💡 MaxDividends Mission: Helping people build growing passive income, retire early, and live off dividends.

List of Undervalued Dividend Stocks

These stocks are undervalued. By investing in strong, undervalued companies that frequently increase their dividend rates, we benefit from dividend compounding and strong price performance—getting great businesses at a discount.

⭐️ Start with the MaxDividends App

Hi — Max here.

Let’s start with something practical.

When we talk about “undervalued dividend stocks,” we’re not talking about cheap charts or fallen prices for the sake of it. We’re talking about strong businesses where the market narrative has drifted away from the actual cash-flow reality.

And this month, that gap is wide.

👉 Open the Undervalued Dividend Short-List

Get instant full access to the MaxDividends Universe, MaxDividends Income System & App.

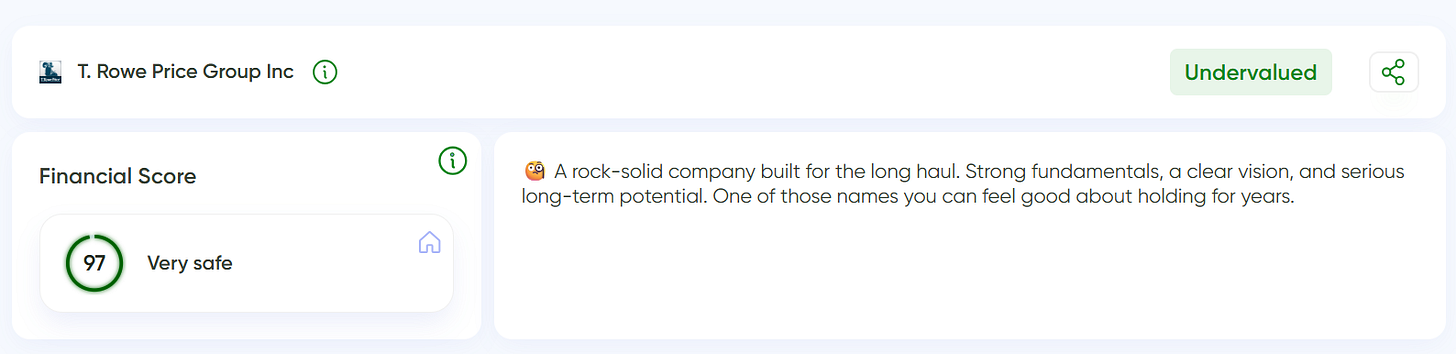

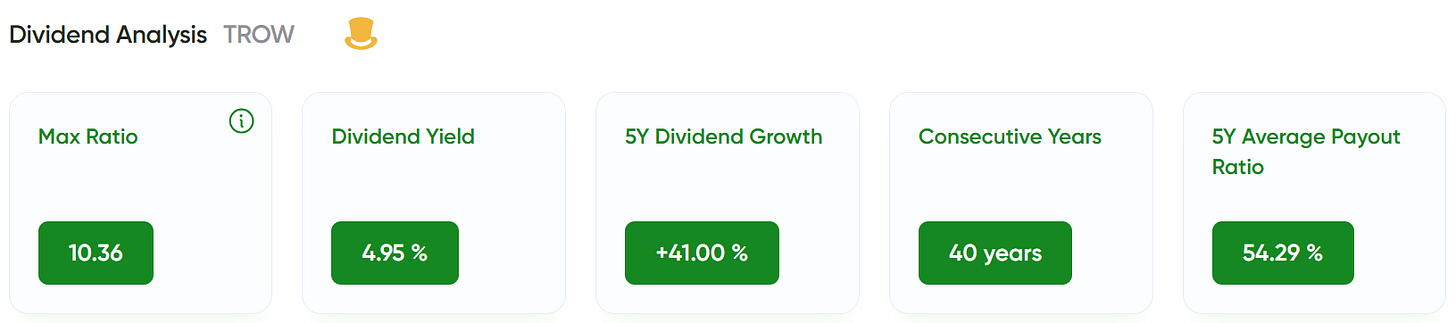

Take T. Rowe Price, for example

The market sees one thing: “Active managers are losing assets to ETFs. Margins may never come back.”

What the numbers show instead:

No debt problems

Massive free cash flow

A dividend that has grown aggressively over the last five years

And a balance sheet that allows management to keep paying — even through ugly cycles

This isn’t a broken business. It’s a cyclical narrative discount.

And those are exactly the moments where long-term income gets an edge.

Or look at Bank OZK

Regional banks are still being painted with a very broad brush. Commercial real estate fears, higher-for-longer rates, headlines that refuse to die.

But when we dig into OZK specifically, we see something different:

Conservative underwriting

Solid credit quality

A dividend that has more than doubled over the last five years

And financial metrics that simply don’t match the current valuation

This is what happens when fear becomes generalized — strong operators get priced like weak ones.

This is where the system matters

Here’s the key point.

Anyone can name an undervalued stock. The real work is knowing which undervaluation actually matters for income — and which ones are traps.

That’s why inside the MaxDividends Income System, valuation is never looked at in isolation.

Every company on this list first clears the hard filters:

Financial strength

Dividend reliability

Payout sustainability

Long-term income quality

Only after that do we ask the valuation question. Inside the system, every company comes with clear guidance based on live data, not opinions:

Is this a Buy at current prices?

Is it a Hold, where income keeps compounding but new capital waits?

Or is it time to Sell and reallocate into a stronger opportunity?

👉 See how the Income System filters real opportunities

Get instant full access to the MaxDividends Universe, MaxDividends Income System & App.

Another good example is Target

Most people stop at: “Margins are under pressure. Consumers are uneven. Retail is hard.”

Fair. But the system goes deeper.

What we see instead:

A long dividend history that management has protected even through worse cycles

Cash flow that still comfortably supports the dividend

And a yield today that prices in a lot of bad news already

That doesn’t mean the stock shoots up tomorrow. It means future income buyers are getting paid while waiting — and often paid more than they were a few years ago.

Why undervaluation accelerates compounding

When a strong dividend business is mispriced, three things quietly work in your favor at once:

Higher starting yield

Faster dividend compounding on reinvestment

Potential price recovery over time — without needing it to “save” the investment

That combination is powerful. And it only shows up when discipline beats emotion.

This month’s Undervalued Short-List is full of these quiet setups — across Dividend Eagles, Aristocrats, and even Kings with 50+ years of increases.

Inside Premium, these names plug directly into our Buy / Hold / Sell List, so there’s always clarity on what fits the system today.

A quick personal note

When I review this list for my own capital, I focus on one simple intersection:

High financial quality + dividend growth capacity + valuation that doesn’t make sense long-term. That’s where income doesn’t just grow — it accelerates over time.

Slowly. Calmly. Predictably.

That’s the entire philosophy behind the MaxDividends Income System and the App that supports it.

No guessing. No chasing. Just structure, data, and patience doing the heavy lifting.

👉 Get full access to the MaxDividends Income System & App

Get instant full access to the MaxDividends Universe, MaxDividends Income System & App.

Because real income isn’t built by reacting to headlines.

It’s built by consistently buying great dividend businesses when the market temporarily forgets what they’re worth.

— Max

P.S. The full, regularly updated lists of Undervalued Dividend Eagles, Aristocrats, and Kings — with Financial Scores, payout metrics, and income forecasts — live inside the App. That’s where this turns from ideas into a working income engine.