Qualcomm (QCOM): Chips, Dividends, and Steady Growth

Making tech for the world—and paying shareholders along the way

MaxDividends Mission: Helping & Supporting Everyone in Building a Growing Passive Income, Retiring Early, and Living Off Dividends.

For dividend investors seeking opportunities with strong growth potential, MaxDividends Stock Ideas offers a daily, in-depth look at companies worth considering for a dividend portfolio.

What you get instantly: Full access to the newsletter, community, in-depth research, and founder portfolios + 🎁 MaxDividends App & Dividend Eagles + 🎁 Premium Hardcover Book ($69 Amazon value)

Intro

💡 Invest in companies you believe in - W. Buffett

Let’s be honest: microchips aren’t flashy. They’re not Teslas, not Apple gadgets, not AI hype. But here’s the truth: some of the “behind-the-scenes” businesses are the ones that really make investors money.

Take Qualcomm. They make the chips that power smartphones, 5G networks, and countless devices. Not glamorous — but essential. And essential businesses tend to keep paying shareholders year after year.

Even through market swings, Qualcomm’s steady dividends make it a stock worth keeping on your radar.

History of the Company

Qualcomm was founded in July 1985 by seven visionaries — Irwin Jacobs, Andrew Viterbi, Franklin Antonio, Adelia Coffman, Andrew Cohen, Klein Gilhousen, and Harvey White — all former Linkabit engineers. The name Qualcomm itself comes from “QUAlity COMMunications.” In its early days, Qualcomm started as an R&D firm contracting for government and defense projects, but its breakthrough came in 1988 when it launched OmniTRACS, a satellite communication system for tracking and messaging in trucking fleets.

Using the profits from OmniTRACS, Qualcomm poured money into research on CDMA (Code‑Division Multiple Access) – a then-experimental wireless technology that would later become a cellular standard.

In September 1991, Qualcomm went public to fund the mass production of CDMA-based phones, base stations, and infrastructure. During the 1990s it faced losses from its heavy R&D spending, but by the mid‑90s CDMA networks began to be deployed commercially, helping Qualcomm turn the corner.

In the 2000s, Qualcomm restructured: it spun off less-profitable divisions and doubled-down on its patent licensing business and chip design. Over time, the company became a powerhouse in wireless technology, securing a dominant role in 3G, 4G, and later 5G, largely thanks to its strong patent portfolio.

A Proven Dividend Eagle🦅

Qualcomm pays a quarterly cash dividend — as of now, it’s $0.89 per share. That adds up to roughly $3.56 per share per year, giving a yield of around 2.05%.

