When Income Starts to Matter More Than Growth

Hi - Max here.

Before we go any further, let me show you something.

I don’t know how your mind works, but mine works like this: I can’t go to a family therapist for advice on saving a marriage if I know they’ve been divorced three times. And I can’t seriously take diet and weight-loss advice from a specialist who clearly struggles with their own weight.

My logic is simple. I trust someone when I can see that they actually know what they’re talking about — when they’re in the same boat as me.

That’s how it works for me. How about you?

There are plenty of opinions out there. But today, I want to show you what I mean — not tell you. My own portfolio.

I don’t usually put it on public display. It’s something I normally share only with Premium Partners. But today is different. Today, I want to talk about a situation that matters deeply to me — one I personally went through. And there’s a good chance it’s your story too.

The kind of situation where circumstances change, time is limited, and you don’t have the luxury of overthinking. You have to make a decision — and make the right one.

From Savings to 5%+ Income: A Clear, Livable Plan

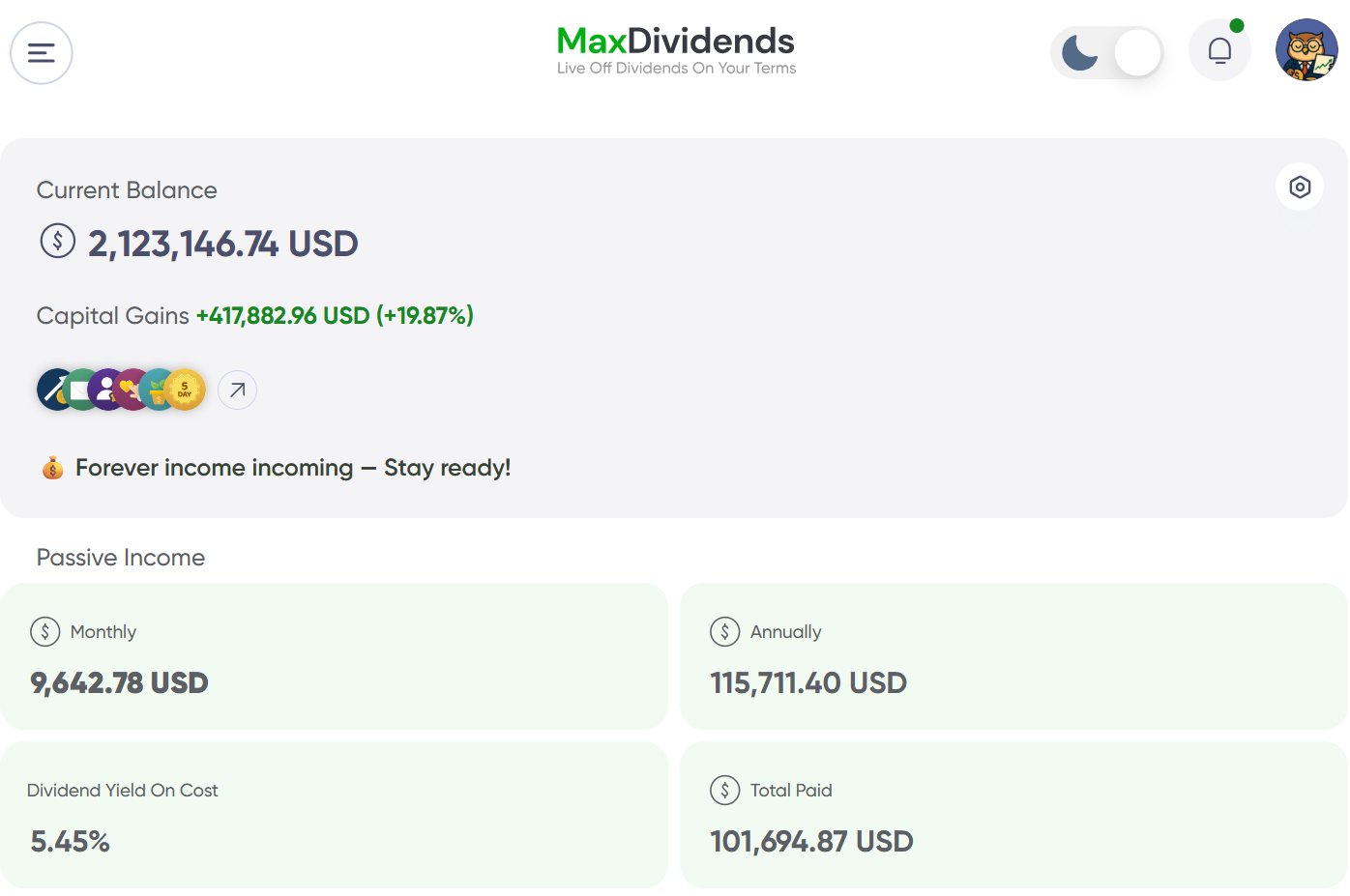

This is what my portfolio looks like today.

