☕️ Sunday Coffee: The Original Black Friday: Wall St. Hustlers, Gold and Chaos

How Two Wall Street Hustlers Tried to Buy the Gold Market and Broke the Economy

Intro

Hi there, this is Max!

The past three days have been absolutely insane. Our whole team is still catching our breath. I’m genuinely happy for everyone who joined us during this sprint — welcome to the MaxDividends family!

The promotion is officially over, new records were set, and we learned a ton thanks to you. This truly became an epic chapter in MaxDividends history — and now we keep moving forward.

And to properly honor the Black Friday sprint we all just survived, I thought it’d be fun to rewind a bit and look at where the name and the whole concept originally came from (not the modern marketing version — the real historical roots).

Let’s dive in!

The Original Black Friday: How Two Wall Street Hustlers Tried to Buy the Gold Market and Broke the Economy

Think Black Friday is just about grabbing deals on TVs and gadgets? Not even close.

The real Black Friday had nothing to do with shopping—and everything to do with greed, gold, and outright financial chaos.

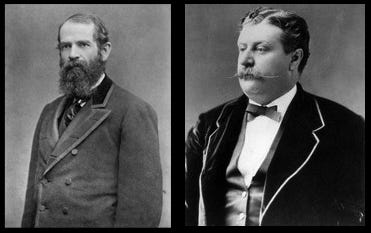

Back in 1869, two Wall Street operators—Jay Gould and Jim Fisk—tried to corner the entire gold market. In the process, they managed to send the U.S. economy into a full-blown tailspin.

What happened next?

Let’s just say it involved gold prices exploding, President Grant losing his mind, and a level of market mayhem that still makes economists shake their heads.

Intrigued? Keep reading—because it only gets crazier from here.

The Setup: How Two Railroad Men Tried to Rule Gold

Jay Gould and Jim Fisk weren’t your typical financiers. As top figures at the Erie Railroad, they already had a reputation for bending rules until they snapped.

But in 1869, they cooked up a plan that took ambition—and greed—to an entirely new level.

These guys didn’t just want to trade gold. They wanted to control the whole market… and force the U.S. Treasury, the President, and the entire financial system to bend to their will.

And for a moment—it actually looked like they might pull it off.

Here’s the scheme:

1. Buy Up Gold:

Gould and Fisk started scooping up gold like it was going extinct, pushing the price higher with every move.

2. Corner the Market:

Their goal? Create a fake shortage, send prices into orbit, and make everyone else play by their rules.

3. Cash In Through Railroads:

They believed soaring gold prices would drive grain prices higher, which meant more demand—and more lucrative tariffs—for their railroad empire.

It wasn’t just bold. It was borderline insane. But Gould and Fisk had one massive advantage: political access.

They cozied up to lawmakers, whispered into the right ears, and even tried to influence President Ulysses S. Grant’s administration to halt government gold sales. If they could freeze the Treasury, gold would shoot to the moon—and their profits with it.

Gold Fever Hits the Market

As the two piled into gold, prices exploded. By late summer 1869, gold was rising so fast traders could barely keep up. Wall Street lit up with speculation. The entire economy started to feel the squeeze—farmers, merchants, exporters… everyone was caught in the shockwave.

By September, it was full-blown madness. Gold rocketed to $162 per ounce—up from $130 just weeks earlier. It looked like Gould and Fisk were about to pull off the most outrageous financial coup of the century.

And then? That’s when everything snapped.

Enter President Grant: The Party Crasher

But Gould and Fisk miscalculated one thing: President Ulysses S. Grant wasn’t going to sit back and watch them torch the U.S. economy.

Sensing the scheme—and furious at the chaos it was creating—Grant struck hard.

On September 24, 1869, the day that would go down as Black Friday, the U.S. Treasury dumped massive amounts of gold onto the market.

The result? Absolute pandemonium.

Gold collapsed from $162 to $133 in minutes. Investors rushed to unload their positions, but by the time they reacted, the damage was already done. The entire market buckled under the shock.

