🎯 My Dividend Hunt: Who’s in the Crosshairs?

Interesting Dividend Stocks On My Radar Today

💡 MaxDividends Mission: Helping people build growing passive income, retire early, and live off dividends.

I’m kicking off my 🎯 dividend hunt for today, and one name have caught my eye in my main portfolio.

⭐️ Your Premium Hub | 🎬 MaxDividends App: 2-Minute Video

Intro

💡 “Invest in companies you believe in.” — W. Buffett

Hi — Max here.

Since November, my family portfolio has generated roughly $7,000 in dividend income. I deliberately didn’t rush to reinvest it right away. I prefer to wait, review my watchlist calmly, and deploy capital only when a business truly fits my long-term dividend plan.

This Monday (Dec 15, 2025), I’m finally putting that dividend cash to work — and I’m adding a Japan-based industrial company that has been quietly checking all the right boxes for me.

After some digging, this is the one company I decided to add right now — using dividends already earned. A disciplined Japanese manufacturer with a solid balance sheet, resilient cash flows, and a shareholder-friendly approach that fits exactly how I want my family portfolio to compound over the long run.

Below, I’ll walk you through why the business made the cut — and why I’m comfortable buying it with dividend income rather than chasing something louder or more fashionable.

Let Me Share It with You!

Imagine a Japanese industrial business quietly supplying mission-critical auto components to global manufacturers — not chasing headlines, not dependent on consumer moods, but tied to real production demand across multiple regions.

This is a company that built its reputation on engineering precision, long-term OEM relationships, and conservative financial management. While others in the auto supply chain swing with cycles and leverage, this one focuses on efficiency, balance-sheet strength, and steady cash generation.

G-TEKT doesn’t try to be flashy. It operates behind the scenes — designing and manufacturing body and transmission components that automakers simply can’t do without. That discipline has translated into resilient operations, improving shareholder returns, and a dividend profile that’s been quietly moving in the right direction.

Intrigued? Let’s explore it step by step.

When I go on a dividend hunt, I focus on buying businesses at sensible prices with a long-term mindset — guided by the MaxDividends Investing Concept.

Here’s what matters most to me:

The company’s financial health

Current dividends and their growth trajectory

Future dividend yield on cost (MaxRatio)

Fair value and margin of safety today

Let’s see how today’s idea stacks up against these pillars.

🎯 Today’s Idea — 🦅 Dividend Eagle. G-TEKT Corporation (TSE: 5970).

G-TEKT Corporation is a Japan-based manufacturer of automotive body components, transmission-related parts, and high-precision tooling and dies, supplying major global OEMs across Japan, North America, Europe, and Asia.

👉 📊 Full G-TEKT Dividend & Financial Snapshot (MaxDividends App)

This is not a consumer-facing brand — and that’s exactly the point. G-TEKT operates deep inside the industrial supply chain, where engineering precision, reliability, and long-term customer relationships matter far more than marketing or fashion cycles.

Founded in Japan and built with a classic Japanese manufacturing DNA, the company has spent decades refining a business model centered on operational efficiency, capital discipline, and steady cash generation, rather than aggressive expansion or leverage-driven growth.

🏭 Industrial Built Different — Precision Over Flash

What sets G-TEKT apart is its quiet discipline.

Instead of chasing volume at any cost, the company focuses on:

long-term OEM partnerships

high entry barriers through tooling, know-how, and process integration

conservative capital allocation

While many auto suppliers struggle with volatility, pricing pressure, or debt-heavy balance sheets, G-TEKT has consistently prioritized stability and balance-sheet resilience. That approach doesn’t always produce exciting headlines — but it tends to produce durable earnings and dependable shareholder returns over time.

This is the kind of industrial business that fits naturally into a family portfolio: not exciting, not speculative — but engineered to last.

📊 The Company’s Financial Condition

⭐️⭐️⭐️⭐️⭐️

Financial Score: 96 / 99

📊 Full G-TEKT Dividend & Financial Snapshot (MaxDividends App)

G-TEKT maintains a solid balance sheet, conservative leverage, and a financial structure designed to withstand cyclical pressure in the automotive industry. Cash flows are supported by long-term supply contracts and diversified geographic exposure rather than single-market dependence.

