Easy Peasy #23: Build Your Dividend Portfolio to Live Off Dividends with Pre-Selected Stock Sets

Dividend Growing Stock Sets starting at $300, $500, or $1000 each week

MaxDividends Mission: Help & support everyone on the way to build growing passive income, retire early and live off dividends

In this section we publish ready-made sets of interesting dividend growth stocks with excellent prospects for dividend growth in the future. The ideas of Easy Peasy sets will be especially interesting for DGI investors.

We also track returns and publish portfolio links for every set so you can see past results and current status in a real-time.

Intro

Fed Hawks Clip Market Wings: Dow’s 10-Day Slide Hits 45-Year Record

Wednesday was an unforgettable day for investors, but not in a good way. The Federal Reserve delivered its widely expected 25-basis-point rate cut, but paired it with a hawkish outlook that rattled the markets. Stocks tumbled across the board, with every major index deep in the red as the Fed projected fewer rate cuts in 2025 and signaled higher inflation ahead. Here’s how the carnage unfolded:

Dow Jones: Crashed 1,123.03 points (-2.58%) to 42,326, extending its losing streak to 10 days, the longest since 1974.

S&P 500: Plunged 178.45 points (-2.95%) to 5,872.

Nasdaq: Tanked 716.37 points (-3.56%) to 19,392, its worst day in nearly five months.

Russell 2000: Collapsed 102.57 points (-4.39%) to 2,231, with small caps hit hardest by rate-sensitive fears.

The pain didn’t stop there: all 11 S&P sectors ended lower, while volatility exploded, sending the VIX surging over 74% to 27.62, its highest level in four months.

What the Fed Did—and Why Markets Freaked

The 25-bps cut was expected, but the dot plot painted a hawkish picture for 2025:

The Fed now anticipates only 50 bps in cuts next year (down from 100 bps forecasted in September).

Inflation (PCE) is expected to end 2025 at 2.5% (up from 2.1% in September), with core inflation at the same level.

GDP growth for 2025 was revised up slightly to 2.1%, while unemployment was revised down to 4.3%.

This combo of higher-for-longer rates, sticky inflation, and a more optimistic growth outlook sent stocks spiraling. The Fed’s reluctance to cut rates aggressively spooked risk assets, especially small caps and tech, which are more sensitive to rate policy.

Economic Data: Housing and Trade Woes

Housing Starts:

Fell -1.8% in November to an annualized rate of 1.289M (below estimates of 1.343M), led by a -23.2% drop in multifamily starts.

Housing permits rose +6.1%, signaling potential stabilization ahead.

Current Account Deficit:

Ballooned to a record -$310.9B in Q3, up from -$266.8B in Q2.

Mortgage Rates:

The average 30-year fixed-rate mortgage rose to 6.75%, refinancing demand fell -3%, but purchase applications ticked up +1%.

Treasuries and Currencies: Hawkish Fed Fuels Big Moves

Treasuries:

The 10-year yield surged 8.2 bps to 4.484%, while the 2-year yield climbed to 4.307%.

Dollar:

The DXY Index spiked 1.2% to 108.25, with the euro falling to $1.0346 (-1.35%).

Bitcoin plunged -5%, retreating to $101,000 amid a flight to safety.

Sector Highlights: No Shelter in the Storm

Tech: Freefall for Growth Stocks

Tesla (TSLA): Tumbled -8.3%, erasing much of its December rally.

Nvidia (NVDA): Fell -4.5%, extending recent losses as investors rotated out of high-beta names.

Retail: OLLI Stands Out

Ollie’s Bargain Outlet (OLLI): Double upgraded by Citi to Buy, shares jumped +3.4% as investors sought defensive retail plays.

General Mills (GIS): Dropped -3.7% after cutting its earnings outlook due to promotional pressures.

Energy: Resilient Amid the Rout

Oklo (OKLO): Gained +6.8% after signing a nuclear power deal with AI firm Switch.

Halliburton (HAL): Downgraded by Barclays, falling -5.1% as bearish sentiment hit the oil services sector.

Crypto Miners:

Riot Platforms (RIOT) and Marathon Digital (MARA) slipped -6.5% and -8.1%, respectively, as Bitcoin slumped below $100,000.

Bottom Line: Buckle Up for Volatility

The Fed’s hawkish surprise sent shockwaves through every corner of the market, ending a six-week equity rally and deepening the Dow’s historic losing streak. With volatility spiking and year-end positioning in full swing, investors are bracing for more turbulence as we head into 2025. Stay nimble—it’s going to be a wild ride.

--

But none of this news really matters to MaxDividends members. We're all about growing the cash flow everyone gets in their pocket each month. No stressing over price swings or stock market noise.

