🍽 Dividend Lunch: McDonald’s

How this business really works

This is one of the pieces our Premium members see regularly. Today, I’m sharing it with you — not as a teaser, but as a look behind the curtain.

This is how we build clarity. This is how we turn businesses into understandable income machines. And this is exactly how long-term dividend success is built — calmly, consistently, one company at a time.

Let’s have lunch and talk business.

Picture this: You’re driving on the highway. You’re hungry. You don’t want surprises. You don’t want an experiment. You don’t want to wonder if the food will be good.

You see the golden arches. You already know what’s inside. That predictability — that comfort — is the real product McDonald’s sells. Not burgers. Not fries. Predictability.

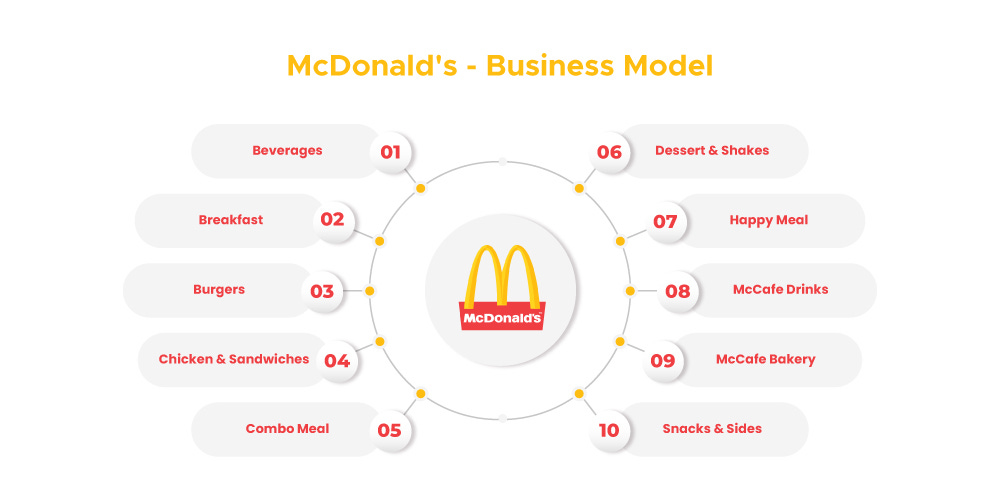

What McDonald’s Actually Is

Most people think McDonald’s is a fast-food company. It’s not.

It’s a global real estate business that happens to sell burgers. Let me explain in simple terms.

When someone opens a McDonald’s restaurant, they usually don’t own the land. McDonald’s corporate often owns it. Or controls it. Or holds a long-term lease on it.

The franchisee:

runs the restaurant

hires the staff

buys the equipment

handles daily operations

But they pay McDonald’s:

a percentage of sales

rent for the property

fees for using the brand

So McDonald’s gets paid first. Before profit. Before “what’s left.” Before excuses. That’s powerful.

Why That Model Is So Strong

Imagine you own a rental apartment. Your tenant runs a business inside it. They work hard. They take risks. They deal with customers.

But every month, you collect rent. That’s closer to what McDonald’s does.

It doesn’t need to flip burgers in every location. It doesn’t need to manage every shift. It doesn’t need to worry about every customer complaint. It collects rent and a percentage of sales.

And because McDonald’s chooses high-traffic locations — busy roads, shopping areas, city centers — those restaurants tend to produce steady cash flow.

Steady restaurants → steady franchise payments → steady corporate income. You see the pattern.

Why Customers Keep Coming Back

Now let’s talk about the other side — the customer.

You can land in Tokyo. Or Chicago. Or Paris. Or a small town in Texas. You walk into McDonald’s. And you know what you’re getting.

The same fries. The same Coke. The same style of service. That consistency isn’t accidental. It’s built into the system:

standardized suppliers

strict operating procedures

controlled kitchen layouts

global quality controls

It’s not exciting. But it’s reliable. And reliability builds habits.

Habits build traffic. Traffic builds sales. Sales build rent payments. Rent payments build dividends.

What Happens During a Recession?

