One High-Yield Dividend Stock for Safe, Growing Passive Income

Medtronic is a reliable company for generating stable and growing passive income through high-yield dividends

MaxDividends Mission: Helping & Supporting Everyone in Building a Growing Passive Income, Retiring Early, and Living Off Dividends.

For dividend investors seeking opportunities with strong growth potential, MaxDividends Stock Ideas offers a daily, in-depth look at companies worth considering for a dividend portfolio.

Scroll Down to Read. No access yet? Check your status & upgrade to Premium to join the movement. Exclusive insights await inside!

Intro

💡 Invest in companies you believe in - W. Buffett

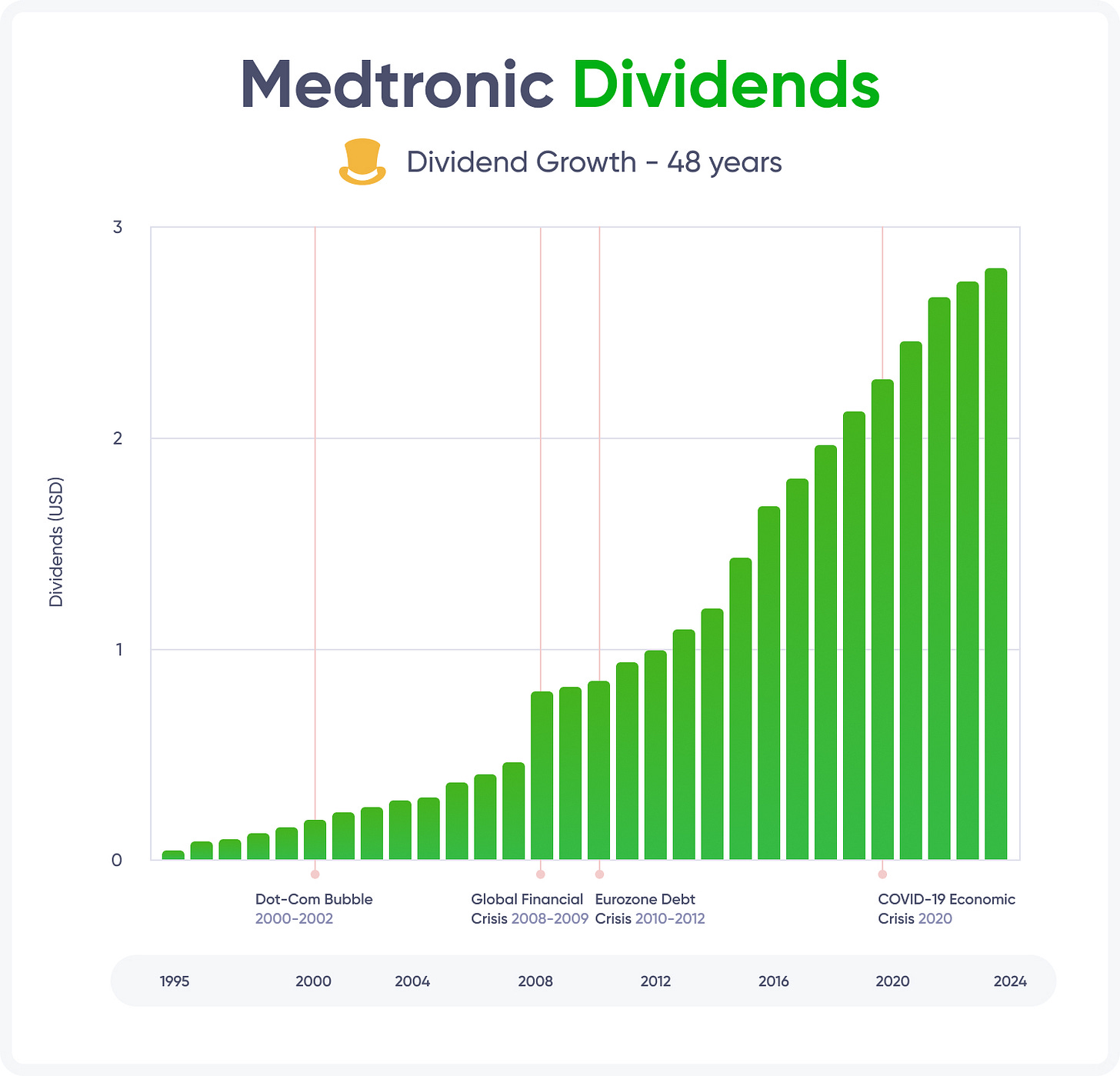

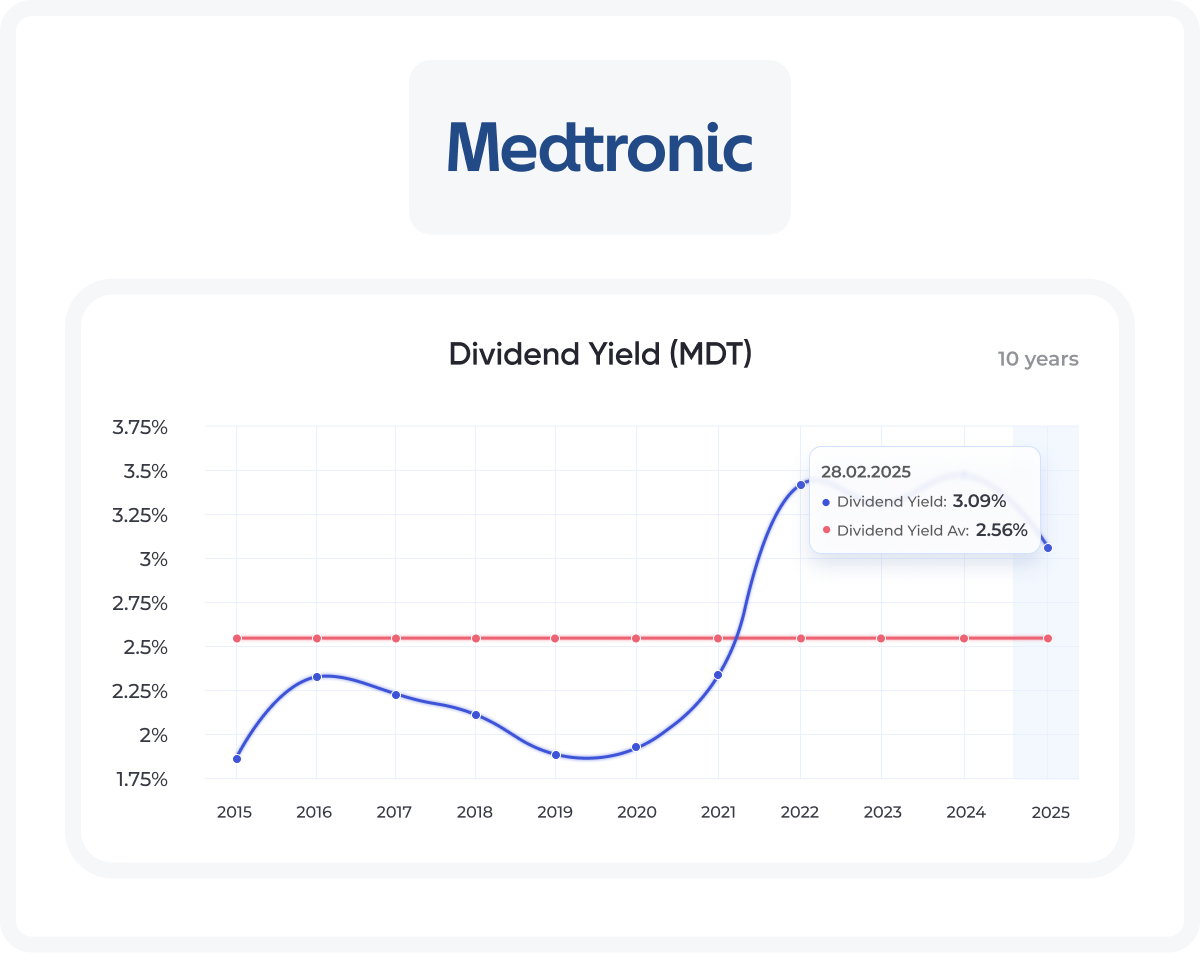

Investing in dividend-paying stocks can be a great way to generate passive income, but it’s crucial to choose financially stable companies with a track record of consistent payouts. Medtronic (NYSE: MDT) stands out as one such company, boasting 48 consecutive years of dividend growth. With a 3.1% dividend yield, more than double that of the S&P 500 (1.2%), Medtronic offers investors a reliable and growing income stream.

History of the Company

Medtronic was founded in 1949 when Earl Bakken and Palmer Hermundslie started a small business repairing medical equipment in a garage in Minneapolis. In 1957, Bakken developed the world’s first battery-powered pacemaker, a breakthrough in medical technology. Over time, the company grew into one of the world's largest medical device manufacturers. Today, Medtronic is headquartered in Dublin, Ireland, and its products are sold in 160 countries.