The truth is, about a year and a half ago, I found myself facing a very real question: what if things don’t go as planned? What if my other income streams disappear? Am I ready for that? How will my family live? Will I be able to support them? Will we be okay?

I’m 40 now, heading into 41.

And I’ll be honest with you — with every year, I don’t feel a stronger desire to work more and push harder. No. You might be surprised, but it’s the opposite.

And don’t get me wrong. Everything’s good. My motivation is solid. My health is in great shape, thank God.

It’s just that with every year, I feel a stronger pull to spend more time on the things I truly enjoy — to develop what genuinely interests me, even if it doesn’t promise flashy income or quick wins.

Time starts to feel more valuable than upside alone.

I want more quiet. More walks. More time at my kids’ events. Long summer vacations. I want to live.

I don’t have another 40 years to wait. What I do have is real uncertainty around current income. And real expenses that need to be paid today — not someday.

The electricity bill comes today.

School and daycare bills come today.

Swimming lessons, insurance — all of it needs to be paid now.

Probably just like in your life.

I didn’t manage to accumulate $10 million before this moment arrived. So what then?

Yes, I had saved a decent amount. But the question became: how do I deal with this challenge using what I already have?

A ~1% passive yield from broad market indexes won’t feed my family. It won’t cover insurance for my kids. And it won’t let me look at the future calmly.

I honestly don’t believe in all those “super-safe” option strategies everyone keeps hyping up. None of them have actually lived through 10+ years without blowing up. They always do — sooner or later. No, thank you.

So what’s the alternative? Just slowly spend down everything I worked so hard to build?

That’s not who I am. I’d rather rebuild the structure than quietly consume my savings and wake up one day with nothing left. And you might be feeling something similar yourself.

That’s when I realized I needed a system.

A system that answers hard questions.

A system that gives me independence and freedom.

A system that lets me live calmly.

A system simple as a hammer.

A system that creates an additional income stream — on my terms.

Today, I live off dividends.

My income keeps growing. My capital keeps growing too.

I’ve done it. And now I know the path — not from theory, not from someone else’s story, but from my own experience. I don’t just understand this — I live it.

These are real cash flows that cover my family’s expenses and give us peace of mind, allowing us to stay flexible and free in our choices today.

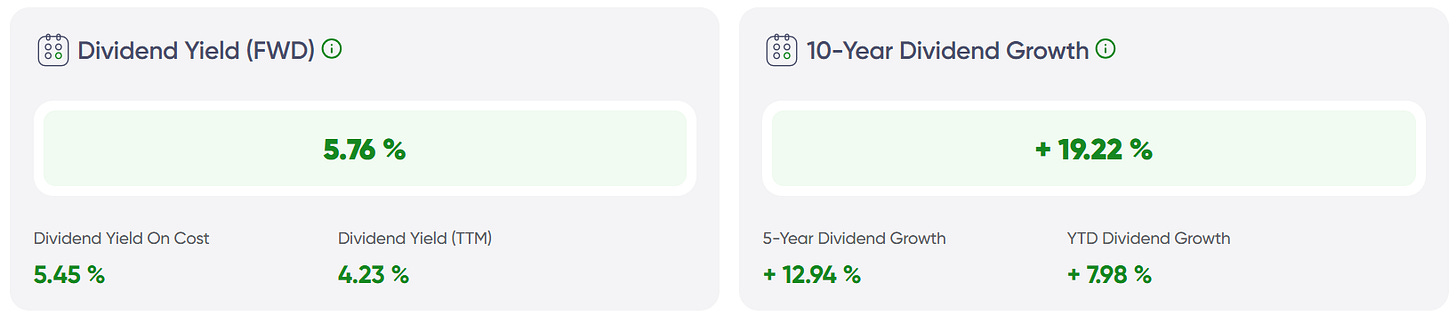

We managed to cross that critical gap between 2–3% and the 5%+ level — the point where passive income becomes the foundation, not a side feature. And from there, it keeps growing, bringing more freedom with every passing year.

I became a true dividend geek, exploring every corner of the dividend universe.

This isn’t magic. These are real numbers. This is a system in action. A system I personally follow — and one that works.

In the next email, I’ll show you how I actually do this.

How I select the companies that pay my bills month after month.

How the system works step by step.

And why I feel calm and confident about my future.

If this resonates, click the button below — and I’ll show you how it works step by step.

Just a clear path forward.

— Max