adapt and grow even as shopping habits evolve—all while maintaining a dividend that keeps climbing. Neither stock is without its challenges, but for investors who value steady income with a side of resilience, these two dividend kings still have plenty to offer.

The question isn’t whether they belong in your portfolio—it’s how much of your portfolio they deserve.

To your wealth, MaxDividends Team

More Dividend Ideas

Scroll Down to Read. Don’t have access? Check Your Paid Status & Upgrade to Premium.

Don’t have access? Check Your Paid Status & Upgrade to Premium.

⭐️ ⭐️⭐️⭐️⭐️

What You’ll Get by Joining MaxDividends Premium

The most important thing our MaxDividends community members value us for

Freedom & Independence

No boss, no schedules—complete control over your time. Ability to work on passion projects or simply enjoy life without financial stress.

Passive Income That Grows Over Time

Dividend-paying stocks provide a steady, rising income stream. Unlike traditional retirement funds, you don’t need to sell assets to cover expenses.

Protection Against Inflation

Dividend growth investing ensures your income keeps pace with inflation. Companies that increase payouts help maintain purchasing power.

Stress-Free Investing

No need for active trading or daily market monitoring. Long-term buy-and-hold strategy minimizes stress and decision fatigue.

More Time for Family & Personal Goals

Spend more time with loved ones instead of working 40+ hours a week. Pursue hobbies, travel, and personal development without financial pressure.

Health & Well-Being Benefits

Less work stress leads to better mental and physical health. More time for fitness, proper sleep, and healthier lifestyle choices.

Avoiding the Corporate Rat Race

Escape office politics, toxic work environments, and endless meetings. Focus on meaningful activities instead of chasing promotions and pay raises.

Living Life on Your Own Terms

Ability to relocate, slow travel, or move to a lower-cost-of-living area. No restrictions on how you spend your day—whether it's reading, volunteering, or building a new skill.

Leaving a Legacy

Build generational wealth and leave assets for your family. Teach the next generation financial independence by leading by example.

Financial Security & Peace of Mind

A well-built dividend portfolio provides stability even during economic downturns. No fear of outliving your savings—passive income keeps flowing.

Many who already joined say it’s the best financial decision they’ve ever made—because money becomes a tool for freedom, not a source of stress.

Ready to Give It a Try?

Check Your Subsription Status & Upgrade to Premium.

If you have any questions, feel free to email me at: maxdividends@beatmarket.com

MaxDividends Community: What ELSE You’ll Get Here

🔹 MaxDividends Stocks of the Week

Top 10 undervalued, high-yield, ultra-high yield, and dividend growth stocks every week.

Bonus: Full access to the updated weekly list of MaxDividends stocks—boost your passive income and start living off dividends.

🔹 Top Dividend Insights

Get exclusive, high-quality dividend investment ideas and insights, handpicked to help you crush your financial goals, retire early, and live off dividends.

🔹 Roadmap to Live Off Dividends

A step-by-step weekly guide to achieving financial freedom through dividend investing.

🔹 Easy Peasy: Build Your MaxDividends Portfolio

Ready-made MaxDividends stock sets starting at $300, $500, or $1000 each week—making it easier to build a strong dividend portfolio.

🔹 MaxDividends Business Overview

Deep dives into the top dividend stocks we hold, including key metrics, business insights, perspectives, and expert consensus.

🔹 MaxDividends Portfolio: Goal → $12,000 Monthly for 120 Months

My personal dividend portfolios with weekly updates, changes, and insights.

🔹 MaxDividends App & Tools Access

Comprehensive tools to help you retire early and live off dividends with confidence.

🔹 Community of Like-Minded Investors

Stay connected with me and other MaxDividends followers. Join the MaxDividends community chat to discuss ideas, share insights, set goals, and stay motivated. Support, accountability, and like-minded investors—all in one place!

🔹 Sunday Coffee ☕️

My personal life & business column, where I share:

Life moments & investing insights

Long-term investment philosophy

Thought-provoking ideas to help you succeed

🟢 What ELSE You’ll Get

Top Dividend Ideas

Unlock exclusive, high-quality dividend investment ideas available only for Premium members. These ideas are carefully curated to maximize returns, provide growing income, and accelerate your journey to financial freedom and early retirement.

By upgrading to Premium, you’ll gain access to:

Advanced stock recommendations tailored for dividend growth

In-depth research on high-yield dividend stocks with strong growth potential

Exclusive updates and insider insights to stay ahead of the curve

Undervalued Dividend Lists

With Premium access, you’ll get:

Undervalued Dividend Eagles (updated monthly)

Undervalued Dividend Kings (updated monthly)

Undervalued Dividend Aristocrats (updated monthly)

These lists highlight the most promising undervalued dividend stocks with strong growth potential, helping you maximize returns on your investment.

Dividend Insights

Gain exclusive insights:

Top 5 MaxDividends Ideas of the Month

Top 3 Most Promising Dividend Ideas of the Week

List of Dangerous Dividend Stocks (updated monthly) – avoid risky picks

These carefully researched ideas will guide you in making smart, informed decisions to build wealth with dividends.

🟢 And even MORE!

Unlock the best dividend tools available, created by the MaxDividends Team:

Dividend Screener: Find your own hidden gems—uncover undervalued dividend stocks with high growth potential.

Dividend Portfolio Tracker: Keep track of every aspect of your passive income and optimize your portfolio.

Dividend Checker: Check the financial and dividend score of 19,000+ companies worldwide to make data-driven choices.

MaxDividends Premium gives you all the tools you need to build, track, and grow your passive dividend income to retire early and live off dividends.

We are Recommended on Substack

Trusted by 48,000+ subscribers. Followed by 41,000+ dedicated readers

The European Value Investor ⭐️⭐️⭐️⭐️⭐️

“If you are interested in dividend strategies or passive income strategies, this Substack ia great! Its worth a visit“

Johan Lunau - The Long View ⭐️⭐️⭐️⭐️⭐️

“Practical dividend focus. Saving for retirement.“

Shailesh Kumar - The Astute Investor’s Calculus ⭐️⭐️⭐️⭐️⭐️

“Love the concept and the execution. If you are into building a portfolio that will generate ever growing income for you, subscribe to Max Dividends. I did.“

MS Cliff Notes ⭐️⭐️⭐️⭐️⭐️

“A useful substack for those that invest in stocks that pay dividends or are looking to get into such a strategy. Includes education and actionable ideas.“

Timothy Assi - Panic Drop ⭐️⭐️⭐️⭐️⭐️

“Great for helling you pick up high-yield dividend growth stocks“

And 180+ more other great authors and pro’s are recommend MaxDividends!

FAQ

I ❤️ Dividends: Why I Believe Dividend Investing Is the Best Strategy | PDF Book

How Effective is the MaxDividends Strategy for Building Growing Passive Income

Someone's sitting in the shade today because someone planted a tree a long time ago. ― Warren Buffett.