Down 30% in 2025: Is This Dividend King a Must-Buy Stock Now?

Target shares have fallen 30% this year, pushing the company's dividend yield up to 4.7%. But given its weak financial results, is buying shares in this retail giant at such low levels a wise decision

MaxDividends Mission: Helping & Supporting Everyone in Building a Growing Passive Income, Retiring Early, and Living Off Dividends.

For dividend investors seeking opportunities with strong growth potential, MaxDividends Stock Ideas offers a daily, in-depth look at companies worth considering for a dividend portfolio.

Start Here: The MaxDividends Guide to Passive Income

Intro

💡 Invest in companies you believe in - W. Buffett

This is a Dividend King with 54 consecutive years of payout hikes, is facing one of its toughest stretches yet. Shares have tumbled over 30% year-to-date as sluggish sales, inflated inventories, and stiff competition from Walmart and Amazon raise doubts about a turnaround.

With management forecasting another year of declining earnings, investors are left wondering: Is Target a screaming bargain at these prices, or is further downside ahead? We break down the retailer’s latest results, turnaround strategy, and whether the stock is truly a no-brainer buy today.

History of the Company

Target Corporation traces its origins to 1902 when businessman George Dayton founded Goodfellow Dry Goods in Minneapolis, Minnesota. Renamed Dayton Dry Goods Company in 1903 and later Dayton Company in 1910, the retailer grew into a regional department store chain known for its conservative Presbyterian values, including no Sunday operations or alcohol sales.

A pivotal moment came in 1962 when Dayton’s leadership launched the first Target discount store in Roseville, Minnesota, pioneering an upscale yet affordable retail model. By 1969, Dayton merged with Detroit’s J.L. Hudson Company to form Dayton-Hudson Corporation, which expanded through acquisitions like Mervyn’s (1978) and Marshall Field’s (1990). Target’s success as the group’s top revenue driver led to a corporate rebranding as Target Corporation in 2000, shedding non-core assets to focus on its signature discount chain.

Over the decades, Target innovated with formats like SuperTarget (1995) and small-format urban stores, while navigating challenges such as a failed Canadian expansion (2015) and a massive 2013 data breach.

Today, with nearly 2,000 U.S. stores and a focus on e-commerce (e.g., acquiring Shipt in 2017), Target remains a retail leader, blending value, design, and community philanthropy—a legacy rooted in Dayton’s original 5% profit-giving pledge.

A Proven Dividend Eagle 🦅

50+ consecutive years of dividend increase

Target Corporation (TGT) stands as a proven Dividend Eagle, boasting 54 consecutive years of dividend increases—a testament to its resilience through economic cycles, shifting consumer trends, and retail industry disruptions.

Despite recent challenges, including a 30% stock decline in 2025 due to earnings pressure and inventory mismanagement, Target’s 4.7% dividend yield remains one of the highest in its sector, offering income-focused investors an attractive entry point.

The company’s ability to maintain and grow its payout for over half a century underscores its strong cash flow generation, disciplined capital allocation, and commitment to shareholder returns—qualities that define elite dividend kings.

While its turnaround efforts, including digital expansion and cost optimization, are still unfolding, Target’s low forward P/E (~10-13.5) and historical reliability make it a compelling candidate for long-term dividend growth portfolios.

Key Strengths

54-year dividend growth streak (one of the longest in retail)

4.7% yield, nearly 3x the S&P 500 average

Fortress balance sheet with a payout ratio below 60%, supporting sustainability

Omnichannel resilience, with e-commerce sales growing at a 4.7% clip in Q1 2025

🦅 Dividend Eagles

An updated compilation of 100+ top-performing dividend stocks with 15+ years of consecutive dividend increases, selected based on MaxDividends’ strict criteria.

Companies featured on the Dividend Eagles list have a proven track record of regular and increasing dividend payouts. This ensures you receive a reliable income, whether you're planning for retirement or seeking additional cash flow.

