💡 How Do We Select Top Dividend Stocks

In this article, I’ll break down the approach to selecting stocks for MaxDividends Top Dividend Companies

MaxDividends Mission: Helping people build growing passive income, retire early, and live off dividends.

No one wants to work forever. And as time goes on, the question of financial security only gets louder. Can we really enjoy life in retirement without having to pick up another job just to pay the bills?

Intro

My name is Max, nice to meet! I am an entrepreneur, dad to three, and a private investor in stocks.

As the creator of the MaxDividends Strategy, I focus on investing in high-yield and dividend growth stocks—building a reliable income stream that allows me to live off dividends and retire early.

Am I out walking with my kids? My dividends are growing. Is the oil market shifting, and now isn’t the right time to invest, so you're waiting? My income just grew again.

Do you see that amazing magic?

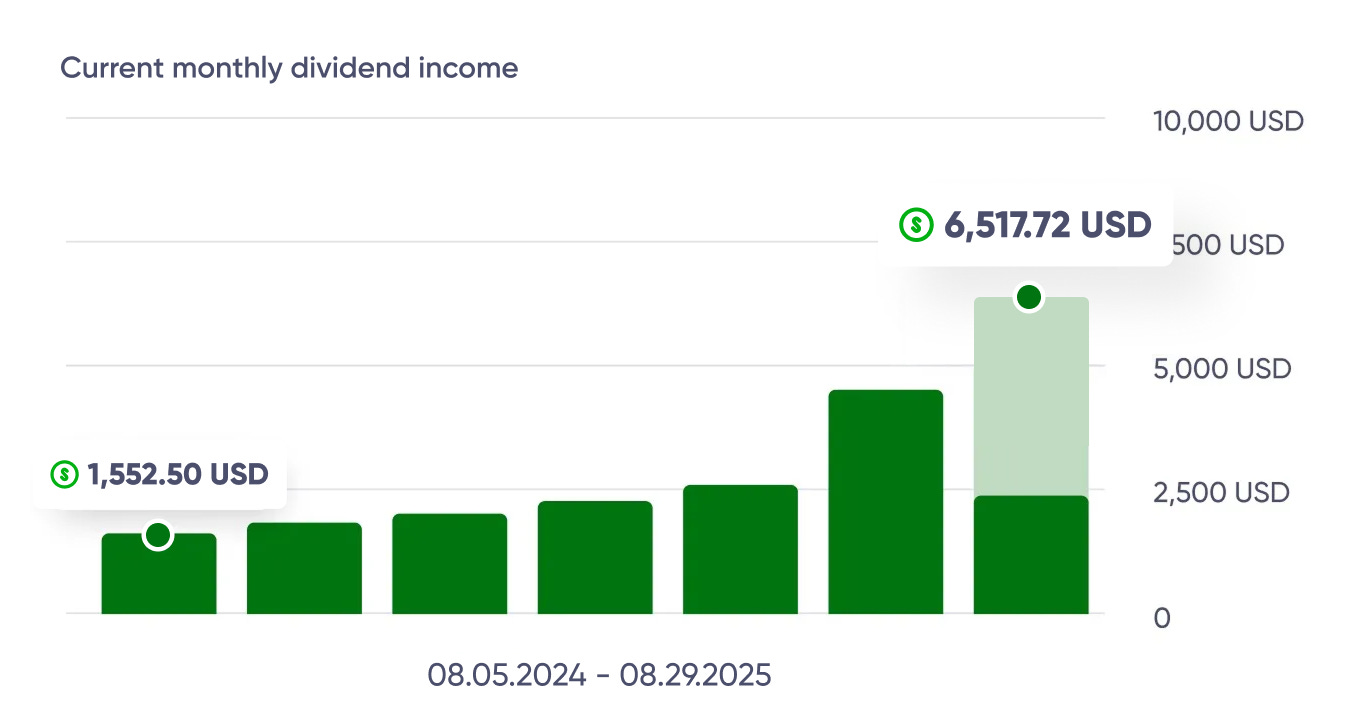

At 40, I’ve already started living off dividends

My passive income from stock dividends already exceeds my daily expenses and continues to grow every month thanks to MaxDividends Strategy of investing.

Every month, every week, every day—while I sleep, eat, shower, walk, or write this post—my income keeps rising.

My Passive Income with the MaxDividends Strategy Keeps Climbing

Last week, it ticked up again. Not just good—fantastic. It feels amazing watching dollars roll in almost effortlessly.

This is exactly why I love this way of investing.

💡 How Do We Select Top Dividend Stocks

My strategy is to invest in reliable, resilient businesses that increase their dividends every single year. Every year, more and more cash income flows into my pocket. Sounds great? It absolutely is.

I have a very simple, time-tested strategy that will undoubtedly get me—and each of you—to our goal.