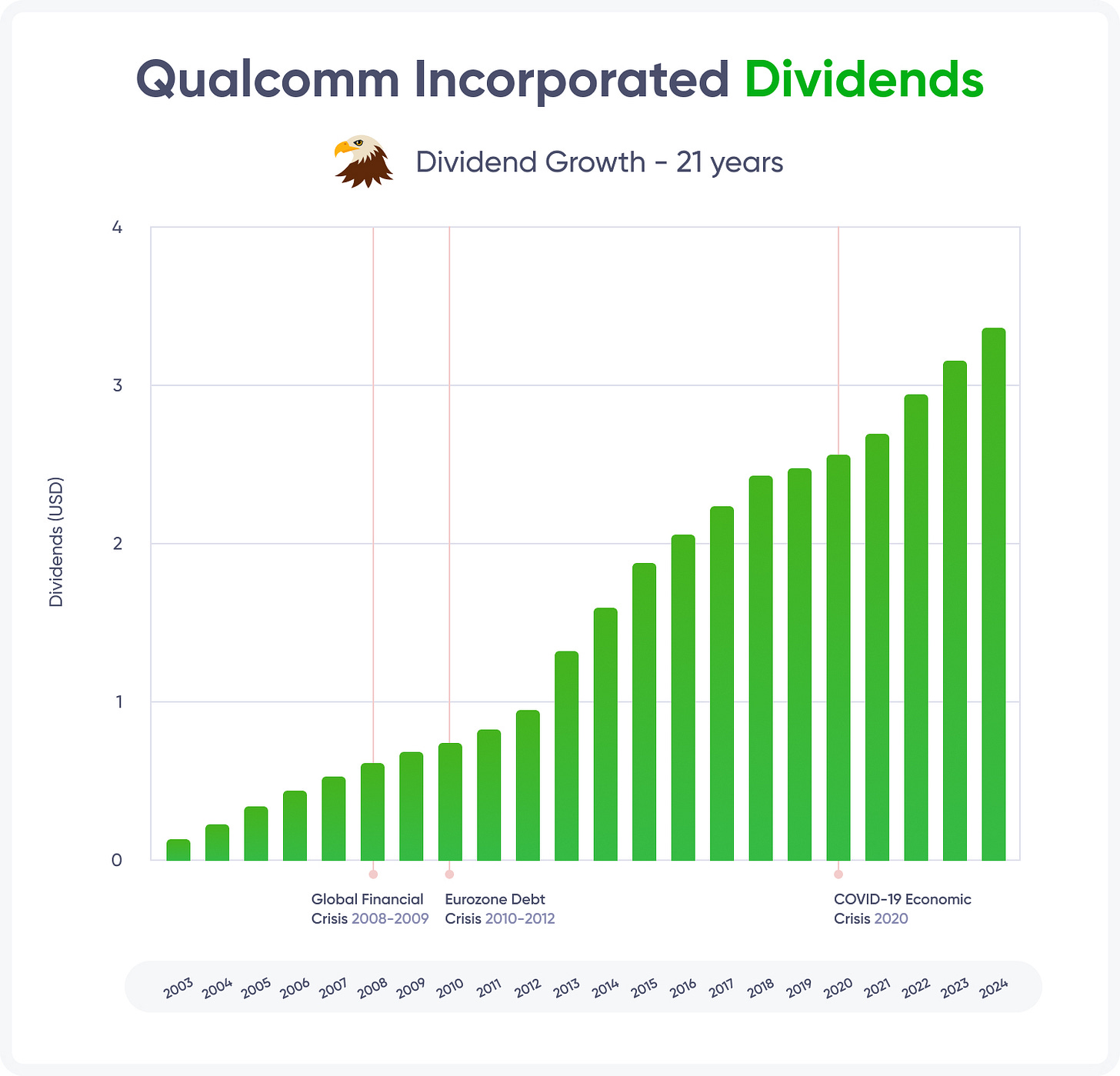

The company has been steadily raising its dividend: in March 2025, Qualcomm bumped it up from $0.85 to $0.89. Their long-term track record shows consistent growth — according to Dearborn Partners, that was the 21st consecutive annual dividend increase.

When it comes to sustainability, the payout ratio (how much of its earnings Qualcomm pays out as dividends) is moderate. Based on trailing earnings, it’s about 72.8%, but based on estimates for next year it drops to around 36%.

On top of dividends, Qualcomm also returns capital via share buybacks, which helps boost total shareholder returns.

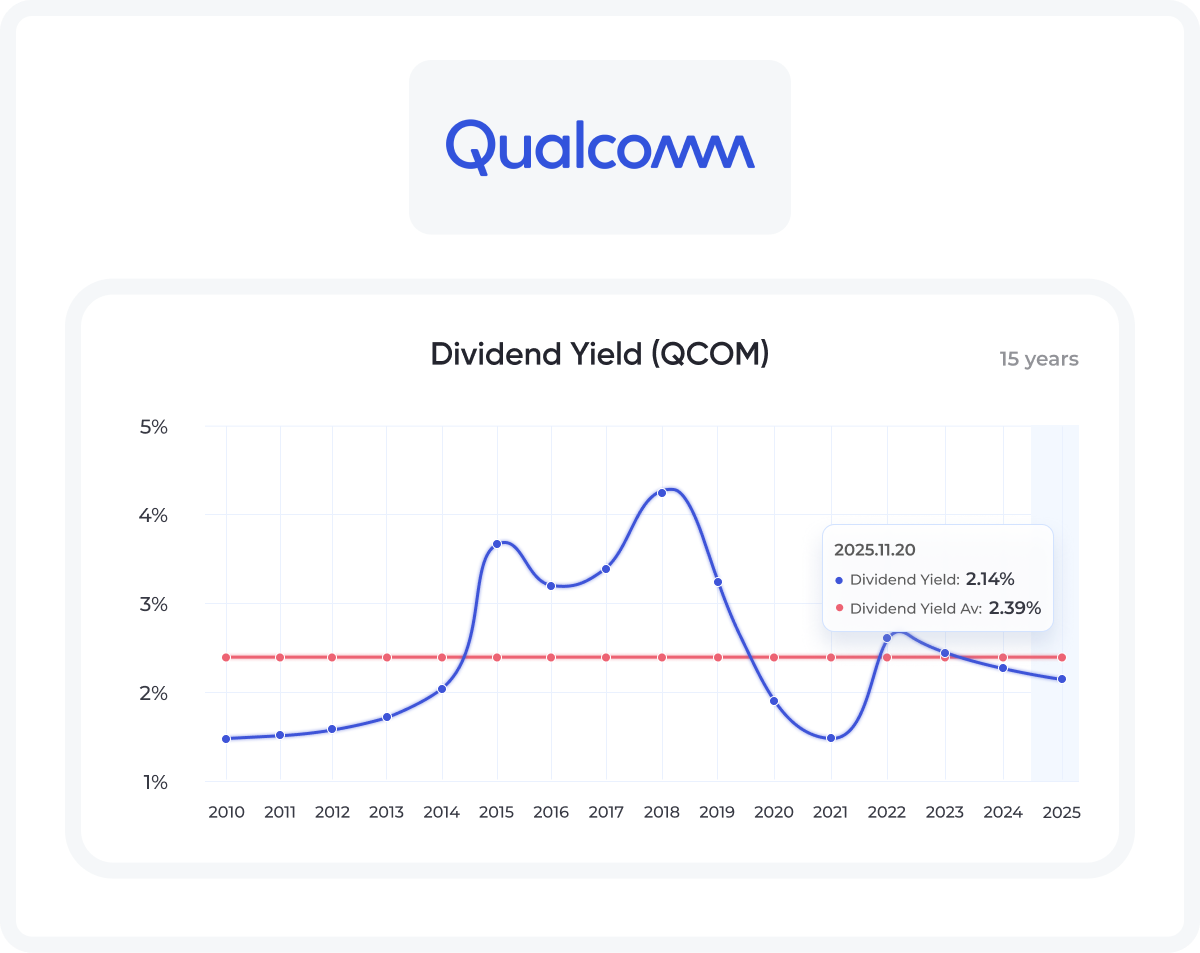

🟢 Current Dividend Yield 2.14% lower than 10 Years Average 2.39% Dividend Yield.

