Two Unstoppable Dividend Stocks to Buy and Hold Forever

Microsoft and Visa stand out with strong business models, reliable dividends, and massive growth potential—making them ideal forever holdings.

MaxDividends Mission: Helping & Supporting Everyone in Building a Growing Passive Income, Retiring Early, and Living Off Dividends.

For dividend investors seeking opportunities with strong growth potential, MaxDividends Stock Ideas offers a daily, in-depth look at companies worth considering for a dividend portfolio.

⭐️ Premium content for paid subscribers

No access yet? Check your status & upgrade to Premium. Exclusive insights await inside!

Intro

💡 Invest in companies you believe in - W. Buffett

Market volatility driven by Donald Trump's policies has made many investors nervous. However, presidents and economic policies come and go, while the stock market continues to deliver returns over the long term.

Dividend stocks stand out in particular, as they have historically outperformed non-dividend-paying stocks. But not all dividend companies are equally reliable.

Among them, Microsoft (MSFT) and Visa (V) shine—two companies with powerful competitive advantages, steady growth, and decades of potential ahead. Let’s take a closer look at why these stocks deserve a permanent place in your portfolio.

1. Microsoft (MSFT)

Microsoft (NASDAQ: MSFT) is one of the world's largest technology companies, founded in 1975 by Bill Gates and Paul Allen. Headquartered in Redmond, Washington, Microsoft is best known for its Windows operating systems, Microsoft Office productivity suite, Azure cloud platform, Xbox gaming consoles, and the professional social network LinkedIn (acquired in 2016 for $26.2 billion).

Today, Microsoft is a leader in cloud computing (with Azure being second only to Amazon Web Services), artificial intelligence (Copilot, OpenAI integration), and enterprise software (Dynamics 365, Power Platform). The company is also actively expanding into cybersecurity and mixed reality (HoloLens) technologies.

History of the Company

Founded in 1975 by childhood friends Bill Gates and Paul Allen, Microsoft began as a small startup focused on developing software for early personal computers. The company's big break came in 1980 when IBM licensed Microsoft's MS-DOS operating system for its first PC, establishing Microsoft as a key player in the tech industry. The 1985 launch of Windows 1.0 marked the beginning of Microsoft's dominance in PC operating systems, a position solidified by the massively successful Windows 95 release.

Throughout the 1990s, Microsoft expanded its software empire with products like Microsoft Office while facing antitrust lawsuits over its competitive practices. The company entered the 21st century by diversifying into gaming (Xbox, 2001), mobile (though with limited success), and enterprise software.

A transformative moment came in 2014 when Satya Nadella became CEO, pivoting Microsoft toward cloud computing (Azure) and artificial intelligence, including a landmark $1 billion investment in OpenAI in 2019. Today, Microsoft stands as one of the world's most valuable companies, continually evolving while maintaining its core software business.

A Proven Dividend Eagle 🦅

Microsoft (NASDAQ: MSFT) has established itself as a reliable dividend grower, rewarding shareholders with 20 consecutive years of annual payout increases since initiating dividends in 2003.

The tech giant currently offers a 0.7% dividend yield (as of June 2025), which appears modest but reflects the company's extraordinary stock price appreciation. More impressively, Microsoft has delivered a 10-year dividend growth rate (CAGR) of 10.2%, demonstrating management's commitment to returning capital to investors.

The company maintains a conservative payout ratio of 25-30% of earnings, ensuring ample room for future increases while preserving cash for strategic investments in cloud computing and AI. Microsoft's dividend payments consume less than $20 billion annually from its $60+ billion yearly free cash flow, making the payout exceptionally sustainable.

Key dividend milestones:

2003: Initiated dividends at $0.08/share annually

2014: Doubled payout frequency to quarterly2023: Annual dividend reached $3.00/share

2025: Projected $3.60/share dividend (20% increase since 2023)

Microsoft's dividend policy complements its $60 billion share repurchase program, creating a powerful total return proposition. While the yield remains below the S&P 500 average, the combination of double-digit dividend growth, strong buybacks, and capital appreciation potential makes MSFT particularly attractive for long-term investors. The company's AAA credit rating (higher than the U.S. government) further ensures dividend safety during economic downturns.

