A Calm, Income-Focused Setup With a 5% Yield And Growing Payouts

MaxDividends Mission: Helping people build growing passive income, retire early, and live off dividends.

A calm, high-quality income idea we’re watching closely. One income-focused business, reviewed through the MaxDividends Income System.

⭐️ Start with the MaxDividends App

A ~5% yield… from an undervalued business that basically prints cash every tax season

Hi friends — Max here.

Let’s talk about a company everyone knows, but almost nobody looks at like a dividend machine.

This is one of those “quietly essential” businesses. Every year, taxes show up like gravity. Millions of people don’t want to mess it up, don’t have time, or just want a pro to handle it.

And that simple reality can create a very shareholder-friendly setup when the stock gets priced like it’s dying.

Right now, this company is showing up in our MaxDividends lens as a classic Income Eagle.

The Quick Snapshot (what jumped out immediately)

Here’s how this name looks inside our numbers-first view:

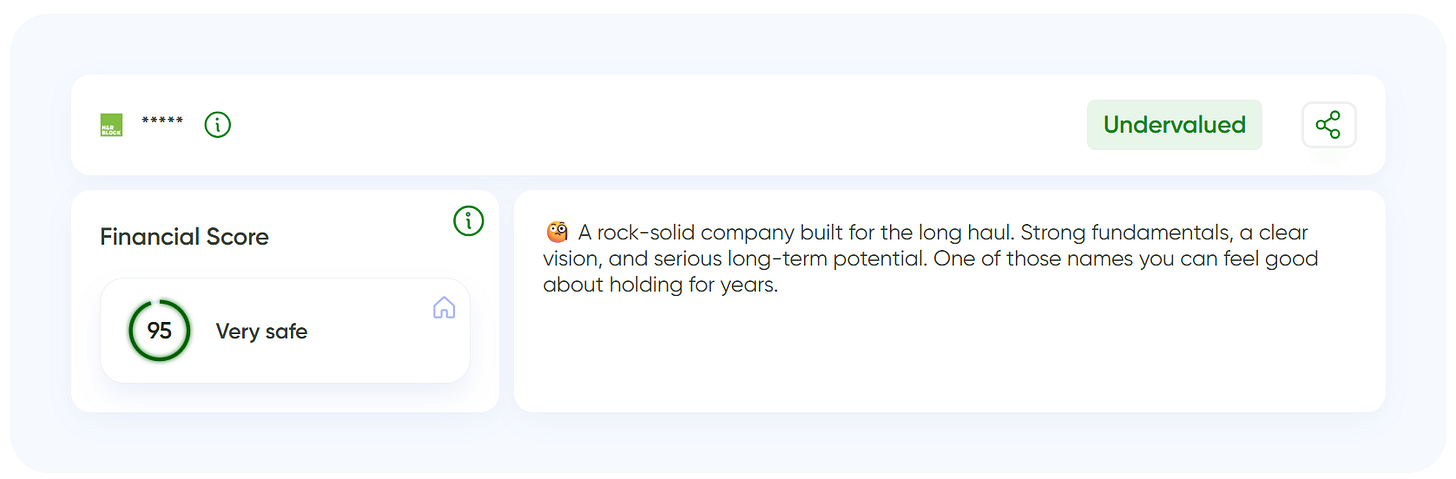

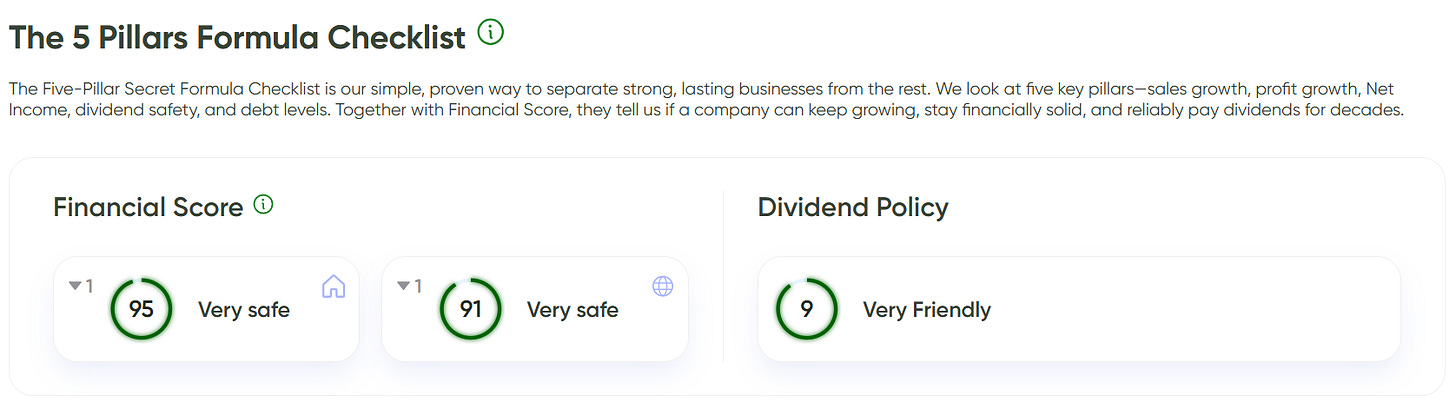

Financial Score: 95 (strong)

