Dividend Macro Overview: January'25

Our latest MaxDividends Macro Report for January 2025 is out! 🔥

Hey Dividend Investors!

Ever wondered how to keep your portfolio growing with minimal effort? Our latest MaxDividends Macro Report for January 2025 is out, and it's packed with insights that could change the way you invest.

We are the most dividend community on Earth. Join us.

Dividend Macro Overview: January'25

Dividend Macro Highlights: Global Dividend Trends

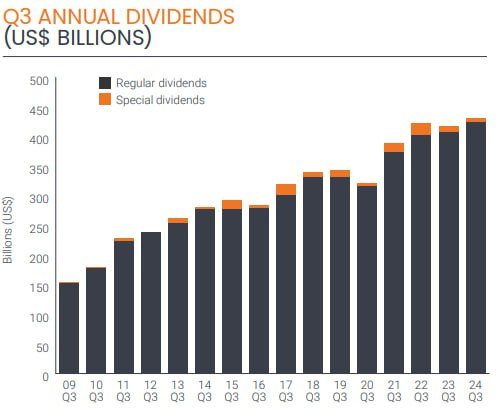

The cumulative global dividend payout for Q3 2024 continued the upward trend of Q3 2020.

This suggests that most dividend companies have calmly endured the effects of the 2020 crisis and adapted their businesses to the new reality. As a consequence, they continued to increase their dividend payouts

Companies paid out $431.1 billion in dividends in the third quarter of 2024. For comparison, in Q3 2023, companies collectively paid out $418.2 billion (Figure 1).

Regional Dividend Leaders

The dividend growth leaders in the third quarter were Japan, Emerging Markets and North America. They showed an increase of 14.4%, 8.9% and 8.7%, respectively.

Among those regions that showed negative dynamics in dividend growth, Asia Pacific ex Japan is the leader. The drop in dividend payments was 9.9%, respectively

U.S. Dividend Landscape (S&P 500)

