S&P Global: A Reliable Dividend King with Growth Potential in a Turbulent Market

With potential rate cuts and AI-driven tools boosting efficiency, S&P Global is well-positioned for earnings growth and a continuation of its 52-year dividend streak.

MaxDividends Mission: Helping & Supporting Everyone in Building a Growing Passive Income, Retiring Early, and Living Off Dividends.

For dividend investors seeking opportunities with strong growth potential, MaxDividends Stock Ideas offers a daily, in-depth look at companies worth considering for a dividend portfolio.

Scroll Down to Read. No access yet? Check your status & upgrade to Premium to join the movement. Exclusive insights await inside!

Intro

💡 Invest in companies you believe in - W. Buffett

S&P Global (NYSE: SPGI) is a cornerstone of the financial world, providing credit ratings, market intelligence, and data analytics relied upon by banks, corporations, and investors globally. In times of economic uncertainty, its services become even more critical, insulating the company from tariffs and macroeconomic headwinds. While high interest rates temporarily slowed its credit ratings business in 2022–2023, a potential rate decline could reignite growth.

As a Dividend King with 52 consecutive years of payout increases, S&P Global combines stability with long-term income growth. Its low payout ratio (29%) and expected EPS growth of 9–12% in the coming years suggest room for further dividend hikes. Trading at a forward P/E of 26, SPGI remains a compelling choice for investors seeking a blend of reliability and growth. This article explores why S&P Global deserves a spot in a long-term portfolio.

History of the Company

S&P Global Inc. was founded in 1860 by Henry Varnum Poor as Standard & Poor’s, beginning its journey with the publication of financial information and investment guides. Since then, it has evolved from a small publishing firm into one of the world’s leading providers of financial data and analytics.

Over its more than 160-year history, the company has undergone multiple transformations, including a merger with McGraw-Hill in 1966 and a subsequent rebranding to S&P Global in 2016. These changes reflected its strategic shift toward digital analytical solutions and global expansion. Today, S&P Global plays a key role in the global financial system, providing data, indices, and credit ratings that support investment decisions in over 30 countries.

