🎓 MaxDividends Academy Case Study: Microsoft (MSFT)

A step-by-step company analysis that teaches you how to apply the MaxDividends strategy in real life.

MaxDividends Mission: Helping people build growing passive income, retire early, and live off dividends.

This series is part of the MaxDividends Academy — where we teach our proven secret Five-Pillar Formula in practice. Each lesson breaks down a real company, showing how to spot lasting dividend payers and avoid traps, step by step.

Learn Dividend Investing One Stock at a Time

🎓 MaxDividends Academy Case Study: Microsoft (MSFT)

Hey - Max here 💪

When you talk about dividend growth, Microsoft isn’t usually the first name that comes up — but it should be. Behind the tech headlines and trillion-dollar market cap is one of the safest, most consistent dividend machines on Wall Street.

In this Deep Dive, I’ll put Microsoft under the MaxDividends Five-Pillar Formula — our simple, proven checklist for spotting companies that can grow sales, protect profits, keep balance sheets strong, and raise dividends decade after decade.

On this example, I’ll show you exactly how I look at Microsoft, how it fits (or doesn’t fit) my plan, and how I walk through the steps to reach a fact-based conclusion for myself and my investments. No guessing, no hype — just the MaxDividends framework in action. Step by step, it turns a complex decision into something simple and clear, so you can see how the strategy works in real life.

👉 Let’s dive in.

💡 How This Company Makes Money?

Do I clearly understand how Microsoft earns its money — and does the business make sense to me?

Microsoft makes money in a way that’s hard to escape. Most of us touch their products every single day — whether it’s Word, Excel, Outlook, or even LinkedIn. Businesses and governments around the world pay subscriptions to keep these tools running, and once they’re in, they almost never leave.

On top of that, Microsoft has turned its cloud business, Azure, into the backbone of modern computing. It’s what powers apps, data storage, and even artificial intelligence for everyone from small startups to Fortune 500 giants — bringing in steady, recurring revenue that just keeps growing.

And then there’s Windows, Surface devices, and Xbox, now backed by blockbuster gaming titles from Activision, which makes the ecosystem even stickier. The beauty of this setup is simple: Microsoft doesn’t depend on a single product or country.

The money flows in from all sides — software, cloud, devices, and gaming — and most of it is recurring, predictable cash.

Is This a Good Stock to Buy Long Term?

Has the company shown the kind of consistency and resilience I want to see?

Our approach is simple but powerful: stick with reliable, resilient businesses that raise their dividends year after year. The longer you hold, the more income flows into your pocket—steadily, predictably, and without you having to lift a finger. That’s the compounding power behind our strategy.

The MaxDividends Strategy Checklist – Simple Steps to Pick the Right Stocks

Step 1: Dividend History

Our filter: Companies with 15+ years of consistent dividend growth.

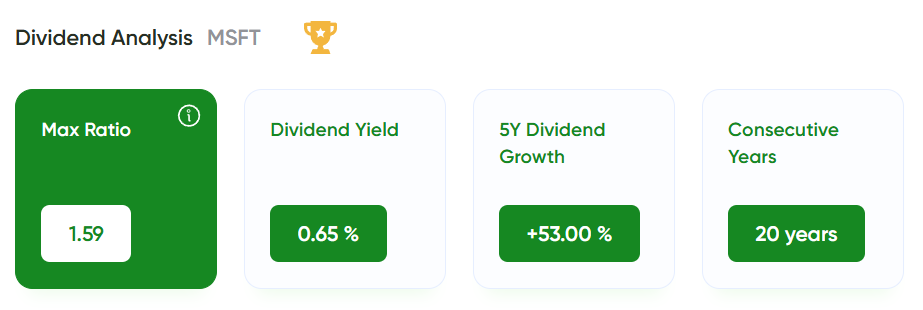

The company has paid dividends since 2003 and raised them every single year. Over the past decade, the average increase has been in the double digits — and in 2025, management already announced another +10% boost.