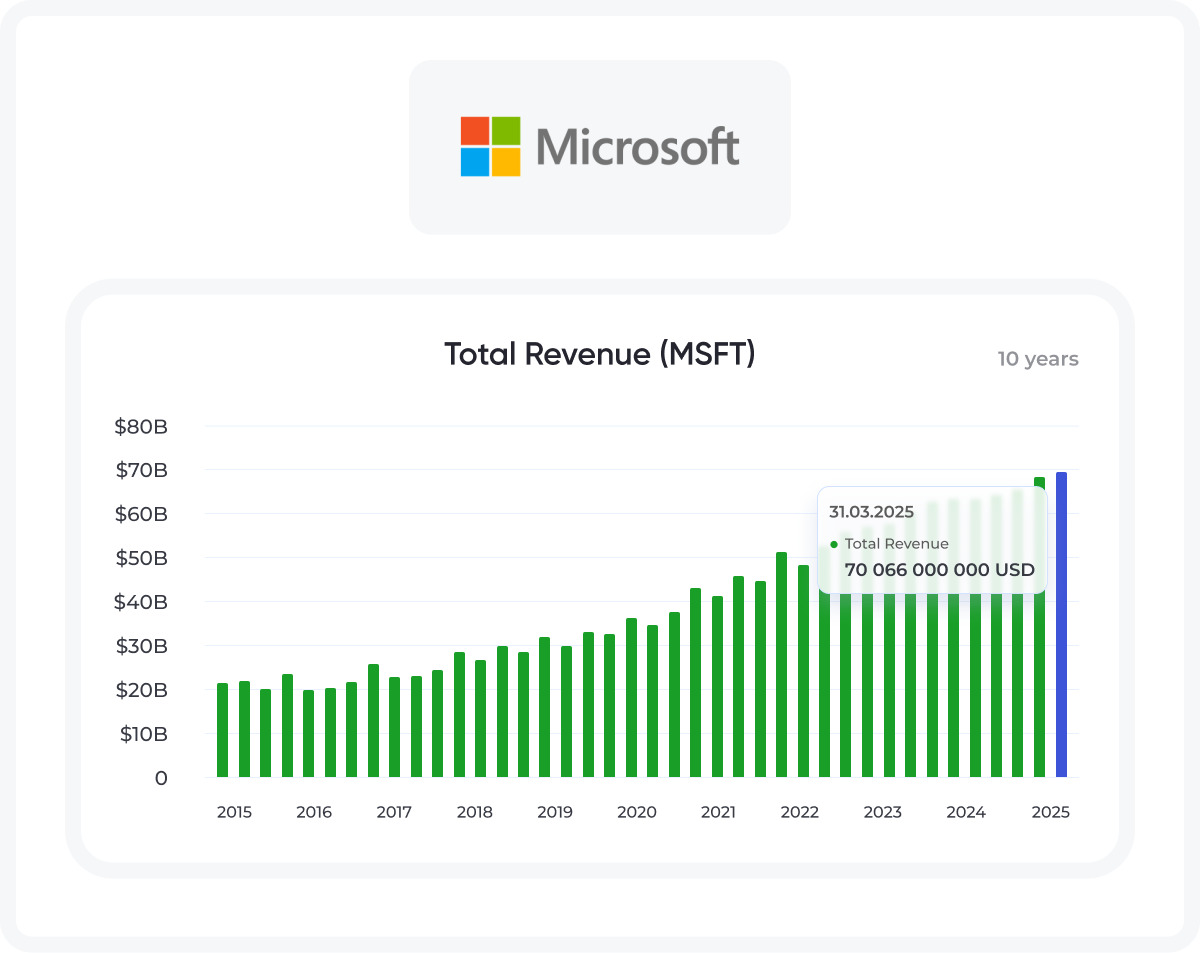

Financial Statement

If you want to stay on top of your portfolio's health, don't forget to check in on the financials of the companies you've invested in. The better shape they’re in, the better your results will be. Keep an eye on their quarterly and annual reports to see how they're performing.