People don’t stop eating when the economy slows down. In tougher times, something interesting happens:

Families trade down from expensive restaurants

Office workers skip higher-end lunches

Budget-conscious consumers look for cheaper meals

McDonald’s becomes the “affordable option.” That can actually stabilize the business when other restaurants struggle. It’s not recession-proof. But it’s recession-resistant. Big difference.

Let’s Talk Numbers — Gently

McDonald’s is enormous.

Annual revenue: over $20 billion

Operating margins: very strong

Free cash flow: consistent

Dividend history: decades of increases

But the key isn’t the size. The key is the structure. High-margin franchising. Prime real estate control. Global brand recognition.

That combination produces predictable cash flow. And predictable cash flow supports predictable dividends.

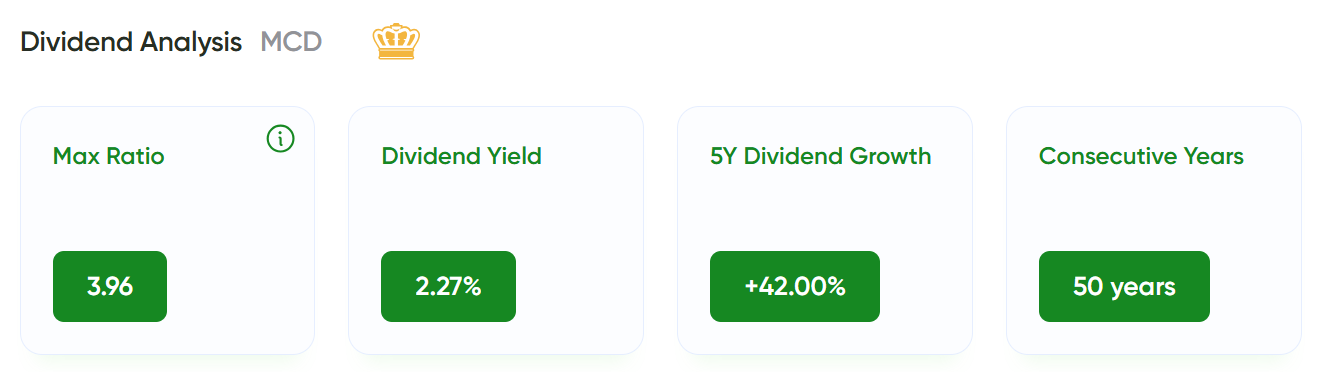

Dividends

McDonald’s is also on the doorstep of becoming a Dividend King — this year it’s just one increase away from reaching 50 consecutive years of dividend growth. Think about that for a moment. Half a century of raising the payout, through recessions, oil crises, financial crashes, pandemics, and changing consumer habits.

The company has been paying dividends since the 1970s and increasing them year after year for nearly five decades. That kind of consistency doesn’t happen by accident. It reflects a business model built on durable cash flow and disciplined capital allocation.

⚠️ And Now The Real Questions

Now come the questions every serious seeker of reliable, growing dividend income eventually asks.

Is McDonald’s today a good long-term investment?

Is it undervalued right now — or already priced for perfection?

Are the dividends truly protected by earnings and cash flow — or are we stretching the payout?

These are not emotional questions. They are ownership questions.

Inside MaxDividends, our Premium partners already know the answers. Not guesses. Not opinions based on headlines. Structured, data-driven answers inside the system.

More importantly, we also know something else. We know which companies today have even stronger forward prospects. Businesses that:

are growing faster

are priced more attractively

have healthier payout ratios

are raising dividends decade after decade

Not just dividend machines. Growing dividend machines.

Companies whose income expands year after year — and whose share prices have room to grow because they’re currently undervalued.

Because long-term dividend success is not about owning famous names.

It’s about owning the right businesses at the right time — calmly, systematically, and with full clarity. And that’s exactly what we do.

⭐️ Get Full Access to Our Top Dividend Picks ⭐️

Top Undervalued Dividend Picks — powered by the proven Income System.

Full breakdowns. Clear roles. Clear signals.

We don’t own tickers. We own businesses. Outgrow your passive income — one dividend business at a time.

— Max