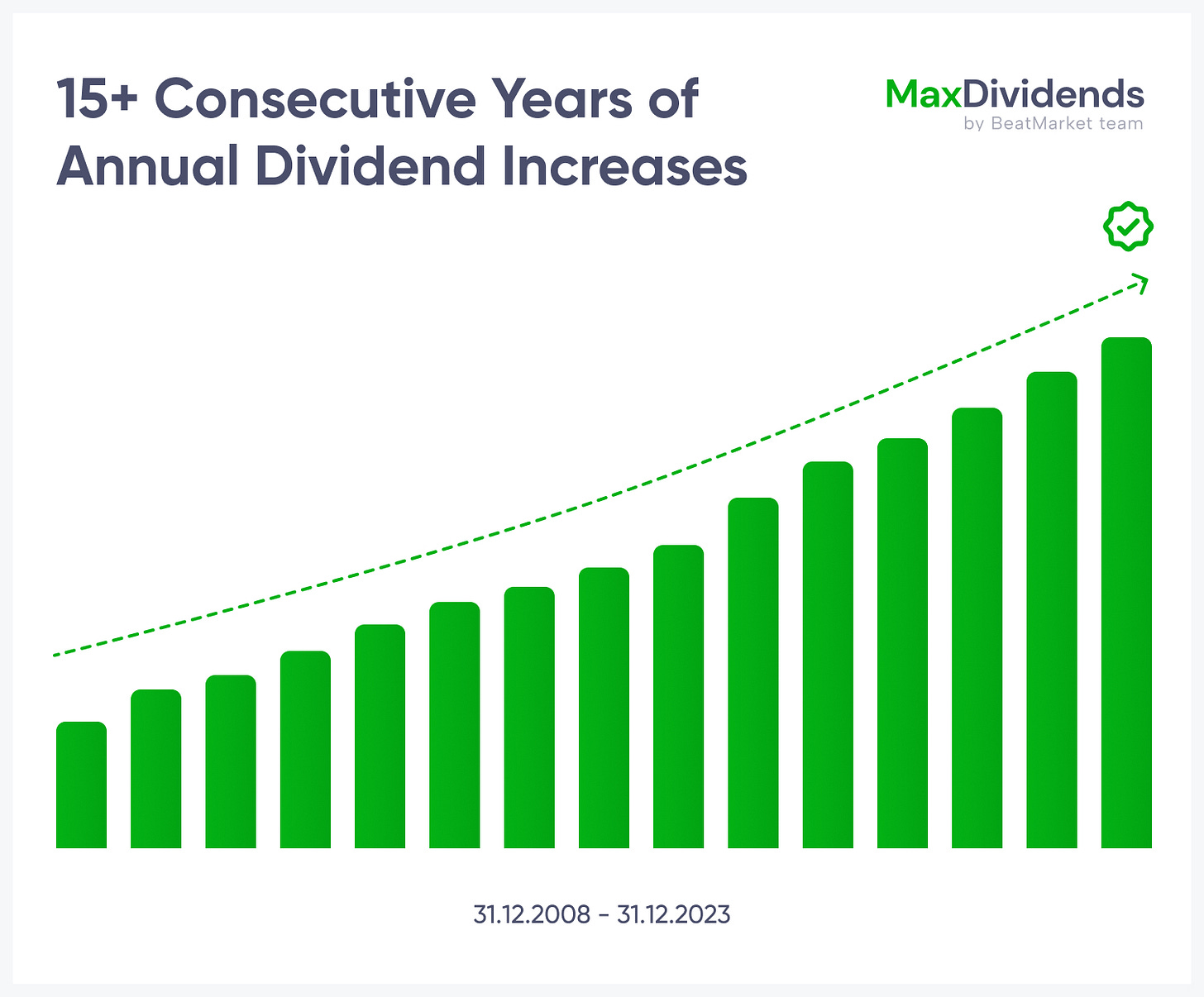

We invest in companies that have consistently increased their dividend payouts to shareholders every year for 15+ years.

In addition to that, My Team and I use a secret five-step formula to identify businesses built to last forever.

This gives us a double advantage: a rapidly growing, reliable source of passive income and long-term capital appreciation to leave a solid legacy for future generations.

Our 2-Step Criteria for Identifying the Best Dividend Stocks

⭐️ #1 Proven & Time-Tested Dividend Companies

Each company on our dividend list has a stellar track record of increasing dividends for at least 15 consecutive years.

This consistency is a testament to financial strength, resilience, and a shareholder-friendly approach.

Why does this matter?

Reliable Passive Income – These companies have weathered recessions, market crashes, and economic downturns while continuing to pay and grow dividends.

Long-Term Wealth Growth – A history of rising dividends often signals a strong, well-managed business with sustainable earnings growth.

Confidence & Security – Investing in proven companies reduces risks and provides peace of mind, knowing your portfolio is built on a foundation of stability.

By focusing on time-tested dividend companies, you ensure that your investments work for you, compounding over time and creating a reliable stream of passive income.

⭐️ #2 MaxDividends Five-Step Secret Formula

Here’s the five-step formula we use to identify businesses built to last forever. Each step ensures that the company is financially strong, capable of generating growing passive income, and positioned for long-term success.

