The September King List: Legendary Payers at Discount Prices

50+ years of dividend raises. Some of the strongest companies in the world — now trading below fair value.

MaxDividends Mission: Helping people build growing passive income, retire early, and live off dividends.

👑 Undervalued Dividend Kings — September Edition

Dividend Kings are the rarest of the rare.

These are companies that have raised their payouts for 50+ years straight — through recessions, inflation spikes, wars, market crashes, you name it. Half a century of consistency.

Right now, a handful of these Kings are trading below their true worth. That means you can lock in stronger yields and buy world-class businesses at discounted prices — the kind of setup smart dividend investors wait for.

📊 What We Found This Month

Inside MaxDividends, we track over 5,000 companies and run them through 150+ fundamentals to build the Financial Score. Each month, we check which Kings are not only strong (Score 90+) but also undervalued right now.

This September, we flagged 30 Kings in strong shape. Out of them, 11 stand out as real opportunities today.

Here’s a quick taste:

Johnson & Johnson (JNJ) — Financial Score 97, ~3% yield. A healthcare giant with products in every home, still raising payouts like clockwork, now priced attractively.

That’s just one example. Let’s look at the full spotlight.

💡 Why It Matters

When you buy undervalued Kings, you:

✔ Lock in better yields today

✔ Own companies that keep raising dividends through thick and thin

✔ Let compounding build your future wealth while the market noise fades into the background

Most investors wait until these names get expensive again. Smart investors? They pick them up while they’re still on sale.

⚡ The MaxDividends Kings Playbook

Here’s the simple approach we live by:

Pick only the strongest — our Financial Scoring turns 10–15 years of sales, profits, dividends, and debt into one simple number. If it’s 90+, you know the company is strong and reliable.

Buy when they’re undervalued — the app flags Kings that are “on sale” so you can spot bargains fast.

Stick with brands you trust — household names you’d be proud to hold for decades.

Collect and reinvest — dividend raises + time do the compounding for you.

Replace only on a cut — if it ever happens, the app alerts you instantly so you can swap and stay on track.

That’s it. Clear rules, full transparency, no stress — just steady wealth-building made simple inside the MaxDividends App.

🎯 Spotlight: 3 Kings Right Now

Grainger (GWW) — Industrial distribution, Financial Score 99. Yield 0.92%, +41% growth in 5 years.

👉 Keeps sales growing through service and e-commerce, and right now trades below fair value — rare for a 55-year Dividend King.

Abbott Labs (ABT) — Medical devices, Financial Score 98. Yield 1.73%, +72% growth in 5 years.

👉 Healthcare demand never sleeps. Abbott keeps delivering worldwide and raising payouts aggressively — a King tied to long-term medical growth.

Nucor (NUE) — Steel, Financial Score 98. Yield 1.65%, +35% growth in 5 years.

👉 America’s most efficient steelmaker, with strong cash flows and infrastructure tailwinds. Today’s price makes it a classic “buy the cycle” play.

👉 And those are just three. The full lineup of 11 Undervalued Kings for September is live right now — only for Premium Partners.

📌 Max’s Note

“I personally love these giants — the steady payers that quietly fatten my wallet year after year. And whenever I find a true gem among the Kings, it feels like a gift to my portfolio. I use this very list inside the MaxDividends App all the time in my own dividend hunt.”