The Dividend Eagles list offers precisely that—a gateway to financial growth and stability.

Beyond dividends, these companies often exhibit strong fundamentals and growth prospects. Investing in them not only provides income but also the opportunity for your investment to grow over time.

This is how we build our own growing passive income and long-term wealth.

Key Institutional Investors in Target Corporation

Target Corporation (NYSE: TGT) is overwhelmingly owned by institutional investors, who control approximately 86% of its outstanding shares—a level of institutional backing that signals strong confidence from major financial players but also exposes the stock to potential volatility based on their trading activity.

The top 22 shareholders alone hold 51% of the company, ensuring collective influence over corporate decisions while preventing any single entity from dominating governance.

Leading Shareholders:

The Vanguard Group, Inc. – 10% ownership, making it the largest institutional shareholder.

State Street Global Advisors, Inc. & BlackRock, Inc. – Each holds 7.7%, reflecting the dominance of passive index funds in Target’s ownership structure.

Other Major Holders – Firms like UBS Asset Management (0.89%) and Geode Capital Management also maintain significant positions, contributing to the stock’s liquidity and stability.

What Makes Target Stand Out?

Target Corporation (NYSE: TGT)

Financial Score: 91 / 99 ⭐️⭐️⭐️⭐️

Industry: Discount Stores

👉 Learn more about Financial Score

Target Corporation (NYSE: TGT) is a leading American retail giant, operating as a general merchandise and grocery retailer with nearly 2,000 stores across the U.S. and a robust digital presence via Target.com.

Founded in 1902 as Goodfellow Dry Goods and later rebranded in 1962 as the first Target discount store, the company has grown into the seventh-largest U.S. retailer and a S&P 500 component.

Core Business Operations

Target offers a diverse product range, including:

Apparel & Accessories (clothing, shoes, jewelry)

Electronics & Entertainment (toys, video games, home tech)

Home Goods & Furniture (décor, appliances, bedding)

Groceries & Essentials (perishables, snacks, household supplies)

Exclusive Brands (e.g., Cat & Jack, Threshold, Good & Gather).

The company differentiates itself through "cheap chic" merchandising, blending affordability with trendy design, and emphasizes same-day services (e.g., Shipt delivery, acquired in 2017) to compete with e-commerce rivals like Amazon.