A Proven Dividend Eagle 🦅

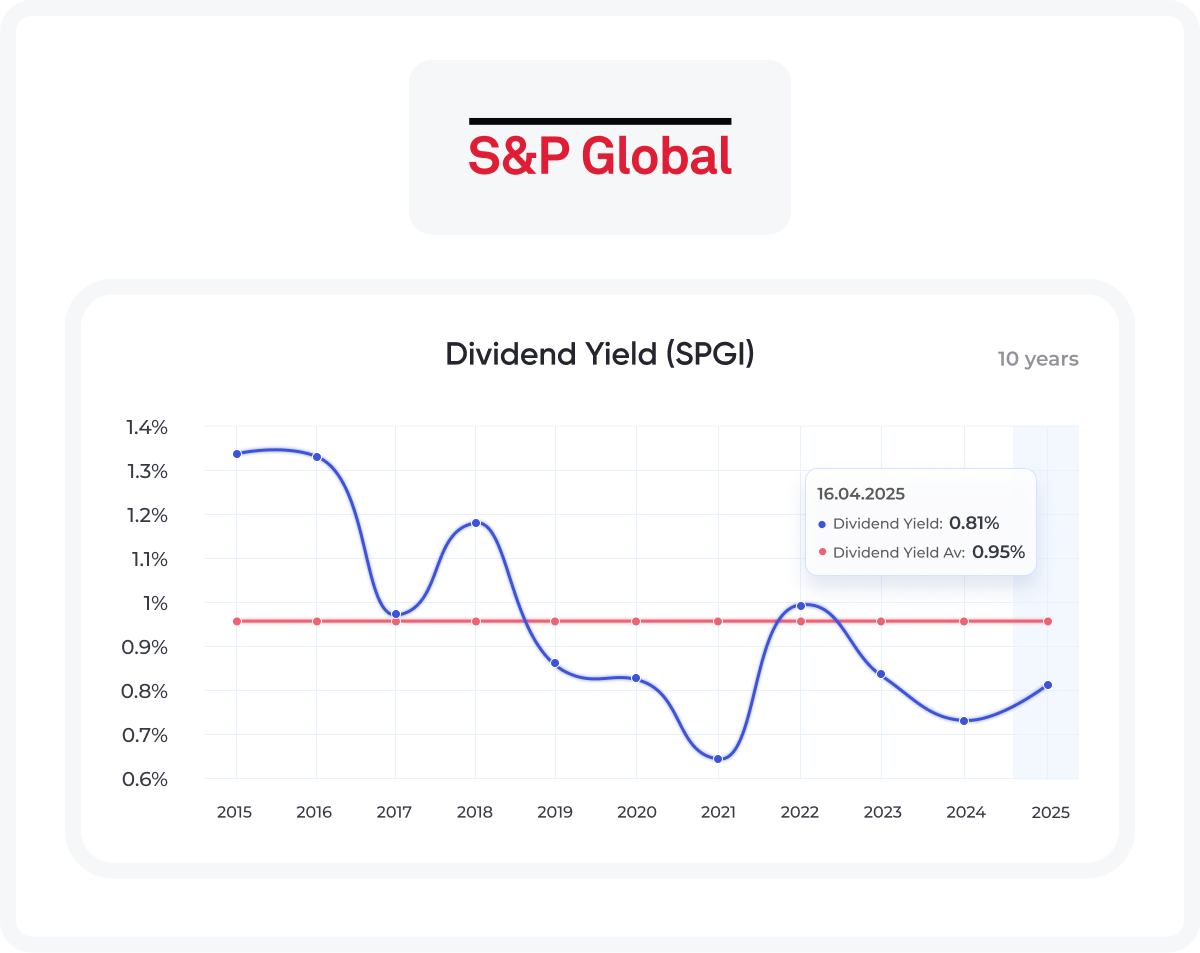

Let’s talk about S&P Global’s crown jewel—its 53-year streak of dividend hikes. That’s not just impressive; it’s elite company. With a payout ratio sitting at a comfortable 31%, this isn’t some yield-chasing trap—it’s a sustainable cash machine with room to keep growing.

Sure, the 0.83% yield won’t make income investors swoon at first glance, but dig deeper: that dividend has been climbing at a 5.7% annual clip over the last three years, quietly compounding in the background. And with earnings covering the payout nearly three times over, S&P Global isn’t just maintaining its Dividend King status—it’s reinforcing it. For long-term investors, that’s the kind of reliability you can build a portfolio around.

🦅 Dividend Eagles

An updated compilation of 100+ top-performing dividend stocks with 15+ years of consecutive dividend increases, selected based on MaxDividends’ strict criteria.

Companies featured on the Dividend Eagles list have a proven track record of regular and increasing dividend payouts. This ensures you receive a reliable income, whether you're planning for retirement or seeking additional cash flow.

The Dividend Eagles list offers precisely that—a gateway to financial growth and stability.

Beyond dividends, these companies often exhibit strong fundamentals and growth prospects. Investing in them not only provides income but also the opportunity for your investment to grow over time.

This is how we build our own growing passive income and long-term wealth.

Key Institutional Investors in S&P Global Inc.

As of the latest filings, the top institutional investors in S&P Global Inc. include some of the world’s largest asset management firms. Vanguard Group leads with approximately 51.3 million shares, representing 14.2% of total ownership. BlackRock Inc. follows with 45.6 million shares, accounting for 12.6%, while State Street Corporation holds around 29.8 million shares, or 8.3%. These major stakeholders reflect strong institutional confidence in the company’s long-term value and stability in the financial data and analytics sector.

What Makes S&P Global Corporation Stand Out?

S&P Global Inc. (NYSE: SPGI)

Financial Score: 97 / 99 ⭐️⭐️⭐️⭐️⭐️+

Industry: Financial Data & Stock Exchanges

Dividend Increase - 52 Years

👉 Learn more about Financial Score

S&P Global Inc. is a leading provider of credit ratings, market benchmarks, data analytics, and workflow solutions for the global capital, commodity, and automotive markets. Through its five main divisions—Market Intelligence, Ratings, Commodity Insights, Mobility, and Dow Jones Indices—the company delivers critical information and tools that support decision-making across finance, energy, and industry worldwide.