The Fallout: When the Dust Settled

The crash didn’t just wipe out Gould and Fisk’s paper gains (though they still walked away with more money than they deserved). It unleashed real, widespread economic pain:

• Farmers got crushed:

As gold collapsed, grain prices tanked right behind it—leaving farmers with huge losses.

• Businesses went under:

Companies that bet big on the gold rally suddenly found themselves bankrupt.

• Investor confidence evaporated:

The chaos undermined trust in markets and rattled Wall Street for years.

Why It Matters: Lessons from the 1869 Gold Grab

Black Friday wasn’t just a dramatic footnote. It reshaped financial history—and left behind lessons that still matter today:

1. Greed Has Consequences

Gould and Fisk thought they were smarter than the market, the government, and basic economics. They weren’t.

2. Intervention Can Save (or Shock) Markets

Grant’s decision to unleash Treasury gold stabilized the system—but it also sent shockwaves through it.

3. Market Manipulation Hurts Everyone

Farmers, businesses, traders—no one escaped the fallout. When greed goes unchecked, the entire economy pays the price.

Fun Fact: Gould and Fisk Somehow Walked Away Clean

Here’s the wild part: despite engineering one of the biggest financial scandals of the 19th century, Jay Gould and Jim Fisk didn’t exactly vanish in disgrace.

Gould went on to become one of the richest—and most feared—tycoons of his era.

Fisk kept living large as a flamboyant showman, businessman, and all-around character.

Not exactly the downfall you’d expect after nearly breaking the U.S. economy.

The True Legacy of Black Friday

Today, Black Friday means discounted TVs, long lines, and doorbuster sales.

But its original meaning? A full-blown financial meltdown.

The 1869 gold scandal became a turning point—a reminder of:

what unchecked greed can do,

how quickly markets can crack under manipulation, and

why government intervention sometimes becomes the only line of defense.

So the next time you’re scrolling through Black Friday deals, remember Gould and Fisk.

At least now, the only thing people are fighting over is a cheaper laptop—not the fate of the entire U.S. economy.

With respect for your well-being, Max

***

With MaxDividends Community you’ll always be part of a winning team and stop viewing the future as an uncertainty. Worry will fade, replaced by confidence and peace of mind. You’ll focus on doing what you love while your passive income continues to grow.

“The only one who cares about your wealth is you. This is your money, your future, and your life. Your passive income is a result of your efforts, and it’s a reflection of your success.”

Max

MaxDividends Community

MaxDividends Mission: Helping people build growing passive income, retire early, and live off dividends.

Someone’s sitting in the shade today because someone planted a tree a long time ago. ― Warren Buffett.

We follow our time-tested strategy for tapping into overlooked dividend plays that can make your portfolio more resistant to recessions and other market panics and pack on consistent gains for years to come.

Love what we’re building?

Pay once, enjoy forever — the app, the tools, the community.

MaxDividends Idea

“Retire early and live on dividends. Because no one wants to work forever.”

👉 My Own High Yield Dividend Growth Story

With MaxDividends Community, you’re not just investing—you’re joining a winning team. The uncertainty about the future starts to fade. Worry gets replaced with confidence and peace of mind. Your focus shifts to doing what you love, while your passive income keeps growing month after month.

Here’s the truth: your environment shapes your results. Surround yourself with people who think bigger, act smarter, and stay disciplined—and you raise your own game. Inside MaxDividends, you’ll find exactly that: a community that supports your journey and pushes you toward greater heights.

📚 Knowledge Base & Premium Guides

Start Here

Guides & Step-by-Step

Deep Insights

📖 I ❤️ Dividends: Why I Believe Dividend Investing Is the Best Strategy | E-Book

How Effective is the MaxDividends Strategy for Building Growing Passive Income

Help & Support

Got a question about dividends? Ask Max, your AI Dividend Assistant!

Didn’t get the answer you need? Reach out: max@maxdividends.app or team@maxdividends.app — we’ll help you out.

MaxDividends Mission

Helping people build growing passive income, retire early, and live off dividends.

Someone’s sitting in the shade today because someone planted a tree a long time ago. ― Warren Buffett.

Great Gold story. Must read!! Best, david