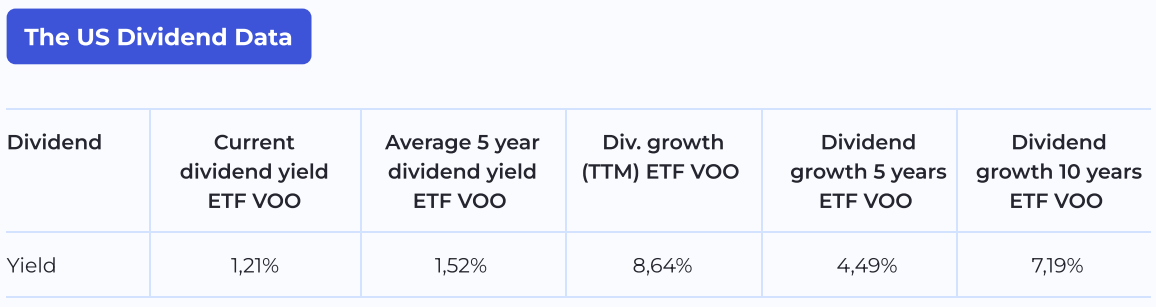

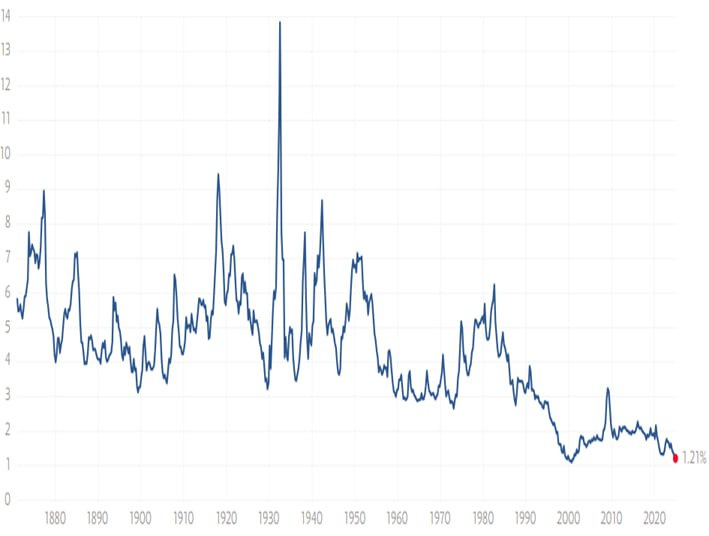

The dividend yield of the S&P 500 has halved over the past 10 years. It is now 1.21%, which suggests that the price of stocks relative to dividends is higher than normal. Therefore, dividend yield is at a lower lows.

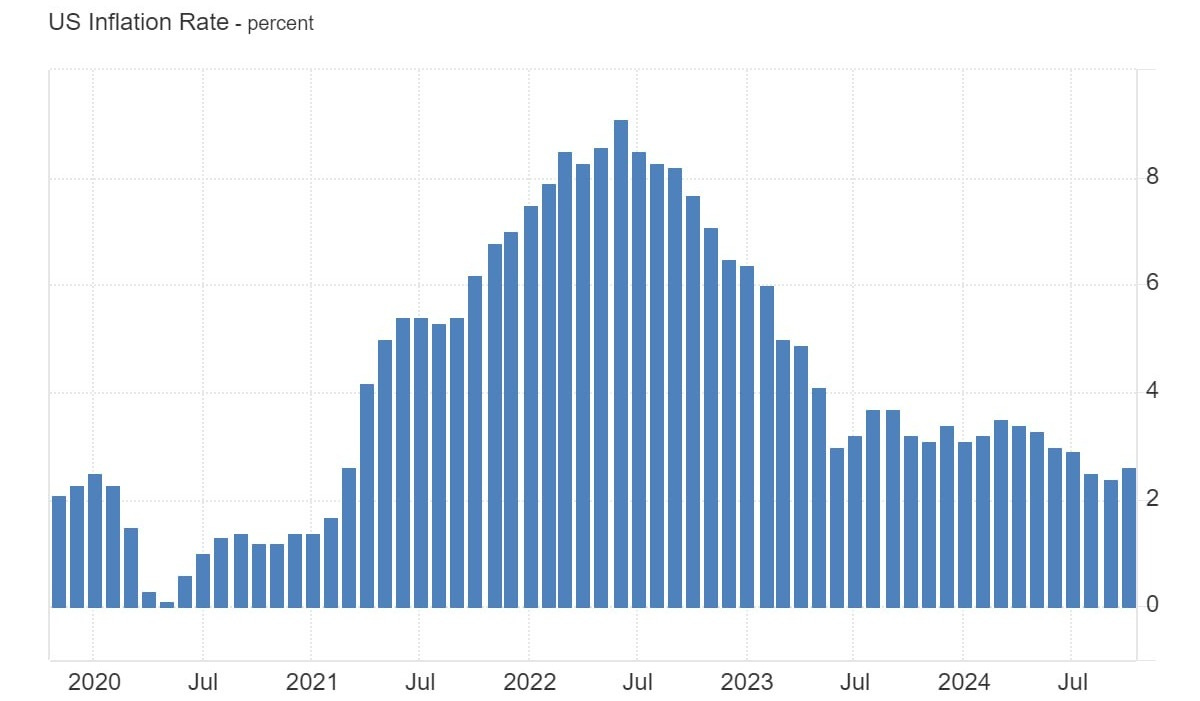

Inflation's Impact on Dividends

Inflation growth rate is high and exceeds the rate of dividend growth. Therefore, the S&P 500 dividend chart is showing a correction.

However, high inflation will not hold forever. Once the correction ends, the chart will turn around again. Thus, over the last reporting periods, inflation has been steadily declining.