S&P Global Inc. - Quick MaxDividends Team Overview

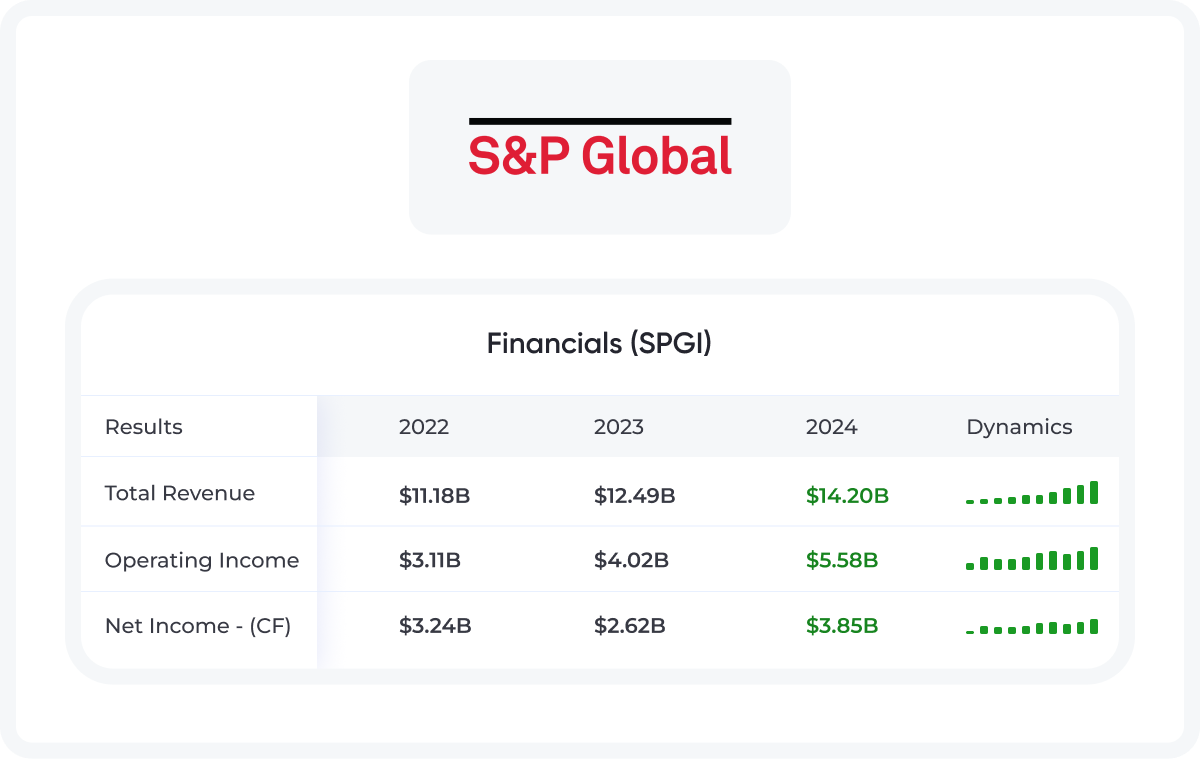

🟢 The latest data suggests that the company is currently profitable.