Here is a quick dive into Microsoft over last years

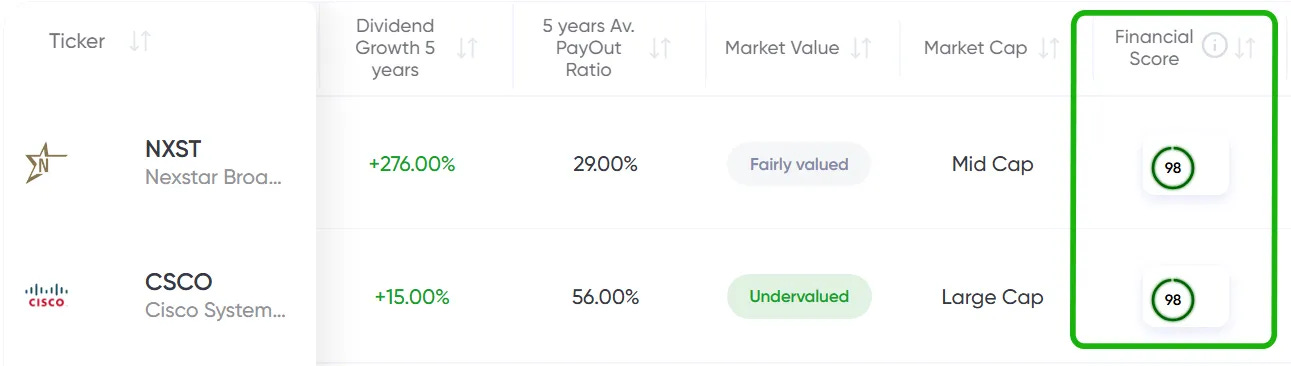

The strongest and most stable companies tend to have a Financial Score of 80+, with the very best ones hitting 90+. If you see that score start to dip below 80, that’s your cue to consider jumping ship before things get worse.

👉 Learn More about Financial Score

Our Paid Members get access to a curated watchlist of 19,000 companies worldwide, all scored by our team on a regular basis. Companies like Microsoft are on that list, too.

Future Growth Prospects for Microsoft

Microsoft (NASDAQ: MSFT) is well-positioned for sustained growth, driven by its leadership in cloud computing (Azure), artificial intelligence (AI), and enterprise software. The company’s $80 billion investment in AI infrastructure in FY2025 underscores its commitment to scaling high-margin AI services, with Azure AI revenue already contributing 16 points of growth in Q3 2025. Key growth drivers include:

AI Monetization & Copilot Expansion

Microsoft 365 Copilot ($30/user/month) and GitHub Copilot (15M+ users, up 4x YoY) are fueling high-margin subscription growth, with enterprises adopting AI agents at scale.

OpenAI’s exclusive Azure integration and 100 trillion tokens processed quarterly (up 5x YoY) reinforce Azure’s AI dominance.

Cloud & Hybrid Work Solutions

Azure’s 33% revenue growth (outpacing AWS and Google Cloud) is supported by enterprise migrations and AI workloads. Microsoft projects 34–35% Azure growth in Q4 2025.

The rise of "Frontier Firms" (hybrid human-AI teams) is boosting demand for Microsoft 365, Dynamics 365, and Power Platform (56M monthly users).

Strategic Partnerships & Market Expansion

OpenAI’s projected $125B revenue by 2029 could yield Microsoft $62B+ in cumulative revenue share under current terms.

New industry-specific AI certifications (e.g., Energy, Healthcare) aim to capture vertical markets.

Windows & Gaming Innovations

Windows 11 adoption (75% YoY growth in commercial deployments) and Copilot+ PCs (with AI features like Recall) are revitalizing the PC segment.

Xbox’s cross-platform strategy (e.g., Switch 2 ports) and record cloud gaming hours (150M+) are diversifying gaming revenue.

Global Infrastructure & Policy Tailwinds

Microsoft’s data center expansion (10 new regions in Q3) and quantum computing advancements (Majorana-1) position it for long-term infrastructure dominance.

U.S. AI policy initiatives under the Trump administration could further benefit Microsoft’s $2.5M workforce skilling program and R&D investments.

Risks: Tariff impacts on hardware costs and OpenAI partnership renegotiations may create short-term volatility 413. However, Microsoft’s AAA credit rating and diversified cash flows ($60B+ annual FCF) provide resilience. Analysts project a 12-month average price target of $513 (11.8% upside), with bullish targets reaching $600.

With MaxDividends, it's easier than ever to access top dividend companies, track your results, and explore new dividend ideas.

The MaxDividends Top Stocks List features ~100 of the most reliable dividend companies in the U.S. market, each with 15+ years of consecutive dividend increases. These stocks are carefully selected based on MaxDividends' strict criteria for consistency and reliability.

