Dividend Stock to Double Up On Right Now

Here's a dividend paying stock that should continue to pay its shareholders.

MaxDividends Mission: Helping & Supporting Everyone in Building a Growing Passive Income, Retiring Early, and Living Off Dividends.

For dividend investors seeking opportunities with strong growth potential, MaxDividends Stock Ideas offers a daily, in-depth look at companies worth considering for a dividend portfolio.

Scroll Down to Read. No access yet? Check your status & upgrade to Premium to join the movement. Exclusive insights await inside!

Intro

💡 Invest in companies you believe in - W. Buffett

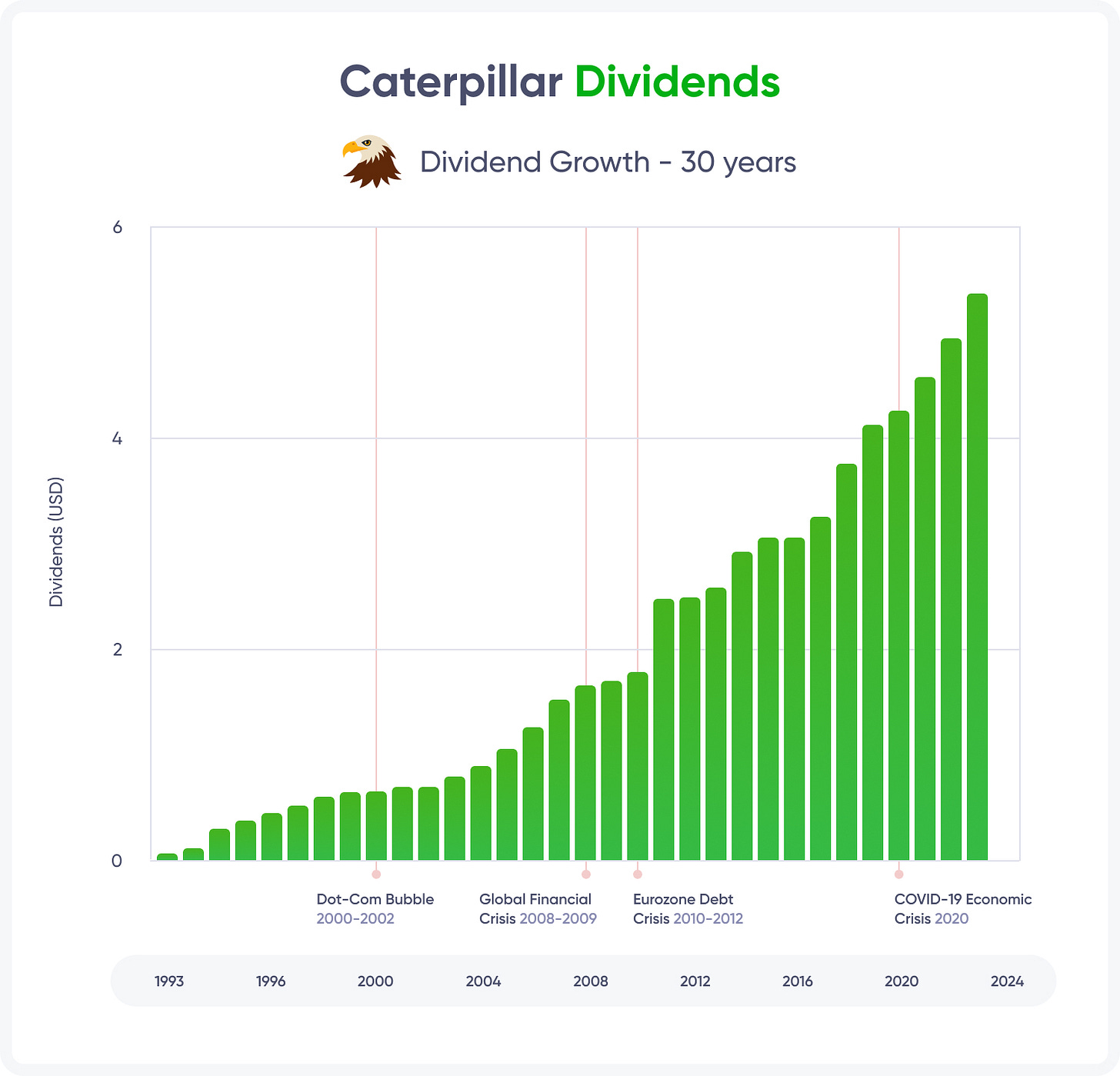

In times of market volatility, dividend stocks offer investors a sense of stability and a steady income stream. Companies with a long history of paying and increasing dividends often demonstrate disciplined capital management, helping them navigate economic challenges more effectively. One such company is Caterpillar (NYSE: CAT)—the world's largest construction equipment manufacturer—which has been paying dividends for over 90 years.

History of the Company

Caterpillar Inc. has a rich history that dates back to the early 20th century. The company was formed in 1925 through the merger of two pioneering tractor manufacturers—Holt Manufacturing Company and C. L. Best Tractor Co. Their innovative designs laid the foundation for Caterpillar’s dominance in the construction and mining equipment industry.

Headquartered in Deerfield, Illinois, Caterpillar has since grown into a global powerhouse, operating in more than 180 countries and employing over 109,000 people. Over the decades, the company has expanded its portfolio to include not only heavy machinery but also diesel and natural gas engines, industrial gas turbines, and financial services.

Its commitment to innovation and sustainability has positioned it as an industry leader for nearly a century.