At MaxDividends, we focus on a dividend growth strategy. It’s a great fit for investors who want capital appreciation, a decent level of safety, and growing income.

A growing dividend is a clear indicator that a company is thriving and wants its shareholders to thrive with it.

This week, we’ve rolled out a fresh batch of ready-to-go MaxDividends Stock Sets 💪.

Easy Peasy #23: Pre-Selected Dividend Growing Stock Sets

⭐️ $300 per week. Week 23

👉 Link to real-time MaxDividends $ 300 / Weekly Portfolio

Today's investment: ~ $248.80

Total Invested: ~ $7,015.15

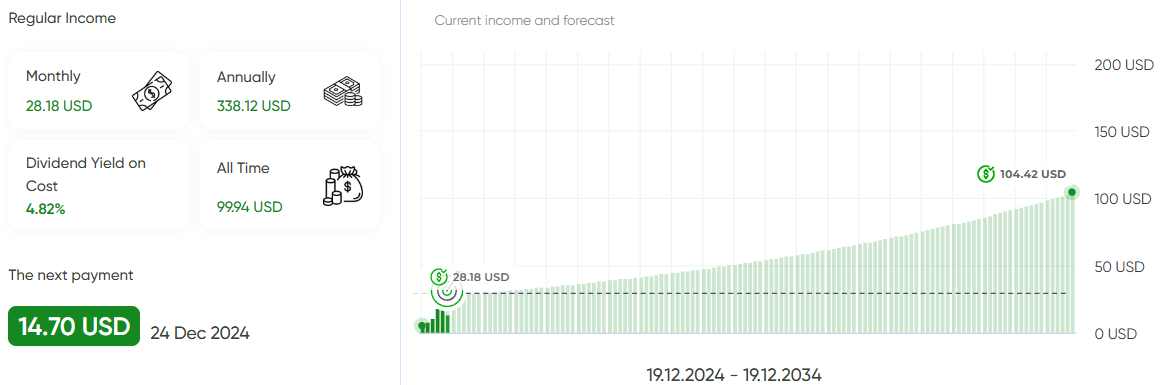

Portfolio dividend yield on cost: ~ 4.83% | Dividends now: ~ $338.12

$ 248.80 / 300.00

Archier Daniels Midland | Shares: 2 Price: 49.67 Total: 99.34 USD

Skyworks Solutions | Shares: 1 Price: 88.47 Total: 88.47 USD

Greif Inc | Shares: 1 Price: 60.99 Total: 60.99 USD

Stock News in the Portfolio

🏆 Cisco Systems, Inc showed profitability +20.65%

Robert Half International Inc showed profitability +12.15%

Starbucks Corporation showed profitability +18.30%

⭐️ $500 per week. Week 23

👉 Link to real-time MaxDividends $ 500 / Weekly Portfolio

Today's investment: ~ $400.26

Total Invested: ~ $11,690.34

Portfolio dividend yield on cost: ~ 4.98% | Dividends now: ~ $577.15

$ 400.26 / 500.00

Abbott Laboratories | Shares: 1 Price: 112.99 Total: 112.99 USD

Medtronic | Shares: 1 Price: 80.16 Total: 80.16 USD

Brunswick Corporation | Shares: 1 Price: 67.06 Total: 67.06 USD

Skyworks Solutions | Shares: 1 Price: 88.47 Total: 88.47 USD

Winnebago Industries | Shares: 1 Price: 51.57 Total: 51.57 USD

Stock News in the Portfolio

🏆 Central Pacific Financial Corp showed profitability +33.79%

Johnson & Johnson is planned to pay dividends 1.24 USD per share

CompX International Inc is planned to pay dividends 0.30 USD per share

PPG Industries, Inc. is planned to pay dividends 0.68 USD per share

👉Real Time Investing with $500. Take a Look on Goals, Progress, Vision

How to Get Started. RoadMap and Tools to Live Off Dividends. Weekly Updated.

⭐️ $1,000 per week. Week 23

👉 Link to real-time MaxDividends $ 1,000 per week portfolio

Today's investment: ~ $884.93

Total Invested: ~ $24,256.15

Portfolio dividend yield on cost: ~ 4.81% | Dividends now: ~ $1,160.88

$ 884.93 / 1,000.00

Cisco Systems | Shares: 2 Price: 57.84 Total: 115.68 USD

T. Rowe Price | Shares: 1 Price: 112.92 Total: 112.92 USD

Nike | Shares: 2 Price: 77.11 Total: 154.22 USD

Cohen & Steers | Shares: 1 Price: 90.53 Total: 90.53 USD

Greif Inc | Shares: 2 Price: 60.99 Total: 121.98 USD

Abbott Laboratories | Shares: 1 Price: 112.66 Total: 112.66 USD

Skyworks Solutions | Shares: 2 Price: 88.47 Total: 176.94 USD

Stock News in the Portfolio

🏆 Cisco Systems, Inc showed profitability +21.59%

Chevron Corporation is planned to pay dividends 1.63 USD per share

CompX International Inc is planned to pay dividends 0.30 USD per share

Robert Half International Inc is planned to pay dividends 0.53 USD per share

Max’s Comments

The companies we choose here for Easy-Peasy Section are great compounders with double-digit dividend yield potential over 10-12 years.