That track record makes Microsoft a true Dividend Eagle (21+ years of raises) and puts it firmly on the path toward Dividend Aristocrat status (25+ years).

✅ Step 1 passed — Microsoft clears this bar with ease: 20 straight years of dividend hikes. Microsoft’s dividend history proves consistency, reliability, and a clear commitment to shareholders.

Step 2: The Five-Pillar Secret Formula

1️⃣ Sales Growth – The Foundation of a Strong Business

Over the last decade, Microsoft’s revenue more than doubled — from under $100B in 2015 to nearly $250B in 2024. That’s steady, compounding growth driven by Azure cloud, Office 365, and enterprise contracts.

✅ Sales Growth Passed: strong, durable demand fueling expansion.

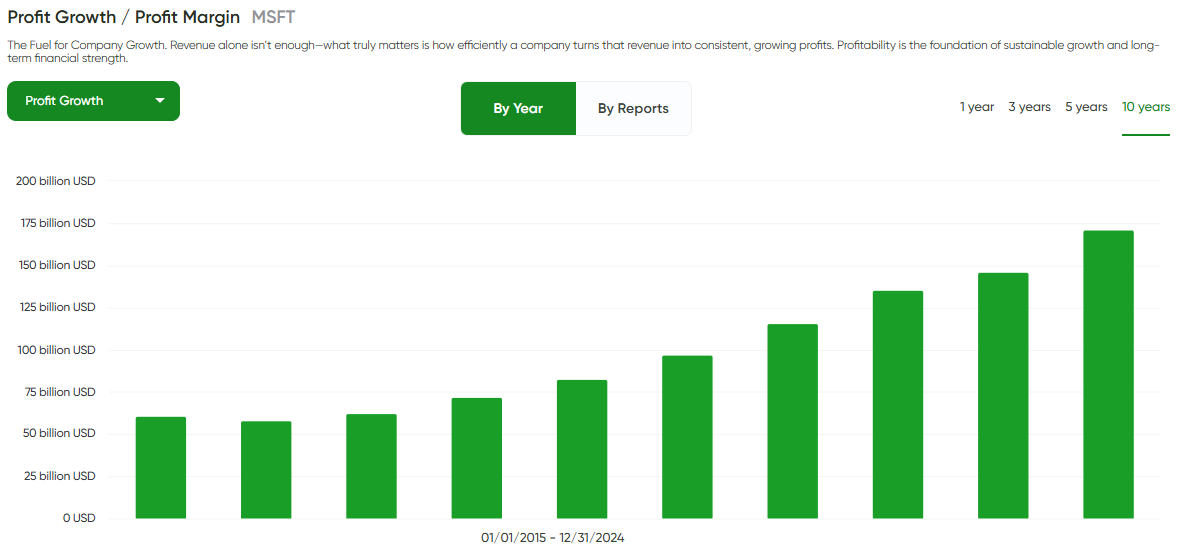

2️⃣ Profit Growth – The Fuel for Dividend Growth

Profits have kept pace with sales. Operating profit grew past $150B in 2024, with margins holding steady thanks to the high-moat software model. Microsoft isn’t just selling more — it’s keeping profits healthy along the way.

✅ Profit Growth Passed: profitability is rising in step with sales.

3️⃣ Net Income – True Measure of Strength

Net income surged from ~$13B in 2015 to over $90B in 2024. Even during global shocks (COVID, rate hikes, inflation), Microsoft stayed consistently profitable. That resilience is exactly what dividend investors want.

✅ Net Income Passed: resilient earning power through all cycles.

4️⃣ Dividend Payout Safety – Protecting Passive Income

TTM payout ratio: ~24%

5-year average: ~29%

This is conservative. Microsoft could double dividends and still have plenty of earnings left over for reinvestment. Dividend safety here is as good as it gets.

✅ Dividend Payout Safety Passed: extremely safe payout with room to grow.