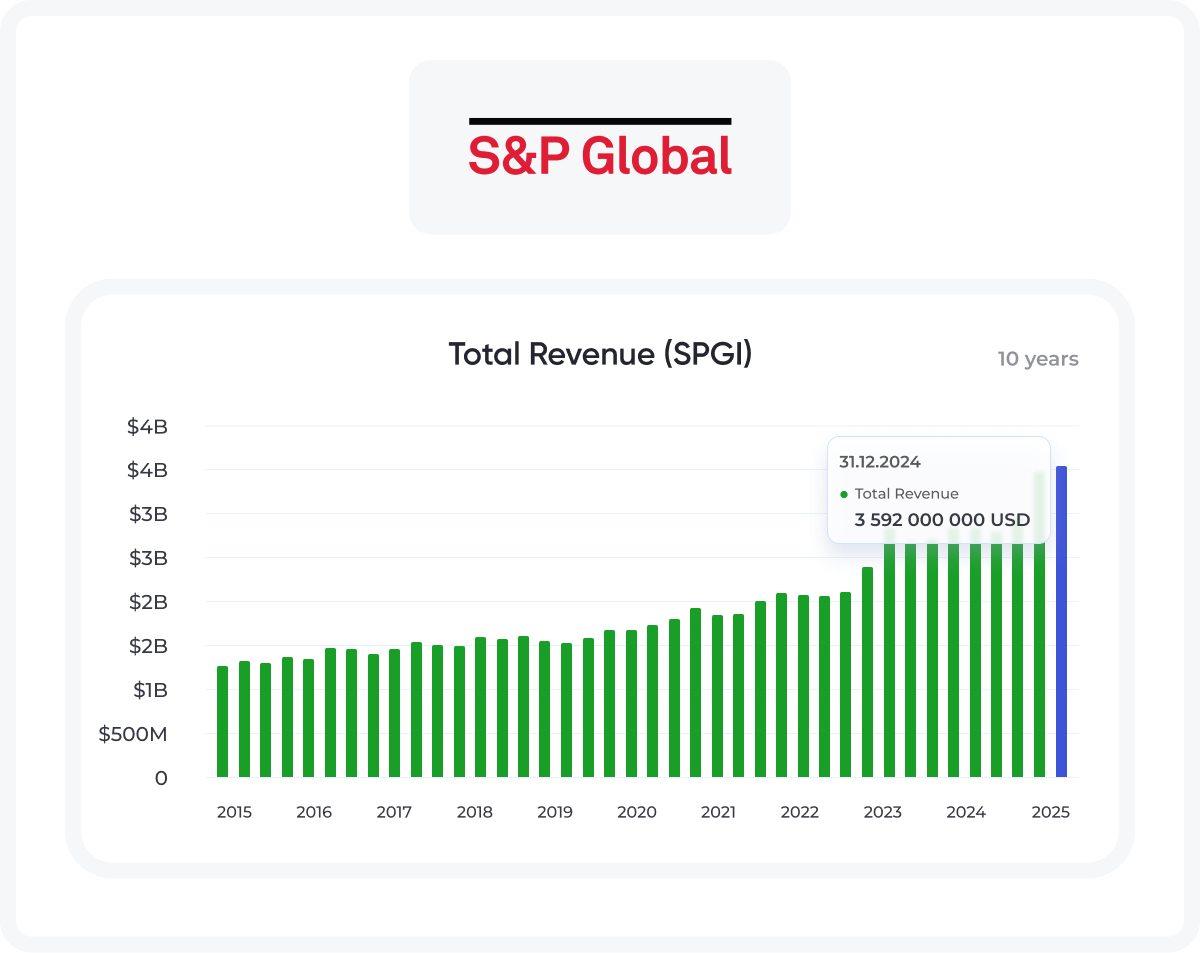

🟢 Sales are stable and growing, business is developing

🟢 Operating profit is growing, the company in this sense has a good margin of safety and dynamics

🟢 Earnings per share are growing, the dynamics have been positive for several years. This means the company knows how to manage business profitability and maintain it for many years

🟢 In general, the company demonstrates a favorable development picture and stability in income.Financial Statement

If you want to stay on top of your portfolio's health, don't forget to check in on the financials of the companies you've invested in. The better shape they’re in, the better your results will be. Keep an eye on their quarterly and annual reports to see how they're performing.

Here is a quick dive into S&P Global over last years

The strongest and most stable companies tend to have a Financial Score of 80+, with the very best ones hitting 90+. If you see that score start to dip below 80, that’s your cue to consider jumping ship before things get worse.

👉 Learn More about Financial Score

Our Paid Members get access to a curated watchlist of 19,000 companies worldwide, all scored by our team on a regular basis. Companies like S&P Global are on that list, too.

Future Growth Prospects for S&P Global.

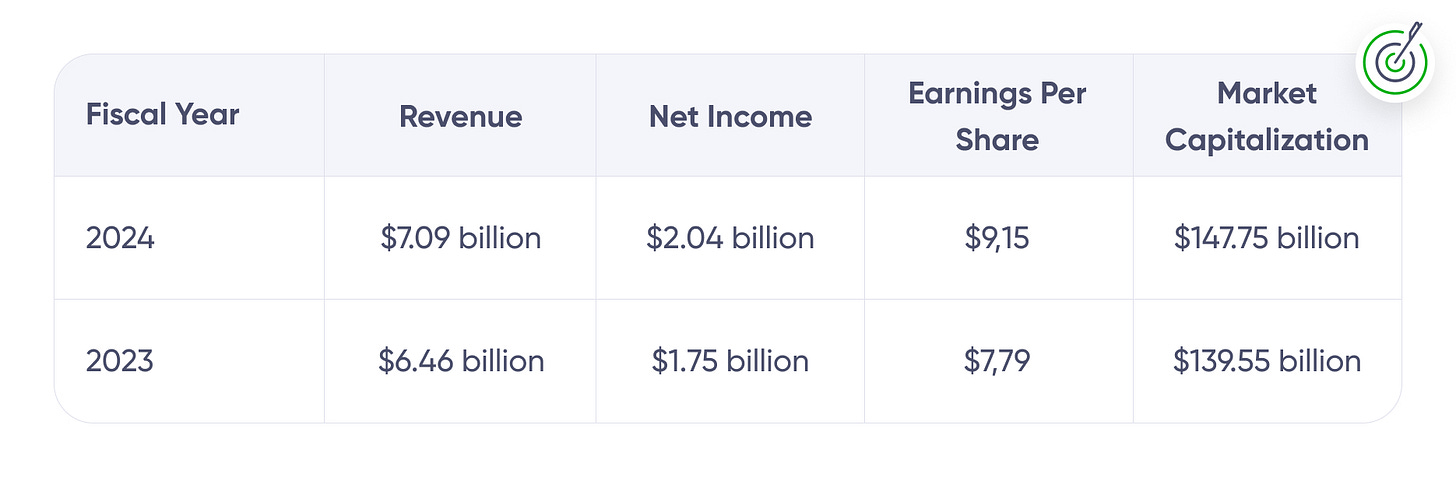

S&P Global Inc. demonstrates strong growth potential driven by diversified revenue streams, strategic investments, and an active global expansion strategy. In 2022, the Market Intelligence segment generated $1.38 billion in revenue, the Ratings segment brought in $3.86 billion, and the Platts segment contributed $1.14 billion. The company’s total revenue is projected to grow from $8.4 billion in 2023 to $9.8 billion in 2025, reflecting an average annual growth rate of around 6%.

Key strategic initiatives include annual investments of $350 million in digital transformation and $200 million in AI and machine learning integration. The company is also placing a strong focus on expanding into emerging markets.