The Easy-Peasy Portfolios are builded with MaxDividends Tools:

MaxDividends App

MaxDividends Assistant - Dividend Ideas

Dividend Eagles List of Stocks

Investing in dividend growth stocks allows you to generate growing passive income. Using ready-made dividend stock sets as an example, you can see how it works.

Anyone can follow the MaxDividends Concept. We have collected various tools for investors. We are the most dividend community on Earth. And we also live and dream of living off dividends.

For Dividend Beginners

Start with Ready-to-Go MaxDividends Assistant to launch your passive growing income to retire early and live off dividends.

For Experienced Dividend Investors

List of Top Dividend Stocks to your own due diligence, Top Ideas Weekly, Deep Reports with the most undervalued and perspective dividend companies.

For All Dreamers to Live Off Dividends

The Most Dividend Community on Earth, Personal support from Max and Max Team, Dividend Tools to enjoy the journey.

As an author of the MaxDividends Concept and Strategy I follow it to pick up high-yield & dividend growth stocks to live off dividends and retire early.

By creating a dividend snowball, you and I are step by step gaining freedom by supporting the best businesses with the right values. It matters.

MaxDividends App

We’re building the best app in the world for dividend investors to help everyone on the way retire early, live off dividends and build growing passive income with dividends.

MaxDividends Idea

👉 My Own High Yield Dividend Growth Story

Retire Early and Live Off Dividends. $12,000 monthly for 120 months. No one wants to work forever. Make sense? Don’t hesitate to message me with any question.

MaxDividends Key Concept

Predictability in important things is the foundation of peace of mind. Peace of mind is the basis of financial well-being. MaxDividends is all about peace of mind.

At MaxDividends, we focus on a dividend growth strategy. It’s a great fit for investors who want capital appreciation, a decent level of safety, and growing income.

As the name suggests, dividend growth investing is all about finding stocks that pay dividends and can keep growing them over time. MaxDividends is all about that plus maximizing yields to get the most from dividends and boost growing passive income on your side.

MaxDividends Stocks pay sustainable dividends by decades without interruption, rasing them consistently over years.

Look at this:

Wednesday, September 25 – $1,814

Thursday, September 26 – $1,827

Friday, September 27 – $1,834

Previous Month → Today - $2,043.. → $2,697.51

Just a few days in my life of a dividend investor. These are my monthly dividends from total investments for now.

MaxDividends Premium Partners already know the magic formula: Each dividend increase puts more money into our pocket.

Remember dividends are deposited as cash into your trading account, you can spend the money if you wish or re-invest it.

My dividend income just keeps growing. Almost every day. Always upward.

Coffee gets cheaper, lunch becomes free, and life gets brighter. My Projected MONTHLY Income in 10 Years from Now

October’24 $10,393.59 → Today → $12,396.10

Enjoy Dividend Idea? Join to move together

We are recommended on Substack

Supported by 21,000 subscribers. Inspired by 15,000 constant readers.

The European Value Investor ⭐️⭐️⭐️⭐️⭐️

“If you are interested in dividend strategies or passive income strategies, this Substack ia great! Its worth a visit“

Johan Lunau - The Long View ⭐️⭐️⭐️⭐️⭐️

“Practical dividend focus. Saving for retirement.“

Shailesh Kumar - The Astute Investor’s Calculus ⭐️⭐️⭐️⭐️⭐️

“Love the concept and the execution. If you are into building a portfolio that will generate ever growing income for you, subscribe to Max Dividends. I did.“

MS Cliff Notes ⭐️⭐️⭐️⭐️⭐️

“A useful substack for those that invest in stocks that pay dividends or are looking to get into such a strategy. Includes education and actionable ideas.“

Timothy Assi - Panic Drop ⭐️⭐️⭐️⭐️⭐️

“Great for helling you pick up high-yield dividend growth stocks“

And 100+ more other great authors and pro’s are recommend MaxDividends!

Someone's sitting in the shade today because someone planted a tree a long time ago. ― Warren Buffett.