Dividend Kings represent the elite tier of dividend growth stocks. With 50+ years of consecutive dividend increases, these companies offer unparalleled income stability, making them a top choice for investors seeking long-term reliability in an unpredictable market.

With 25+ years of consecutive dividend increases, Dividend Aristocrats are among the strongest dividend growth stocks. These companies have a proven track record of not only maintaining but consistently increasing their dividends, often outperforming the broader market over time.

2. Visa (V)

Visa (NYSE: V) is the global leader in digital payments, providing transaction processing infrastructure that connects consumers, merchants, financial institutions, and government entities across more than 200 countries.

Originally launched in 1958 as Bank Americard, the payment system was rebranded as Visa in 1976 to facilitate worldwide expansion. The company is renowned for its VisaNet payment network, which can process over 65,000 transactions per second, and commands approximately 55% market share by value of global card payment volume.

History of the Company

Visa traces its origins to 1958, when Bank of America launched the Bank Americard—the first consumer credit card with revolving credit—in Fresno, California. Initially, the program faced challenges, including 22% delinquency rates and widespread fraud, costing Bank of America nearly $20 million in losses 115.

By 1966, Bank of America began licensing the BankAmericard to other U.S. banks to compete with Master Charge (now Mastercard), forming a decentralized network.

A pivotal moment came in 1970, when Dee Hock, a manager at National Bank of Commerce, restructured the system into National Bank Americard Inc. (NBI), a cooperative of issuing banks. This laid the groundwork for VisaNet, the electronic processing network capable of handling 65,000+ transactions per second 15. In 1976, the brand was renamed Visa for global appeal, and by 1975, it introduced the first debit card.

Visa’s modern era began in 2007, when regional entities merged to form Visa Inc., which went public in 2008 in a record $17.9 billion IPO—the largest in U.S. history at the time 18. Today, Visa processes $14 trillion annually and maintains a 50% global market share (excluding China), despite competition from UnionPay and fintech disruptors.

A Proven Dividend Eagle 🦅

Visa (NYSE: V) has established itself as a dividend aristocrat among payment processors, with 15 consecutive years of annual dividend increases since its 2008 IPO. While the current yield appears modest at 0.7% (as of 2025), this reflects Visa's extraordinary share price appreciation rather than weak payout growth. The company has delivered an impressive 17.5% CAGR in dividend growth over the past decade, far outpacing the financial sector average.

Key Dividend Characteristics:

Payout Ratio: Maintains a conservative 20-25% of earnings, allowing simultaneous investment in growth initiatives

Cash Flow Backing: Generates $18+ billion annual free cash flow, with dividends consuming just $4.1 billion (2024)

Growth Trajectory: Increased quarterly dividend from $0.50/share (2021) to $0.90/share (2025).