In the MaxDividends app, open the 10-year yield band and set a price/yield alert to ping you when it drifts back into your buy zone.

🟢 Current Payout Ratio 69.4%

That’s a healthy level — Qualcomm covers its dividends solidly, but there’s still room for growth. A payout ratio under 70% usually signals that dividends are sustainable without draining future earnings. In the MaxDividends app, check the Payout Safety gauge and the forward payout view to double-check before you add or reinvest.

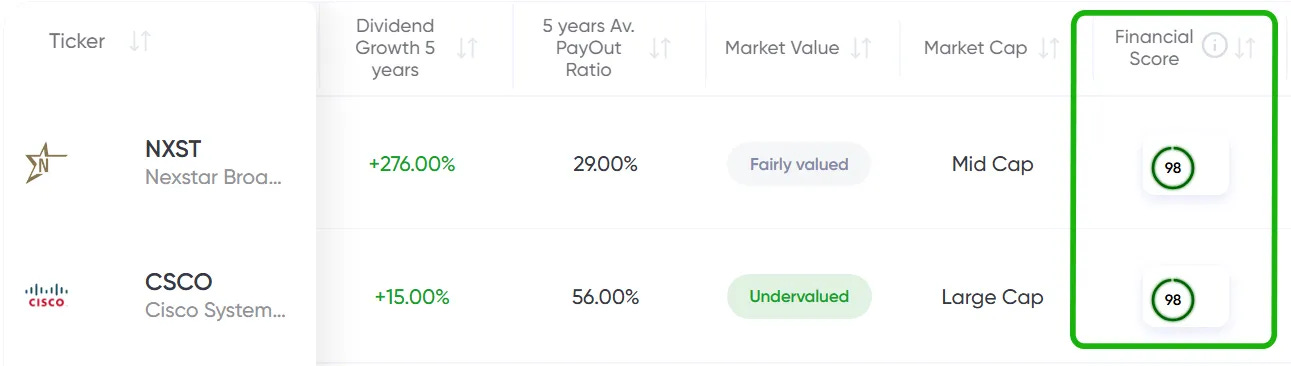

🦅 Dividend Eagles

An updated compilation of 100+ top-performing dividend stocks with 15+ years of consecutive dividend increases, selected based on MaxDividends’ strict criteria.

Companies featured on the Dividend Eagles list have a proven track record of regular and increasing dividend payouts. This ensures you receive a reliable income, whether you’re planning for retirement or seeking additional cash flow.

The Dividend Eagles list offers precisely that—a gateway to financial growth and stability.

Beyond dividends, these companies often exhibit strong fundamentals and growth prospects. Investing in them not only provides income but also the opportunity for your investment to grow over time.

This is how we build our own growing passive income and long-term wealth.

Key Institutional Investors in Qualcomm (QCOM)

Qualcomm enjoys solid institutional backing, which shows that big players trust its long-term business model and cash flow strength. As of the latest filings:

Vanguard Group, Inc. holds around 10.3% of QCOM.

BlackRock, Inc. owns about 8.9% of the company.

State Street Global Advisors controls roughly 4.8–5.0%

What Makes Qualcomm Stand Out?

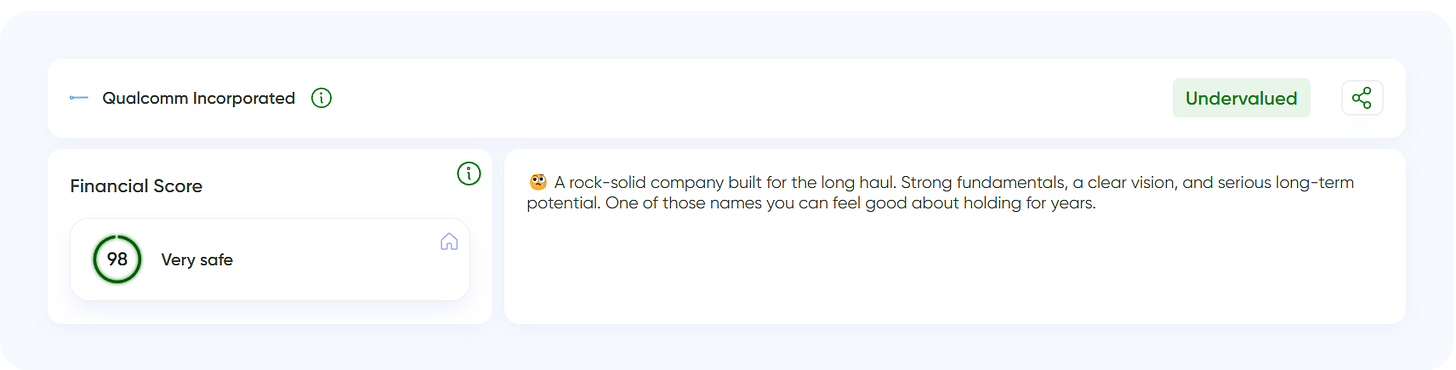

Qualcomm Incorporated (NASDAQ: QCOM)

Financial Score: 98 / 99 ⭐️⭐️⭐️⭐️⭐️

Industry: Semiconductors

Dividend Increase - 21 Years

👉 Learn more about Financial Score

Qualcomm isn’t just about building chips — it’s a powerhouse at the heart of wireless tech, with a brilliant two‑part business that keeps money flowing in from different angles.