S&P Global holds significant competitive advantages, including a 42% market share in financial information services and R&D spending of $600 million in 2022. High-potential growth areas include data analytics and ESG solutions, with planned investments of $450 million and $250 million respectively, expected to generate returns of 8–10% and 7–9%.

Recent S&P Global Financial Performance (2023)

With MaxDividends, it's easier than ever to access top dividend companies, track your results, and explore new dividend ideas.

The MaxDividends Top Stocks List features ~100 of the most reliable dividend companies in the U.S. market, each with 15+ years of consecutive dividend increases. These stocks are carefully selected based on MaxDividends' strict criteria for consistency and reliability.

Dividend Kings represent the elite tier of dividend growth stocks. With 50+ years of consecutive dividend increases, these companies offer unparalleled income stability, making them a top choice for investors seeking long-term reliability in an unpredictable market.

With 25+ years of consecutive dividend increases, Dividend Aristocrats are among the strongest dividend growth stocks. These companies have a proven track record of not only maintaining but consistently increasing their dividends, often outperforming the broader market over time.

Why Invest in S&P Global?

S&P Global (NYSE: SPGI) represents a rare combination of defensive resilience and growth potential, making it an attractive long-term investment. As a Dividend King with 52 consecutive years of payout increases, the company offers reliable income even in volatile markets.

Its asset-light, subscription-based business model—providing essential credit ratings, financial data, and indices—generates high-margin recurring revenue, insulating it from economic cycles. With AI-driven analytics accelerating efficiency and falling interest rates poised to revive debt issuance, S&P Global is well-positioned for 9-12% annual EPS growth through 2026.

Trading at 26x forward earnings with a low 29% payout ratio, the stock balances reasonable valuation with strong upside potential. For investors seeking a market-leading data monopoly with dividend growth and innovation, SPGI stands out as a core portfolio holding.

Interesting Fact

S&P Global's roots trace back to the 19th century when it started by publishing railroad investment guides—essentially helping investors navigate one of the most transformative industries of the time.

Fast forward over 160 years, and the company now powers trillions of dollars in global financial decisions each day, analyzing everything from oil prices to ESG scores using artificial intelligence and machine learning. From steam engines to smart algorithms—S&P Global has literally evolved with the world economy.