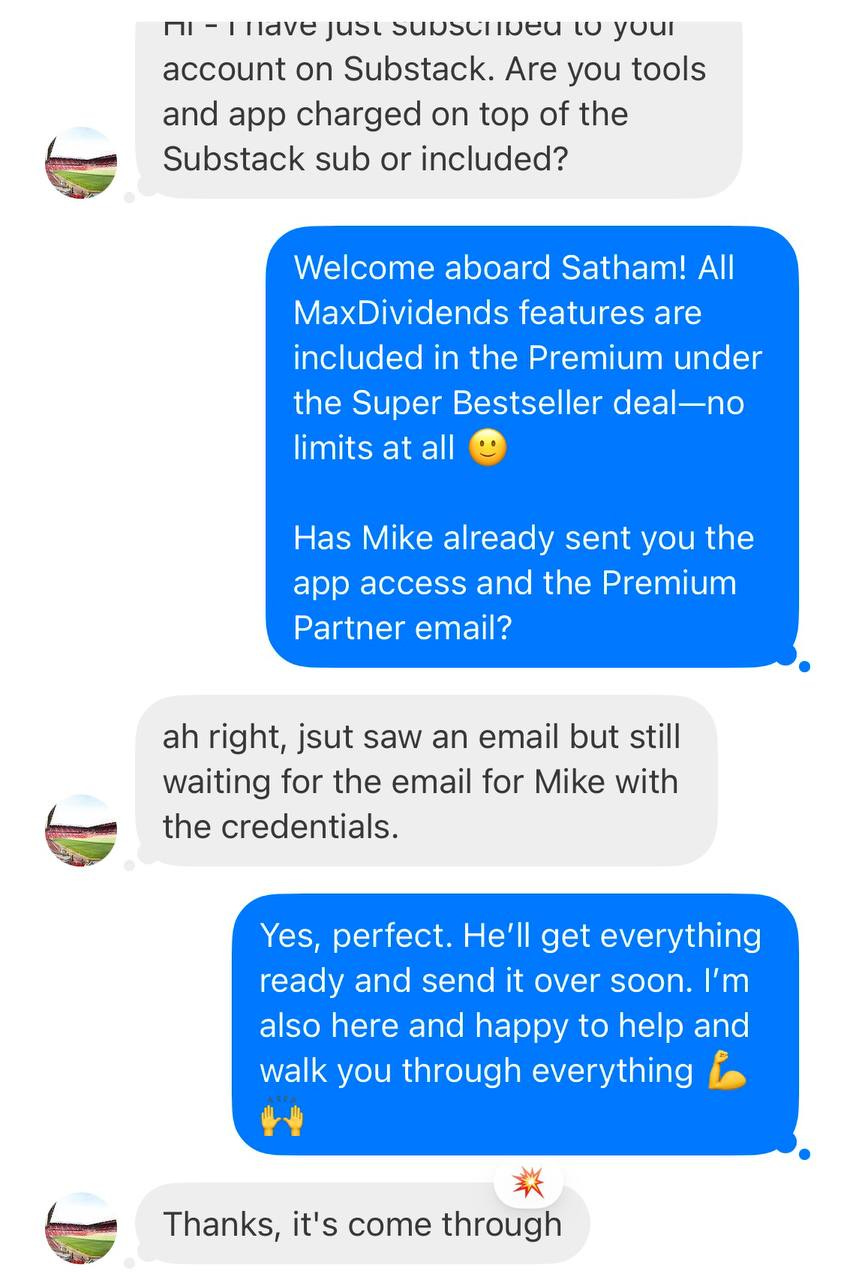

📱 Unlock the Full Power of MaxDividends

The MaxDividends App is your all-in-one hub — Dividend Kings, Aristocrats, Eagles, updated payouts, financial scores, and strategy tools, all in one place. No spreadsheets. No guesswork. Just the data and discipline you need.

🚀 Super Bestseller Deal 2025

Right now, we’re running the Super Bestseller Deal — your chance to lock in 55% OFF Premium for life. No renewals, no price hikes, just unlimited access to every list, every tool, every update.

⚠️ Slots are limited and shrinking daily. Once they’re gone, the price jumps from $89/year to $249/year.

5 slots only. First presale sold out in hours — don’t wait for the next one to slip away.

This deal will never return. The earlier you secure it, the longer you enjoy compounding dividends at a price that never rises.

That’s Just The Beginning!

🎁 We’re giving you our MaxDividends App — FREE when you join the #1 Dividend Investor Community before all 300 slots are taken.

As an early adopter, you’ll not only get free access but also the chance to shape the product with your feedback, and our full support on your dividend journey.

This is your opportunity to track your passive income, optimize your portfolio, and be part of building the ultimate dividend tool.

Alex - “Brother. Just want to say I love the app! I’m happy”

Scott - “Love what you do :) huge strategy“

⭐️⭐️⭐️⭐️⭐️

Trusted by 100,000+ subscribers!