A Proven Dividend Eagle 🦅

Medtronic is a true dividend eagle, having increased its dividend for 48 consecutive years. Over the last five years, its dividend growth rate has been an impressive 32%, showing the company’s commitment to rewarding shareholders.

Based on dividend analytics, Medtronic has a MaxRatio of 6.01%, which estimates its potential 10-year yield on cost. This calculation considers the current dividend yield, 5-year and 10-year average dividend growth rates, and the company’s financial stability.

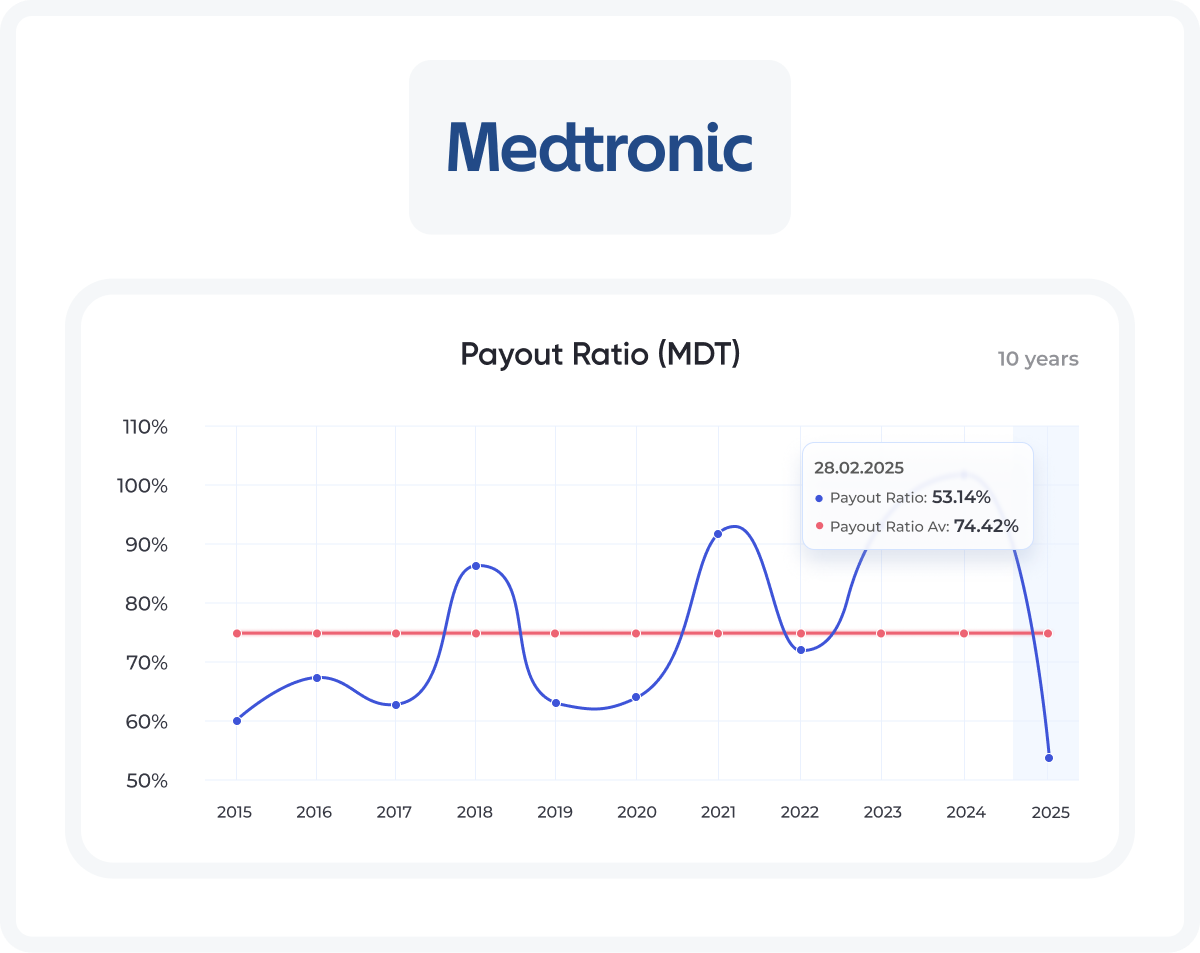

With a 5-year average payout ratio of 85%, Medtronic demonstrates strong earnings support for its dividends, making it a reliable long-term investment for income-focused investors.

🦅 Dividend Eagles

An updated compilation of 100+ top-performing dividend stocks with 15+ years of consecutive dividend increases, selected based on MaxDividends’ strict criteria.