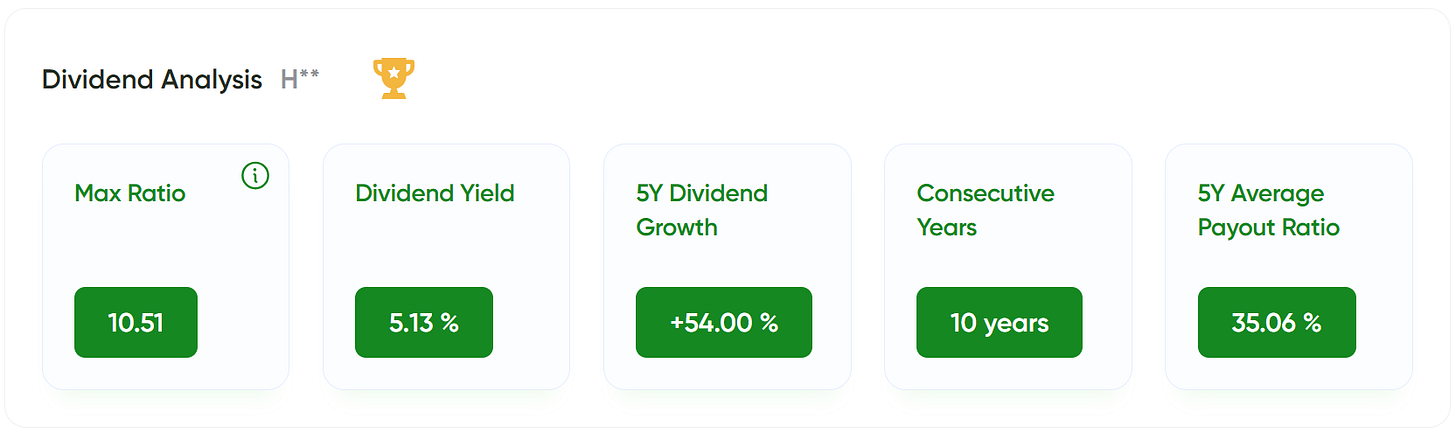

MaxRatio: 10.51 (Income Eagle territory)

Dividend yield: 5.13%

5Y dividend growth: +54%

Dividend track record: 19 years paid, 10 straight years of increases

Payout ratio: ~36% (conservative)

3Y dividend CAGR: ~13%

Dividend policy: 9/10 (very shareholder-friendly)