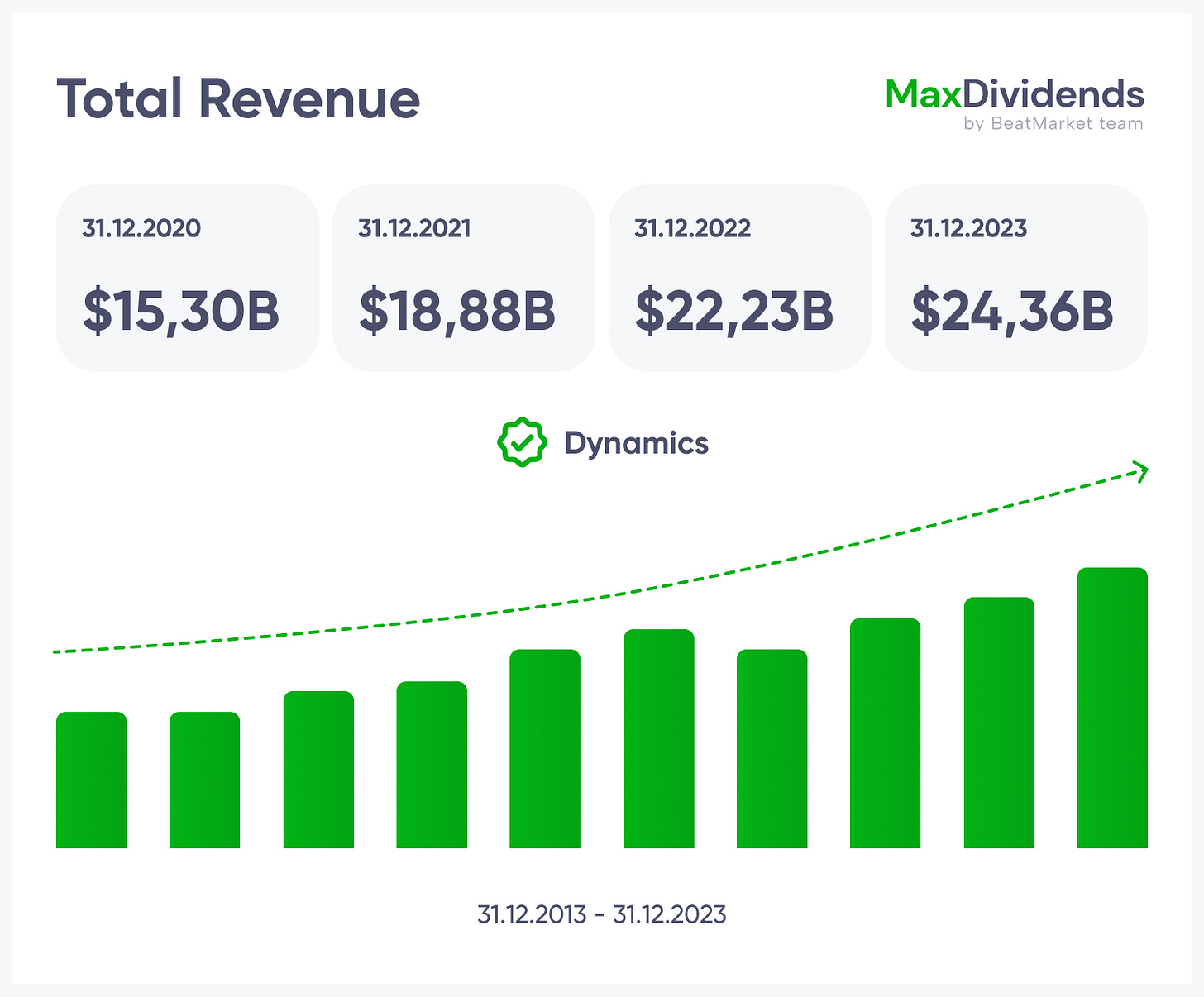

1️⃣ Sales Growth – The Foundation of a Strong Business

Consistent revenue growth over the past 10-15 years is a key sign of a thriving company. It shows that demand for its products and services is increasing, allowing it to expand operations, gain market share, and invest in future growth. Businesses that can consistently grow sales tend to have strong competitive advantages, making them resilient in any market condition.

A Key Indicator of Business Strength

We prioritize companies with long-term positive sales trends, as consistent revenue growth is a strong signal of a thriving business.

Sales trends are crucial—if sales are stagnant or declining, the business is in trouble. Sustainable growth starts with increasing sales, as it fuels profitability and long-term success. A company with strong sales momentum can overcome other challenges.

That’s why the MaxDividends screener focuses on identifying businesses with a history of steady sales growth, ensuring they are on an upward trajectory and built for the future.

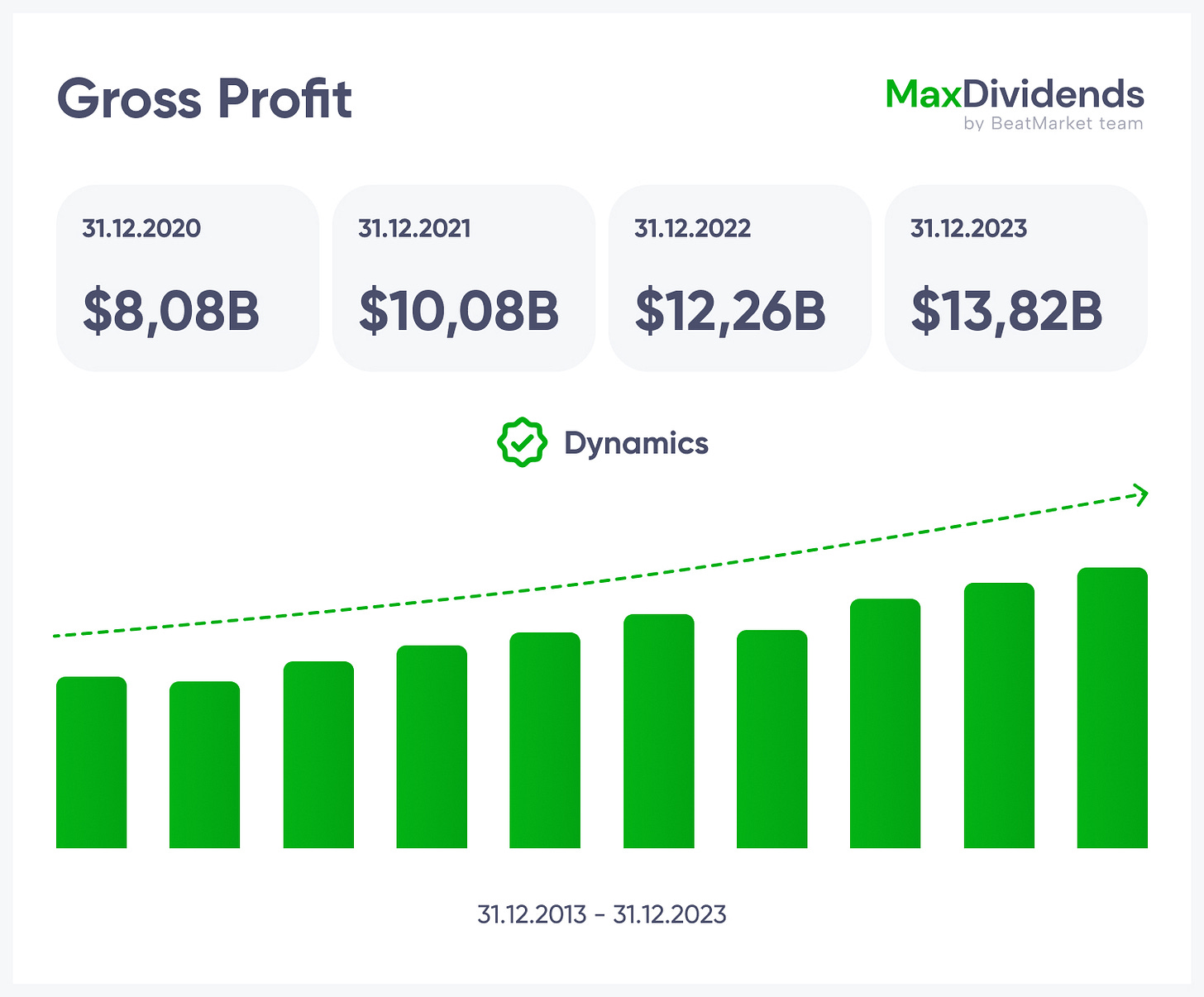

2️⃣ Profit Growth – The Fuel for Dividend Growth

Revenue alone isn’t enough—what truly matters is how efficiently a company turns that revenue into consistent, growing profits. Profitability is the foundation of sustainable dividend growth and long-term financial strength.