5️⃣ Debt Burden – Avoiding Financial Traps

Debt ratio has stayed below 0.7 for a decade, backed by massive free cash flow. Microsoft carries some debt but it’s tiny relative to its balance sheet and cash generation. No red flags here.

✅ Debt Burden Passed: leverage is low and well-controlled.

Bottom Line: The Company Financial Condition?

Financial Score 90+ ✅

Think of it as a quick health check for any company. The higher the score, the stronger and safer the business. A score of 90+ means it’s rock-solid and built to last.

MaxDividends Five-Pillar Secret Formula. Step 2 - ✅

By our Five-Pillar Secret Formula, Microsoft scores as a sturdy Dividend Eagle—strong history, sensible payout policy, and a decent margin of safety for the road ahead.

The Financial Score inside MaxDividends is built on these very same five pillars, giving you a quick, one-glance way to review any company with the full depth of our proven framework behind it.

✅ Passed: Microsoft - Proven Dividend Eagle 🦅

Does It Fit My Plan?

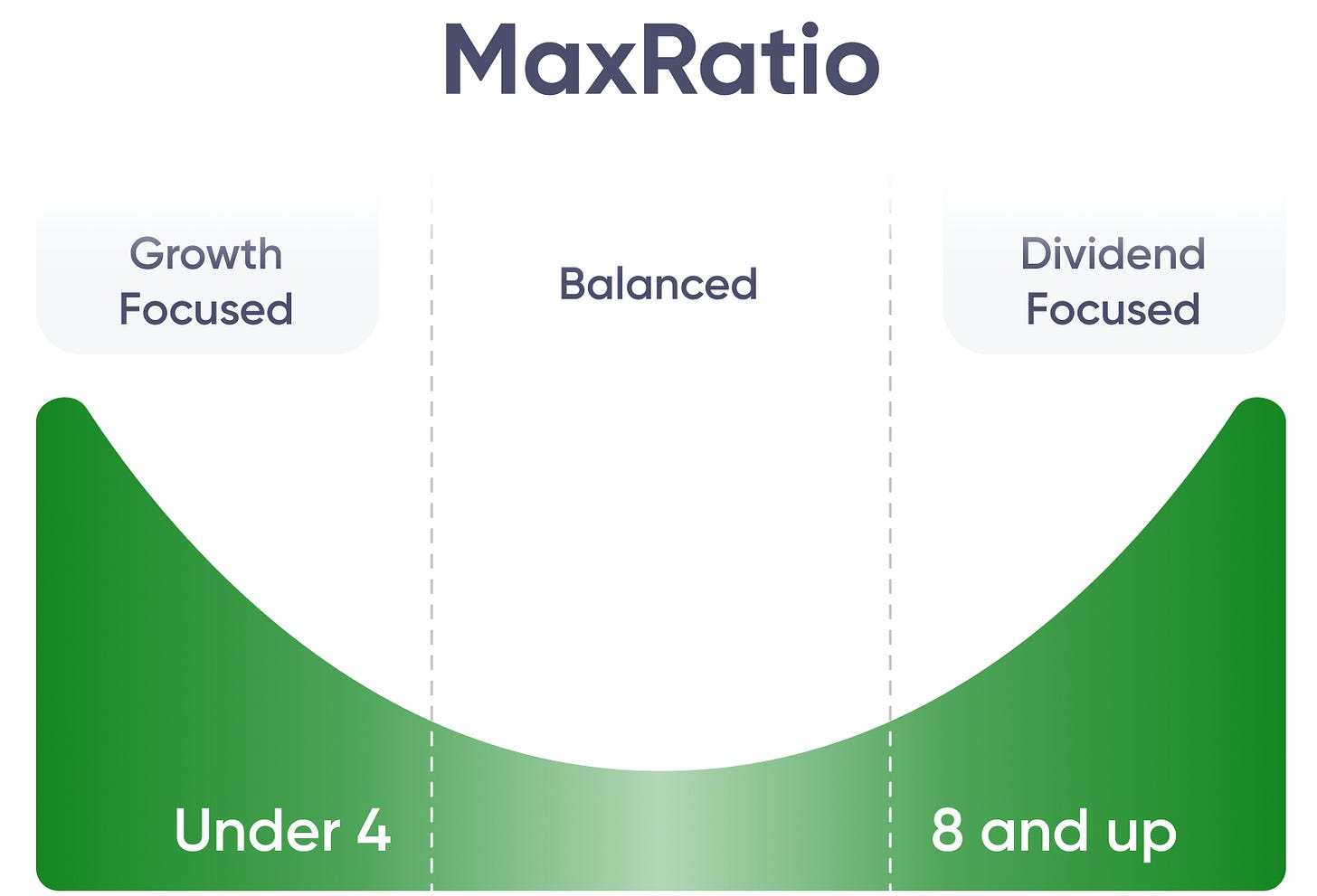

Finding the Right Role for Every Dividend Stock - MaxRatio

Not every dividend stock serves the same purpose — and that’s the beauty of building a portfolio with intention. Some companies are best at growing capital, others strike a balance between growth and income, and a few are built to deliver steady cash right now.

That’s where MaxRatio comes in. It’s a simple metric we created at MaxDividends to help investors cut through the noise and quickly see what a stock is really giving them.

MaxRatio looks at three things: the dividend yield, the pace of dividend growth, and the company’s overall financial strength.