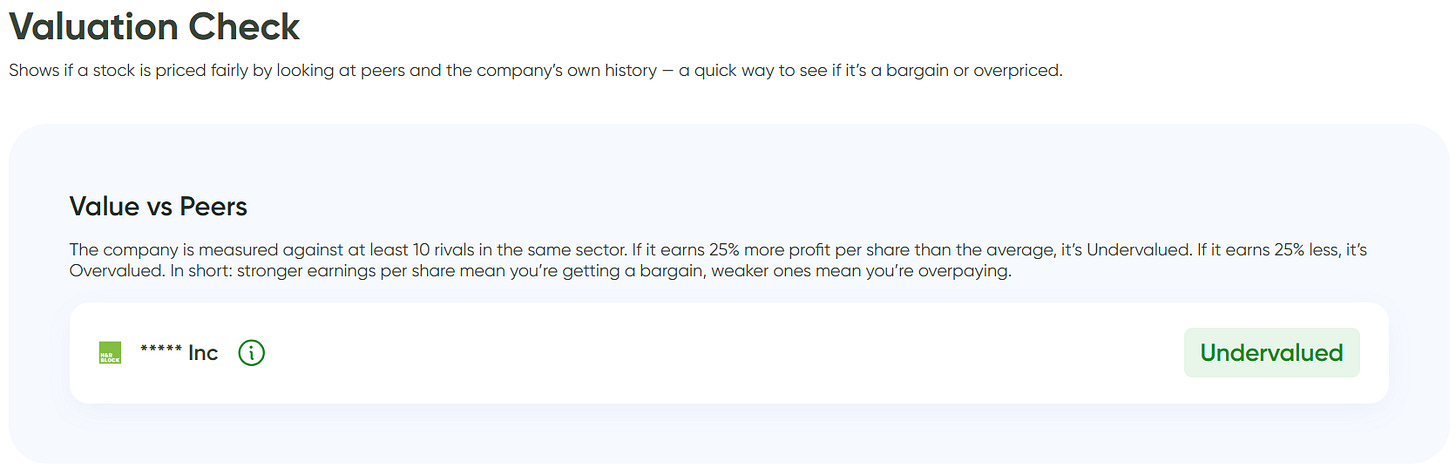

Valuation: Undervalued

Forward P/E: ~6 (that’s cheap)

Financial Score: 95

This is about business health. Plain and simple. It tells us the company isn’t living on debt, isn’t walking a financial tightrope, and isn’t paying dividends out of thin air. There’s real strength here. When a score is this high, it usually means the business knows how to earn money — and stay on its feet when conditions get tough, without panic moves.

Dividend yield: 5.13%

Put simply: the cash starts coming in right away. Every $100 you put to work brings you more than $5 a year in real cash. Not “someday.” Not “if markets cooperate.” Right now.

$0.42 per share each quarter ($1.68 per year)

This isn’t theoretical. These are actual payments. Four times a year. Like a subscription — except this time, the company is subscribed to you.

19 years of dividends, 10 straight years of increases

This says a lot about culture. The company doesn’t just “pay when it feels like it.” It’s used to sharing profits year after year — even when conditions weren’t ideal. You don’t build a record like that by accident.

+54% dividend growth over 5 years and ~13% per year over the last 3 years

This is where it gets interesting. You’re not just getting a 5% yield today. Those payments are growing — and not at token levels. Real growth. That means a few years from now, your income is meaningfully higher even if you never add another dollar.

Payout ratio: ~36%

Translation: the company uses only about a third of what it earns to pay dividends.

The rest stays inside the business — as a safety buffer, for reinvestment, and for future growth. These dividends aren’t being paid on fumes.

Dividend Policy: 9/10

This is about mindset. Management clearly treats shareholders like partners, not passengers. Dividends here aren’t window dressing — they’re part of the plan.

MaxRatio: 10+ — Income Eagle

Short version: this stock is built to generate income. Not to promise growth “one day,” but to deliver cash regularly — and slowly turn that stream into something bigger. These are the kinds of businesses that eventually start covering real-life expenses: bills, trips, peace of mind.

Undervalued + Forward P/E ~6

And here’s the final touch. The market is pricing this business as if it doesn’t expect much from it. You’re paying very little for each dollar of profit the company generates. That’s not a promise of upside — but for an income investor, it’s often a very attractive place to start.

How This Business Really Makes Money

This is a tax preparation company. They make money by helping people and small businesses file taxes through:

in-person assisted tax prep

DIY software

and a set of related financial services

And the key point is: this isn’t a “fun consumer purchase.” It’s a must-do task that repeats every year. So instead of asking “Will people want this next year?” the better question is:

Will this income-focused tax services company keep converting that seasonal tax demand into steady cash… and keep sharing it with owners?

Why MaxRatio 10+ Matters Here

Inside MaxDividends, MaxRatio is basically the “job description” of a stock. With MaxRatio 10.51, this cash-generating income business is not pretending to be a growth rocket. It’s built to do this job:

pay us meaningful cash now (5%+ yield),

raise that cash at a real pace (13% 3Y CAGR, +54% over 5 years),

while staying financially strong (Fin Score 95),

and not stretching the payout (payout ~36%).

That combo is the “paid-now + paid-more-later” effect we’re always hunting for.

Dividend behavior: Not Just Paid — Raised With Discipline

This is what I like most here: A 5% yield is nice. But a 5% yield plus consistent raises plus a conservative payout ratio is how you build an income line that keeps getting fatter without you doing anything.

And current dividend level 5%+ is real, current, and confirmed.

Valuation: Priced Like Low Expectations

A forward P/E around ~6 is basically the market saying: “Yeah okay, but we don’t trust the future.” Yahoo’s key stats show its forward P/E right around ~6.

Could it be cheap for a reason? Sure. But that’s exactly where Income Eagles often come from: solid cash mechanics + skeptical pricing.

The Risks We Should Respect

Here’s what we keep on the dashboard with a name like this:

Competition / pricing pressure (DIY options, promos, customer churn)

Regulatory / tax-code shifts (the industry is tied to policy)

Seasonality (results swing hard by quarter — this is normal here)

Execution risk in digital (product experience matters a lot in DIY)

None of that is a deal-breaker. It just tells us what to monitor so we don’t get surprised.