Companies featured on the Dividend Eagles list have a proven track record of regular and increasing dividend payouts. This ensures you receive a reliable income, whether you're planning for retirement or seeking additional cash flow.

The Dividend Eagles list offers precisely that—a gateway to financial growth and stability.

Beyond dividends, these companies often exhibit strong fundamentals and growth prospects. Investing in them not only provides income but also the opportunity for your investment to grow over time.

This is how we build our own growing passive income and long-term wealth.

Key Institutional Investors in Medtronic (MDT)

The Vanguard Group, Inc.

Vanguard is one of the largest shareholders of Medtronic, owning 8.7% of the company’s shares. Known for its long-term investment approach, Vanguard typically invests in companies with stable growth and strong financial health. Its significant stake in Medtronic underscores confidence in the company’s ability to deliver consistent returns.BlackRock, Inc.

BlackRock holds 7.3% of Medtronic, positioning it as another major institutional investor. With a focus on companies that show strong growth potential and financial stability, BlackRock values Medtronic’s established market position in the healthcare sector, including its leadership in medical technologies.State Street Corporation

State Street owns 5.2% of Medtronic’s shares, making it a key investor in the company. As a major asset manager, State Street prioritizes investments in firms with a solid track record of performance and stability. Medtronic’s strong cash flow and growth prospects align well with State Street’s investment strategy.Capital World Investors

Capital World Investors holds 4.6% of Medtronic, reflecting its confidence in the company’s continued growth and profitability. This institutional investor is known for its focus on high-quality companies that offer both strong market presence and consistent financial returns. Medtronic fits well within this strategy, with its ongoing innovations and global reach.What Makes Illinois Tool Works Stand Out?

Medtronic (NYSE: MDT)

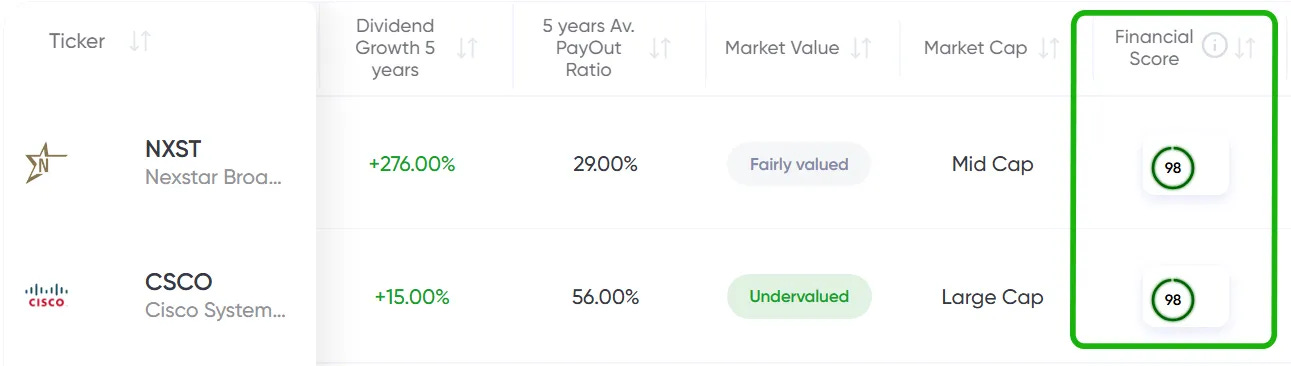

Financial Score: 98 / 99 ⭐️⭐️⭐️⭐️⭐️+

Industry: Medical Devices

Dividend Increase - 48 Years 🦅 Dividend Eagle.

👉 Learn more about Financial Score

Medtronic PLC is a global leader in medical technology, specializing in developing, manufacturing, and selling device-based medical therapies to healthcare systems, physicians, and patients.

The company operates in various sectors, including Cardiovascular, Neuroscience, Medical Surgical, and Diabetes, offering a wide range of medical devices and solutions.

These include implantable cardiac devices, insulin pumps, surgical stapling instruments, and spinal cord stimulation systems, among others.

Medtronic PLC - Quick MaxDividends Team Overview

🟢 According to the latest data, the company demonstrates financial stability and profitability.

🟢 The company's sales are growing steadily, which contributes to its good prospects

🟢 The growth in operating profit over recent years confirms the strategic success of the company and its ability to increase its presence in the market.

🟢 The dynamics of earnings per share are positive, the company shows good pace and stability in terms of profitability

🟢 The business is very stable and generates excellent, stable incomeFinancial Statement

If you want to stay on top of your portfolio's health, don't forget to check in on the financials of the companies you've invested in. The better shape they’re in, the better your results will be. Keep an eye on their quarterly and annual reports to see how they're performing.