Put together, it shows whether a stock belongs in your portfolio as a growth play, a balanced compounder, or an income leader.

🚀 Growth Eagles (MaxRatio under 4) — Capital growth first. Dividends may be small today, but they’re proof the business is profitable and resilient. These names build wealth over the long haul while quietly compounding income in the background.

⚖️ Balanced Eagles (MaxRatio 4–8) — The best of both worlds. They pay you now and raise those checks steadily year after year, compounding both wealth and income together.

💵 Income Eagles (MaxRatio 8+) — The cash generators. High-yield stocks that put money in your pocket today and usually add a slow but steady growth layer on top. Perfect for reliable, no-drama income.

That’s why MaxRatio matters: it helps you assign the right role to each stock and build a portfolio that works for your goals, whether that’s wealth building, balanced growth, or pure income.

Let’s Take Microsoft

In the MaxDividends app, just head to the Company Analytics section. You can quickly check any stock you’re interested in — see the Financial Score and the MaxRatio in one place. It saves a ton of time.

With a MaxRatio 1.59, modest yield but double-digit dividend hikes and fortress-level financials, it’s the textbook Growth Eagle.

You don’t own it for the paycheck today. You own it because it expands, dominates, and builds capital, while dividends quietly reinforce the strategy.

💵 Is the Stock Undervalued Today?

Cheaper than Competitors?

⚠️ Not cheap vs. peers, but the premium is often justified.

Microsoft shows up as “Fairly valued.” In plain English: it’s priced about right compared to competitors. You’re not getting a bargain, but you’re not badly overpaying either — you’re paying a fair price for a strong, reliable business.