That financial foundation gives management flexibility — not just to operate through cycles, but to return capital to shareholders while preserving stability.

💰 Current Dividends & Dividend Growth

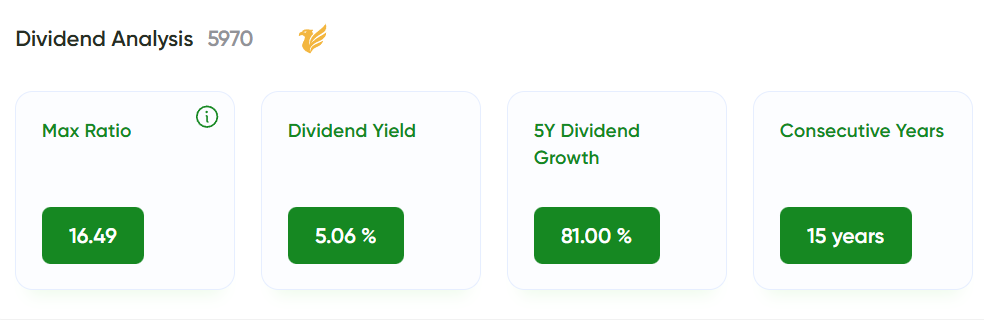

G-TEKT’s dividend profile reflects a measured, shareholder-aware approach, consistent with many well-run Japanese industrials:

Dividend Yield: ~4.90%

Recession Proof: 15+ consecutive years

Dividend Growth 5Y: +81%

Recent 2025 hike +10%. FWD Dividend Yield ~5.05%

Payout Ratio: ~35% (very conservative for retail)

📈 Future Dividend Yield on Cost (MaxRatio)

MaxRatio is an estimated dividend yield on cost calculated by combining the current dividend yield with the 5-year & 10-year average dividend growth rate, projected over the next 10 years. It provides a clear outlook on future dividend returns.

G-TEKT’s MaxRatio ~10+ ✅

That means an investor today can reasonably expect their yield on cost to approach 9–10% over the next 10–12 years if dividend growth trends continue. For a retail stock, that’s an exceptional long-term dividend compounding profile.

For G-TEKT, the math points to a solid long-term compounding profile rather than an income spike. If the company continues executing with the same discipline, today’s yield has the potential to grow into a meaningfully higher yield on cost over the next decade — exactly what I want from a reinvested-dividend purchase.

The Company’s Fair Value Today: Seems Undervalued

Current Company P/E < Compare to Av. Competitors P/E? - Yes ✅

Current P/E < 10 Years Company Av. P/E? - Yes ✅

Current Dividend Yield > 10 Years Company Av. Dividend Yield? - Yes ✅

Analysts Price Consensus for Today (Or Lack Thereof)

G-TEKT does not have broad analyst coverage, and there’s no widely agreed-upon “target price” being debated across Wall Street.

And you know what? That’s a feature — not a flaw.

It tells me this business is still being valued primarily by its fundamentals, not by short-term narratives, headline upgrades, or quarterly sentiment shifts. The stock trades where it trades because of what the business earns and how it operates — not because analysts are pushing price targets up or down.

For a long-term dividend investor, this is exactly the kind of setup I’m comfortable with. A company quietly running by business rules, not market noise. And for a family portfolio focused on steady compounding, that suits me perfectly.

Max’s Conclusion: ✅

📝 Recent Operating Highlights

Here’s what the company’s recent official results show — with real growth trends and context.

📊 Revenue & Profit Trends

In the most recent annual results, G-TEKT reported revenue of approximately ¥339.2 billion, slightly below the prior year’s ~¥344.6 billion. This reflects a largely flat top line in a challenging global automotive cycle.

Net income came in at ~¥12.44 billion, compared with ~¥13.24 billion a year earlier — a modest decline of about 6% year-over-year, driven by cyclical volume pressure rather than structural weakness.

💼 Gross Profit Expansion

Despite muted revenue growth, gross profit increased to ~¥33.1 billion from ~¥27.8 billion, representing approximately 19% growth year-over-year.

