My February’s Dividend Watchlist: The Stocks I’m Betting On Now

A complete list of my favorite stocks that I'm currently tracking

MaxDividends Mission: Helping people build growing passive income, retire early, and live off dividends.

A complete list of the businesses I’m actively tracking right now. Every stock on this WatchList is here because it passed a system — a system built over thousands of hours of thinking about one simple idea: Cash is king. And in dividend investing, cash has one job.

⭐️ Premium Hub | Start with the MaxDividends App

My Personal Stock Watchlist for February 2026

A complete list of the businesses I’m actively tracking right now

Hi, 👑 Partners — Max here.

I spend a lot of time doing this: Reading reports. Checking cash flows. Watching how businesses behave — not on good days, but across cycles.

This WatchList is the result of hundreds of hours of analysis.

But here’s the important part. You don’t need to do all of that. That’s exactly why MaxDividends exists: the MaxDividends Income System, powered by our dividend intelligence app — a proven, safe financial engine that turns invested capital into growing dividend income so you can live off dividends and retire early on your own terms.

I do it because I genuinely enjoy the process — and because we’re building MaxDividends to be the best dividend-focused product in the world, with data and structure I wish I had years ago.

This list is simply where my attention is right now.

These are the companies I’m watching closely. Some I already own. Some I’m adding to slowly. Some I’m observing to see how the story develops.

Nothing here is spontaneous.

Every stock on this WatchList is here because it passed a system — a system built over thousands of hours of thinking about one simple idea: Cash is king. And in dividend investing, cash has one job.

To pay. To keep paying. And to grow over time.

I want growing, durable, repeatable income. The kind that doesn’t depend on headlines. The kind you can actually live on.

That’s why this WatchList exists.

It’s not a list of “ideas.” It’s not a list of predictions. And it’s definitely not a list built for excitement.

It’s a working framework. A place where strong businesses earn the right to stay under observation — and weak ones quietly fall away.

Behind it sits the MaxDividends Income System — a clear, repeatable structure that turns capital into income — supported by the technology we’ve built into the App to make that process visible, measurable, and calm.

This is how I invest. This is how I’m building my own income machine. I’m doing it using the very same framework you have access to inside MaxDividends — the same system, the same rules, the same lens.

And I’m sharing this with you today because we’re partners — we’re building toward the same goal. These are my reference points on that path. And they can be yours too.

Scroll down.

📌 Today's Table of Contents

My Personal Stock Watchlist for February 2026 - The businesses I’m watching most closely right now

Top Undervalued Dividend Stocks This Month - High-quality income names trading below intrinsic value

This Month’s Shortlist - Where my focus and capital are most aligned today

Love what we’re building?

Get instant full access to the MaxDividends Universe, MaxDividends Income System & App.

The Goal

I’m all-in on strong dividend stocks. I balance capital growth with growing dividend income. The goal is simple and very real: to build a strong, reliable passive income stream that I can actually live on.

Before we go any further, let me show you how this system works in real life — using one real company as an example. This isn’t theory or a model portfolio. This is the exact framework I use myself, and it’s the same MaxDividends Income System that’s available to you.

The MaxDividends Income System — My Framework

Everything starts with my extended watchlist. This isn’t a random collection of tickers or short-term ideas. These are high-quality businesses built for the long run.

I focus on companies with real operating history, durable demand, proven management, and a clear record of paying shareholders. Quality always comes first.

1. Do I Understand the Business?

Before I look at numbers, I ask a very basic question: do I actually understand this business?