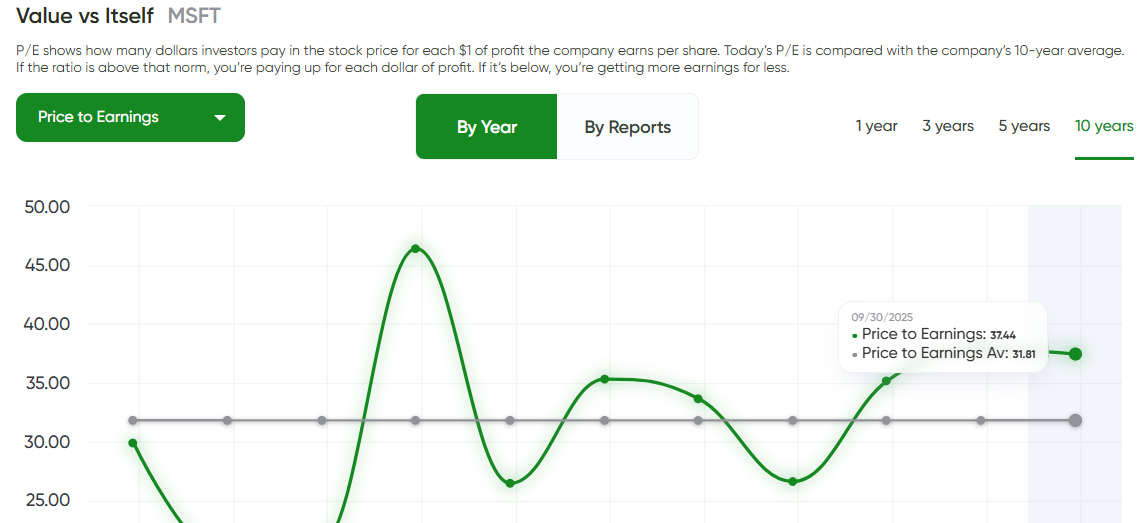

Cheaper than Its Own History?

⚠️ Slightly expensive vs. its own track record.

Over the past 10 years, Microsoft’s stock has usually traded at about 31 times its earnings. Right now, it’s at 37 — which means the stock is more expensive than it normally is. Investors are paying a premium for the company’s safety and growth.

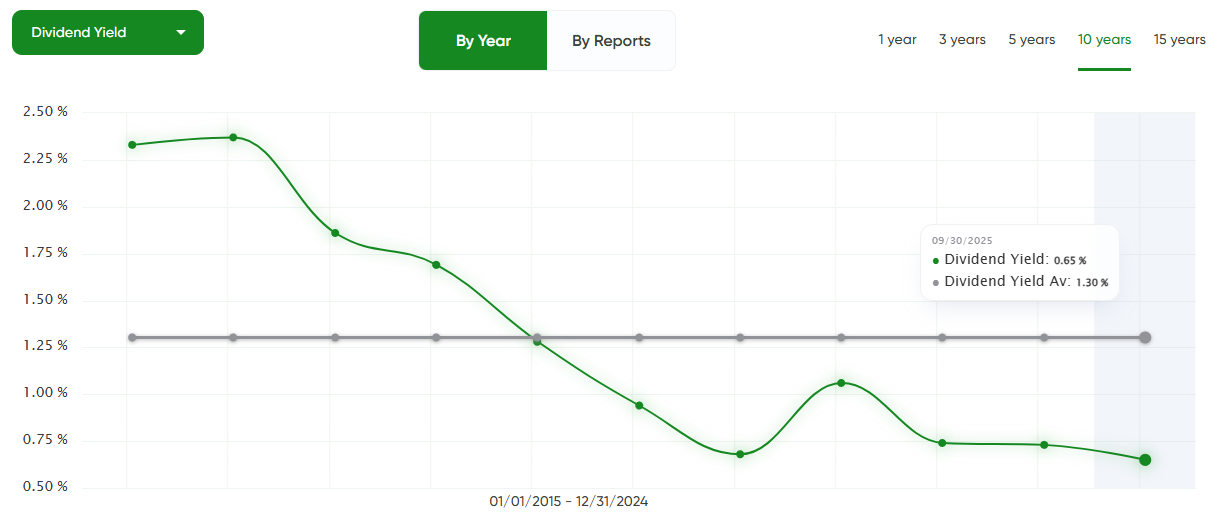

Better Yield Than Usual?

⚠️ Yield below its usual level.

Today’s dividend yield is around 0.6%, which is actually below its 10-year average of ~1.3%. In other words, the yield looks slimmer than usual because the stock price is so strong right now.

Analyst Consensus

✅ Some capital appreciation potential on top of dividend growth.

Stock trades around $420/share. Analyst price targets cluster near $460–480, suggesting ~10–15% upside from here.

Microsoft isn’t “undervalued” in the classic sense — it trades at a premium. But that premium reflects world-class financials, fortress safety, and long-term dividend growth.