Why Profit Growth Matters

Stronger Dividend Growth – Companies with rising profits have the ability to increase dividend payouts consistently without jeopardizing their financial health. When profits grow, dividends naturally follow.

Reinvestment & Expansion – A profitable company can reinvest in innovation, acquisitions, and market expansion, securing its future growth and competitive edge.

Resilience During Downturns – Companies with healthy and growing profits have better cash reserves and financial flexibility to weather economic downturns, inflation, and market volatility. This ensures stability in dividend payments even in tough times.

Efficiency & Strong Management – Consistently rising profits indicate a well-run business with disciplined cost management and the ability to maintain or expand profit margins over time.

At MaxDividends, we focus on companies with a proven track record of profit growth—not just those increasing revenue, but those consistently improving their bottom line.

These are the companies that not only reward shareholders today but also secure a future of rising passive income.

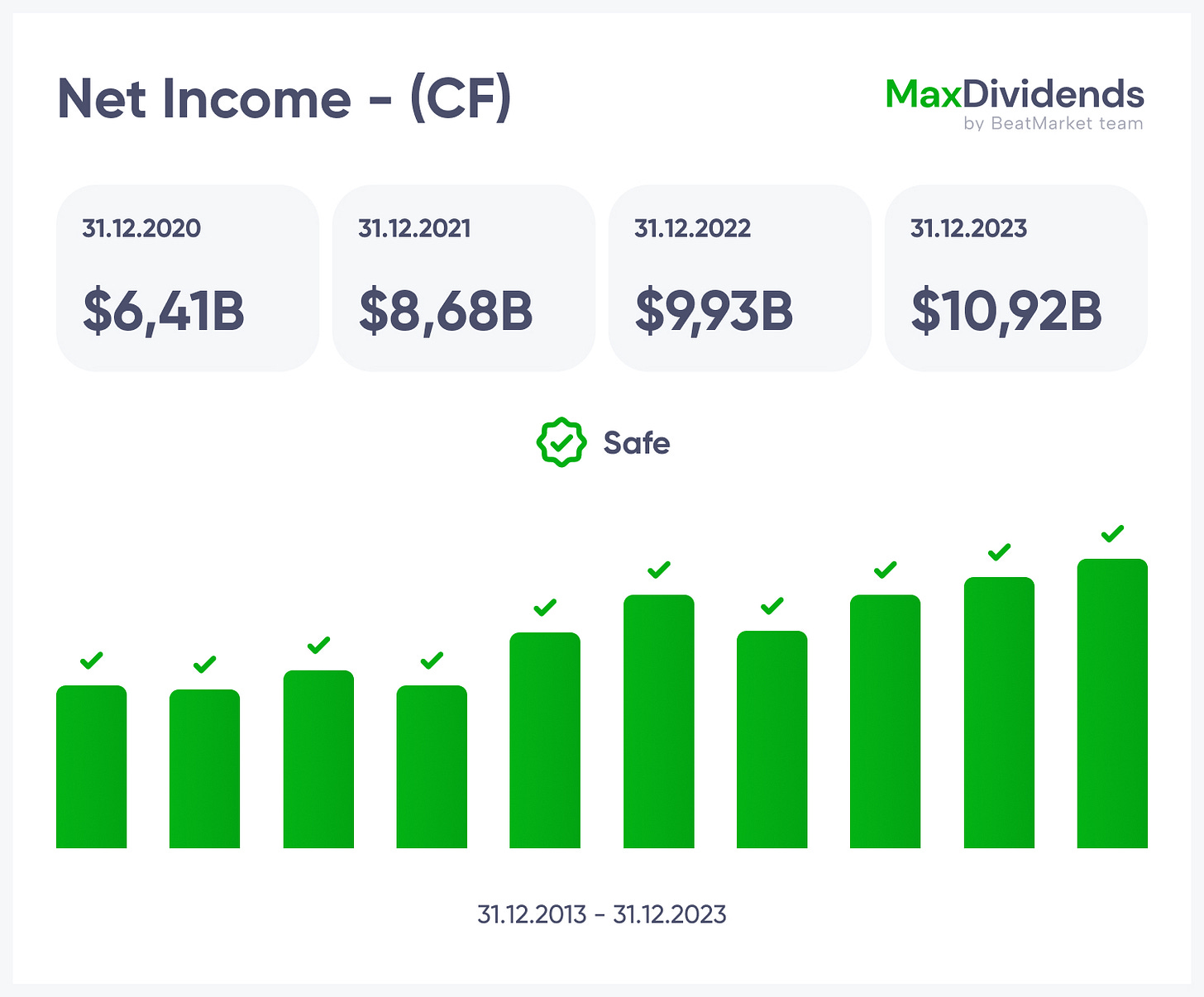

3️⃣ Net Business Income – The True Measure of Financial Strength

Net income is what remains after all expenses, taxes, and costs. This is the company’s real earning power. We analyze businesses that generate strong, sustainable net income, ensuring they have enough cash flow to continue paying—and increasing—dividends over time.

Profitability Check: A Decade of Consistent Earnings

We prioritize companies that have maintained profitability for at least 10 years, proving their ability to generate steady earnings through various market cycles and economic conditions.

Why Profitability Matters

Sustained Dividend Payments – Only consistently profitable companies can reliably fund and increase dividends without taking on excessive debt.

Resilience Through Market Cycles – A 10+ year track record of profitability typically covers multiple economic cycles, including recessions, inflationary periods, and market corrections. Companies that remain profitable through these phases have proven their business model’s durability.