On one side, there’s QCT: Qualcomm’s fabless chip division that designs and sells Snapdragon processors, modems, and RF parts for smartphones, cars, IoT devices, and more.

On the other, there’s QTL, Qualcomm’s licensing arm: it earns royalties from its huge library of patents in 3G, 4G, and 5G — so even if someone doesn’t buy its chips, they still pay Qualcomm for using its tech.

Here’s the twist: Qualcomm is more like a “wireless‑tech IP engine” than a traditional semiconductor company. Its patents are deeply embedded in the world’s telecom standards, giving it recurring, high-margin royalty income.

Meanwhile, its QCT business keeps innovating — Snapdragon chips now power not just phones, but cars, wearables, and edge‑AI devices. This combo—big licensing cashflows plus a scalable, high-growth chip business—lets Qualcomm invest heavily in R&D while maintaining a strong, diversified revenue base.

Qualcomm Incorporated - Quick MaxDividends Team Overview

🟢 The company is currently profitable, according to the latest reports.

🟢 Rising sales figures confirm that the company is executing well and capturing demand.

🟢 Profitability has improved year after year — a clear sign of smart strategy and execution.

🟢 Strong upward trend in EPS. That’s what you want to see as a long-term investor.

🟢 Overall, things look solid — stable income and financial strength.Historical Context

Qualcomm Incorporated (QCOM) has maintained a consistent quarterly dividend schedule for years. Most recently:

Dividend: $0.89 per share, declared July 18, 2025, ex‑dividend date September 4, 2025, payment date September 25, 2025.

Previous dividend: $0.89 per share, paid after the ex‑dividend date June 5, 2025 (with payment June 26, 2025).

These regular payments reflect Qualcomm’s commitment to returning cash to shareholders while supporting long‑term dividend growth

With MaxDividends App, it’s easier than ever to access top dividend companies, track your results, and explore new dividend ideas.

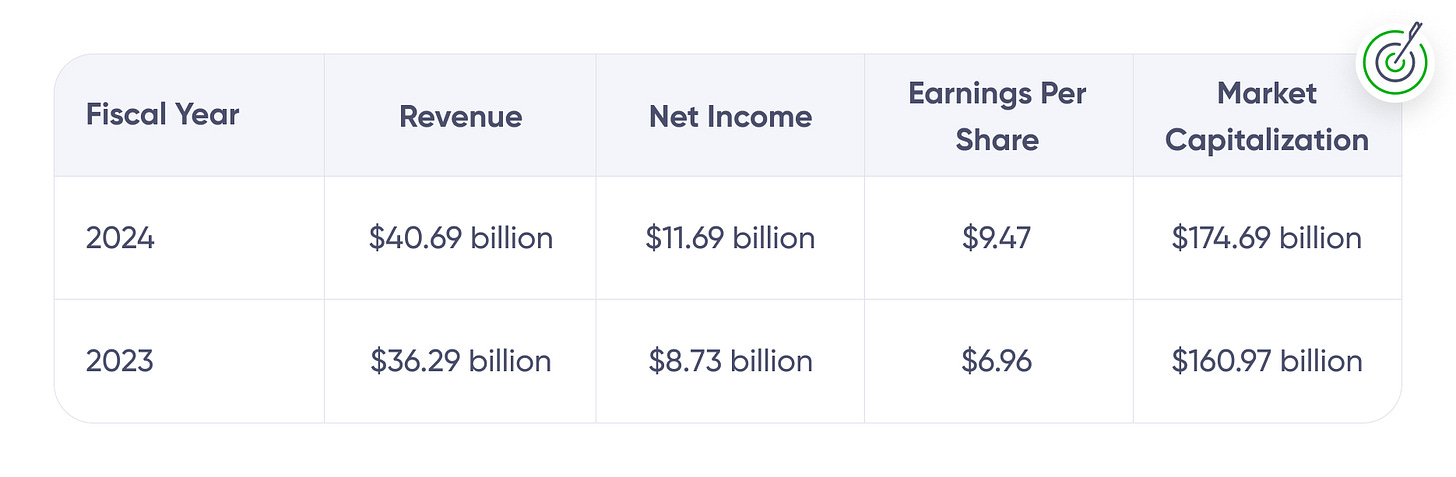

Financial Statement

👉 The latest fiscal figures for Qualcomm Incorporated show solid operational strength, though some caution points emerge in profitability:

Revenue for FY 2025 reached $44.28 billion, up from $38.96 billion in FY 2024.

Net profit after tax for FY 2025 dropped to $5.54 billion, compared with $10.14 billion in FY 2024.

Operating income (EBIT) stood at $12.355 billion, with a margin of about 27.9% of revenue. (Derived from user‑provided table)

Gross profit was $24.546 billion, yielding a gross margin of approximately 55.4%. (Derived from user‑provided table)

📱 In the MaxDividends app this snapshot helps illustrate how Qualcomm leverages its large scale and diversified revenue (chips + licensing) to generate meaningful earnings. However, the drop in net income suggests that investors should check non‑recurring items, tax charges or one‑off impacts to fully understand sustainability of earnings and dividend coverage.