Is This One for Me?

Here’s how the company stacks up under the MaxDividends lens:

✅ How This Company Makes Money?

Do I clearly understand how Microsoft earns its money — and does the business make sense to me? (Yes: software, cloud, devices, and gaming, with recurring revenue streams I can rely on.)

✅ Is This a Good Stock to Buy Long Term?

Has the company shown the kind of consistency and resilience I want to see? (Yes: 20 years of dividend growth, strong profits, fortress balance sheet.)

⚠️ Does It Fit My Plan?

No — my strategy is built around stocks that pay a solid dividend upfront and grow it steadily. This company starts with too low a yield, which doesn’t match my goal of building a meaningful passive income stream today.

⚠️ 💵 Is the Stock Undervalued Today?

Not particularly. It trades at a premium, so there’s no immediate value opportunity.

Final Take

This company doesn’t fit my main portfolios — the Family Core Portfolio and the public $12K Dividend Portfolio. In those accounts I look for names with higher dividend payouts today and strong potential for steady raises in the years ahead. I focus on top Dividend Eagles with a MaxRatio of 8+, because the goal there is clear: meaningful dividend income now, with reliable growth year after year.

I don’t need the cash flow immediately, but within the next 5–10 years I plan to stop reinvesting and start living off the dividends. For that mission, Microsoft doesn’t make the cut. Capital growth isn’t my top priority anymore — dividend yield and long-term dividend growth are.

That said, when it comes to my kids’ portfolios, Microsoft is a no-brainer. It’s a fortress-like Growth Eagle 🦅 and belongs on their shortlist as a high-quality business built to drive capital growth over decades.

***

The same simple formula I just used for Microsoft works for any stock. No hype, no noise — just clear steps that let you see whether a company truly fits your plan.

And the best part? This isn’t theory. It’s all already built into the MaxDividends app: the Financial Score, the MaxRatio, the Top Dividend Eagles list, and even my own personal shortlist. Everything in one place, ready whenever you are.

MaxDividends is a treasure chest for dividend investors of any size and focus. Whether you’re after growth, balance, or pure income, you’ll find the tools and the community to back you up.

This series of case studies is here to show you just how simple — and powerful — dividend investing can be. One stock at a time, you’ll see the clarity, the confidence, and the peace of mind that comes from building your own growing stream of passive income.

With respect for your well-being,

Max

Someone’s sitting in the shade today because someone planted a tree a long time ago. ― Warren Buffett.

Learn the MaxDividends Way

Start Here

🔑 Explore the Premium Hub (exclusive — upgrade to unlock)

Guides & Step-by-Step

Deep Insights

📖 I ❤️ Dividends: Why I Believe Dividend Investing Is the Best Strategy | E-Book

How Effective is the MaxDividends Strategy for Building Growing Passive Income

Help & Support

Got a question about dividends? Ask Max, your AI Dividend Assistant!

Didn’t get the answer you need? Reach out: max@maxdividends.app or team@maxdividends.app — we’ll help you out.

The MaxRatio framework is a brilliant way to segment dividend stocks, and Microsoft fits perfectly into the Growth Eagle category. What resonates most is your point about portfolio stage—Microsoft makes sense for capital accumulation phases but less so for someone needing immediate income generation. The 24% payout ratio with consistent double-digit dividend growth shows enormous runway for future increases, which is exactly what younger investors should be hunting for. The Azure revenue stream is particularly compelling because it's high-margin, sticky, and growing faster than legacy businesses. One thing I'd add: Microsoft's ability to bundle AI (Copilot) across their existing ecosystem (Office 365, Azure, Dynamics) creates a defensible moat that most competiters can't replicate. Even with the premium valuation (37x vs historical 31x), the combination of AI tailwinds, subscription durability, and dividend safety makes this a core holding for long-term capital growth. Great breakdown that shows how the same stock serves different purposes depending on your investment horizon.