Financial Strength & Stability – Long-term profitability ensures a company has strong cash flow, manageable debt levels, and the ability to reinvest in growth, innovation, and shareholder returns.

While some companies struggle during downturns, those with a decade of consistent earnings have already weathered major market events and economic disruptions.

These are the businesses we trust for long-term dividend growth and financial security.

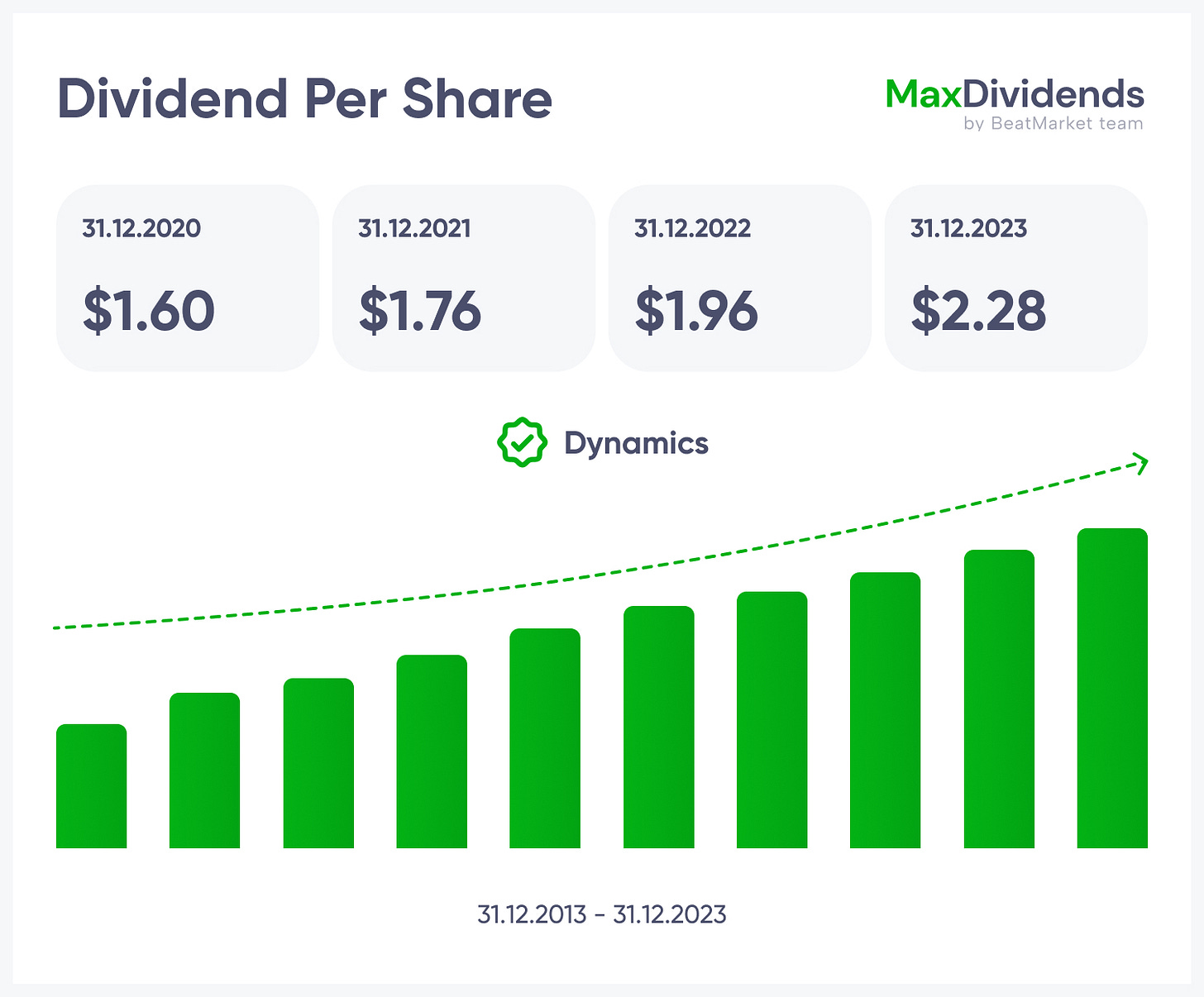

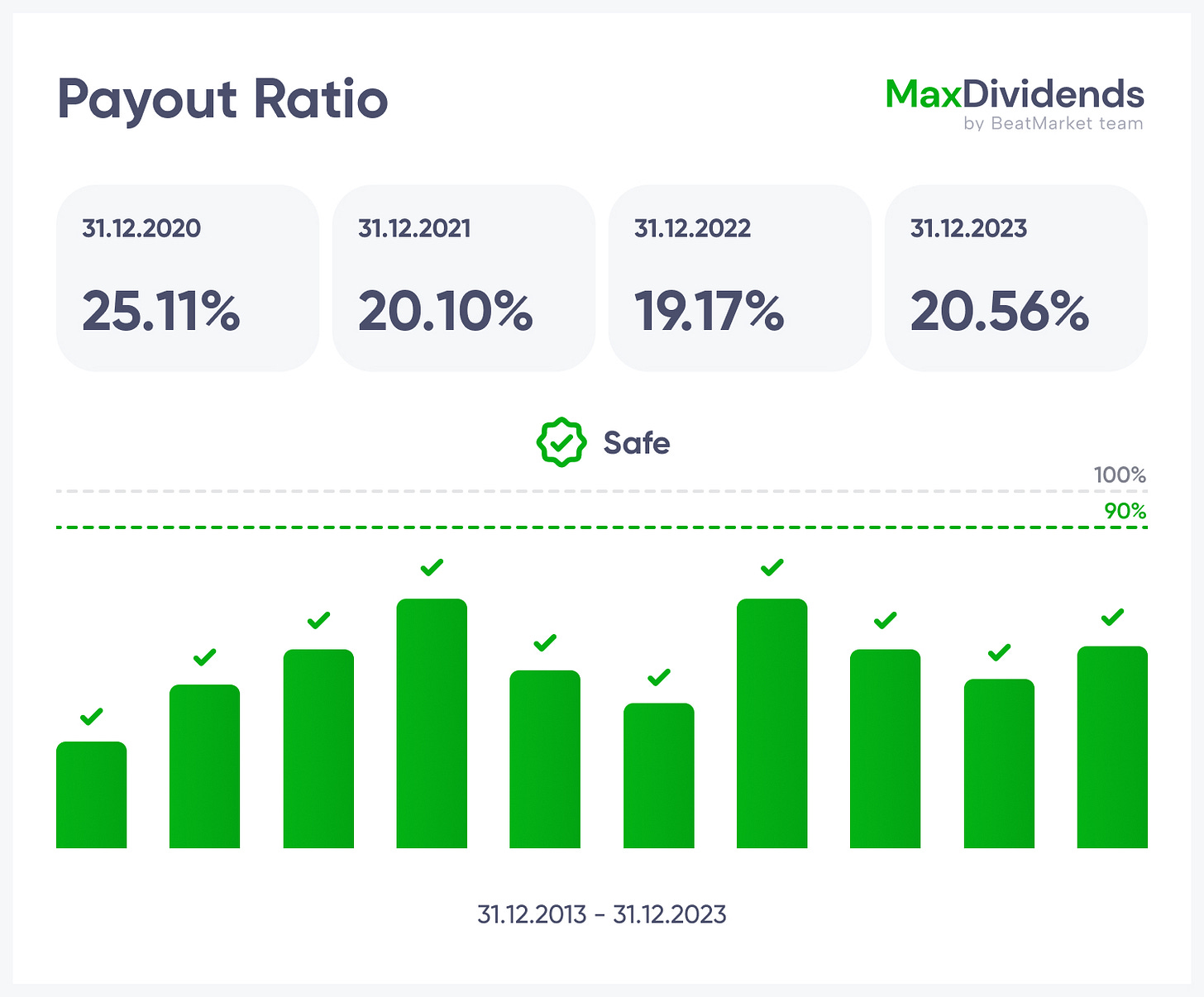

4️⃣ Dividend Payout Safety – Protecting Your Passive Income

A high dividend yield is meaningless if the company can’t afford to sustain it. We evaluate payout ratios to ensure the company is not overextending itself.

The best companies have a balanced approach—paying generous dividends while still reinvesting in future growth. Dividend safety is crucial for long-term income stability.

Dividend Consistency: 15+ Years of Reliable Payouts

We focus on companies that have paid dividends consistently for at least 15 years, proving their commitment to rewarding shareholders.

Why Dividend Consistency Matters

Reliable Passive Income – A strong dividend history ensures steady and predictable cash flow, essential for long-term investors seeking financial stability.

Proven Business Strength – Companies that maintain and grow dividends for over 15 years have weathered economic downturns, inflation, and market volatility—demonstrating resilience and financial discipline.

Confidence in Future Growth – A long track record of dividend payments and increases gives investors a strong foundation for predicting future income growth and building generational wealth.

At MaxDividends, we focus on businesses that don’t just pay dividends—but consistently raise them year after year, ensuring a growing passive income stream you can count on.

Dividend Coverage – Ensuring Dividends Are Paid from Profit with a Sufficient Surplus

Stable dividend payments and long-term growth rely on dividends being funded by current profits rather than past earnings or borrowed money.

MaxDividends ensures that dividends are well-covered by profits, demonstrating strong financial planning and competent management.

5️⃣ Debt Burden – Avoiding Financial Traps

Too much debt can cripple a company, even if its revenues and profits look great. We analyze how well a company manages its liabilities, ensuring that debt levels are under control. Low-debt companies are better equipped to navigate economic downturns and continue paying dividends without disruption.

This is how we build lasting wealth and financial freedom.

At MaxDividends, we were the first to create a list of these unique titans of the business universe, primarily for ourselves.