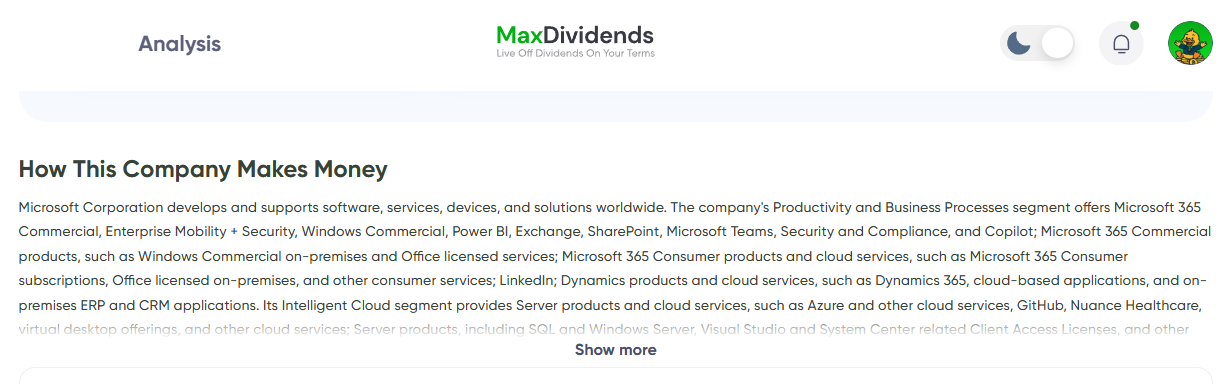

I read the company description inside MaxDividends analytics and focus on how the company makes money, who pays them, why customers stay, and where the cash flow really comes from. If that explanation makes sense to me, I move forward.

If it doesn’t, I stop. This part is personal. It’s not about being right or wrong, it’s about whether the business itself feels clear and understandable.

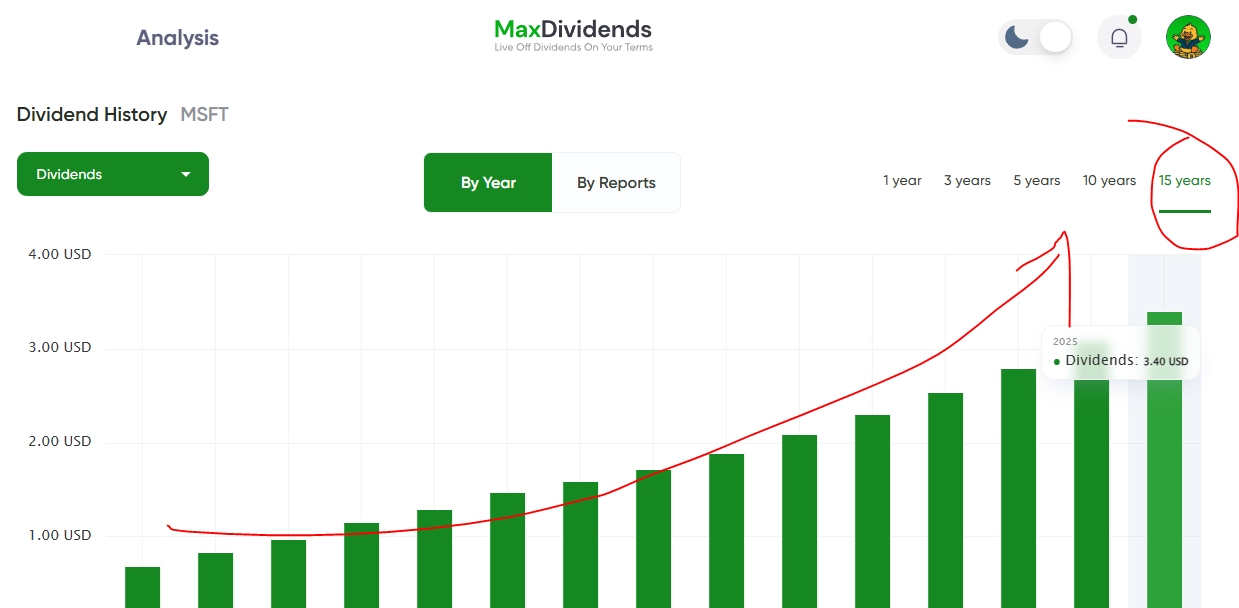

2. Dividend History Comes Next

After that, I look at dividends and the history behind them.