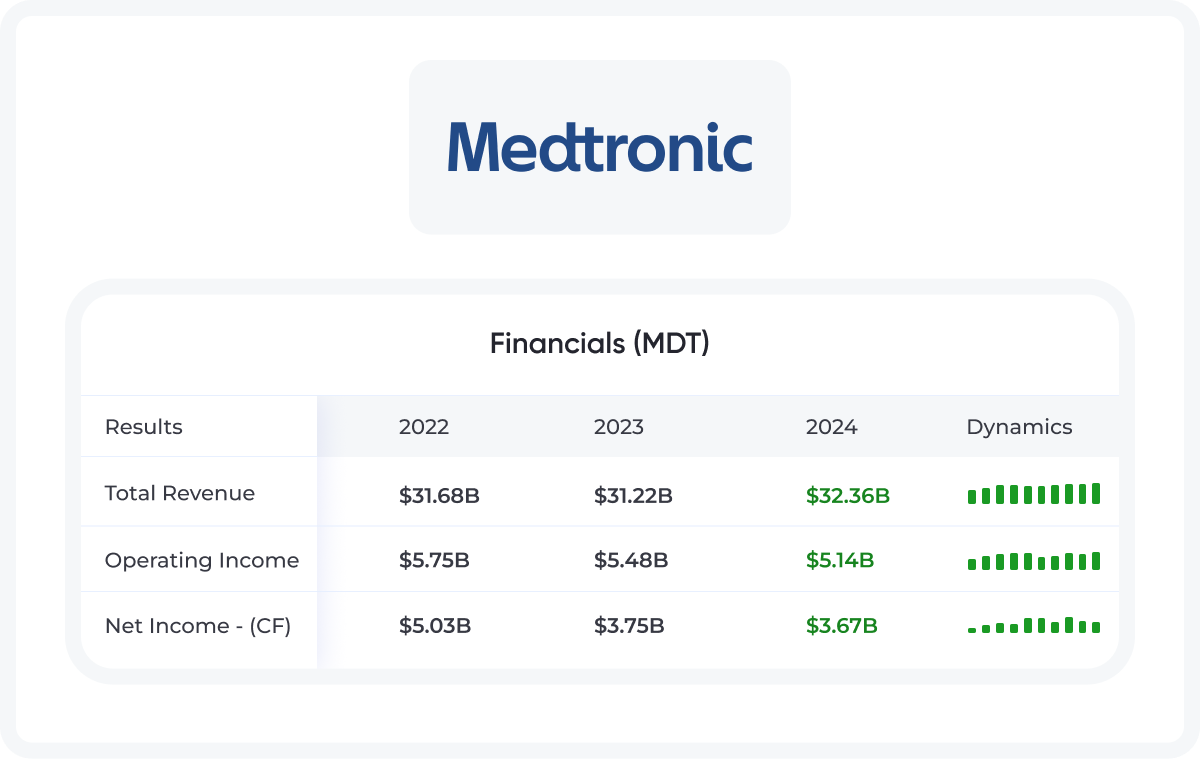

Here is a quick dive into Medtronic PLC over last years

The strongest and most stable companies tend to have a Financial Score of 80+, with the very best ones hitting 90+. If you see that score start to dip below 80, that’s your cue to consider jumping ship before things get worse.

👉 Learn More about Financial Score

Our Paid Members get access to a curated watchlist of 19,000 companies worldwide, all scored by our team on a regular basis. Companies like Medtronic PLC are on that list, too.

Future Growth Prospects for Medtronic PLC.

Medtronic's growth strategy is focused on advancing innovation in medical technology and expanding its global market presence. The company is investing heavily in product development across key areas such as cardiac devices, diabetes management, and surgical technologies.

For example, Medtronic plans to invest $785 million in cardiac devices, $612 million in diabetes management, and $453 million in surgical technologies, with these products expected to launch in the coming years.

Additionally, Medtronic is targeting emerging markets, where it anticipates a 25% revenue growth potential, and is actively expanding its digital health solutions portfolio. The company is also increasing its presence in the Asia-Pacific region to tap into new growth opportunities.

Looking ahead, Medtronic is projecting steady revenue growth, with an expected $32.4 billion in revenue for 2024, a 5.2% increase from the previous year. By 2025, revenue is expected to reach $34.1 billion, followed by $36.3 billion in 2026.

Strategic partnerships, particularly in AI healthcare technology and remote monitoring, as well as acquisitions in the digital health space, further bolster the company's prospects.

With a strong commitment to research and development, Medtronic remains well-positioned for long-term growth, backed by a $1.2 billion annual investment in R&D and its advanced technological capabilities.