A Proven Dividend Eagle

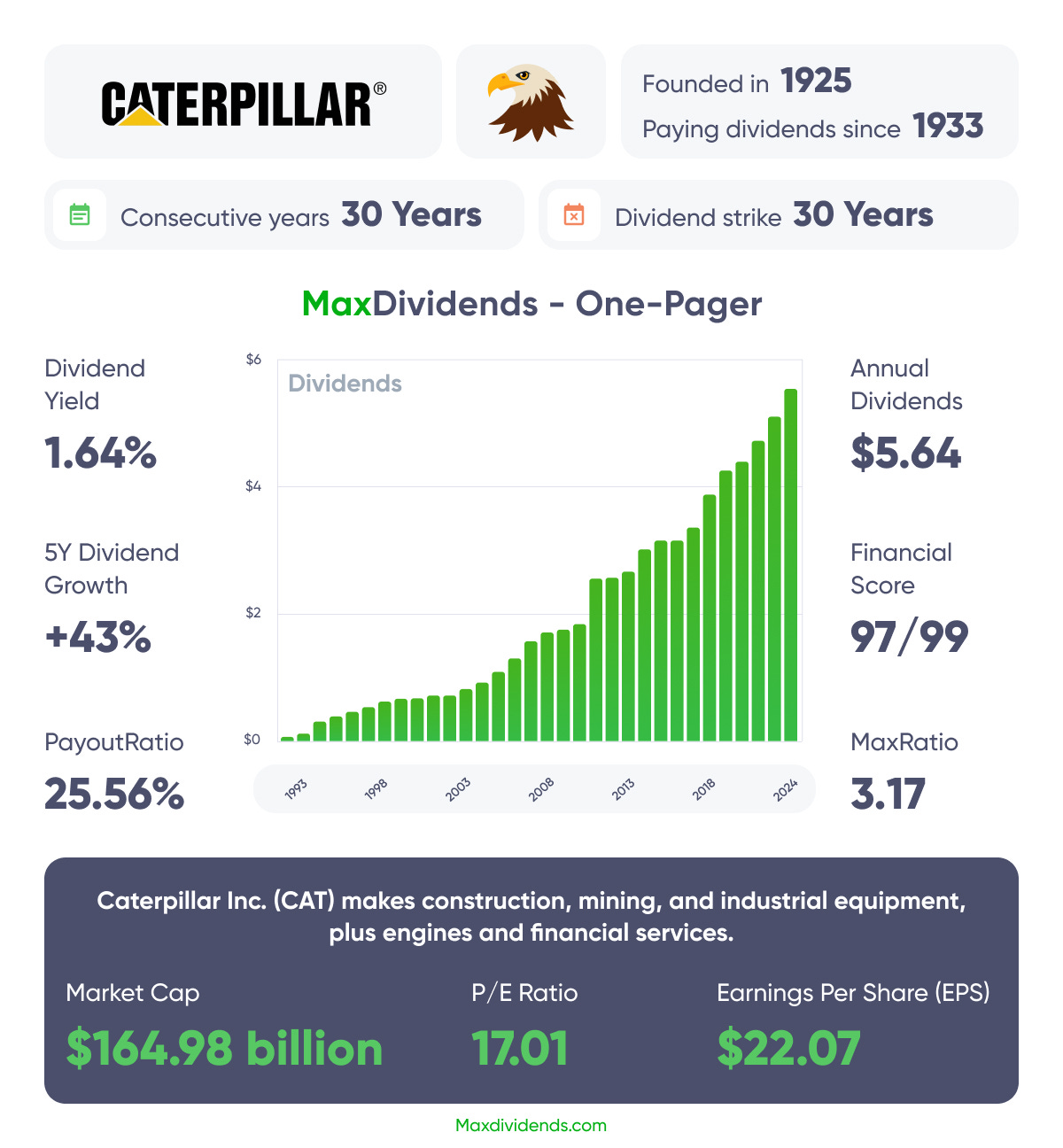

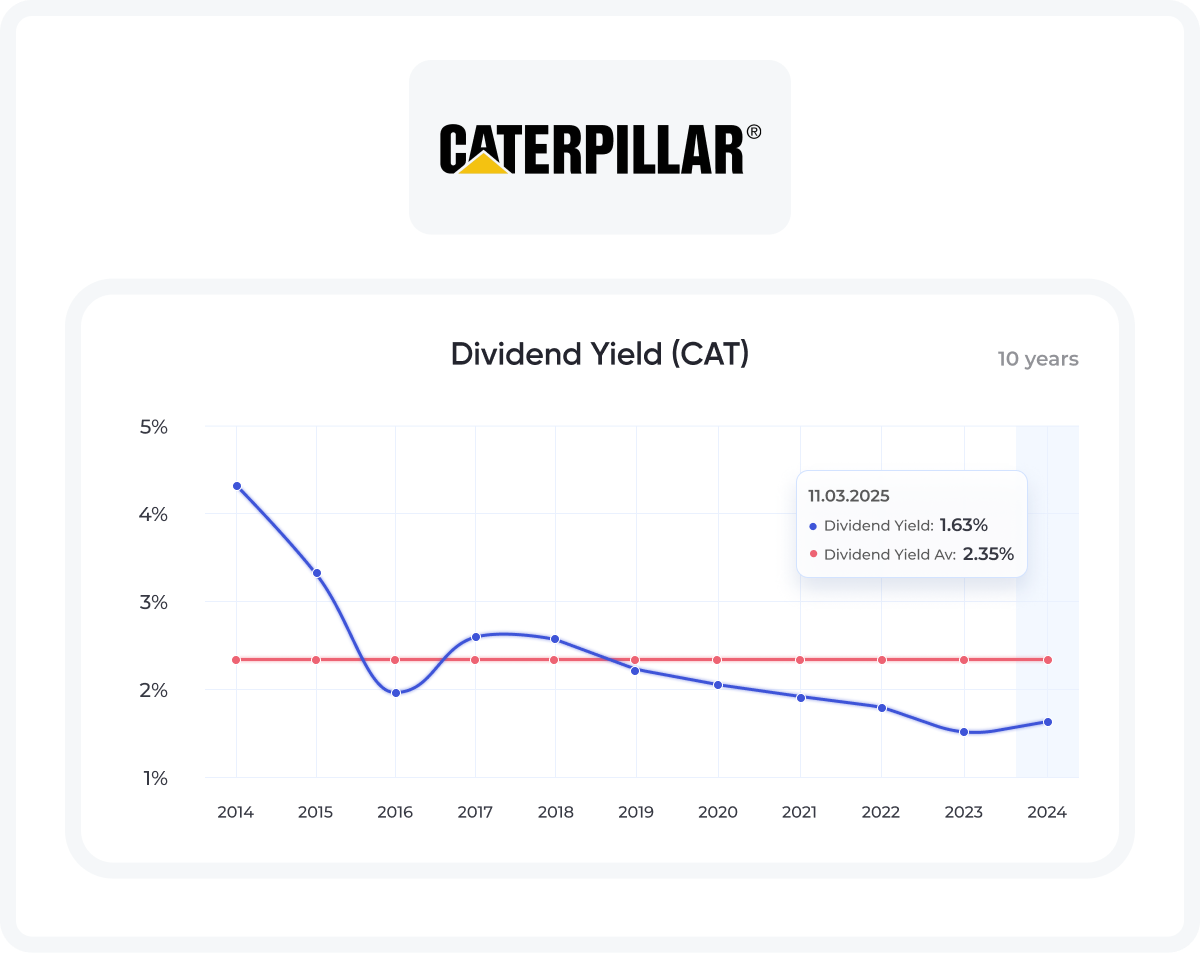

Caterpillar (NYSE: CAT), the world’s largest construction equipment manufacturer, has been a reliable dividend-paying stock for 92 consecutive years. Not only has the company consistently paid dividends, but it has also raised them annually for the past 31 years. Currently, Caterpillar offers a quarterly dividend of $1.41 per share, translating to an annual yield of 1.66% with a payout ratio of 24.5%.

🦅 Dividend Eagles

An updated compilation of 100+ top-performing dividend stocks with 15+ years of consecutive dividend increases, selected based on MaxDividends’ strict criteria.

Companies featured on the Dividend Eagles list have a proven track record of regular and increasing dividend payouts. This ensures you receive a reliable income, whether you're planning for retirement or seeking additional cash flow.

The Dividend Eagles list offers precisely that—a gateway to financial growth and stability.

Beyond dividends, these companies often exhibit strong fundamentals and growth prospects. Investing in them not only provides income but also the opportunity for your investment to grow over time.

This is how we build our own growing passive income and long-term wealth.

Commitment to Shareholders

In addition to dividends, Caterpillar actively repurchases its shares. Over the past three years, the company has reduced its outstanding shares by 10.4%, further enhancing shareholder value.

Management has reaffirmed its commitment to using "substantially all" of its machinery, energy, and transportation (ME&T) free cash flow for shareholder returns. In 2024 alone, Caterpillar generated $9.4 billion in ME&T free cash flow but returned an impressive $10.3 billion through dividends and share buybacks.