For context, this dividend name just reported fiscal 2026 Q2 results (quarter ended Dec 31, 2025) and reaffirmed full-year outlook ranges — always good to track heading into tax season.

Where This Dividend-Focused Cash Engine Fits Best In Our Portfolio Plan

Based on current metrics, it fits best when we want:

strong income now (5%+)

dividend growth that’s actually meaningful

financial strength

and low expectations in the price

This is not a “sleep-well utility.” It’s more like a cash engine tied to a recurring annual event (tax season) — and when the valuation is cheap, it can be a very productive Income Eagle.

My Takeaway

This company is the kind of dividend idea that looks almost too simple:

People have to file taxes. Many want help, and this business converts that demand into cash. Shareholders get paid — with a ~5% yield, solid growth, and a conservative payout.

With Fin Score 95, MaxRatio 10.51, and forward P/E ~6, this is exactly the type of “boring on the surface, powerful in the portfolio” setup we like to see.

👉 Want the ticker + full premium breakdown of this Income Eagle (buy zone, risks, what we track, and how it fits our portfolio)?

Top Undervalued Dividend Picks — powered by the proven Income System.

Full breakdowns. Clear roles. Clear signals.

Outgrow your passive income — one dividend business at a time.

And one important thing to be clear about

This isn’t a random company pulled from another analyst roundup. This is a business selected strictly by the rules of the MaxDividends system — the same type of business we invest our own money into.

The same kind of companies that actually sit in my personal portfolio.

And today, I want to show you the real system that’s feeding me and my family right now — the one that lets me sleep calmly while my savings do the work.

It’s also the system you can use to validate your own ideas — instead of guessing or relying on opinions.

The foundation: what I actually wanted (and why)

These principles aren’t “marketing.” They’re a reflection of how I’m wired, how I see life, and what I consider right investing at this stage.

I see investing as a partnership.

We put our capital into talented, honest, transparent businesses that build something real and useful. They grow. They create value. And they share that value with us.

The business wins. We win.

And we get to look at the future without that constant tight feeling in the chest.

So here’s the “ideal solution” I was looking for — very plainly:

Income starts today.

The dividend income I begin receiving right away — from the companies and funds I choose — covers a meaningful part of my family’s expenses (or even all of them). That changes everything. It means we can make decisions based on what we want, not what we fear.Income grows over time — even if I stop adding money.

Even if I don’t reinvest new savings or reinvest dividends, the income still rises year after year. We get wealthier. The checks get bigger.My capital is protected and grows.

I’m not slowly eating my savings. My capital is working intelligently and compounding. I’m building legacy and a stronger safety cushion over time.I don’t have to stare at the portfolio every day.

I can step away for 3–5 years and still know the system is doing its job. Of course, I’ll check in more often — but not because I’m anxious. Because I enjoy it. I like seeing the income climb and watching the dividend calendar fill up.

That’s the point. I didn’t just want to “live on dividends today.”

I wanted a structure where every year I feel more freedom and more options — and my family gets wealthier and calmer along the way. So I built it. Here are the principles it’s built on.

Principle #1 — Business first

No business can pay dividends for long if there’s nothing behind them. If the cash register is empty, it can’t magically print money (unless you’re the Federal Reserve).

This has been true for hundreds of years, and it will always be true. So the first filter is always the same:

Is this a strong business? What does “strong” mean in practice?

growing sales

growing earnings

stable, positive fundamentals even in tough years

manageable debt

strong liquidity

a smart balance between reinvesting for growth and rewarding shareholders

That’s the type of business I want to partner with.

Principle #2 — Dividend DNA

This is what I call a company’s commitment to rewarding shareholders with dividends — not just paying them, but improving over time so it can pay more.

How do we know if that commitment is real? Time. There’s only one way to know if a marriage is strong: years.

If you’ve been together 15–20 years, you’ve probably been through enough storms that the next 20 years are much more likely too. Same with business behavior.

My family’s goal for investing is income. So I choose companies with dividend DNA — businesses that treat dividends as a core responsibility, a public promise, a form of partnership.

A long history of paying dividends tells me something important: This company has a culture of accountability to shareholders. Not perfection. Not “no bad years.” But a real, tested habit of rewarding owners.

Principle #3 — Champions only

Imagine this: You’re choosing partners from 10 basketball players. Nine are unknown. The tenth is Michael Jordan. Who do we pick? We pick the champion.

Because champions have already proven they can win at the highest level — again and again.