S&P 500 Historical Dividend Trends

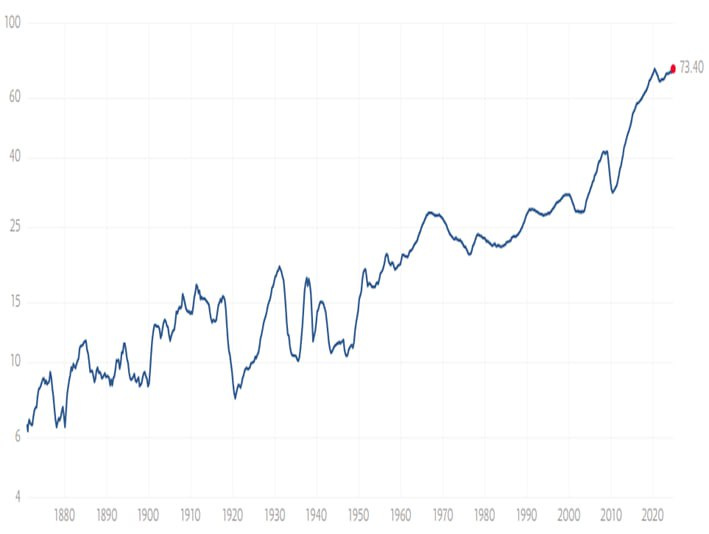

Historical dividends from stocks that are part of the S&P 500 Index are shown in Figure 5.

The data are adjusted for inflation. At the current inflation rate (Figure 4), there is a gradual acceleration in the growth of dividends on the S&P 500 index. The previous peak was in May 2020, when dividend was 73.09. At the moment, this figure is 73.40.

S&P 500 Dividend Growth

The S&P 500 dividend growth is shown in Figure 6. Over the past 32 years, the chart has been negative only three times.

All of those periods were associated with crises. Over the last month, dividend growth has outpaced inflation to 5.90%.

However, over the past 12 months, these indicators almost always show the same dynamics.

The Most Solid Dividend Hikes of the Previous Month

KLA Corp (KLAC) +17.24%

Popular Inc (BPOP) +12.90%

Dolby Laboratories (DLB) +10.00%

Assurant (AIZ) +11.11%

Automatic Data Processing (ADP) +10.00%

Griffon (GFF) +20.00%

Motorola Solutions (MSI) +11.22%

Snap-on (SNA) +15.05%

Texas Pacific Land (TPL) +36.75%

Royal Gold (RGLD) +12.50%

For your convenient reading, we have prepared a PDF version of the Dividend Macro Overview. You can download and study it at any time.

Top 3 Gainers of the Week: MaxDividends Top Stocks

Top Dividend Stocks picked by MaxDividends Team

+4.10% Lindsay Corporation

Lindsay Corporation (NYSE: LNN) might be known for its irrigation systems, but they’re watering more than just fields—they’re growing dividends too.

With a 1.17% yield and an annual payout of $1.44 per share, they’ve been increasing dividends for an impressive 22 years straight.

Sure, the 2.72% 3-year growth rate isn’t flashy, but the 23.11% payout ratio shows they’ve got plenty of room to grow without breaking a sweat. It’s steady, reliable, and worth keeping an eye on.

+5.12% CDW Corporation

CDW Corporation (NASDAQ: CDW) isn’t just about IT solutions—they’ve mastered the art of keeping investors happy.

They’re rocking a 1.37% dividend yield, with an annual payout of $2.50 per share, and have been boosting dividends for 10 straight years.

Over the past three years, they’ve cranked up dividends at a 13.49% growth rate, all while keeping a super-manageable 30.56% payout ratio, leaving room for more growth. If you’re into reliable growth with a tech edge, CDW might just be your play.

+5.23% Tractor Supply

Tractor Supply Company (NASDAQ: TSCO) isn’t just for ranchers and DIYers—it’s a dividend growth machine. They’ve been increasing payouts for 15 straight years, with a juicy 28.37% 3-year growth rate that shows they mean business.

With a 1.61% dividend yield and an annual payout of $0.88 per share, they’re striking a sweet spot between rewarding shareholders and reinvesting for future growth.