Andrew - "Based of your MaxDividends App now I know it's scoring is low before I didn't have access to a well and easy financial evaluation on this stock."

Russell - "Want to get caught up with your portfolio so far and follow along until we can all retire. "

Todd - "Just found this site --excited to get started!"

Vinny - "Helping retail investors retire early and comfortably "

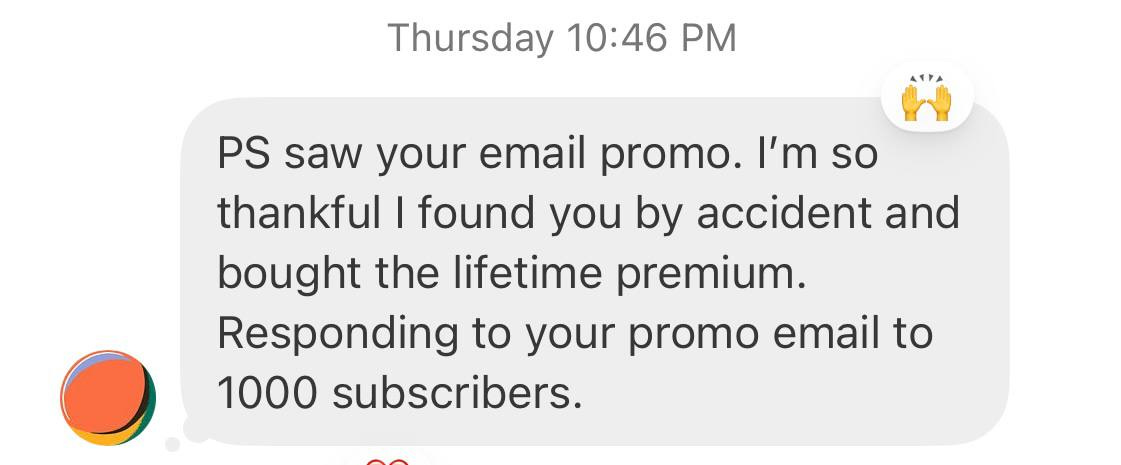

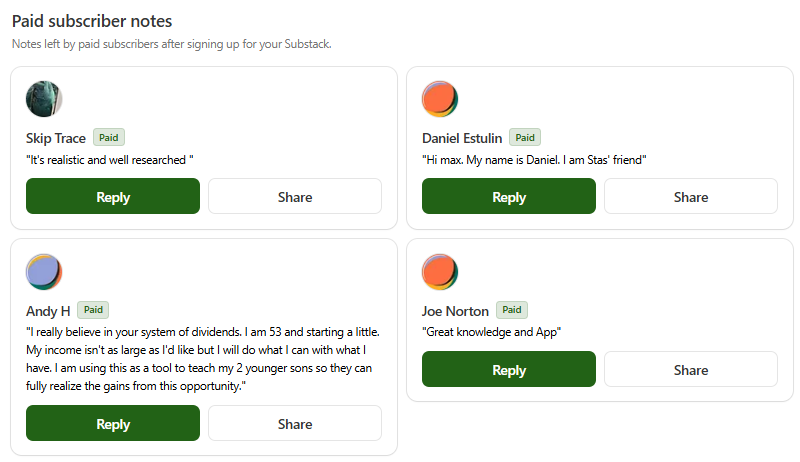

We're happy to help and thrilled to see new partners join through referrals

Recommended by Our Community

What Premium Partners Are Saying

And many others

“You are serious and trustwhorty”

“Developing an additional source of retirement income.”

Thought I would share - I was able to create an Ultra High Dividend portfolio w/15 companies today that would net me a $4,200+/month income. I just retired this month and have a current income of $10,230/mo., will be $12,500/mo. in '27 so another $4200/mo. would be nice! Love the app, had a lot of fun creating a portfolio today!

Thanks for all the hard work putting the MaxDividends! You guys have done all the heavy lifting.

$89/year (55% OFF — locked in for life. Only 287 of 300 slots remain)