Business Performance and Outlook

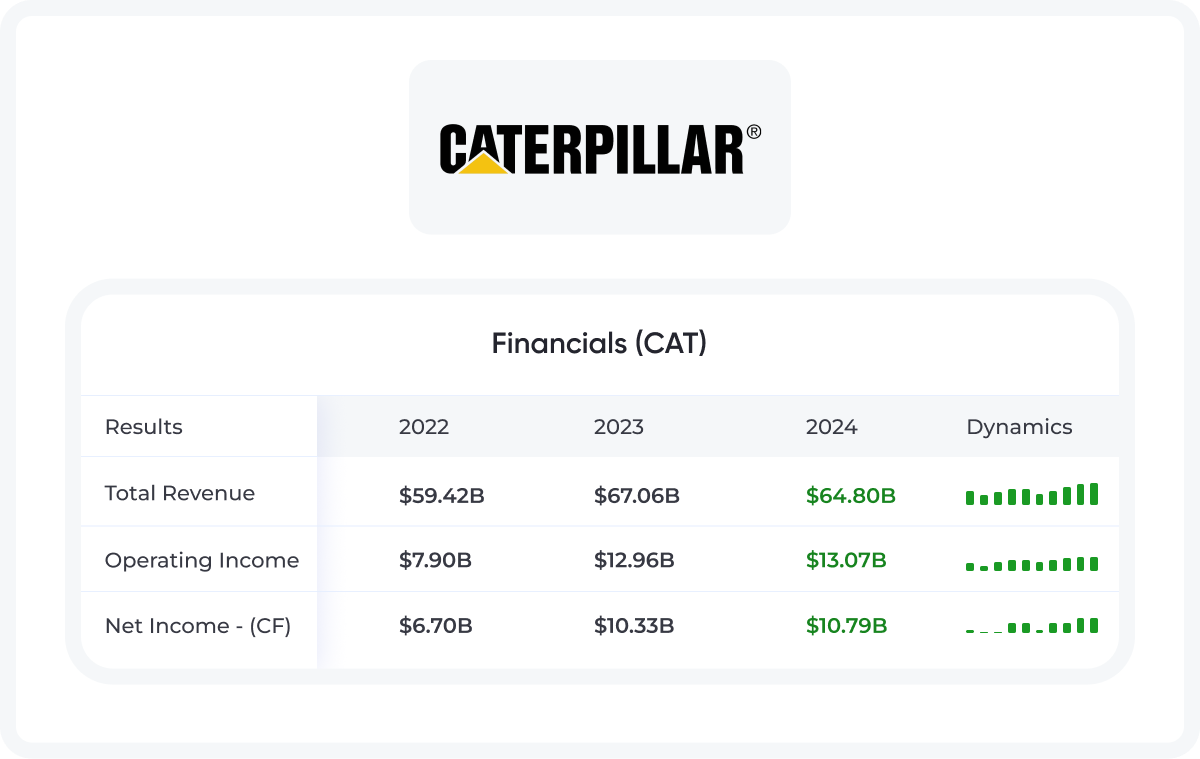

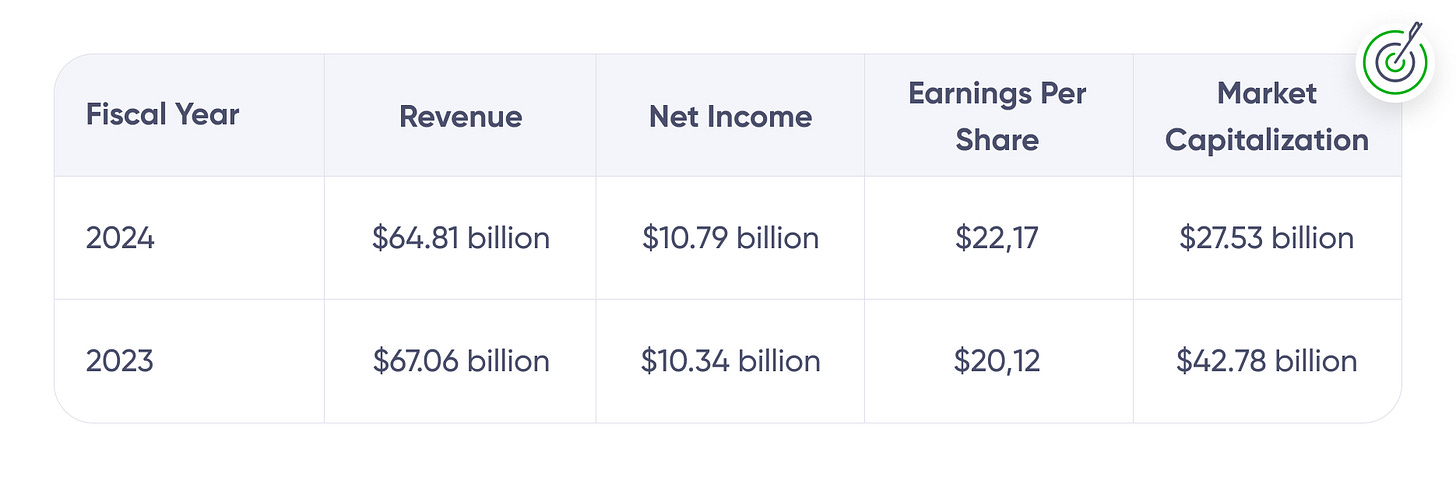

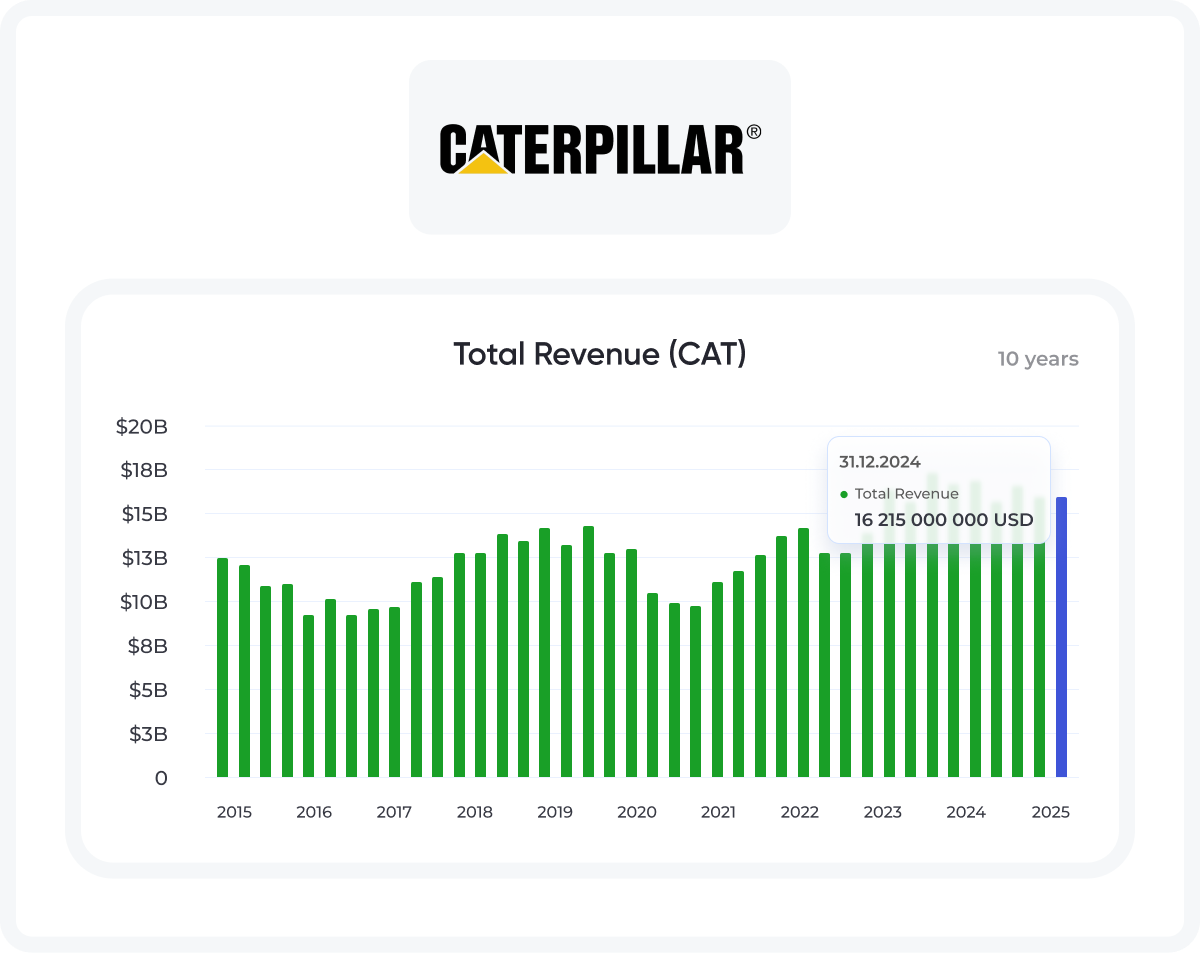

Caterpillar’s sales experienced a slight dip in 2024, totaling $64.8 billion compared to $67.1 billion in 2023. Management attributed this decline to lower sales volume, a natural fluctuation in industries like oil and gas. Looking ahead to 2025, Caterpillar expects another slight sales decline but anticipates ME&T free cash flow to remain at the upper end of its $5 billion to $10 billion range.

Key Institutional Investors in Caterpillar (CAT)

Institutional investors hold a significant stake in Caterpillar Inc., reflecting confidence in the company’s long-term growth and financial stability. As of Q4 2023, the three largest institutional shareholders are:

Vanguard Group Inc. – Holding 8.7% of Caterpillar’s shares, Vanguard is the company's largest investor. With a strong focus on long-term value, Vanguard’s investment highlights Caterpillar’s appeal to passive index funds and ETFs.

BlackRock Inc. – Owning 7.4% of Caterpillar, BlackRock is another major institutional investor. As one of the world’s largest asset managers, BlackRock’s stake reflects its belief in Caterpillar’s consistent profitability and dividend reliability.

State Street Corporation – With 5.2% ownership, State Street plays a key role in institutional ownership. The firm specializes in managing large-scale index funds, reinforcing Caterpillar’s position as a stable and attractive investment.

Caterpillar Inc (NYSE: CAT)

Financial Score: 97 / 99 ⭐️⭐️⭐️⭐️⭐️+

Industry: Farm & Heavy Construction Machinery

Dividend Increase - 31 Years

👉 Learn more about Financial Score

Caterpillar Inc. is a leading global manufacturer of construction and mining equipment, diesel and gas engines, industrial turbines, and diesel-electric locomotives. The company develops and supplies machinery for construction, mining, energy, and transportation industries, while also providing financial and insurance services. Founded in 1925, its headquarters are located in Irving, Texas.

Caterpillar - Quick MaxDividends Team Overview

🟢 According to the latest reports, the company is currently showing financial profit.

🟢 The company's sales have been growing for a long time and there is positive momentum

🟢 Growing operating profit over recent years is a good indicator of the effective management of the company in recent years.

🟢 The dynamics of earnings per share are positive, the company shows good pace and stability in terms of profitability

🟢 Business is quite stable and developing. Reports indicate that the company is basically generating income, although sometimes there are drawdownsFinancial Statement

If you want to stay on top of your portfolio's health, don't forget to check in on the financials of the companies you've invested in. The better shape they’re in, the better your results will be. Keep an eye on their quarterly and annual reports to see how they're performing.