If you want to stay on top of your portfolio’s health, don’t forget to check in on the financials of the companies you’ve invested in. The better shape they’re in, the better your results will be. Keep an eye on their quarterly and annual reports to see how they’re performing.

The strongest and most stable companies tend to have a Financial Score of 80+, with the very best ones hitting 90+. If you see that score start to dip below 80, that’s your cue to consider jumping ship before things get worse.

👉 Learn More about Financial Score

Our Premium Members get access to a curated watchlist of 19,000 companies worldwide, all scored by our team on a regular basis. Companies like Qualcomm are on that list, too.

Future Growth Prospects for Qualcomm

Qualcomm is betting big on more than just smartphones — its roadmap is packed with ambitious growth engines. At its 2024 Investor Day, the company revealed a vision for an expanded total addressable market (TAM) of around $900 billion by 2030, driven by “edge” computing.

Here are the key growth levers:

Automotive & Digital Chassis: Qualcomm expects its automotive revenue to reach $8 billion by FY2029, powered by its Snapdragon Digital Chassis. Its automotive business is already accelerating: in Q3 FY25, auto revenue grew ~21%. The Digital Chassis platform — covering in-cabin compute, ADAS, and connectivity — is gaining strong OEM traction.

IoT Diversification: Beyond cars, Qualcomm is targeting $14 billion in IoT revenue by FY2029, with big bets on industrial IoT, XR (AR/VR), and other connected devices. IoT is already growing fast: in Q3 FY25 it jumped ~24% year ↗ year.

AI & Edge Computing: Qualcomm leans into on‑device AI — embedding NPU (neural processing) right into its chips — which boosts its relevance in everything from smartphones to ultra-efficient edge devices.

Data Center Ambitions: The company is making a bold move into AI data centers. Through strategic acquisitions (like Alphawave) and its Hexagon-based AI chip designs, Qualcomm is positioning to power inference workloads in a more energy-efficient way.

PCs and XR (Extended Reality): Qualcomm sees a future for its Snapdragon X-series in PCs and is aiming for $4 billion in PC revenue by FY2029. And in XR (augmented/virtual reality), it’s aiming for more than $2 billion by the same year.

With MaxDividends, it’s easier than ever to access top dividend companies, track your results, and explore new dividend ideas.

The MaxDividends Top Stocks List features ~100 of the most reliable dividend companies in the U.S. market, each with 15+ years of consecutive dividend increases. These stocks are carefully selected based on MaxDividends’ strict criteria for consistency and reliability.

Dividend Kings represent the elite tier of dividend growth stocks. With 50+ years of consecutive dividend increases, these companies offer unparalleled income stability, making them a top choice for investors seeking long-term reliability in an unpredictable market.

With 25+ years of consecutive dividend increases, Dividend Aristocrats are among the strongest dividend growth stocks. These companies have a proven track record of not only maintaining but consistently increasing their dividends, often outperforming the broader market over time.

Why Invest in Qualcomm?

Leading player in 5G and wireless chip technology — a major backbone of the connected world.

Proven dividend growth for decades — strong commitment to returning cash to shareholders.

Very healthy free cash flow and disciplined capital allocation: Qualcomm often returns nearly 100% of FCF to investors through buybacks + dividends.

Diversified growth engines: not just phones — big bets on automotive, IoT, edge AI, and data center inference.

Strategic acquisition (Alphawave) bolsters its infrastructure footing for high-performance and low-power AI workloads.

Massive long-term opportunity: Qualcomm projects its total addressable market (TAM) could reach $900 billion by 2030 thanks to on‑device AI, IoT, and automotive.

Strong balance sheet and financial health, making it resilient in volatile tech cycles.

Undervalued potential: some analysts argue the stock is cheap relative to its growth runway, especially given its traction in AI and vehicle markets.

Interesting Fact

Qualcomm didn’t start off by building smartphones — in fact, one of their first big products was OmniTRACS, a satellite-based two-way messaging and tracking system for truck fleets, launched in 1988.

Even more surprising: in 2000, Qualcomm bought SnapTrack, a company that made one of the first GPS‑chip solutions for mobile phones — that acquisition helped lay the groundwork for modern location services and emergency‑911 tracking

Competitors

1. Broadcom Inc (NASDAQ: AVGO)

Financial Score: 98 / 99

Industry: Semiconductors

Broadcom competes with Qualcomm on multiple fronts — from RF (radio frequency) modules, to connectivity, to infrastructure chips. Its strength in networking and data-center components makes it a major opponent in the broader semiconductor market.

2. NVIDIA Corporation (NASDAQ: NVDA)

Financial Score: 99 / 99

Industry: Semiconductors

Qualcomm’s push into AI and edge computing brings it into indirect competition with NVIDIA, which dominates in high-performance AI workloads, data center GPUs, and autonomous driving platforms

Final Thoughts

Qualcomm (QCOM) stands out as a tech dividend play with real staying power:

More than 20 years of consecutive dividend increases, signaling a long-term commitment to shareholders.

A moderate payout ratio — trailing‑12‑month earnings show ~72.8%, and forward estimates drop to around ~36%.

A solid yield for a growth tech company: ~2.05% annual yield.

Strong free cash flow and disciplined capital return: Qualcomm is returning cash not only via dividends but also through buybacks.