I’m comfortable with companies that pay dividends regularly, without cuts, and raise them year after year. In most cases, I focus on businesses with at least 15 consecutive years of dividend growth. This isn’t about chasing high yields. It’s about building income that keeps showing up regardless of market noise.

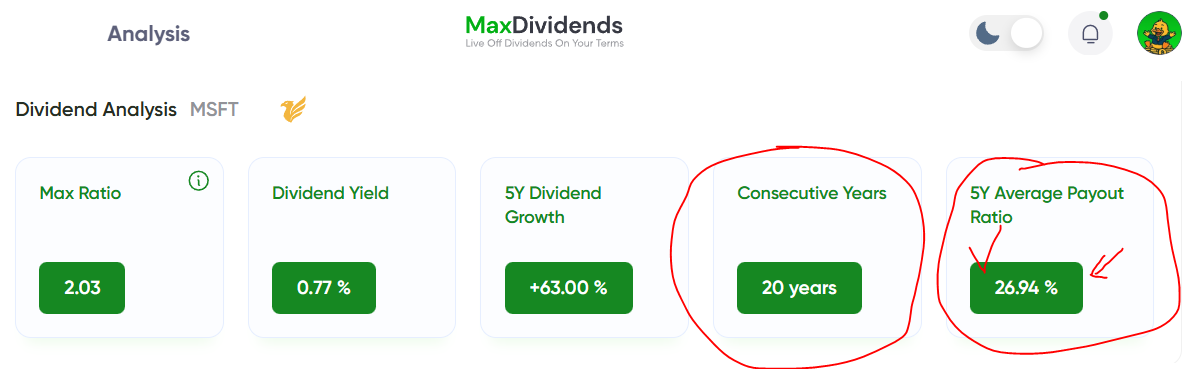

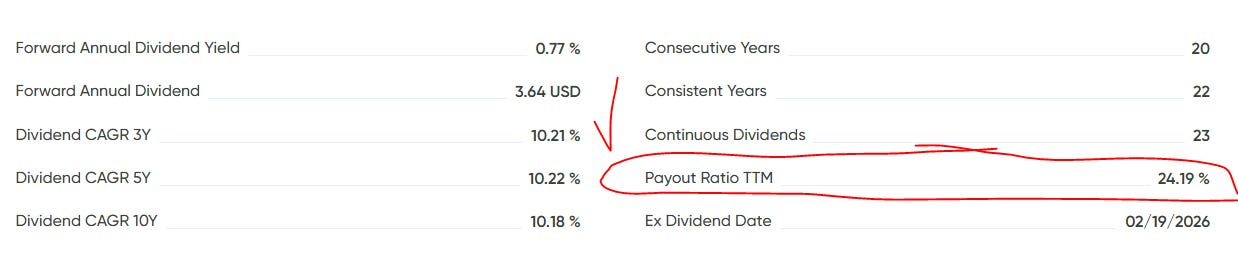

3. Are Those Dividends Actually Safe?

Then comes an important safety check.