Here is a quick dive into Caterpillar over last years

The strongest and most stable companies tend to have a Financial Score of 80+, with the very best ones hitting 90+. If you see that score start to dip below 80, that’s your cue to consider jumping ship before things get worse.

👉 Learn More about Financial Score

Our Paid Members get access to a curated watchlist of 19,000 companies worldwide, all scored by our team on a regular basis. Companies like Caterpillar are on that list, too.

Future Growth Prospects for Caterpillar Inc.

Caterpillar Inc. (CAT) has strong future growth prospects driven by market expansion, technological advancements, and sustainability initiatives. The company is targeting key regions, including Asia-Pacific, Latin America, and the Middle East, with projected annual growth rates of 7.2%, 5.8%, and 6.5%, respectively. Strategic investments include $450 million for digital transformation, a 12% increase in R&D spending, and $280 million for sustainable product development.

Revenue is expected to grow steadily, reaching $65.9 billion by 2026. With a global manufacturing presence in 27 countries, 3,200 active patents, and a diverse product portfolio, Caterpillar strengthens its competitive edge. Additionally, planned strategic partnerships worth $1.2 billion will further drive innovation and market expansion.

Recent Caterpillar Financial Performance (2023)

With MaxDividends, it's easier than ever to access top dividend companies, track your results, and explore new dividend ideas.

The MaxDividends Top Stocks List features ~100 of the most reliable dividend companies in the U.S. market, each with 15+ years of consecutive dividend increases. These stocks are carefully selected based on MaxDividends' strict criteria for consistency and reliability.

Dividend Kings represent the elite tier of dividend growth stocks. With 50+ years of consecutive dividend increases, these companies offer unparalleled income stability, making them a top choice for investors seeking long-term reliability in an unpredictable market.

With 25+ years of consecutive dividend increases, Dividend Aristocrats are among the strongest dividend growth stocks. These companies have a proven track record of not only maintaining but consistently increasing their dividends, often outperforming the broader market over time.

Why Invest in Caterpillar Inc?

Caterpillar Inc. (NYSE: CAT) stands out as a strong investment due to its consistent dividend history, shareholder-friendly capital allocation, and long-term growth potential. The company has paid dividends for 92 consecutive years and increased them annually for the past 31 years. With a quarterly dividend of $1.41 per share (1.66% yield) and a low payout ratio of 24.5%, Caterpillar offers a reliable income stream for investors.