Financial & Social Impact

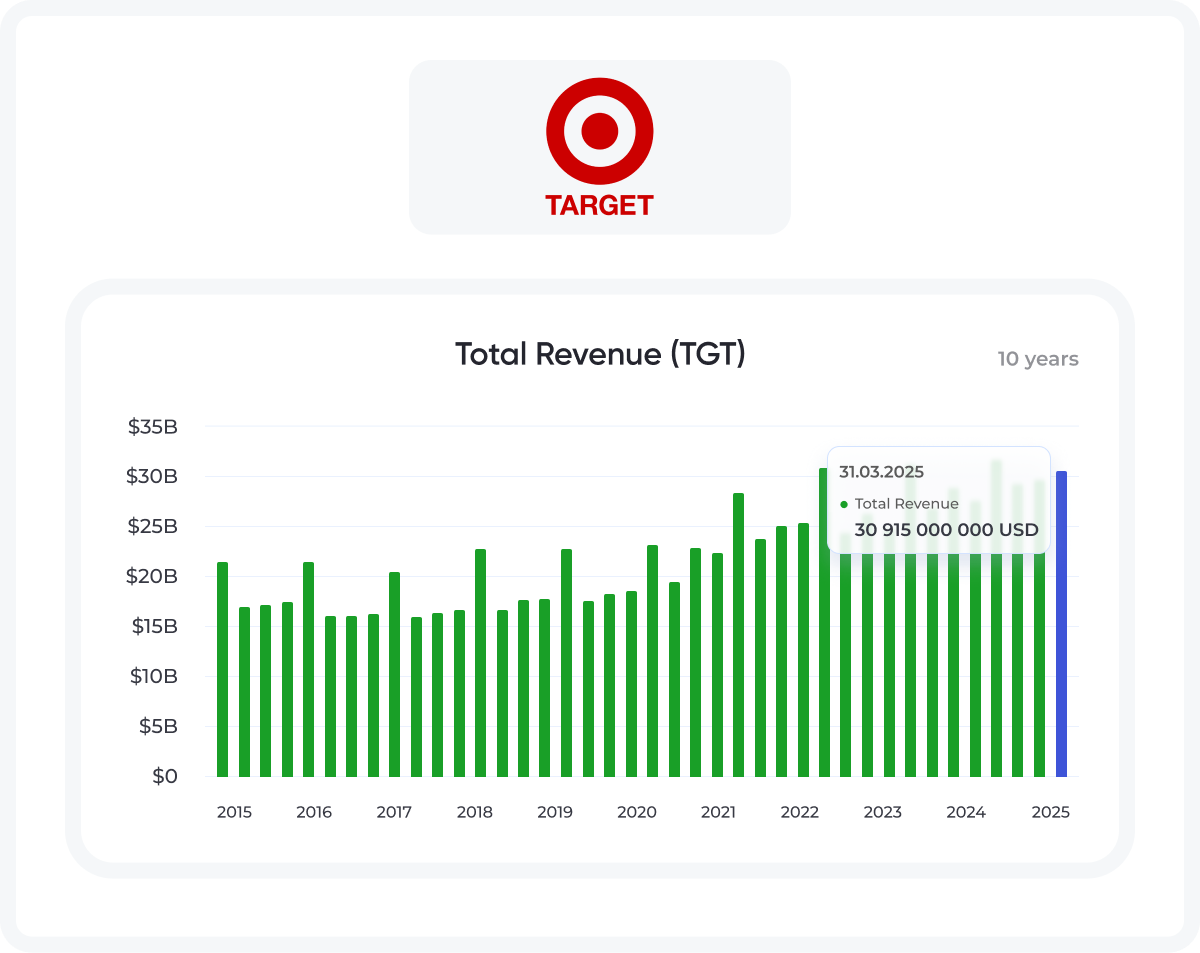

Revenue (2024): $106.6 billion, with 440,000 employees globally.

Philanthropy: Donates 5% of profits to communities, a tradition since 1946.

Challenges: Recent stock declines (-30% YTD in 2025) reflect inventory mismanagement and soft consumer demand, though its 4.7% dividend yield and 53-year payout growth streak appeal to income investors.

Target Corporation - Quick MaxDividends Team Overview

🟢 Recent reports confirm that the company is profitable.

🟢 A positive factor is the dynamics of business sales growth

🟢 The dynamics of operating profit growth over recent years underscores the company’s successful steps to expand and strengthen its position in the markets.

🟢 Earnings per share are growing, the dynamics have been positive for several years. This means the company knows how to manage business profitability and maintain it for many years

🟢 The company demonstrates a high degree of sustainability and provides stable income.Financial Statement

If you want to stay on top of your portfolio's health, don't forget to check in on the financials of the companies you've invested in. The better shape they’re in, the better your results will be. Keep an eye on their quarterly and annual reports to see how they're performing.

Here is a quick dive into Target Corporation over last years

The strongest and most stable companies tend to have a Financial Score of 80+, with the very best ones hitting 90+. If you see that score start to dip below 80, that’s your cue to consider jumping ship before things get worse.

👉 Learn More about Financial Score

Our Paid Members get access to a curated watchlist of 19,000 companies worldwide, all scored by our team on a regular basis. Companies like Target Corporation are on that list, too.

Future Growth Prospects for Target Corporation.

Target Corporation (NYSE: TGT) is navigating a challenging retail landscape but has outlined several strategic initiatives to drive long-term growth.

Despite recent headwinds—including a 30% YTD stock decline in 2025 due to soft consumer demand and inventory issues—the company’s multi-year Enterprise Acceleration Office, launched in May 2025, aims to streamline operations, enhance agility, and leverage AI-driven tools to improve inventory management and cost efficiency.