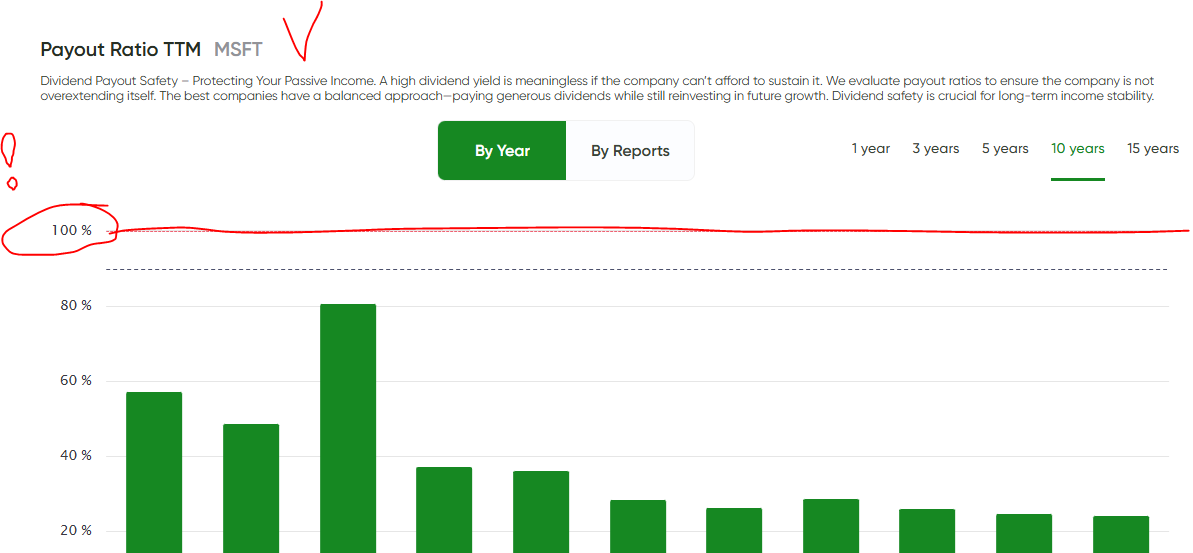

I look at how those dividends were funded over the last five years and what’s happening today.

I want dividends to be paid from profits, with room to spare. If a company paid out more than 100% of earnings at any point during that period, I usually pass. I want a margin of safety built into my income, not just optimism.

Structure and Resilience

This is where structure really matters.