We call them

🦅 Dividend Eagles 🦅

🦅 Dividend Eagles

By applying this five-step formula, we filter out unstable businesses and focus only on high-quality, financially strong companies that provide growing passive income.

An updated compilation of 100+ top-performing dividend stocks with 15+ years of consecutive dividend increases, selected based on MaxDividends’ strict criteria.

Unlock the Benefits of Dividend Eagles: Elevate Your Investment Portfolio.

Imagine a curated selection of top-tier dividend-paying stocks, handpicked to provide you with consistent income and potential for capital appreciation.

Companies featured on the Dividend Eagles list have a proven track record of regular and increasing dividend payouts. This ensures you receive a reliable income, whether you're planning for retirement or seeking additional cash flow.

The Dividend Eagles list offers precisely that—a gateway to financial growth and stability.

Beyond dividends, these companies often exhibit strong fundamentals and growth prospects. Investing in them not only provides income but also the opportunity for your investment to grow over time.

From this list, I pick the businesses I particularly like or feel connected to for various reasons. I enjoy investing in these incredible companies.

This is how we build our own growing passive income and long-term wealth.

Using the Dividend Eagles list, I select the strongest companies in the world—ones I am proud to own. Every year, they thank me by increasing the payments to my bank account.

Accessing the Dividend Eagles list equips you with a powerful tool to enhance your investment portfolio. Don't miss out on the opportunity to benefit from consistent income, potential growth, and financial stability.

Daily Market Scan

We scan over 5,000 U.S. stocks daily to identify companies that meet MaxDividends' high-dividend criteria.

Twice a week, my team and I conduct in-depth market scans, reviewing approximately 5,000 companies listed on the NYSE and Nasdaq—publicly traded U.S. businesses. On other days, we update financial data, aggregating all available public reports for further analysis.

Market conditions change daily. Stock values fluctuate, new financial reports are released, and news emerges. Our goal is to uncover the best opportunities amid these constant shifts.

Manually analyzing such a vast amount of data is impossible for a small team, let alone a single person. Even with the right tools, it takes 4–5 minutes to review one company's financial report. For 5,000 companies, that amounts to 25,000 minutes or 17 days.

That's why we built MaxDividends App—to automate financial data analysis and quickly identify top dividend-paying companies.