Key growth drivers include

Digital Expansion: Target’s digital sales grew 4.7% YoY in Q1 2025, fueled by same-day services like Drive Up and Target Circle 360, which saw a 36% surge in delivery demand. The company plans to further integrate its $20 billion first-party e-commerce business with its physical stores, creating a seamless omnichannel experience.

Private Brands & Partnerships: Target’s $31 billion owned-brand portfolio (e.g., Cat & Jack, Good & Gather) and collaborations (e.g., kate spade, Ulta Beauty) continue to differentiate its assortment. The success of limited-time designer collections, like the record-breaking kate spade partnership, highlights the potential for high-margin exclusives.

Loyalty Program: The revamped Target Circle program, with over 100 million members, drives repeat purchases—subscribers spend 8x more than non-members. Coupled with Roundel, Target’s $2 billion ad business, this ecosystem enhances personalized marketing and revenue diversification.

Cost Optimization: Target has saved $2 billion over two years through efficiency measures and plans to reinvest in pricing, supply chain upgrades, and small-format stores (20+ new locations annually) to capture urban and college markets.

Long-Term Targets: Management aims to add $15 billion in revenue within five years, focusing on high-frequency categories (groceries, essentials) and discretionary recoveries (apparel, home goods). The company’s 4.7% dividend yield and 53-year payout growth streak also position it as a resilient income stock.

Risks to Watch: Inflationary pressures, competition from Walmart and Amazon, and execution risks in inventory management could delay progress. However, Target’s low P/E (~10.7) and $8.4 billion share buyback capacity provide flexibility to capitalize on a potential turnaround.

Target Corporation Financial Performance

Target Corporation (NYSE: TGT) reported mixed financial results in Q1 2025, with net sales declining 2.8% year-over-year to $23.8 billion, driven by softer consumer demand and a 3.8% drop in comparable sales (including a 5.7% decline in physical store sales).

However, digital comparable sales grew 4.7%, fueled by a 36% surge in same-day delivery services (Target Circle 360 and Drive Up). Despite revenue pressures, GAAP EPS rose to $2.27 (up from $2.03 in 2024), though adjusted EPS—excluding a $593 million litigation settlement gain—was just $1.30, reflecting ongoing profitability challenges.

Key Financial Metrics

Gross margin: Fell to 28.2% (from 28.8% in 2024) due to higher markdowns and digital fulfillment costs.

Operating income: Increased 13.6% to $1.5 billion, but the margin (excluding one-time gains) dropped to 3.7%, highlighting operational strain.

Inventory management: Levels rose 11% year-over-year, signaling overestimation of demand and potential markdown risks.

Shareholder returns: Paid $510 million in dividends (up 1.8% per share) and repurchased $251 million in stock, with $8.4 billion remaining in buyback capacity.

2025 Outlook: Target anticipates a low-single-digit sales decline and adjusted EPS of $7.00–$9.00, reflecting cautious optimism amid economic uncertainty26. The newly formed Acceleration Office aims to streamline operations, but near-term headwinds persist8. Investors are closely watching inventory normalization and holiday-season performance for signs of a turnaround.

Target Corp Dividend Data

With MaxDividends, it's easier than ever to access top dividend companies, track your results, and explore new dividend ideas.

The MaxDividends Top Stocks List features ~100 of the most reliable dividend companies in the U.S. market, each with 15+ years of consecutive dividend increases. These stocks are carefully selected based on MaxDividends' strict criteria for consistency and reliability.

Dividend Kings represent the elite tier of dividend growth stocks. With 50+ years of consecutive dividend increases, these companies offer unparalleled income stability, making them a top choice for investors seeking long-term reliability in an unpredictable market.

With 25+ years of consecutive dividend increases, Dividend Aristocrats are among the strongest dividend growth stocks. These companies have a proven track record of not only maintaining but consistently increasing their dividends, often outperforming the broader market over time.