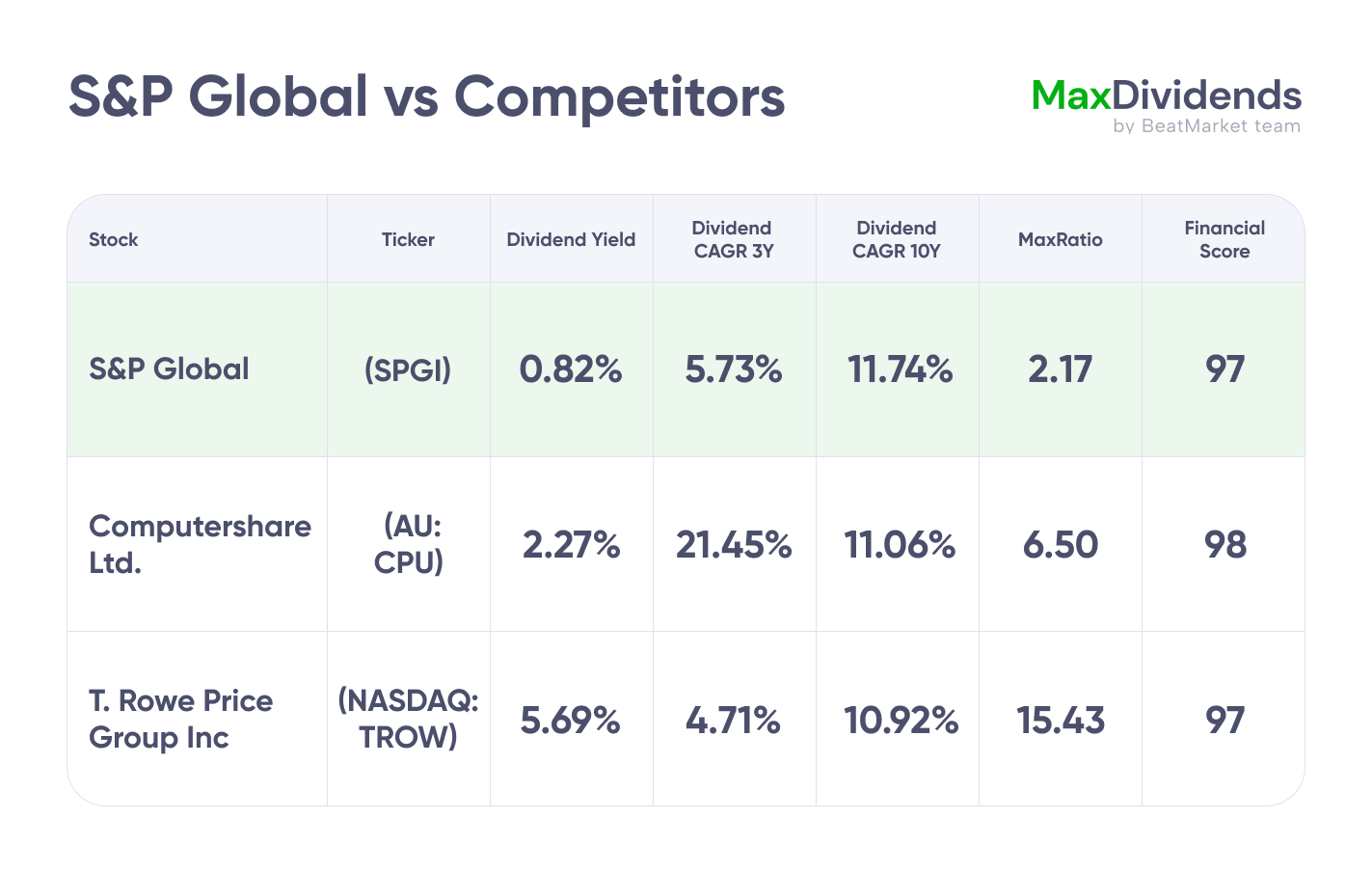

Competitors

1. Computershare Ltd. (AU: CPU)

Financial Score: 98 / 99

Industry: Capital Markets

Computershare Limited is a global provider of financial and administrative services. The company offers issuer services such as register maintenance, corporate actions, and stakeholder management, along with corporate trust services related to debt securities. It also specializes in employee share plans and vouchers, mortgage services, property rental, and tenancy bond protection.

Additionally, Computershare provides communication services, utilities operations, and technology solutions, including software for share registry and financial services. The company operates in multiple countries, including Australia, Hong Kong, the UK, Canada, and across Europe and Asia.

2. T. Rowe Price Group Inc (NASDAQ: TROW)

Financial Score: 97 / 99

Industry: Asset Management

T. Rowe Price Group, Inc. is a publicly traded investment management firm that provides services to individuals, institutions, retirement plans, and financial intermediaries. The company offers equity and fixed income mutual funds and invests globally in public markets using a combination of fundamental and quantitative analysis.

T. Rowe Price is committed to socially responsible investing, with a focus on environmental, social, and governance (ESG) factors. Additionally, it makes investments in late-stage venture capital transactions, typically between $3 million and $5 million. Founded in 1937 and based in Baltimore, Maryland, T. Rowe Price has offices in major cities around the world, including London, Tokyo, Sydney, and Hong Kong.

Final Thoughts: Should You Buy S&P Global?

Let’s be real—S&P Global isn’t the flashiest stock out there. You won’t see it making wild swings on meme trader radars or hyped up as the next big disruptor. But that’s exactly why it’s worth a closer look. This is the kind of company that quietly powers the financial world, the invisible backbone of markets, and it’s been doing it for over 160 years. That’s not just longevity—that’s endurance.

Think about it: When markets get shaky, investors don’t ditch data—they crave it. S&P Global’s ratings, indices, and analytics become more valuable in chaos, not less. And while the stock isn’t dirt cheap, you’re paying for a high-margin, recurring-revenue machine with a dividend that’s grown for 52 straight years. That’s not luck—it’s a business model that works.

So, should you buy it? If you want steady compounding, recession-resistant cash flows, and a dividend that’s practically royalty, then yes—this is a stock to own, not trade. Just don’t expect overnight fireworks. S&P Global is the slow burn that wins the race.

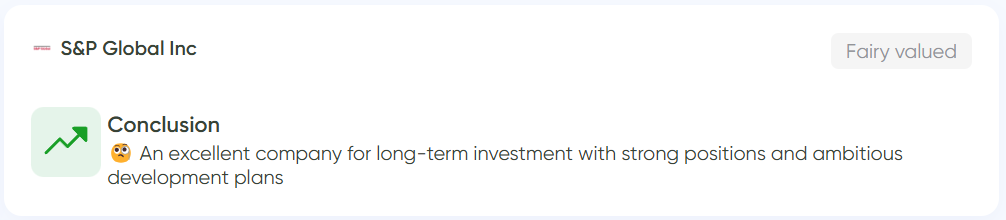

Current Market Value

Undervalued \ Overvalued \ Fairly Valued

Compare the P/E ratios of competitor companies to assess whether the stock you're considering is overvalued. We calculate the average P/E among competitors as a benchmark.

If a company's current P/E is 20% or more below the competitor average, it is considered undervalued.

If it is 20% or more above, it is considered overvalued.

The P/E ratio is calculated by dividing the market value per share by earnings per share (EPS).