This improvement highlights stronger production efficiency, better cost discipline, and operational leverage — exactly what you want to see from a well-run industrial business during a downcycle.

📈 Operating Profit Growth

Operating profit rose to ~¥16.24 billion, up from ~¥12.83 billion in the prior year — a strong increase of roughly 27% year-over-year.

That level of operating improvement, achieved in a cyclical industry, underscores management’s focus on margin control rather than volume chasing.

💰 Dividend & Cash Returns

G-TEKT currently offers a dividend yield in the ~4.8%–4.9% range, with an annual dividend of ¥90 per share.

The payout ratio sits around 30–34%, indicating a conservative and sustainable dividend policy, supported by earnings rather than financial leverage.

🔮 Outlook: Industrial Resilience With Cyclical Dynamics

Management’s approach remains consistent: protect profitability, control costs, and return capital responsibly while navigating automotive cycles.

Revenue will naturally ebb and flow with global vehicle production, but diversified OEM exposure helps soften regional downturns. Recent improvements in operating profit and gross margins show that efficiency gains matter most during cyclical slowdowns.

Cash flow generation, conservative dividend coverage, and disciplined capital allocation remain core pillars — even as top-line growth pauses.

My Comments

A few important points I want to share.

First, G-TEKT operates not only in Japan but across a broad international footprint — including the United States, Brazil, India, Indonesia, Europe, and the UK. I genuinely like businesses with a global focus and no heavy dependence on a single domestic market. That kind of diversification matters, especially in cyclical industries.

Second, both a quick glance and a deeper dive suggest that the company is currently in solid operating shape. Sales trends remain stable, profitability is consistent, the company periodically executes share buybacks, carries very manageable debt, and has a strong margin of safety when it comes to dividend payments. Overall, this is a very healthy balance sheet.

Third, the stock is trading today at a lower earnings multiple than its 10-year historical average, while offering a dividend yield above its own 10-year average. That combination alone already puts it on my radar.

And there’s an extra bonus on top of that: G-TEKT is currently trading below its book value, at a meaningful discount. The last time I saw a similar setup was with Ono Pharmaceutical and Sato Sho-Ji. Both are still undervalued today — yet their share prices are already up 40–50% from those levels.

⚠️ What I See as the Short-Term Risks

There’s always the risk of backing the wrong company — that can never be fully eliminated. That said, buying a business with this kind of balance-sheet strength and valuation cushion significantly limits downside risk in my view. In my case, the position size is intentionally small — about 0.5% of total capital.

Another point worth noting is the Japanese dividend philosophy. Many Japanese companies follow a payout policy tied to a fixed percentage of the previous fiscal year’s profits, often in the 30–40% range. It’s rare to see decades-long payout ratios of 80%+ in Japan.

G-TEKT currently sits at a payout ratio of around 38%. That suggests we may not see aggressive dividend growth next year. On the other hand, the company has raised dividends consistently for over 15 years, averaging 10%+ annual growth, and the current yield of nearly 5% already provides an attractive income base even if growth moderates.

That’s really it. I’m sharing this to be fully transparent.

At current conditions, I clearly see G-TEKT as a reasonable and well-timed investment, and I’m comfortable adding shares during Monday’s morning session.

The company is available via Interactive Brokers on the Tokyo Stock Exchange, and it’s also accessible through the U.S. OTC market.

📌 G-TEKT

US OTC ticker: GTKKY

Tokyo ticker: 5970

Love what we’re building? Our Founding Partners already enjoy lifetime access to premium content, the app, and our community. Thank you for being a part of it!

📚 Knowledge Base & Premium Guides

Start Here

Guides & Step-by-Step

Deep Insights

📖 I ❤️ Dividends: Why I Believe Dividend Investing Is the Best Strategy | E-Book

How Effective is the MaxDividends Strategy for Building Growing Passive Income

Help & Support

Got a question about dividends? Ask Max, your AI Dividend Assistant!

Didn’t get the answer you need? Reach out: max@maxdividends.app or team@maxdividends.app — we’ll help you out.

MaxDividends Mission

Helping people build growing passive income, retire early, and live off dividends.

Someone’s sitting in the shade today because someone planted a tree a long time ago. ― Warren Buffett.