In dividend investing, “champions” are the businesses with an unusual record: they don’t just pay dividends… they refuse to fall backward.

They raise the bar over time. They protect their reputation. They operate with higher internal standards. They don’t just have dividend DNA. They have champion dividend DNA.

And when we own those companies, something beautiful happens: Our income grows on its own — like a tree we planted years ago. Quietly. Reliably. While we live our lives.

Principle #4 — The right moment

Even the best business is not a great buy at any price.

I’m not a “sales guy,” but let’s be honest: if a can of Coke suddenly costs 10 cents instead of a dollar… we’re probably grabbing a few. Timing matters because it’s not about owning great businesses.

It’s about owning great businesses on our terms. And our terms are simple:

Here are our real expenses. Here are the bills. Here is the life we want.

So we choose the best — at the best moments we can reasonably get. That creates a double advantage:

strong businesses (safety + durability)

favorable entry points (better yield, better long-term results, more margin of safety)

The result: we become the “director” of a dream team

When these principles come together, the system starts to feel very simple.

We become the director of a team of elite businesses — strong, durable companies with dividend DNA — and they do real work for us:

They pay our bills.

They grow our income.

They protect and build our capital.

They prepare the next quarter’s cash flow — while we live.

And because our expenses are already covered by the system, we don’t have to rush.

We can be patient. We can make calm decisions: who deserves more capital, who stays steady, and who needs to step aside. That’s the MaxDividends Income System — the structure I built for myself.

And yes… it can become your structure too.

At this point, you’ve seen how I think about income. You’ve seen why structure matters more than tactics. And you’ve seen how this works in real life — calmly, without constant pressure.

So today, I want to be very straightforward with you. You can keep doing what you’re doing now. For some people, that’s perfectly fine.

If your current income feels stable enough, if uncertainty doesn’t bother you much, and if you’re comfortable relying mainly on growth and future outcomes — you don’t need this. And that’s okay.

But if you’re reading this because something feels fragile — if you’ve built solid savings but still don’t feel calm about income — if you don’t want to wait another decade hoping everything works out — then this is exactly why I built the MaxDividends Income System.

Not as a product. As a structure I personally use. This isn’t about chasing yield. And it’s not about “beating the market.”

Get instant full access to the MaxDividends Universe, MaxDividends Income System & App.

Designed to replace your paycheck, not just supplement it.

It’s about building income you can actually live on — and doing it in a way that lets you sleep well at night.

— Max

Here’s What You Get Inside MaxDividends

✔️ Our regularly updated flagship stock lists

The lists that do the heavy lifting for you:

Dividend Radar

Dividend Aristocrats

Dividend Kings

Dividend Eagles

Dividend Champions

Filtered by quality, discipline, and long-term reliability.

✔️ Stock deep dives, top ideas, and the founder’s real trades

We share our thinking openly — not just the picks, but the reasoning behind them.

✔️ Ideas for different goals

Whether you’re focused on:

capital growth,

faster dividend growth, or

high-income ideas with 10%+ yield,

you’ll see what fits your path — with clarity about risks and trade-offs.

✔️ Our Buy / Hold / Sell stock list

So you’re never guessing.

You’ll always know:

what’s a buy,

what we’re holding,

and what’s no longer a priority.

This structure is what allows our portfolios to generate more and more cash over time.

✔️ Full access to the MaxDividends App

Your control panel for dividend income. See where your income stands today, where it’s heading, and what to do next — all in one place.

✔️ Access to the MaxDividends Income System — the same rules we personally follow

This isn’t theory or recycled advice. It’s the exact framework we use to decide what to buy, what to hold, and when to step aside — calmly, without emotion.

✔️ Webinars, full library access, private partner sessions, and community chat

Live sessions, recordings, closed discussions, and a private community of people building income the same way you are. This isn’t about chasing the market.

It’s about building an income system you can actually rely on — step by step, year after year.

Why MaxDividends Works When Everything Else Feels Noisy

🔒 Clarity instead of confusion

You always know where your income stands. Not “someday it should work,” but:

how much income you’re generating now,

how much is coming next year,

and what’s actually driving that growth.

🛡 Protection from emotional decisions

Markets move. Headlines scream. The system keeps you grounded — so you don’t sell good assets at the wrong time or chase ideas you don’t need. That discipline alone is worth more than most “hot tips.”

🧭 A real path to living off dividends

This isn’t just about investing better — it’s about knowing the distance between today and financial independence.

You see what you have, what’s missing, and the exact steps that close that gap over time. This is what turns investing from stress into structure.

And structure is what compounds — quietly, steadily, year after year.