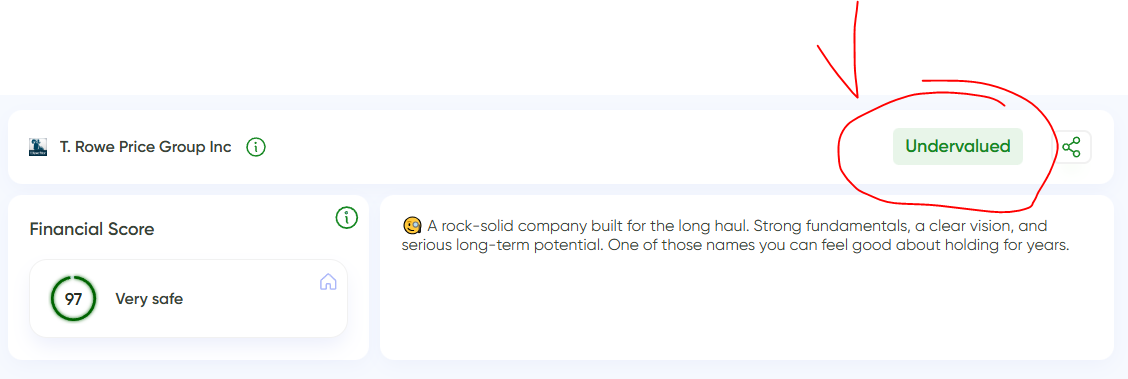

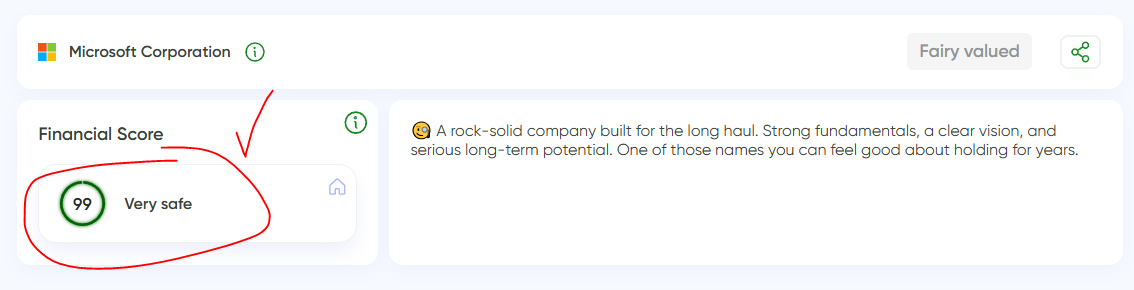

At this stage, I apply two separate filters. First is the Financial Score. It’s a high-level health indicator that quickly shows whether a business is fundamentally strong. In most cases, I want to see a Financial Score of 90 or higher, which immediately removes a large number of weak or unstable companies.

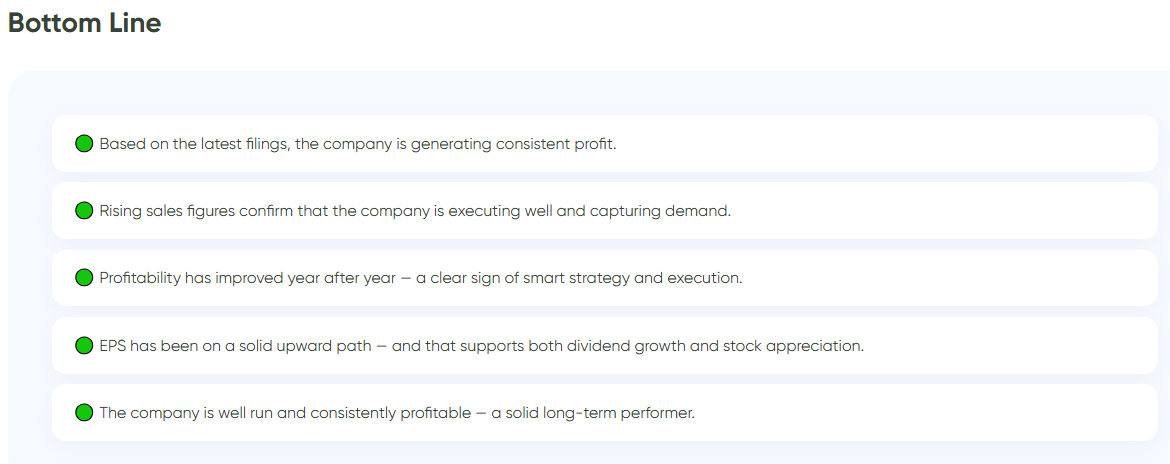

Then we go deeper using our 5-pillar stability framework, the same framework available to every partner directly on the company analytics page.