Diversified growth avenues beyond smartphones — including automotive chips, IoT, and on‑device AI, making its business less dependent on any single market.

The company is also preparing for next‑generation wireless, with work already underway on 6G, which could unlock entirely new markets.

Key Takeaways

Qualcomm is a good fit for investors looking for steady dividend growth plus long-term upside, rather than just the highest immediate yield.

Its business model balances innovation and cash return — while it’s investing aggressively in future tech, it still delivers reliable income.

For long-term dividend investors, Qualcomm offers a compelling mix: emerging growth in advanced tech + a proven track record of returning capital to shareholders.

Undervalued \ Overvalued \ Fairly Valued

Compare the P/E ratios of competitor companies to assess whether the stock you’re considering is overvalued. We calculate the average P/E among competitors as a benchmark.

If a company’s current P/E is 20% or more below the competitor average, it is considered undervalued.

If it is 20% or more above, it is considered overvalued.

The P/E ratio is calculated by dividing the market value per share by earnings per share (EPS).

Undervalued

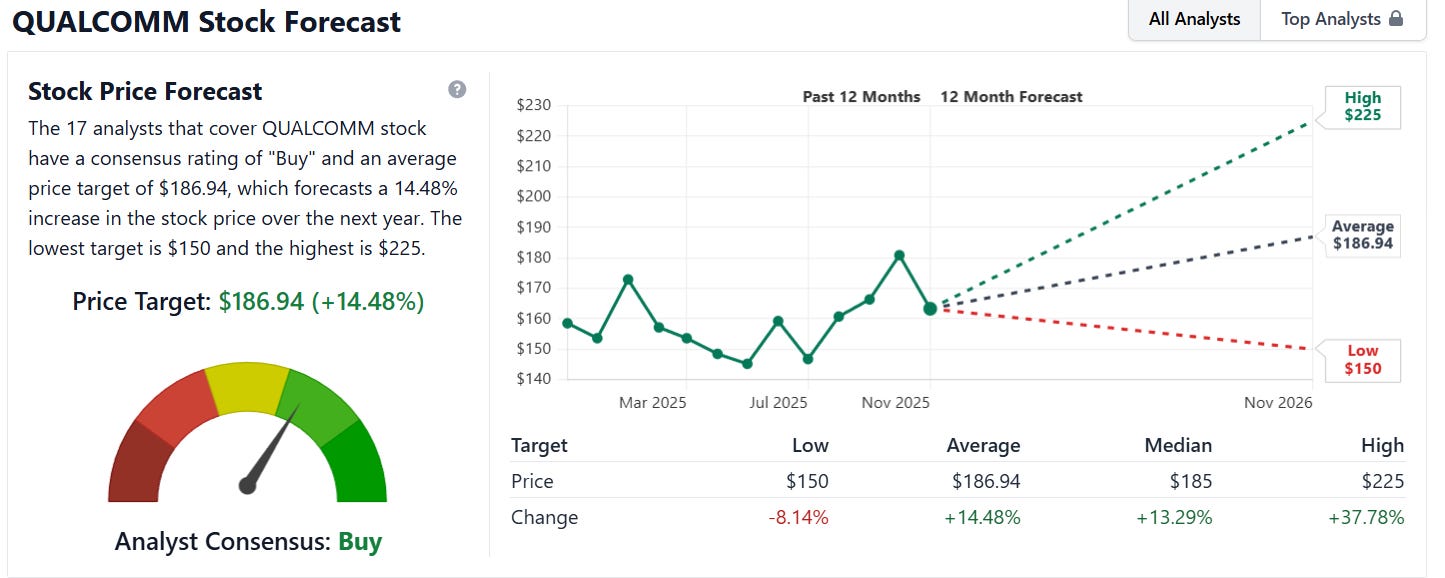

Analysts Consensus

Wall Street is broadly bullish on Qualcomm. According to the 17 analysts covering the stock, the consensus rating is a confident “Buy”, backed by an average 12-month price target of $186.94 — implying a solid +14.48% upside from current levels.

Forecasts span a wide range, from a cautious $150 on the low end to an optimistic $225 on the high end, but the overall trajectory leans positive. The median target of $185 reinforces this balanced optimism. In short, analysts expect Qualcomm to keep climbing, supported by strong fundamentals, diversified revenue drivers, and long-term tailwinds in AI, connectivity, and mobile technologies.