Once the data is collected and updated, we analyze each company's financials in depth. We meticulously review public financial reports from the past 15+ years to ensure we select only the strongest businesses.

Ready to Give It a Try?

Check Your Subsription Status & Upgrade to Premium.

MaxDividends Community

MaxDividends Mission: Helping people build growing passive income, retire early, and live off dividends.

We follow our time-tested strategy for tapping into overlooked dividend plays that can make your portfolio more resistant to recessions and other market panics and pack on consistent gains for years to come.

MaxDividends Idea

“Retire early and live on dividends. Because no one wants to work forever.”

👉 My Own High Yield Dividend Growth Story

With MaxDividends Community you’ll always be part of a winning team and stop viewing the future as an uncertainty. Worry will fade, replaced by confidence and peace of mind. You’ll focus on doing what you love while your passive income continues to grow.

Choosing a strong environment is the key to achieving outstanding results. If you surround yourself with people who dream bigger than you, you increase your chances of reaching greater heights. Surround yourself only with those who will support you on your path to success.

Ready to Give It a Try?

Check Your Subsription Status & Upgrade to Premium.

If you have any questions, feel free to email me at: max@maxdividends.app

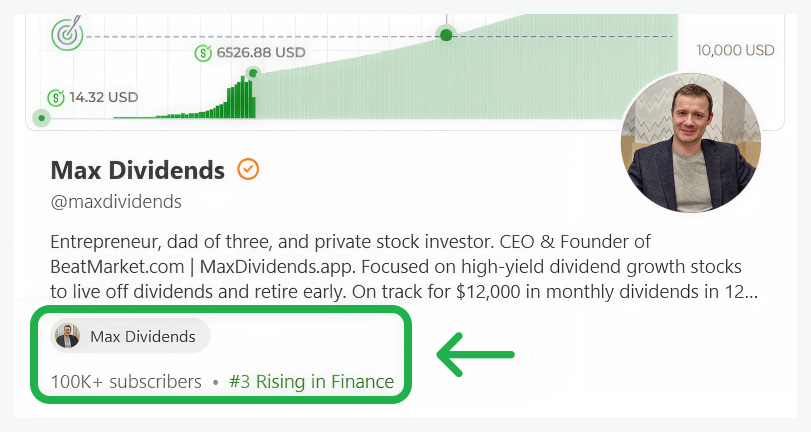

MaxDividends is a Bestseller on Substack!

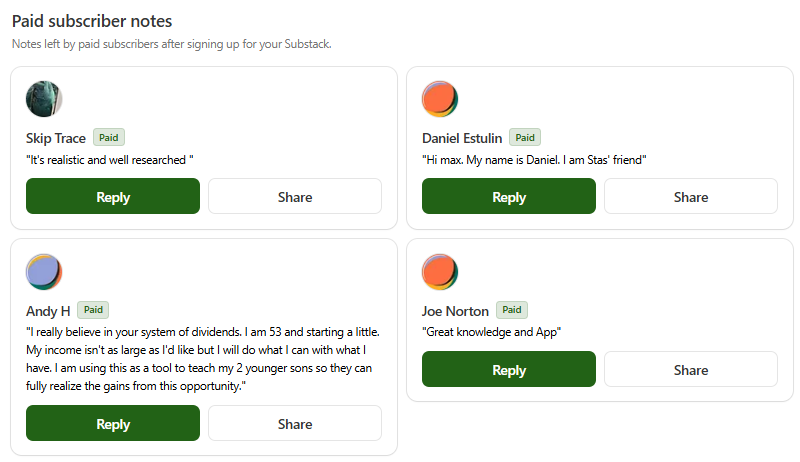

Hundreds of premium members have already discovered the benefits of the community and app, earning passive income through dividends with MaxDividends. Their passive income keeps growing!

⭐️⭐️⭐️⭐️⭐️

What You’ll Get by Joining MaxDividends Premium

The most important thing our MaxDividends community members value us for

Freedom & Independence

No boss, no schedules—complete control over your time. Ability to work on passion projects or simply enjoy life without financial stress.

Passive Income That Grows Over Time

Dividend-paying stocks provide a steady, rising income stream. Unlike traditional retirement funds, you don’t need to sell assets to cover expenses.

Protection Against Inflation

Dividend growth investing ensures your income keeps pace with inflation. Companies that increase payouts help maintain purchasing power.

Stress-Free Investing

No need for active trading or daily market monitoring. Long-term buy-and-hold strategy minimizes stress and decision fatigue.

More Time for Family & Personal Goals

Spend more time with loved ones instead of working 40+ hours a week. Pursue hobbies, travel, and personal development without financial pressure.

Health & Well-Being Benefits

Less work stress leads to better mental and physical health. More time for fitness, proper sleep, and healthier lifestyle choices.

Avoiding the Corporate Rat Race

Escape office politics, toxic work environments, and endless meetings. Focus on meaningful activities instead of chasing promotions and pay raises.

Living Life on Your Own Terms

Ability to relocate, slow travel, or move to a lower-cost-of-living area. No restrictions on how you spend your day—whether it’s reading, volunteering, or building a new skill.

Leaving a Legacy

Build generational wealth and leave assets for your family. Teach the next generation financial independence by leading by example.

Financial Security & Peace of Mind

A well-built dividend portfolio provides stability even during economic downturns. No fear of outliving your savings—passive income keeps flowing.

Many who already joined say it’s the best financial decision they’ve ever made—because money becomes a tool for freedom, not a source of stress.

Ready to Give It a Try?

Check Your Subsription Status & Upgrade to Premium.

If you have any questions, feel free to email me at: max@maxdividends.app

We’re in the Top Financial Blogs on Substack! 💪

MaxDividends continues to be recognized for its consistent effort, commitment to quality, and the loyalty of its growing community of partners.

With Max Dividends Premium, you unlock:

🔹 MaxDividends Stocks of the Week

Top 10 undervalued, high-yield, ultra-high yield, and dividend growth stocks every week.

Bonus: Full access to the updated weekly list of MaxDividends stocks—boost your passive income and start living off dividends.