Beyond dividends, Caterpillar actively repurchases shares, reducing its outstanding shares by 10.4% over the past three years. In 2024, the company generated $9.4 billion in free cash flow from its machinery, energy, and transportation (ME&T) segment but returned $10.3 billion to shareholders through dividends and buybacks, reinforcing its commitment to investor returns.

Despite a slight dip in sales from $67.1 billion in 2023 to $64.8 billion in 2024, management remains optimistic, expecting ME&T free cash flow to stay at the upper end of its $5 billion to $10 billion range. While potential risks, such as tariffs and fluctuating demand, exist, Caterpillar’s strong domestic manufacturing presence and global export capabilities provide resilience.

With a price-to-free cash flow ratio at a three-year low of 19.3, Caterpillar may currently be undervalued. Its combination of steady dividend growth, disciplined financial management, and long-term strategic positioning makes it an attractive choice for both income and value investors.

Interesting Fact

Caterpillar Inc. played a crucial role in World War II. Its bulldozers were widely used by the Allies for building roads, airfields, and clearing debris after battles. Caterpillar equipment was instrumental in the D-Day landings, rapidly constructing temporary roads on the beaches, which helped speed up the Allied advance into Europe.

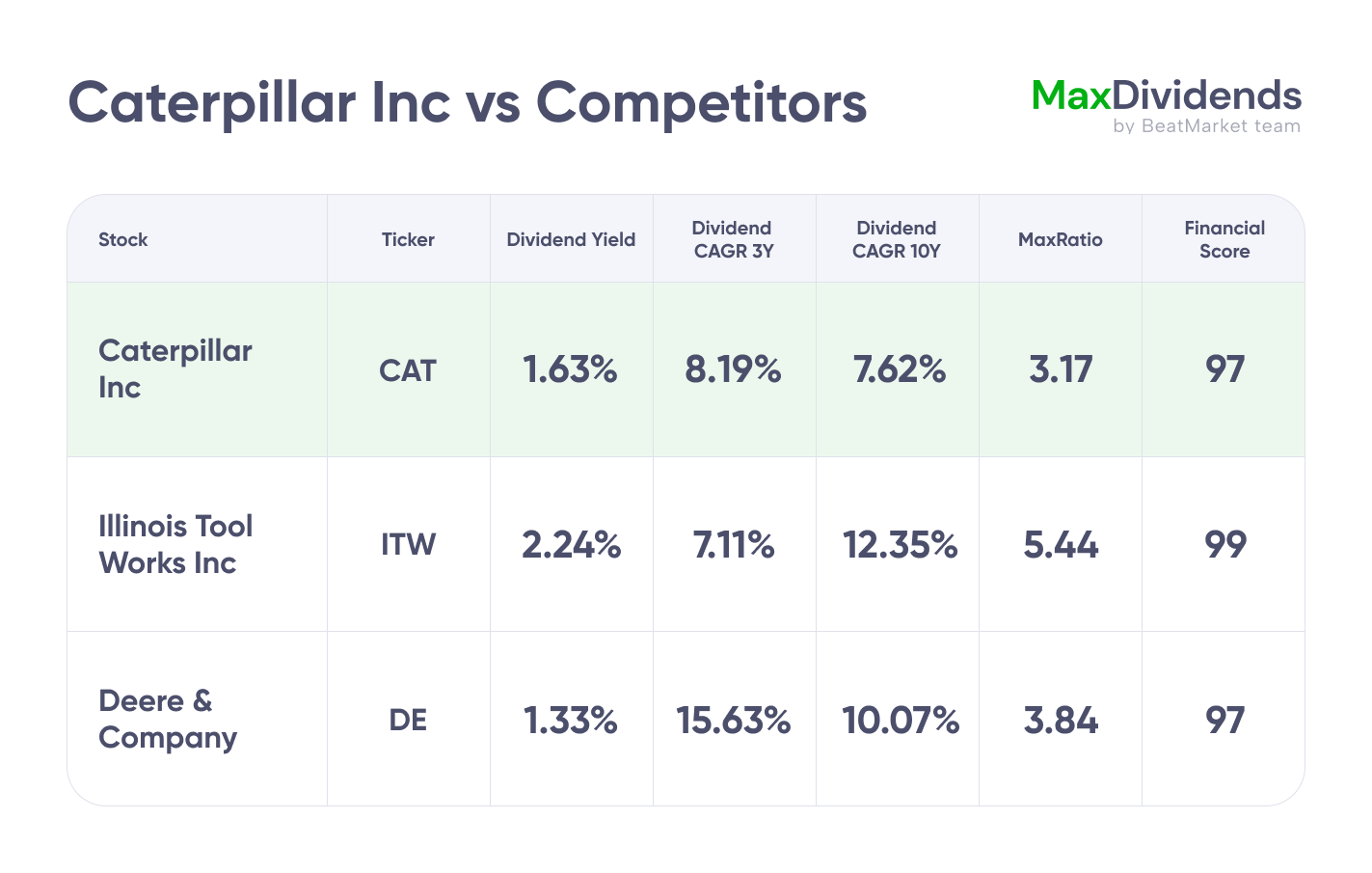

Competitors

1. Illinois Tool Works Inc (NYSE: ITW)

Financial Score: 99 / 99

Industry: Specialty Industrial Machinery

Illinois Tool Works Inc. (ITW) is an American industrial company founded in 1912 and headquartered in Glenview, Illinois.

It manufactures and sells specialized equipment and components for various industries, including automotive, food equipment, measurement and welding equipment, construction materials, polymers, and fluids.

The company has a strong market position, stable profit growth, and high profitability.

2. Deere & Company (NYSE: DE)

Financial Score: 97 / 99

Industry: Farm & Heavy Construction Machinery

Deere & Company is a global manufacturer of agricultural, construction, and forestry equipment, operating through four key segments: Production and Precision Agriculture, Small Agriculture and Turf, Construction and Forestry, and Financial Services.