Fairy valued

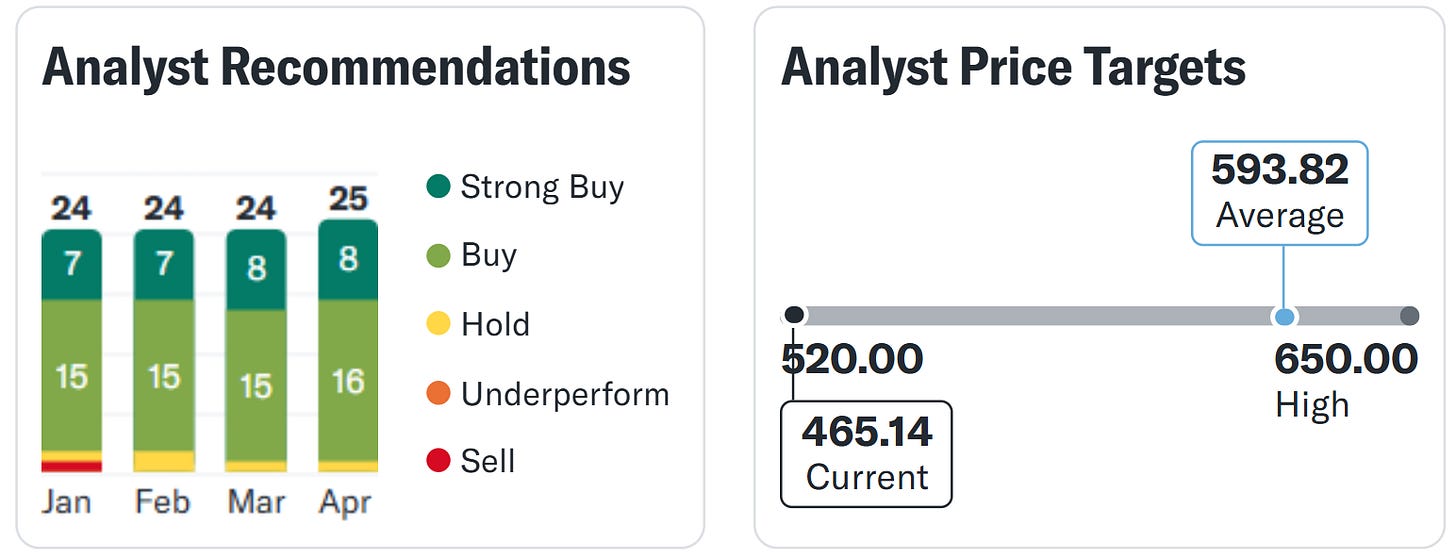

Analysts Consensus

Wall Street is clearly bullish on S&P Global. The stock is currently backed by a strong consensus of Strong Buy and Buy ratings from analysts, with an average price target of $593.82 — a solid 27% above current levels. Even the more cautious projections remain close to the current price, indicating limited downside risk.

While a few analysts have issued neutral Hold ratings, notably none have issued a Sell, which says a lot: this isn’t a controversial pick. Across the board, analysts seem to agree that S&P Global’s stable, data-driven business model and consistent dividend history make it a strong long-term hold, regardless of market swings.

To your wealth, MaxDividends Team

More Dividend Ideas

Scroll Down to Read. Don’t have access? Check Your Paid Status & Upgrade to Premium.

Don’t have access? Check Your Paid Status & Upgrade to Premium.

⭐️ ⭐️⭐️⭐️⭐️

What You’ll Get by Joining MaxDividends Premium

The most important thing our MaxDividends community members value us for

Freedom & Independence

No boss, no schedules—complete control over your time. Ability to work on passion projects or simply enjoy life without financial stress.

Passive Income That Grows Over Time

Dividend-paying stocks provide a steady, rising income stream. Unlike traditional retirement funds, you don’t need to sell assets to cover expenses.

Protection Against Inflation

Dividend growth investing ensures your income keeps pace with inflation. Companies that increase payouts help maintain purchasing power.

Stress-Free Investing

No need for active trading or daily market monitoring. Long-term buy-and-hold strategy minimizes stress and decision fatigue.

More Time for Family & Personal Goals

Spend more time with loved ones instead of working 40+ hours a week. Pursue hobbies, travel, and personal development without financial pressure.

Health & Well-Being Benefits

Less work stress leads to better mental and physical health. More time for fitness, proper sleep, and healthier lifestyle choices.

Avoiding the Corporate Rat Race

Escape office politics, toxic work environments, and endless meetings. Focus on meaningful activities instead of chasing promotions and pay raises.

Living Life on Your Own Terms

Ability to relocate, slow travel, or move to a lower-cost-of-living area. No restrictions on how you spend your day—whether it's reading, volunteering, or building a new skill.

Leaving a Legacy

Build generational wealth and leave assets for your family. Teach the next generation financial independence by leading by example.

Financial Security & Peace of Mind

A well-built dividend portfolio provides stability even during economic downturns. No fear of outliving your savings—passive income keeps flowing.