Recent Medtronic Financial Performance (2023-2024)

With MaxDividends, it's easier than ever to access top dividend companies, track your results, and explore new dividend ideas.

The MaxDividends Top Stocks List features ~100 of the most reliable dividend companies in the U.S. market, each with 15+ years of consecutive dividend increases. These stocks are carefully selected based on MaxDividends' strict criteria for consistency and reliability.

Dividend Kings represent the elite tier of dividend growth stocks. With 50+ years of consecutive dividend increases, these companies offer unparalleled income stability, making them a top choice for investors seeking long-term reliability in an unpredictable market.

With 25+ years of consecutive dividend increases, Dividend Aristocrats are among the strongest dividend growth stocks. These companies have a proven track record of not only maintaining but consistently increasing their dividends, often outperforming the broader market over time.

Why Invest in Medtronic?

Over 75 years of medical technology leadership

47 years of consecutive dividend growth

Financially strong, with high free cash flow and a solid balance sheet

Ongoing investment in medical technology innovation

Active share repurchase program, enhancing shareholder value

Steady revenue and earnings growth, supporting future dividend increases

Interesting Fact

Medtronic made history in 2001 when it became the first major medical device company to become a "tax inversion" company. This controversial move involved Medtronic relocating its headquarters from the United States to Ireland through its $34 billion acquisition of the Irish company Covidien.

This strategy allowed Medtronic to lower its tax rate significantly, sparking a larger conversation about corporate tax practices and international business structures. The deal not only transformed Medtronic’s financial outlook but also reshaped the company into a global healthcare giant.

Competitors

1. Abbott Laboratories (NYSE: ABT)

Financial Score: 98 / 99

Industry: Medical Devices

Abbott Laboratories, founded in 1888, is a global healthcare company based in North Chicago, Illinois. It specializes in the discovery, development, manufacturing, and sale of healthcare products across four key segments: Established Pharmaceutical Products, Diagnostic Products, Nutritional Products, and Medical Devices.

The company offers a wide range of solutions, including generic pharmaceuticals, diagnostics, cardiovascular devices, diabetes care products, and neuromodulation devices.

2. Johnson & Johnson (NYSE: JNJ)

Financial Score: 98 / 99

Industry: Drug Manufacturers - General

Johnson & Johnson, together with its subsidiaries, engages in the research, development, manufacturing, and sale of healthcare products globally. The company’s Innovative Medicine segment offers products for various therapeutic areas, including immunology, infectious diseases, neurology, oncology, cardiovascular and metabolic conditions, as well as pulmonary hypertension.

The MedTech segment provides interventional solutions, technologies for heart recovery, neurovascular care, and products for orthopedics, surgery, as well as contact lenses under the ACUVUE brand and TECNIS intraocular lenses for cataract surgery.

The company collaborates with Stand Up To Cancer to research a combination of teclistamab and daratumumab for the treatment of the rare disease AL amyloidosis. Johnson & Johnson was founded in 1886 and is based in New Brunswick, New Jersey, USA.

Final Thoughts: Should You Buy Medtronic?

Medtronic is a stable company with strong growth prospects, driven by innovations in cardiology, diabetes, and surgery. With a revenue of $31.7 billion and a market capitalization exceeding $100 billion, it holds a strong market position.

The company is actively expanding in emerging markets and investing in digital health. While it offers steady dividends and has a solid financial outlook, competition and potential risks should be considered.

Overall, Medtronic is a solid choice for long-term investors in the healthcare sector.

Current Market Value

Undervalued \ Overvalued \ Fairly Valued

Compare the P/E ratios of competitor companies to assess whether the stock you're considering is overvalued. We calculate the average P/E among competitors as a benchmark.

If a company's current P/E is 20% or more below the competitor average, it is considered undervalued.

If it is 20% or more above, it is considered overvalued.

The P/E ratio is calculated by dividing the market value per share by earnings per share (EPS).

🟢 Undervalued

The company is currently trading below its intrinsic value compared to peers in the industry. This presents an opportunity for investors, as the stock has significant upside potential once it adjusts to its true worth.