The company produces a wide range of machinery, including tractors, combines, sprayers, loaders, excavators, and utility vehicles, as well as precision agriculture solutions and outdoor power products.

Deere also provides financing, leasing, and warranty services. Founded in 1837, the company is headquartered in Moline, Illinois.

Final Thoughts: Should You Buy Caterpillar?

Caterpillar remains a compelling option for dividend-focused investors. With a long-standing history of dividend growth, disciplined capital allocation, and a shareholder-friendly approach, the stock presents an attractive long-term investment. While short-term sales fluctuations exist, Caterpillar’s commitment to returning capital to shareholders makes it a solid choice for income-focused portfolios.

Current Market Value

Undervalued \ Overvalued \ Fairly Valued

Compare the P/E ratios of competitor companies to assess whether the stock you're considering is overvalued. We calculate the average P/E among competitors as a benchmark.

If a company's current P/E is 20% or more below the competitor average, it is considered undervalued.

If it is 20% or more above, it is considered overvalued.

The P/E ratio is calculated by dividing the market value per share by earnings per share (EPS).

⚪️ Fairy Valued

Compared to competitors and companies with business in this industry, the company is fairly valued. A price reduction of 15-20% would be a great investment point.

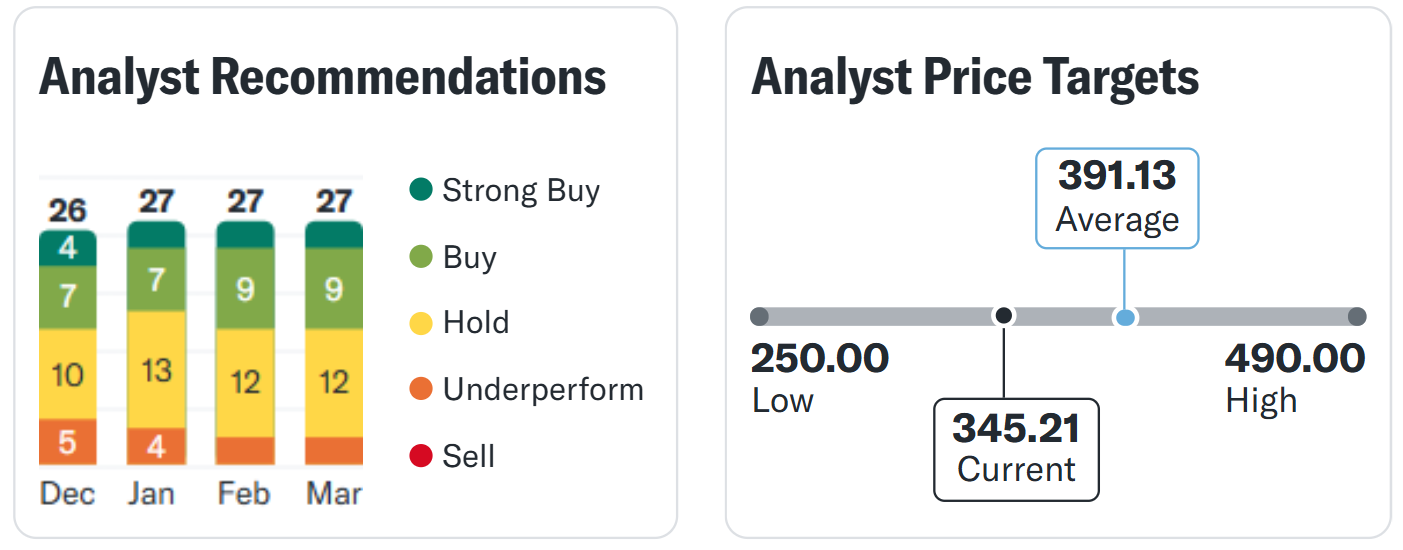

Analysts Consensus

Caterpillar Inc. has received a mix of analyst recommendations, with a notable portion favoring "Hold" and "Buy" ratings. The consensus reflects steady investor sentiment, indicating confidence in the company's long-term performance.

The price targets suggest a potential upside, with the average forecast exceeding the current price. Analysts recognize Caterpillar's market position but maintain a cautious stance due to economic factors affecting industrial equipment demand.

The company demonstrates strong financial performance, stability, and dividend growth. Despite minor declines in quarterly revenue, Caterpillar remains a reliable long-term investment.

Max's Comments

In this review, we've selected competitors, and I recommend paying attention to them as well. These are strong, excellent businesses that are also a great fit for our dividend goals. All three companies in this review look stable, and each could be a solid standalone investment. I like all three—especially Illinois Tools.

To your wealth, MaxDividends Team

More Dividend Ideas

Scroll Down to Read. Don’t have access? Check Your Paid Status & Upgrade to Premium.

Don’t have access? Check Your Paid Status & Upgrade to Premium.

⭐️ ⭐️⭐️⭐️⭐️

MaxDividends is a Bestseller on Substack!

Hundreds of premium members have already discovered the benefits of the community and app, earning passive income through dividends with MaxDividends. Their passive income keeps growing!

What You’ll Get by Joining MaxDividends Premium

The most important thing our MaxDividends community members value us for

Freedom & Independence

No boss, no schedules—complete control over your time. Ability to work on passion projects or simply enjoy life without financial stress.

Passive Income That Grows Over Time

Dividend-paying stocks provide a steady, rising income stream. Unlike traditional retirement funds, you don’t need to sell assets to cover expenses.

Protection Against Inflation

Dividend growth investing ensures your income keeps pace with inflation. Companies that increase payouts help maintain purchasing power.

Stress-Free Investing

No need for active trading or daily market monitoring. Long-term buy-and-hold strategy minimizes stress and decision fatigue.