Many who already joined say it’s the best financial decision they’ve ever made—because money becomes a tool for freedom, not a source of stress.

Ready to Give It a Try?

Check Your Subsription Status & Upgrade to Premium.

If you have any questions, feel free to email me at: maxdividends@beatmarket.com

MaxDividends Community: What ELSE You’ll Get Here

🔹 MaxDividends Stocks of the Week

Top 10 undervalued, high-yield, ultra-high yield, and dividend growth stocks every week.

Bonus: Full access to the updated weekly list of MaxDividends stocks—boost your passive income and start living off dividends.

🔹 Top Dividend Insights

Get exclusive, high-quality dividend investment ideas and insights, handpicked to help you crush your financial goals, retire early, and live off dividends.

🔹 Roadmap to Live Off Dividends

A step-by-step weekly guide to achieving financial freedom through dividend investing.

🔹 Easy Peasy: Build Your MaxDividends Portfolio

Ready-made MaxDividends stock sets starting at $300, $500, or $1000 each week—making it easier to build a strong dividend portfolio.

🔹 MaxDividends Business Overview

Deep dives into the top dividend stocks we hold, including key metrics, business insights, perspectives, and expert consensus.

🔹 MaxDividends Portfolio: Goal → $12,000 Monthly for 120 Months

My personal dividend portfolios with weekly updates, changes, and insights.

🔹 MaxDividends App & Tools Access

Comprehensive tools to help you retire early and live off dividends with confidence.

🔹 Community of Like-Minded Investors

Stay connected with me and other MaxDividends followers. Join the MaxDividends community chat to discuss ideas, share insights, set goals, and stay motivated. Support, accountability, and like-minded investors—all in one place!

🔹 Sunday Coffee ☕️

My personal life & business column, where I share:

Life moments & investing insights

Long-term investment philosophy

Thought-provoking ideas to help you succeed

🟢 What ELSE You’ll Get

Top Dividend Ideas

Unlock exclusive, high-quality dividend investment ideas available only for Premium members. These ideas are carefully curated to maximize returns, provide growing income, and accelerate your journey to financial freedom and early retirement.

By upgrading to Premium, you’ll gain access to:

Advanced stock recommendations tailored for dividend growth

In-depth research on high-yield dividend stocks with strong growth potential

Exclusive updates and insider insights to stay ahead of the curve

Undervalued Dividend Lists

With Premium access, you’ll get:

Undervalued Dividend Eagles (updated monthly)

Undervalued Dividend Kings (updated monthly)

Undervalued Dividend Aristocrats (updated monthly)

These lists highlight the most promising undervalued dividend stocks with strong growth potential, helping you maximize returns on your investment.

Dividend Insights

Gain exclusive insights:

Top 5 MaxDividends Ideas of the Month

Top 3 Most Promising Dividend Ideas of the Week

List of Dangerous Dividend Stocks (updated monthly) – avoid risky picks

These carefully researched ideas will guide you in making smart, informed decisions to build wealth with dividends.

🟢 And even MORE!

Unlock the best dividend tools available, created by the MaxDividends Team:

Dividend Screener: Find your own hidden gems—uncover undervalued dividend stocks with high growth potential.

Dividend Portfolio Tracker: Keep track of every aspect of your passive income and optimize your portfolio.

Dividend Checker: Check the financial and dividend score of 19,000+ companies worldwide to make data-driven choices.

MaxDividends Premium gives you all the tools you need to build, track, and grow your passive dividend income to retire early and live off dividends.

We are Recommended on Substack

Trusted by 40,000+ subscribers. Followed by 35,000+ dedicated readers

The European Value Investor ⭐️⭐️⭐️⭐️⭐️

“If you are interested in dividend strategies or passive income strategies, this Substack ia great! Its worth a visit“

Johan Lunau - The Long View ⭐️⭐️⭐️⭐️⭐️

“Practical dividend focus. Saving for retirement.“

Shailesh Kumar - The Astute Investor’s Calculus ⭐️⭐️⭐️⭐️⭐️

“Love the concept and the execution. If you are into building a portfolio that will generate ever growing income for you, subscribe to Max Dividends. I did.“

MS Cliff Notes ⭐️⭐️⭐️⭐️⭐️

“A useful substack for those that invest in stocks that pay dividends or are looking to get into such a strategy. Includes education and actionable ideas.“

Timothy Assi - Panic Drop ⭐️⭐️⭐️⭐️⭐️

“Great for helling you pick up high-yield dividend growth stocks“

And 220+ more other great authors and pro’s are recommend MaxDividends!

FAQ

I ❤️ Dividends: Why I Believe Dividend Investing Is the Best Strategy | PDF Book

How Effective is the MaxDividends Strategy for Building Growing Passive Income

Someone's sitting in the shade today because someone planted a tree a long time ago. ― Warren Buffett.