🔹 Top Dividend Insights

Get exclusive, high-quality dividend investment ideas and insights, handpicked to help you crush your financial goals, retire early, and live off dividends.

🔹 Roadmap to Live Off Dividends

A step-by-step weekly guide to achieving financial freedom through dividend investing.

🔹 Easy Peasy: Build Your MaxDividends Portfolio

Ready-made MaxDividends stock sets starting at $300, $500, or $1000 each week—making it easier to build a strong dividend portfolio.

🔹 MaxDividends Business Overview

Deep dives into the top dividend stocks we hold, including key metrics, business insights, perspectives, and expert consensus.

🔹 MaxDividends Portfolio: Goal → 120 Months to $12K/Month

My personal dividend portfolios with weekly updates, changes, and insights.

🔹 Community of Like-Minded Investors

Stay connected with me and other MaxDividends followers. Join the MaxDividends community chat to discuss ideas, share insights, set goals, and stay motivated. Support, accountability, and like-minded investors—all in one place!

🔹 Sunday Coffee ☕️

My personal life & business column, where I share:

Life moments & investing insights

Long-term investment philosophy

Thought-provoking ideas to help you succeed

But That’s Just The Beginning!

🎁 We’re giving you our MaxDividends App — FREE when you join Premium on Substack.

As an early adopter, you’ll not only get free access but also the chance to shape the product with your feedback, and our full support on your dividend journey.

This is your opportunity to track your passive income, optimize your portfolio, and be part of building the ultimate dividend tool.

Alex - “Brother. Just want to say I love the app! I’m happy”

Scott - “Love what you do :) huge strategy“

🟢 What ELSE You’ll Get

Top Dividend Ideas

Unlock exclusive, high-quality dividend investment ideas available only for Premium members. These ideas are carefully curated to maximize returns, provide growing income, and accelerate your journey to financial freedom and early retirement.

By upgrading to Premium, you’ll gain access to:

Advanced stock recommendations tailored for dividend growth

In-depth research on high-yield dividend stocks with strong growth potential

Exclusive updates and insider insights to stay ahead of the curve

Undervalued Dividend Lists

With Premium access, you’ll get:

Undervalued Dividend Eagles (updated monthly)

Undervalued Dividend Kings (updated monthly)

Undervalued Dividend Aristocrats (updated monthly)

These lists highlight the most promising undervalued dividend stocks with strong growth potential, helping you maximize returns on your investment.

Dividend Insights

Gain exclusive insights:

Top 5 MaxDividends Ideas of the Month

Top 3 Most Promising Dividend Ideas of the Week

List of Dangerous Dividend Stocks (updated monthly) – avoid risky picks

These carefully researched ideas will guide you in making smart, informed decisions to build wealth with dividends.

If you have any questions, feel free to email me at: max@maxdividends.app

🟢 And even MORE!

Unlock the best dividend tools available, created by the MaxDividends Team:

Dividend Screener: Find your own hidden gems—uncover undervalued dividend stocks with high growth potential.

Dividend Portfolio Tracker: Keep track of every aspect of your passive income and optimize your portfolio.

Dividend Checker: Instantly evaluate 19,000+ companies with financial and dividend scores — so you can spot weak stocks before they drain your returns and focus only on the strongest opportunities.

💎 MaxDividends Premium gives you more than just tools — it gives you clarity. You’ll know which stocks are worth your money and which to avoid, helping you build a stronger portfolio, grow reliable passive income, and reach financial freedom faster.

Shared by 230+ Financial Bloggers on Substack

The European Value Investor ⭐️⭐️⭐️⭐️⭐️

“If you are interested in dividend strategies or passive income strategies, this Substack ia great! Its worth a visit“

Johan Lunau - The Long View ⭐️⭐️⭐️⭐️⭐️

“Practical dividend focus. Saving for retirement.“

Shailesh Kumar - The Astute Investor’s Calculus ⭐️⭐️⭐️⭐️⭐️

“Love the concept and the execution. If you are into building a portfolio that will generate ever growing income for you, subscribe to Max Dividends. I did.“

MS Cliff Notes ⭐️⭐️⭐️⭐️⭐️

“A useful substack for those that invest in stocks that pay dividends or are looking to get into such a strategy. Includes education and actionable ideas.“

Timothy Assi - Panic Drop ⭐️⭐️⭐️⭐️⭐️

“Great for helling you pick up high-yield dividend growth stocks“

230+ authors and pros already recommend MaxDividends!

Trusted by 100,000+ subscribers!

Andrew - “Based of your MaxDividends App now I know it’s scoring is low before I didn’t have access to a well and easy financial evaluation on this stock.”

Russell - “Want to get caught up with your portfolio so far and follow along until we can all retire. “

Todd - “Just found this site --excited to get started!”

Vinny - “Helping retail investors retire early and comfortably “

We’re happy to help and thrilled to see new partners join through referrals

Recommended by Our Community

What Premium Partners Are Saying

And many others

“You are serious and trustwhorty”

“Developing an additional source of retirement income.”

Thought I would share - I was able to create an Ultra High Dividend portfolio w/15 companies today that would net me a $4,200+/month income. I just retired this month and have a current income of $10,230/mo., will be $12,500/mo. in ‘27 so another $4200/mo. would be nice! Love the app, had a lot of fun creating a portfolio today!

Thanks for all the hard work putting the MaxDividends! You guys have done all the heavy lifting.

Someone’s sitting in the shade today because someone planted a tree a long time ago. ― Warren Buffett.

Learn the MaxDividends Way

Start Here

🔑 Explore the Premium Hub (exclusive — upgrade to unlock)

Guides & Step-by-Step

Deep Insights

📖 I ❤️ Dividends: Why I Believe Dividend Investing Is the Best Strategy | E-Book

How Effective is the MaxDividends Strategy for Building Growing Passive Income

Help & Support

Got a question about dividends? Ask Max, your AI Dividend Assistant!

Didn’t get the answer you need? Reach out: max@maxdividends.app or team@maxdividends.app — we’ll help you out.