Why Invest in Target Corporation?

Target Corporation (NYSE: TGT) presents a compelling investment opportunity due to its strong brand recognition, resilient business model, and attractive shareholder returns. As a Dividend King with 54 consecutive years of dividend increases, Target offers a 4.7% yield—one of the highest in the retail sector—making it a prime choice for income-focused investors.

The company’s omnichannel strategy, blending in-store and digital sales (with e-commerce growing at 4.7% YoY), positions it well in a competitive retail landscape dominated by Walmart and Amazon.

Additionally, Target’s valuation appears attractive, trading at a forward P/E of ~10-13.5, significantly lower than Walmart’s 36.9, suggesting potential upside if operational improvements materialize. The company’s $8.4 billion share buyback program and strategic investments in AI-driven supply chain optimization further enhance its long-term growth prospects.

While near-term challenges—such as inventory mismanagement and macroeconomic pressures—have weighed on the stock, Target’s loyalty program (Target Circle, with 100M+ members) and expansion into high-growth categories (e.g., Ulta Beauty shop-in-shops) provide a roadmap for recovery.

For investors seeking a high-yield, blue-chip stock with turnaround potential, Target represents a balanced mix of income and growth opportunity.

Interesting Fact

In 2012, Target's data analytics team made headlines when their pregnancy-prediction algorithm accurately identified a teenage girl's pregnancy before her own family knew. By tracking subtle changes in purchasing habits - like switching to unscented lotion or buying prenatal vitamins - Target's system could predict pregnancies with startling accuracy.

An angry father famously stormed into a Minnesota store demanding answers after his daughter received maternity coupons, only to later discover Target's prediction was correct.

This controversial case study revolutionized retail marketing while raising serious privacy concerns. Target now blends pregnancy-related ads with general offers to avoid startling customers, but the incident remains a legendary example of just how powerful - and intrusive - consumer data analytics can be. The story was later featured in Charles Duhigg's bestseller "The Power of Habit."

Competitors

1. Costco Wholesale Corp (NASDAQ: COST)

Financial Score: 95 / 99

Industry: Discount Stores

Costco Wholesale Corporation is an American chain of membership-only warehouse clubs operating on a subscription-based model (paid membership required).

The company sells bulk goods at discounted prices, including groceries, electronics, appliances, clothing, and more.

2. Walmart Inc (NYSE: WMT)

Financial Score: 86 / 99

Industry: Discount Stores

Walmart Inc. is the world's largest retail corporation, operating a vast network of hypermarkets, discount stores, and supermarkets under its flagship Walmart brand along with warehouse clubs under Sam's Club.

Headquartered in Bentonville, Arkansas, the company serves customers through over 10,500 stores across 20+ countries and through growing e-commerce platforms.

Current Market Value

Undervalued \ Overvalued \ Fairly Valued

Compare the P/E ratios of competitor companies to assess whether the stock you're considering is overvalued. We calculate the average P/E among competitors as a benchmark.

If a company's current P/E is 20% or more below the competitor average, it is considered undervalued.

If it is 20% or more above, it is considered overvalued.

The P/E ratio is calculated by dividing the market value per share by earnings per share (EPS).

Undervalued

Analysts Consensus

Analyst sentiment toward Target Corporation (TGT) remains cautiously optimistic, with the majority maintaining a "Hold" rating, as seen in recent recommendations.

The data shows 37 analysts recommend "Hold", while 11 suggest "Buy" or "Strong Buy", and 7 advise "Underperform" or "Sell".

This mixed outlook reflects uncertainty about Target's near-term performance amid operational challenges, despite its long-term strengths.

Price targets reveal a wide range of expectations, with an average target of $103.23 (6% upside from the current $97.37), a low of $80.00 (18% downside risk), and a high of $135.00 (39% potential upside). The dispersion highlights divergent views on Target's ability to execute its turnaround.