And with a 42.72% payout ratio, there’s plenty of room to keep the dividend train rolling. This company proves steady growth can pack a punch.

Dividend Hike of the Week: Alamo Group (ALG)

Dividend Increase: +15.00%. We have the first dividend hike for 2025!

Alamo Group (NYSE: ALG) just made headlines with a 15.4% dividend hike, bumping their quarterly payout to $0.30 per share.

This isn’t just another increase—it’s their 11th straight year of growth, with a stellar 22.92% 3-year dividend growth rate to back it up.

While the 0.69% yield might seem modest, their ultra-low 12.08% payout ratio leaves tons of room for even more future boosts. For long-term investors, this kind of steady, reliable growth is gold.

The MaxDividends Recent Events

A Deep Dive into Recent Dividend’s Universe Events

Dividend growth investing is all about finding stocks that pay dividends and can keep growing them over time. MaxDividends is all about that plus maximizing yields to get the most from dividends and boost growing passive income on your side.

When the market feels uncertain, dividends remain steady, offering both stability and a sense of financial security.

In December, we wrapped up work on an exciting new feature. The MaxDividends app now includes curated lists of Dividend Aristocrats and Dividend Kings!

👉 Dividend Aristocrats & Dividend Kings Lists Now On the MaxDividends App 🚀

My Comments

Last year was incredible, and I can’t thank you enough for being part of it. In 2025, we’ll continue to publish the best dividend analytics, carefully selecting amazing dividend companies to grow your and our passive income. I’ll continue the $12,000 monthly dividend experiment for 120 months.

My goal is to live off dividends

In 2025, I’m transitioning to fully living off dividends. My primary capital and main portfolio—filled with strong growth companies and high-dividend stocks—will fund this shift. In January, premium MaxDividends members already got a full portfolio breakdown and my detailed Q1 2025 plan.

I love this journey so much that I’ve started the $12,000 Dividend Experiment from scratch to show how important those first steps are and how easy it is to follow the concept of growing passive income with MaxDividends.

From Q2 2025, alongside regular purchases for the $12,000 experiment, I’ll show how I live off dividends using the growing passive income from my main stock portfolio.

My strategy is built on the MaxDividends Investing Concept with Dividend Eagles, and it’s incredibly low-maintenance. Most of the time, I just sit back and watch my dividend income grow.

My dream is to live off dividends and show others how they can do the same.

My personal goal is to reach $12,000 in monthly income for my family within 120 months. In this section, I share the stocks I’ve invested in and the strategy I follow.

This is a proven, time-tested approach that leads predictably to success. By focusing on reliable companies that pay above-average dividends and steadily increase them over time, we set the stage for consistent dividend growth.

👉 My Recent Friday’s Purchases Overview

My Plans for This Week

Last week, I resumed my regular investments and made my first purchases of the year. This week promises to be productive. The stock market is pulling back, which presents us, as long-term investors, with excellent opportunities to buy great companies at discounted prices.

What makes the dividend strategy so appealing is that poor market performance actually works to our advantage. It gives us more time to accumulate shares of fantastic companies at attractive prices, setting us up for greater dividend income and strong results in the future.

I’m taking full advantage of this by making regular investments in dividend growth stocks every week.

This week, my focus is on several major businesses: Medtronic, United Parcel Service, Hershey, and other exciting names. As Friday approaches, I’ll evaluate which companies offer the best opportunities for investment right now.

Happy dividends for all the holders!

For ease of reading, we have posted the report in PDF format. Enjoy! 🙌

My Personal Stock Watchlist for January 2025

A full list of my favorite stocks I’m currently tracking

Right now, I’m following ~50 companies, updating my short list and main watchlist each month.

Scroll Down to Read. Don’t have access? Check Your Paid Status & Upgrade to Premium.

I’m all-in on strong dividend stocks, balancing capital growth with growing dividend income.

Keep reading with a 7-day free trial

Subscribe to Max Dividends to keep reading this post and get 7 days of free access to the full post archives.