Analysts Consensus

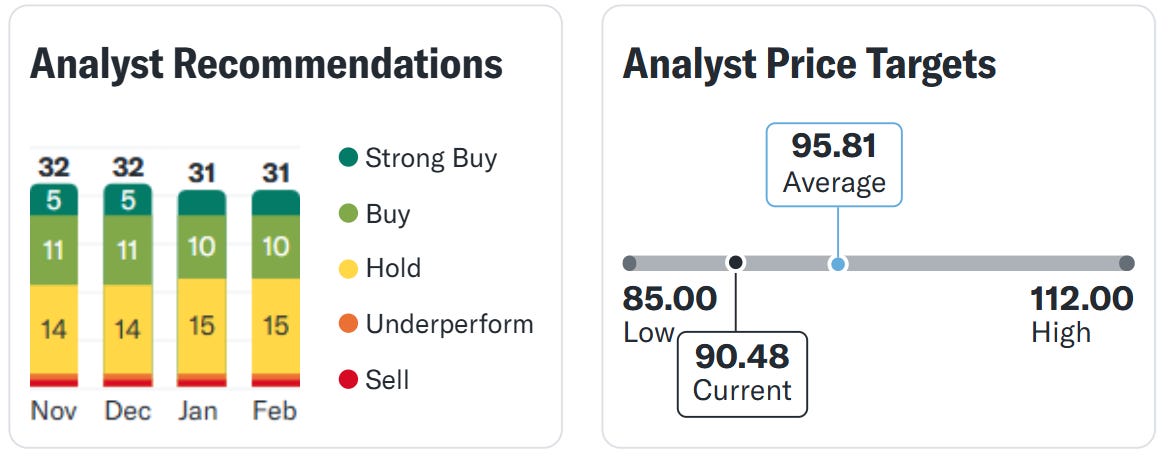

Analysts maintain a neutral-to-optimistic outlook on Medtronic stock. The number of analysts covering the stock remains stable at around 31–32.

The majority recommend a "Hold" position (14–15 analysts), while "Buy" and "Strong Buy" ratings account for a combined 15–16 analysts.

The average price target is 95.81, which is above the current market price of 90.48.

Estimates range from a low of 85.00 to a high of 112.00, indicating potential upside but also mixed expectations among analysts.

At MaxDividends, we consider Medtronic a good long-term investment with strong financial stability and growth potential.

The only concern that bothers our team is the relatively high payout ratio and the slow dividend growth in recent years. The company is a good fit for a high-growth dividend portfolio right now, but for investors focused on growth, it’s worth considering alternative options.

The company is currently undervalued, demonstrating steady sales growth, increasing operating profit, and stable earnings per share. Its resilient business model ensures strong and predictable income.

To your wealth, MaxDividends Team

More Dividend Ideas

Scroll Down to Read. Don’t have access? Check Your Paid Status & Upgrade to Premium.

MaxDividends Community

With MaxDividends Community you’ll always be part of a winning team and stop viewing the future as an uncertainty. Worry will fade, replaced by confidence and peace of mind. You’ll focus on doing what you love while your passive income continues to grow.

👑 What You’ll Get by Joining MaxDividends Premium

The most important thing our MaxDividends community members value us for

Freedom & Independence

No boss, no schedules—complete control over your time. Ability to work on passion projects or simply enjoy life without financial stress.

Passive Income That Grows Over Time

Dividend-paying stocks provide a steady, rising income stream. Unlike traditional retirement funds, you don’t need to sell assets to cover expenses.

Protection Against Inflation

Dividend growth investing ensures your income keeps pace with inflation. Companies that increase payouts help maintain purchasing power.

Stress-Free Investing

No need for active trading or daily market monitoring. Long-term buy-and-hold strategy minimizes stress and decision fatigue.

More Time for Family & Personal Goals

Spend more time with loved ones instead of working 40+ hours a week. Pursue hobbies, travel, and personal development without financial pressure.

Health & Well-Being Benefits

Less work stress leads to better mental and physical health. More time for fitness, proper sleep, and healthier lifestyle choices.

Avoiding the Corporate Rat Race

Escape office politics, toxic work environments, and endless meetings. Focus on meaningful activities instead of chasing promotions and pay raises.

Living Life on Your Own Terms

Ability to relocate, slow travel, or move to a lower-cost-of-living area. No restrictions on how you spend your day—whether it's reading, volunteering, or building a new skill.

Leaving a Legacy

Build generational wealth and leave assets for your family. Teach the next generation financial independence by leading by example.

Financial Security & Peace of Mind

A well-built dividend portfolio provides stability even during economic downturns. No fear of outliving your savings—passive income keeps flowing.

Many who already joined say it’s the best financial decision they’ve ever made—because money becomes a tool for freedom, not a source of stress.

Ready to Give It a Try?

Check Your Subsription Status & Upgrade to Premium.

If you have any questions, feel free to email me at: maxdividends@beatmarket.com

MaxDividends Community: What ELSE You’ll Get Here

🔹 MaxDividends Stocks of the Week

Top 10 undervalued, high-yield, ultra-high yield, and dividend growth stocks every week.