Final Thoughts: Should You Buy Target Corporation?

Key Takeaway: While analysts acknowledge Target's valuation appeal and dividend reliability, many await clearer signs of sustained improvement before upgrading their ratings. Investors should weigh the bullish long-term potential against near-term volatility.

Target Corporation presents a compelling but nuanced investment opportunity. On one hand, its 53-year dividend growth streak and 4.7% yield make it attractive for income investors, while its discounted valuation (P/E ~10-13.5) suggests potential upside if management executes its turnaround. The company’s strong private-label brands, loyalty program (100M+ Target Circle members), and omnichannel capabilities provide competitive advantages.

However, near-term risks remain, including inventory challenges, soft discretionary spending, and intense competition from Walmart and Amazon. Investors must weigh Target’s long-term brand strength and dividend reliability against its short-term operational headwinds.

If you believe in management’s ability to streamline costs and reignite growth—and can tolerate volatility—Target could be a rewarding contrarian buy. For more conservative investors, waiting for clearer signs of sustained sales recovery may be prudent. Ultimately, Target suits those seeking high yield with turnaround potential, but it’s not without risk.

To your wealth, MaxDividends Team

More Dividend Ideas

Scroll Down to Read. Don’t have access? Check Your Paid Status & Upgrade to Premium.

Don’t have access? Check Your Paid Status & Upgrade to Premium.

⭐️ ⭐️⭐️⭐️⭐️

MaxDividends is a Bestseller on Substack!

Hundreds of premium members have already discovered the benefits of the community and app, earning passive income through dividends with MaxDividends. Their passive income keeps growing!

We Are Already Recommended by Our Community

Russell - "Want to get caught up with your portfolio so far and follow along until we can all retire. "

Todd - "Just found this site --excited to get started!"

Vinny - "Helping retail investors retire early and comfortably "

And Many Others

“You are serious and trustwhorty”

“Developing an additional source of retirement income.”

Thought I would share - I was able to create an Ultra High Dividend portfolio w/15 companies today that would net me a $4,200+/month income. I just retired this month and have a current income of $10,230/mo., will be $12,500/mo. in '27 so another $4200/mo. would be nice! Love the app, had a lot of fun creating a portfolio today!

Thanks for all the hard work putting the MaxDividends! You guys have done all the heavy lifting.

And 220+ Financial Bloggers on Substack

Trusted by 70,000+ subscribers. Followed by 68,000+ dedicated readers

Alessandro MacroMornings ⭐️⭐️⭐️⭐️⭐️

“A useful substack for those that invest in stocks that pay dividends or are looking to get into such a strategy. Includes education and actionable ideas.

The European Value Investor ⭐️⭐️⭐️⭐️⭐️

“If you are interested in dividend strategies or passive income strategies, this Substack ia great! Its worth a visit“

The Long View ⭐️⭐️⭐️⭐️⭐️

“Practical dividend focus. Saving for retirement.“

The Astute Investor’s Calculus ⭐️⭐️⭐️⭐️⭐️

“Love the concept and the execution. If you are into building a portfolio that will generate ever growing income for you, subscribe to Max Dividends. I did.

Panic Drop ⭐️⭐️⭐️⭐️⭐️

“Great for helling you pick up high-yield dividend growth stocks“

And 220+ More Great Authors and Pros Are Recommending MaxDividends!

We’re in the Top 3 Financial Blogs on Substack! 💪

MaxDividends continues to be recognized for its consistent effort, commitment to quality, and the loyalty of its growing community of partners.

If you have any questions, feel free to email me at: maxdividends@beatmarket.com

FAQ

I ❤️ Dividends: Why I Believe Dividend Investing Is the Best Strategy | PDF Book

How Effective is the MaxDividends Strategy for Building Growing Passive Income

🔥 Got a question about dividends? Ask Max, your AI Dividend Assistant!

Someone's sitting in the shade today because someone planted a tree a long time ago. ― Warren Buffett.