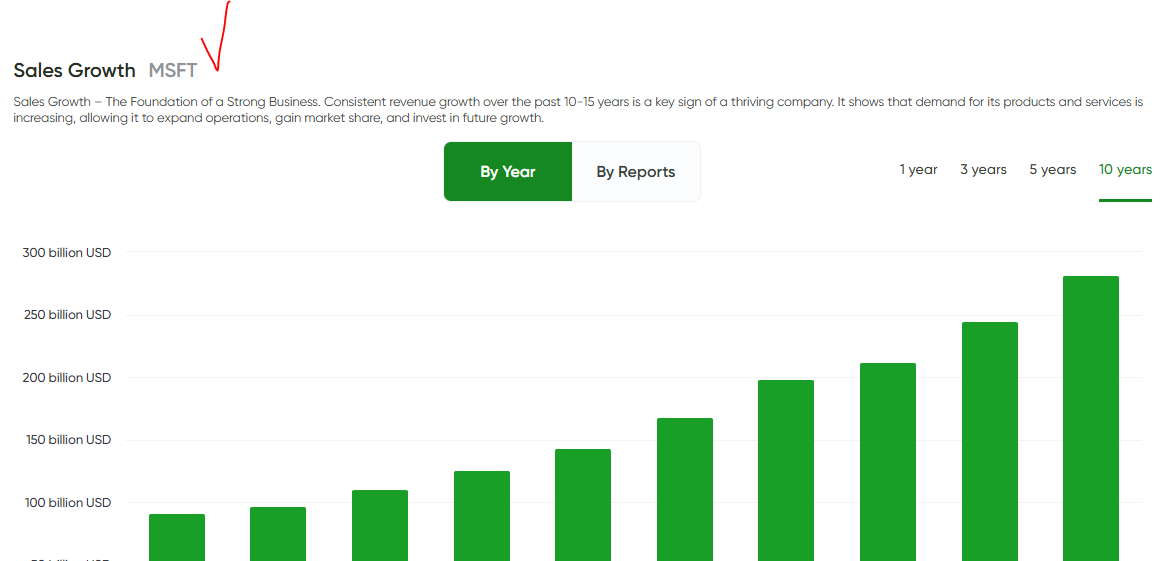

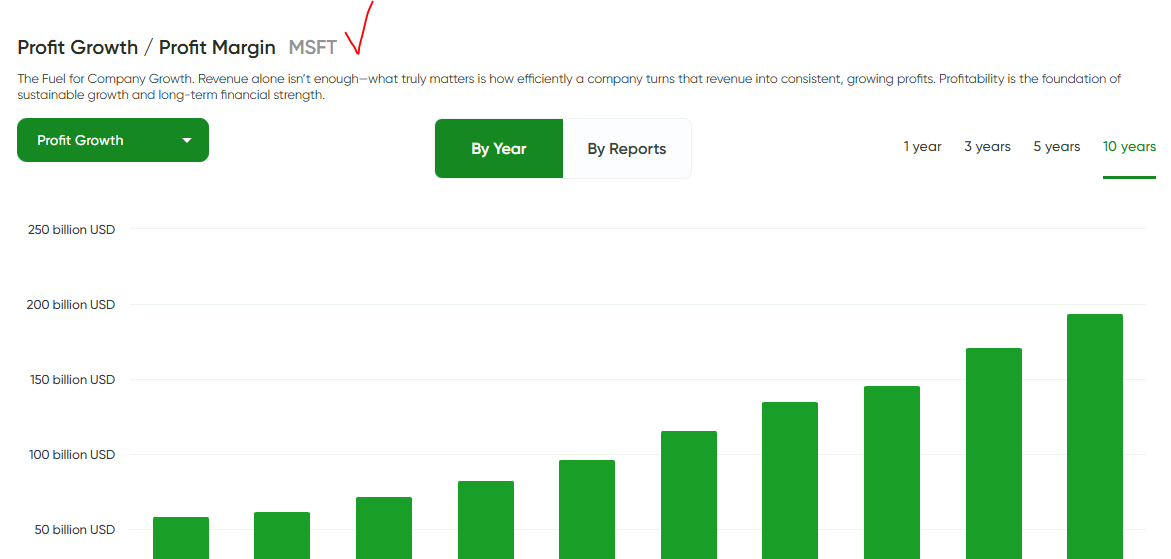

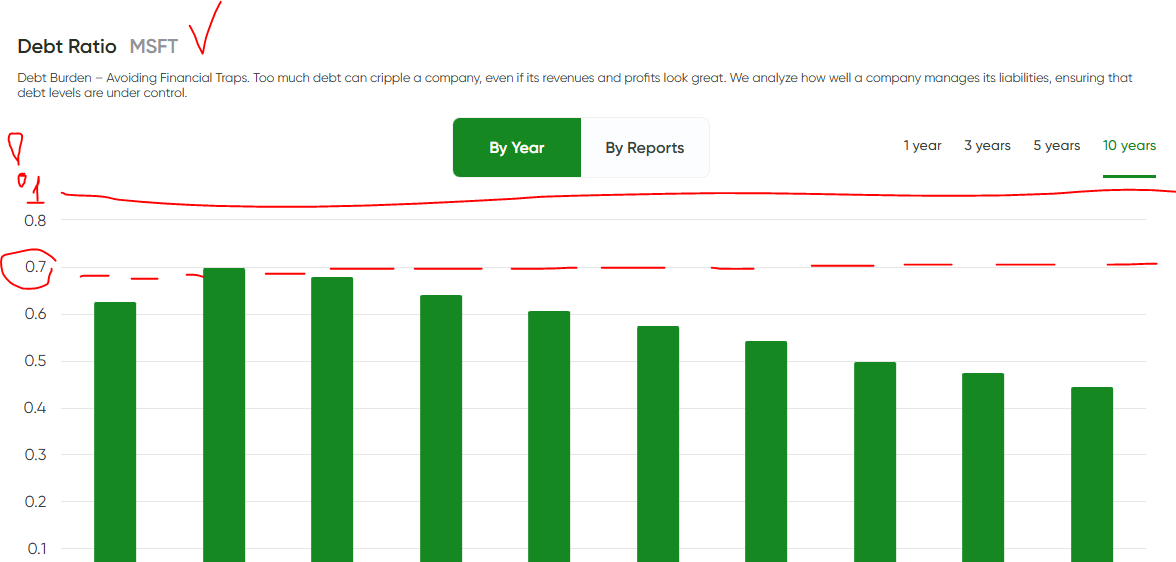

Here we look at revenue trends, profitability, cash flow consistency, debt and liquidity, and balance sheet strength.

This step isn’t about growth stories or hype. It’s about resilience — businesses that can handle pressure, protect dividends, and keep operating without financial stress.

When I Actually Buy

Not every great company becomes a buy immediately.

From the broader watchlist, I build a short “right-now” list — companies that pass all quality filters, fit my income goals, and make sense at today’s prices. I also check valuation to make sure I’m not overpaying.

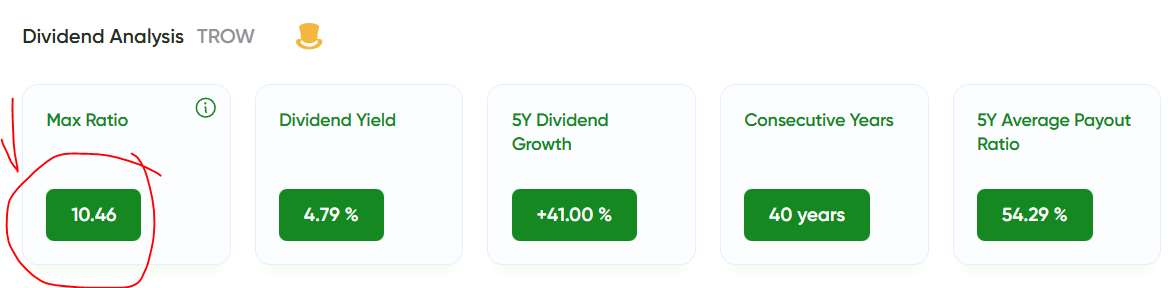

Finally, I look at growth through MaxRatio. I aim for 8 or higher, with 10+ preferred. I want dividends that don’t just pay today, but grow fast enough to stay ahead over time.

The System in One Sentence

That’s the system. No guessing, no reacting to headlines, no emotional decisions.

This is how I invest. This is how I’m building my own income machine. And I’m sharing it with you because we’re partners in this — moving toward the same goal, using the same framework, step by step, with calm and discipline.

Alright, now that I’ve walked you through how the MaxDividends Income System works for me in practice, using the MaxDividends App, let’s take a look at the businesses I’m watching especially closely right now — this month in particular.

Unlock full access and get:

⭐️ Today’s Shortlist

⭐️ Top Undervalued Dividend Stocks on My Watchlist for Now

⭐️ My Personal Stock Watchlist: Complete List

👉 Start with the system. Build income the calm, structured way.

Get instant full access to the MaxDividends Universe, MaxDividends Income System & App.