💡 MaxDividends Mission: Helping people build growing passive income, retire early, and live off dividends.

Structured reviews of dividend stocks worth serious attention. Financially strong. Dividend disciplined. Priced with logic.

⭐️ Premium Hub | 💼 MaxDividends App

A Strategic Defense & Intelligence Player with Dividend Growth Momentum

Dear friends — Max here.

Imagine this for a second.

A cyberattack shuts down a regional hospital system. Surgeries delayed. Records locked. Systems frozen. Now expand that thought to power grids, military logistics networks, border security databases, intelligence platforms.

This isn’t fiction. You’ve heard these stories. We both know they’re happening regularly now.

The U.S. government runs some of the most complex digital infrastructure on the planet. Defense systems. Intelligence platforms. Veteran health networks. Homeland security data systems. Much of it built decades ago. Much of it constantly under threat. None of it allowed to fail.

And here’s the part most people don’t think about: the government doesn’t build or maintain all of this alone.

That’s where today’s dividend idea quietly makes its money.

📊 The Company’s Financial Condition

⭐️⭐️⭐️⭐️⭐️

Financial Score: 98 / 99

Cash flows are generated primarily through multi-year U.S. government engagements across defense, intelligence, and civil agencies.

Unlike commercially diversified consulting firms, BAH’s revenue base is concentrated but contract-driven, providing visibility through backlog and program continuity rather than exposure to short-term consumer or corporate demand swings.

The balance sheet reflects controlled leverage and consistent profitability, allowing the company to fund operations, reinvest in capabilities, and return capital to shareholders without stretching its payout profile.

MaxRatio ~10+ ✅

That means an investor today can reasonably expect their yield on cost to approach 9–10% over the next 10–12 years if dividend growth trends continue.

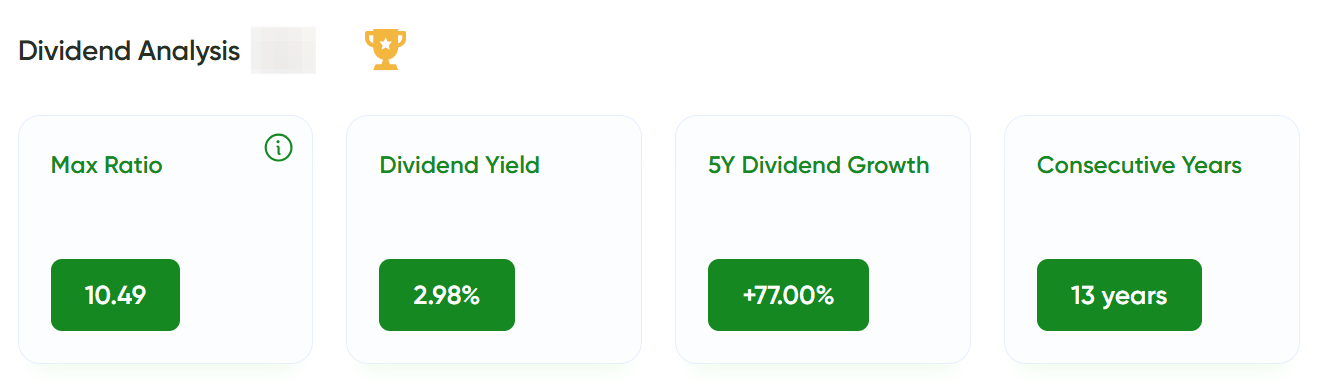

💰 Current Dividends & Dividend Growth

Booz Allen’s dividend profile reflects a growth-oriented payout policy supported by earnings expansion:

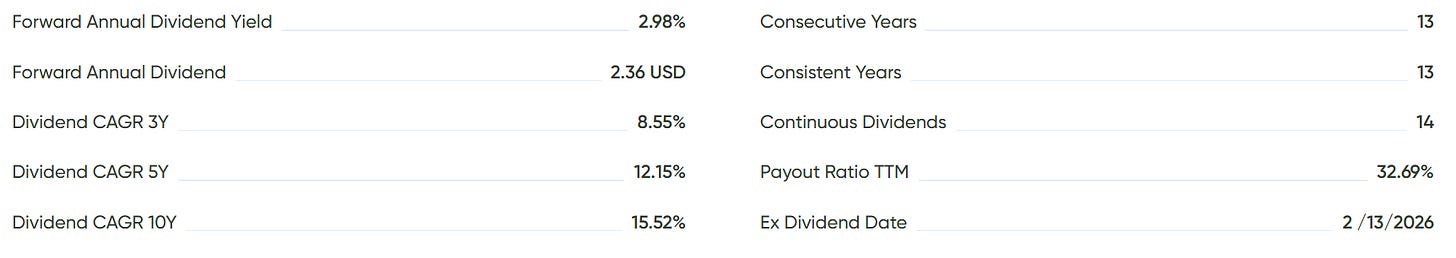

Dividend Yield: ~3.00%

Consecutive Years of Growth: 13

5Y Dividend Growth: +77%

10Y Dividend CAGR: ~15.5%

TTM Payout Ratio: ~32%

With a payout ratio near one-third of earnings, the dividend is supported by underlying profitability rather than financial leverage.

Earlier this year, I added this company to my watchlist

Looking at the financial statements, I personally see a business that appears operationally healthy.

The dividend history is also reasonable in context. The company has been paying dividends for 13 years and has increased them every single year since initiation — including again this year. For a company that only began paying dividends relatively recently, that consistency matters.

A payout ratio around 30% of earnings, combined with a ~3% starting yield, looks balanced to me.

Valuation is another factor. By most comparative measures, the stock appears undervalued relative to its own history and sector positioning.

Today we’ll walk through every key aspect of this idea — analyze the company, break down how the business actually works, identify attractive entry levels, and assess its long-term prospects.

Scroll down to read the full analysis. If it’s locked, check your subscription — and unlock Premium access to continue.

⭐️ Get Full Access to Our Top Dividend Picks ⭐️

Top Undervalued Dividend Picks — powered by the proven Income System.

Full breakdowns. Clear roles. Clear signals.

We don’t own tickers. We own businesses. Outgrow your passive income — one dividend business at a time.

— Max