To your wealth, MaxDividends Team

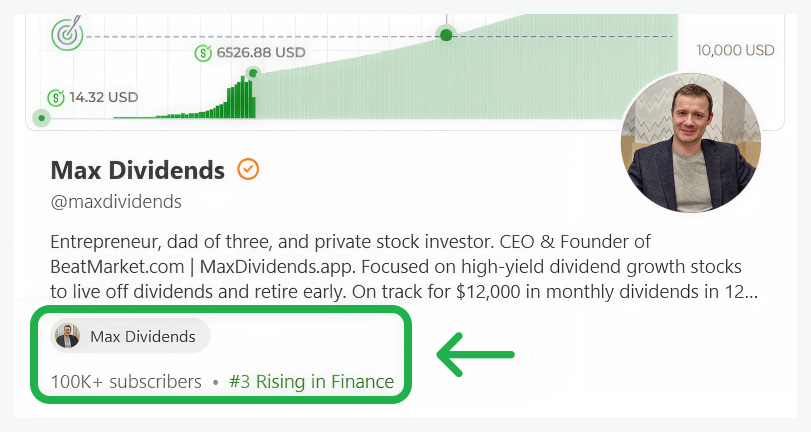

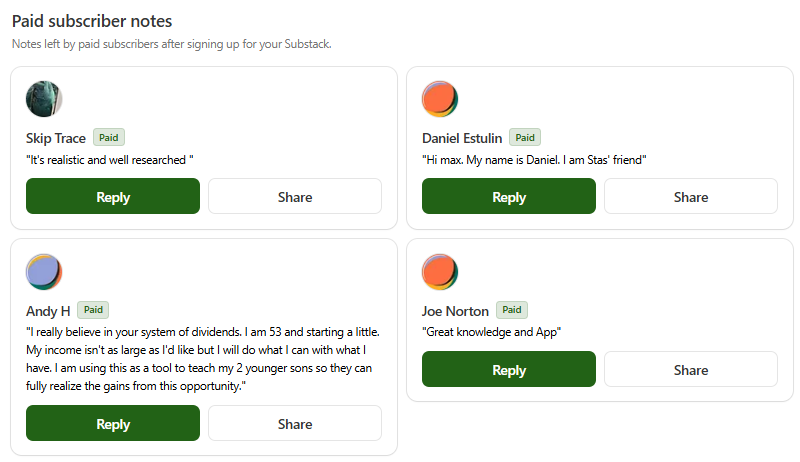

MaxDividends is a Bestseller on Substack!

Hundreds of premium members have already discovered the benefits of the community and app, earning passive income through dividends with MaxDividends. Their passive income keeps growing!

⭐️⭐️⭐️⭐️⭐️

What You’ll Get by Joining MaxDividends Premium

The most important thing our MaxDividends community members value us for

Freedom & Independence

No boss, no schedules—complete control over your time. Ability to work on passion projects or simply enjoy life without financial stress.

Passive Income That Grows Over Time

Dividend-paying stocks provide a steady, rising income stream. Unlike traditional retirement funds, you don’t need to sell assets to cover expenses.

Protection Against Inflation

Dividend growth investing ensures your income keeps pace with inflation. Companies that increase payouts help maintain purchasing power.

Stress-Free Investing

No need for active trading or daily market monitoring. Long-term buy-and-hold strategy minimizes stress and decision fatigue.

More Time for Family & Personal Goals

Spend more time with loved ones instead of working 40+ hours a week. Pursue hobbies, travel, and personal development without financial pressure.

Health & Well-Being Benefits

Less work stress leads to better mental and physical health. More time for fitness, proper sleep, and healthier lifestyle choices.

Avoiding the Corporate Rat Race

Escape office politics, toxic work environments, and endless meetings. Focus on meaningful activities instead of chasing promotions and pay raises.

Living Life on Your Own Terms

Ability to relocate, slow travel, or move to a lower-cost-of-living area. No restrictions on how you spend your day—whether it’s reading, volunteering, or building a new skill.

Leaving a Legacy

Build generational wealth and leave assets for your family. Teach the next generation financial independence by leading by example.

Financial Security & Peace of Mind

A well-built dividend portfolio provides stability even during economic downturns. No fear of outliving your savings—passive income keeps flowing.

Many who already joined say it’s the best financial decision they’ve ever made—because money becomes a tool for freedom, not a source of stress.

Ready to Give It a Try?

👉 Check your subscription status & upgrade to Premium today

What you get instantly: Full access to the newsletter, community, in-depth research, and founder portfolios + 🎁 MaxDividends App & Dividend Eagles + 🎁 Premium Hardcover Book ($69 Amazon value)

We’re in the Top Financial Blogs on Substack! 💪

MaxDividends continues to be recognized for its consistent effort, commitment to quality, and the loyalty of its growing community of partners.

With Max Dividends Premium, you unlock:

🔹 MaxDividends Stocks of the Week

Top 10 undervalued, high-yield, ultra-high yield, and dividend growth stocks every week.

Bonus: Full access to the updated weekly list of MaxDividends stocks—boost your passive income and start living off dividends.

🔹 Top Dividend Insights

Get exclusive, high-quality dividend investment ideas and insights, handpicked to help you crush your financial goals, retire early, and live off dividends.

🔹 Roadmap to Live Off Dividends

A step-by-step weekly guide to achieving financial freedom through dividend investing.

🔹 Easy Peasy: Build Your MaxDividends Portfolio

Ready-made MaxDividends stock sets starting at $300, $500, or $1000 each week—making it easier to build a strong dividend portfolio.

🔹 MaxDividends Business Overview

Deep dives into the top dividend stocks we hold, including key metrics, business insights, perspectives, and expert consensus.

🔹 MaxDividends Portfolio: Goal → 120 Months to $12K/Month

My personal dividend portfolios with weekly updates, changes, and insights.

🔹 Community of Like-Minded Investors

Stay connected with me and other MaxDividends followers. Join the MaxDividends community chat to discuss ideas, share insights, set goals, and stay motivated. Support, accountability, and like-minded investors—all in one place!

🔹 Sunday Coffee ☕️

My personal life & business column, where I share:

Life moments & investing insights

Long-term investment philosophy

Thought-provoking ideas to help you succeed

What you get instantly: Full access to the newsletter, community, in-depth research, and founder portfolios + 🎁 MaxDividends App & Dividend Eagles + 🎁 Premium Hardcover Book ($69 Amazon value)

But That’s Just The Beginning!