More Time for Family & Personal Goals

Spend more time with loved ones instead of working 40+ hours a week. Pursue hobbies, travel, and personal development without financial pressure.

Health & Well-Being Benefits

Less work stress leads to better mental and physical health. More time for fitness, proper sleep, and healthier lifestyle choices.

Avoiding the Corporate Rat Race

Escape office politics, toxic work environments, and endless meetings. Focus on meaningful activities instead of chasing promotions and pay raises.

Living Life on Your Own Terms

Ability to relocate, slow travel, or move to a lower-cost-of-living area. No restrictions on how you spend your day—whether it's reading, volunteering, or building a new skill.

Leaving a Legacy

Build generational wealth and leave assets for your family. Teach the next generation financial independence by leading by example.

Financial Security & Peace of Mind

A well-built dividend portfolio provides stability even during economic downturns. No fear of outliving your savings—passive income keeps flowing.

Many who already joined say it’s the best financial decision they’ve ever made—because money becomes a tool for freedom, not a source of stress.

Ready to Give It a Try?

Check Your Subsription Status & Upgrade to Premium.

If you have any questions, feel free to email me at: maxdividends@beatmarket.com

MaxDividends Community: What ELSE You’ll Get Here

🔹 MaxDividends Stocks of the Week

Top 10 undervalued, high-yield, ultra-high yield, and dividend growth stocks every week.

Bonus: Full access to the updated weekly list of MaxDividends stocks—boost your passive income and start living off dividends.

🔹 Top Dividend Insights

Get exclusive, high-quality dividend investment ideas and insights, handpicked to help you crush your financial goals, retire early, and live off dividends.

🔹 Roadmap to Live Off Dividends

A step-by-step weekly guide to achieving financial freedom through dividend investing.

🔹 Easy Peasy: Build Your MaxDividends Portfolio

Ready-made MaxDividends stock sets starting at $300, $500, or $1000 each week—making it easier to build a strong dividend portfolio.

🔹 MaxDividends Business Overview

Deep dives into the top dividend stocks we hold, including key metrics, business insights, perspectives, and expert consensus.

🔹 MaxDividends Portfolio: Goal → $12,000 Monthly for 120 Months

My personal dividend portfolios with weekly updates, changes, and insights.

🔹 MaxDividends App & Tools Access

Comprehensive tools to help you retire early and live off dividends with confidence.

🔹 Community of Like-Minded Investors

Stay connected with me and other MaxDividends followers. Join the MaxDividends community chat to discuss ideas, share insights, set goals, and stay motivated. Support, accountability, and like-minded investors—all in one place!

🔹 Sunday Coffee ☕️

My personal life & business column, where I share:

Life moments & investing insights

Long-term investment philosophy

Thought-provoking ideas to help you succeed

🟢 What ELSE You’ll Get

Top Dividend Ideas

Unlock exclusive, high-quality dividend investment ideas available only for Premium members. These ideas are carefully curated to maximize returns, provide growing income, and accelerate your journey to financial freedom and early retirement.

By upgrading to Premium, you’ll gain access to:

Advanced stock recommendations tailored for dividend growth

In-depth research on high-yield dividend stocks with strong growth potential

Exclusive updates and insider insights to stay ahead of the curve

Undervalued Dividend Lists

With Premium access, you’ll get:

Undervalued Dividend Eagles (updated monthly)

Undervalued Dividend Kings (updated monthly)

Undervalued Dividend Aristocrats (updated monthly)

These lists highlight the most promising undervalued dividend stocks with strong growth potential, helping you maximize returns on your investment.

Dividend Insights

Gain exclusive insights:

Top 5 MaxDividends Ideas of the Month

Top 3 Most Promising Dividend Ideas of the Week

List of Dangerous Dividend Stocks (updated monthly) – avoid risky picks

These carefully researched ideas will guide you in making smart, informed decisions to build wealth with dividends.

🟢 And even MORE!

Unlock the best dividend tools available, created by the MaxDividends Team:

Dividend Screener: Find your own hidden gems—uncover undervalued dividend stocks with high growth potential.

Dividend Portfolio Tracker: Keep track of every aspect of your passive income and optimize your portfolio.

Dividend Checker: Check the financial and dividend score of 19,000+ companies worldwide to make data-driven choices.

MaxDividends Premium gives you all the tools you need to build, track, and grow your passive dividend income to retire early and live off dividends.

We are Recommended on Substack

Trusted by 29,000+ subscribers. Followed by 22,000+ dedicated readers

The European Value Investor ⭐️⭐️⭐️⭐️⭐️

“If you are interested in dividend strategies or passive income strategies, this Substack ia great! Its worth a visit“

Johan Lunau - The Long View ⭐️⭐️⭐️⭐️⭐️

“Practical dividend focus. Saving for retirement.“

Shailesh Kumar - The Astute Investor’s Calculus ⭐️⭐️⭐️⭐️⭐️

“Love the concept and the execution. If you are into building a portfolio that will generate ever growing income for you, subscribe to Max Dividends. I did.“

MS Cliff Notes ⭐️⭐️⭐️⭐️⭐️

“A useful substack for those that invest in stocks that pay dividends or are looking to get into such a strategy. Includes education and actionable ideas.“

Timothy Assi - Panic Drop ⭐️⭐️⭐️⭐️⭐️

“Great for helling you pick up high-yield dividend growth stocks“

And 190+ more other great authors and pro’s are recommend MaxDividends!

FAQ

I ❤️ Dividends: Why I Believe Dividend Investing Is the Best Strategy | PDF Book

How Effective is the MaxDividends Strategy for Building Growing Passive Income

Someone's sitting in the shade today because someone planted a tree a long time ago. ― Warren Buffett.