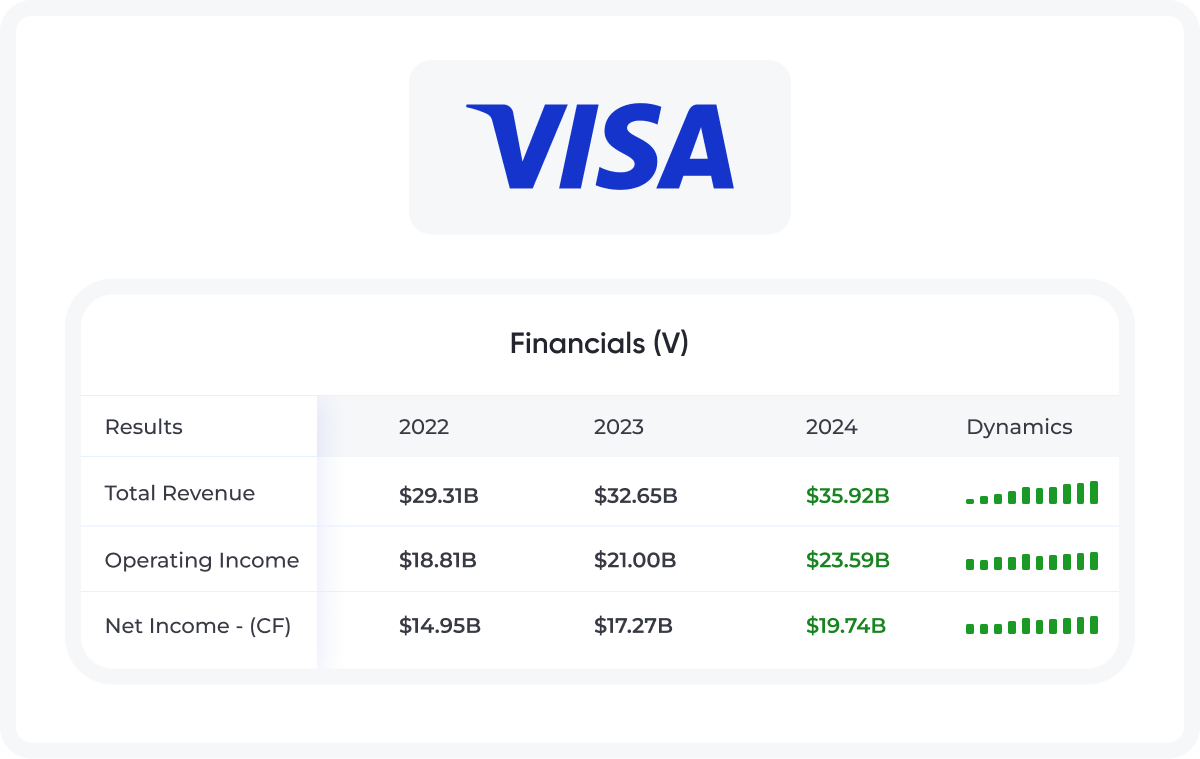

Financial Statement

Here is a quick dive into Visa over last years

Future Growth Prospects for Visa

Visa (NYSE: V) remains well-positioned for sustained growth, driven by global digital payment adoption, expansion in emerging markets, and innovation in fintech solutions. The company continues to benefit from the secular shift from cash to digital payments, with $16+ trillion in annual payment volume and 4.8+ billion cards in circulation3. Key growth drivers include:

Expansion in Emerging Markets

Visa is increasing penetration in regions like Southeast Asia, Africa, and Latin America, where cash still dominates ~50% of transactions.

Partnerships with central banks (e.g., CBDC integrations) and local fintechs enhance market access.

Fintech & B2B Payment Innovations

Visa Direct (real-time P2P/B2B payments) and tokenization (security for digital wallets) are gaining traction.

The BNPL ("Buy Now, Pay Later") segment and stablecoin partnerships (e.g., USDC settlements) open new revenue streams.

High-Margin Business Model

With ~70% EBITDA margins, Visa reinvests in tech (AI fraud detection, blockchain) while maintaining double-digit EPS growth.

Asset-light structure (no credit risk) ensures resilience in economic downturns.

Regulatory & Competitive Landscape

While regulatory scrutiny on fees persists (e.g., EU interchange caps), Visa’s scale and network effects mitigate disruption risks.

Competition from Mastercard, UnionPay, and fintech disruptors (e.g., PayPal) pressures margins but also drives innovation.

Final Thoughts

Microsoft and Visa stand out as two of the most resilient and growth-oriented dividend stocks in the market today. What makes them exceptional long-term holdings isn’t just their dominant market positions—it’s their ability to evolve and capitalize on global megatrends. Microsoft has successfully transitioned from a legacy software company into a cloud and AI leader, while Visa continues to ride the unstoppable shift from cash to digital payments worldwide.

Both companies share key traits that define true "forever stocks": wide economic moats, consistent free cash flow generation, and management teams that balance reinvestment with shareholder returns.

While their dividend yields may appear modest, their double-digit dividend growth rates and massive share buyback programs create powerful compounding potential.

To your wealth, MaxDividends Team

More Dividend Ideas

MaxDividends Community

With MaxDividends Community you’ll always be part of a winning team and stop viewing the future as an uncertainty. Worry will fade, replaced by confidence and peace of mind. You’ll focus on doing what you love while your passive income continues to grow.

Knowledge Base

I ❤️ Dividends: Why I Believe Dividend Investing Is the Best Strategy | PDF Book

How Effective is the MaxDividends Strategy for Building Growing Passive Income

🔥 Got a question about dividends? Ask Max, your AI Dividend Assistant!

MaxDividends Mission

Helping & Supporting Everyone in Building a Growing Passive Income, Retiring Early, and Living Off Dividends.