🎁 We’re giving you our MaxDividends App — FREE when you join Premium on Substack.

As an early adopter, you’ll not only get free access but also the chance to shape the product with your feedback, and our full support on your dividend journey.

This is your opportunity to track your passive income, optimize your portfolio, and be part of building the ultimate dividend tool.

Alex - “Brother. Just want to say I love the app! I’m happy”

Scott - “Love what you do :) huge strategy“

🟢 What ELSE You’ll Get

Top Dividend Ideas

Unlock exclusive, high-quality dividend investment ideas available only for Premium members. These ideas are carefully curated to maximize returns, provide growing income, and accelerate your journey to financial freedom and early retirement.

By upgrading to Premium, you’ll gain access to:

Advanced stock recommendations tailored for dividend growth

In-depth research on high-yield dividend stocks with strong growth potential

Exclusive updates and insider insights to stay ahead of the curve

Undervalued Dividend Lists

With Premium access, you’ll get:

Undervalued Dividend Eagles (updated monthly)

Undervalued Dividend Kings (updated monthly)

Undervalued Dividend Aristocrats (updated monthly)

These lists highlight the most promising undervalued dividend stocks with strong growth potential, helping you maximize returns on your investment.

Dividend Insights

Gain exclusive insights:

Top 5 MaxDividends Ideas of the Month

Top 3 Most Promising Dividend Ideas of the Week

List of Dangerous Dividend Stocks (updated monthly) – avoid risky picks

These carefully researched ideas will guide you in making smart, informed decisions to build wealth with dividends.

What you get instantly: Full access to the newsletter, community, in-depth research, and founder portfolios + 🎁 MaxDividends App & Dividend Eagles + 🎁 Premium Hardcover Book ($69 Amazon value)

🟢 And even MORE!

Unlock the best dividend tools available, created by the MaxDividends Team:

Dividend Screener: Find your own hidden gems—uncover undervalued dividend stocks with high growth potential.

Dividend Portfolio Tracker: Keep track of every aspect of your passive income and optimize your portfolio.

Dividend Checker: Instantly evaluate 19,000+ companies with financial and dividend scores — so you can spot weak stocks before they drain your returns and focus only on the strongest opportunities.

💎 MaxDividends Premium gives you more than just tools — it gives you clarity. You’ll know which stocks are worth your money and which to avoid, helping you build a stronger portfolio, grow reliable passive income, and reach financial freedom faster.

Shared by 230+ Financial Bloggers on Substack

The European Value Investor ⭐️⭐️⭐️⭐️⭐️

“If you are interested in dividend strategies or passive income strategies, this Substack ia great! Its worth a visit“

Johan Lunau - The Long View ⭐️⭐️⭐️⭐️⭐️

“Practical dividend focus. Saving for retirement.“

Shailesh Kumar - The Astute Investor’s Calculus ⭐️⭐️⭐️⭐️⭐️

“Love the concept and the execution. If you are into building a portfolio that will generate ever growing income for you, subscribe to Max Dividends. I did.“

MS Cliff Notes ⭐️⭐️⭐️⭐️⭐️

“A useful substack for those that invest in stocks that pay dividends or are looking to get into such a strategy. Includes education and actionable ideas.“

Timothy Assi - Panic Drop ⭐️⭐️⭐️⭐️⭐️

“Great for helling you pick up high-yield dividend growth stocks“

230+ authors and pros already recommend MaxDividends!

Trusted by 100,000+ subscribers!

Andrew - “Based of your MaxDividends App now I know it’s scoring is low before I didn’t have access to a well and easy financial evaluation on this stock.”

Russell - “Want to get caught up with your portfolio so far and follow along until we can all retire. “

Todd - “Just found this site --excited to get started!”

Vinny - “Helping retail investors retire early and comfortably “

We’re happy to help and thrilled to see new partners join through referrals

Recommended by Our Community

What Premium Partners Are Saying

And many others

“You are serious and trustwhorty”

“Developing an additional source of retirement income.”

Thought I would share - I was able to create an Ultra High Dividend portfolio w/15 companies today that would net me a $4,200+/month income. I just retired this month and have a current income of $10,230/mo., will be $12,500/mo. in ‘27 so another $4200/mo. would be nice! Love the app, had a lot of fun creating a portfolio today!

Thanks for all the hard work putting the MaxDividends! You guys have done all the heavy lifting.

Someone’s sitting in the shade today because someone planted a tree a long time ago. ― Warren Buffett.

Learn the MaxDividends Way

Start Here

🔑 Explore the Premium Hub (exclusive — upgrade to unlock)

Guides & Step-by-Step

Deep Insights

📖 I ❤️ Dividends: Why I Believe Dividend Investing Is the Best Strategy | E-Book

How Effective is the MaxDividends Strategy for Building Growing Passive Income

Help & Support

Got a question about dividends? Ask Max, your AI Dividend Assistant!

Didn’t get the answer you need? Reach out: max@maxdividends.app or team@maxdividends.app — we’ll help you out.

What you get instantly: Full access to the newsletter, community, in-depth research, and founder portfolios + 🎁 MaxDividends App & Dividend Eagles + 🎁 Premium Hardcover Book ($69 Amazon value)