Bonus: Full access to the updated weekly list of MaxDividends stocks—boost your passive income and start living off dividends.

🔹 Top Dividend Insights

Get exclusive, high-quality dividend investment ideas and insights, handpicked to help you crush your financial goals, retire early, and live off dividends.

🔹 Roadmap to Live Off Dividends

A step-by-step weekly guide to achieving financial freedom through dividend investing.

🔹 Easy Peasy: Build Your MaxDividends Portfolio

Ready-made MaxDividends stock sets starting at $300, $500, or $1000 each week—making it easier to build a strong dividend portfolio.

🔹 MaxDividends Business Overview

Deep dives into the top dividend stocks we hold, including key metrics, business insights, perspectives, and expert consensus.

🔹 MaxDividends Portfolio: Goal → $12,000 Monthly for 120 Months

My personal dividend portfolios with weekly updates, changes, and insights.

🔹 MaxDividends App & Tools Access

Comprehensive tools to help you retire early and live off dividends with confidence.

🔹 Community of Like-Minded Investors

Stay connected with me and other MaxDividends followers. Join the MaxDividends community chat to discuss ideas, share insights, set goals, and stay motivated. Support, accountability, and like-minded investors—all in one place!

🔹 Sunday Coffee ☕️

My personal life & business column, where I share:

Life moments & investing insights

Long-term investment philosophy

Thought-provoking ideas to help you succeed

🟢 What ELSE You’ll Get

Top Dividend Ideas

Unlock exclusive, high-quality dividend investment ideas available only for Premium members. These ideas are carefully curated to maximize returns, provide growing income, and accelerate your journey to financial freedom and early retirement.

By upgrading to Premium, you’ll gain access to:

Advanced stock recommendations tailored for dividend growth

In-depth research on high-yield dividend stocks with strong growth potential

Exclusive updates and insider insights to stay ahead of the curve

Undervalued Dividend Lists

With Premium access, you’ll get:

Undervalued Dividend Eagles (updated monthly)

Undervalued Dividend Kings (updated monthly)

Undervalued Dividend Aristocrats (updated monthly)

These lists highlight the most promising undervalued dividend stocks with strong growth potential, helping you maximize returns on your investment.

Dividend Insights

Gain exclusive insights:

Top 5 MaxDividends Ideas of the Month

Top 3 Most Promising Dividend Ideas of the Week

List of Dangerous Dividend Stocks (updated monthly) – avoid risky picks

These carefully researched ideas will guide you in making smart, informed decisions to build wealth with dividends.

🟢 And even MORE!

Unlock the best dividend tools available, created by the MaxDividends Team:

Dividend Screener: Find your own hidden gems—uncover undervalued dividend stocks with high growth potential.

Dividend Portfolio Tracker: Keep track of every aspect of your passive income and optimize your portfolio.

Dividend Checker: Check the financial and dividend score of 19,000+ companies worldwide to make data-driven choices.

MaxDividends Premium gives you all the tools you need to build, track, and grow your passive dividend income to retire early and live off dividends.

We are Recommended on Substack

Trusted by 26,000+ subscribers. Followed by 20,500+ dedicated readers

The European Value Investor ⭐️⭐️⭐️⭐️⭐️

“If you are interested in dividend strategies or passive income strategies, this Substack ia great! Its worth a visit“

Johan Lunau - The Long View ⭐️⭐️⭐️⭐️⭐️

“Practical dividend focus. Saving for retirement.“

Shailesh Kumar - The Astute Investor’s Calculus ⭐️⭐️⭐️⭐️⭐️

“Love the concept and the execution. If you are into building a portfolio that will generate ever growing income for you, subscribe to Max Dividends. I did.“

MS Cliff Notes ⭐️⭐️⭐️⭐️⭐️

“A useful substack for those that invest in stocks that pay dividends or are looking to get into such a strategy. Includes education and actionable ideas.“

Timothy Assi - Panic Drop ⭐️⭐️⭐️⭐️⭐️

“Great for helling you pick up high-yield dividend growth stocks“

And 150+ more other great authors and pro’s are recommend MaxDividends!

MaxDividends Mission

Helping & Supporting Everyone in Building a Growing Passive Income, Retiring Early, and Living Off Dividends.

FAQ

I ❤️ Dividends: Why I Believe Dividend Investing Is the Best Strategy | PDF Book

How Effective is the MaxDividends Strategy for Building Growing Passive Income

Someone's sitting in the shade today because someone planted a tree a long time ago. ― Warren Buffett.