Deep Dive — Badger Meter (BMI)

Water. Data. Dough. How a “boring” meter company quietly prints money.

MaxDividends Mission: Helping people build growing passive income, retire early, and live off dividends.

For dividend investors seeking opportunities with strong growth potential, MaxDividends Stock Ideas offers a daily, in-depth look at companies worth considering for a dividend portfolio.

Intro

💡 Invest in companies you believe in - W. Buffett

Let’s be honest: water meters aren’t exciting. They’re not Teslas, not Apple gadgets, not AI. But here’s the truth: sometimes it’s the “boring” businesses that make investors truly wealthy.

Take Badger Meter. They make the meters and software that track water use and leaks for homes, factories, and cities. Not glamorous — but essential. And essential businesses tend to keep paying.

If you’d invested $1 in 2000, you’d have about $74 today. Even after a recent 27% pullback, Badger looks like a Dividend Eagle worth keeping on your radar.

A Century in the Making

1905 — Solving frozen winters

In Milwaukee, frozen pipes destroyed water meters every year. A small shop came up with a fix: a frost-proof water meter with a replaceable bottom plate. Instead of buying a new meter, you swapped a cheap part. A simple idea — and suddenly, demand exploded.

1920s — Scaling to cities

By the 1920s, Badger wasn’t just selling to households anymore. Entire cities trusted them to handle water billing. Even in the Depression, people still had water bills — so demand held steady.

1940s — War changes everything

When WWII hit, Badger pivoted fast. Instead of meters, it built 7 million bomb fuzes. That kept the business alive and sharpened its manufacturing skills.

1950s–60s — Riding the post-war boom

Badger expanded into new instruments, acquired smaller firms, and set up subsidiaries in Mexico and South America. It was no longer just a meter company — it was a precision manufacturer.

1971 — Going public

Badger listed on the stock exchange, giving it capital and visibility. For investors, that marked the start of decades of consistent dividends.

1980s–2000s — From brass to digital

Meters evolved. The company shifted from mechanical to electronic, adding accuracy and durability. Step by step, Badger became a tech-focused business.

Today — BlueEdge™ and SaaS

Fast-forward to now. Badger’s BlueEdge™ platform ties hardware to data. Utilities can see leaks in real time, save billions of gallons, and cut costs. And instead of one-off sales, Badger now makes recurring SaaS revenue — software subscriptions that grow year after year.

From frozen pipes in Milwaukee to smart water dashboards for entire cities — that’s a century of staying relevant.

The Dividend Story

A paycheck that keeps growing

Most of us beg for raises. Badger investors? They get one every year, no questions asked.

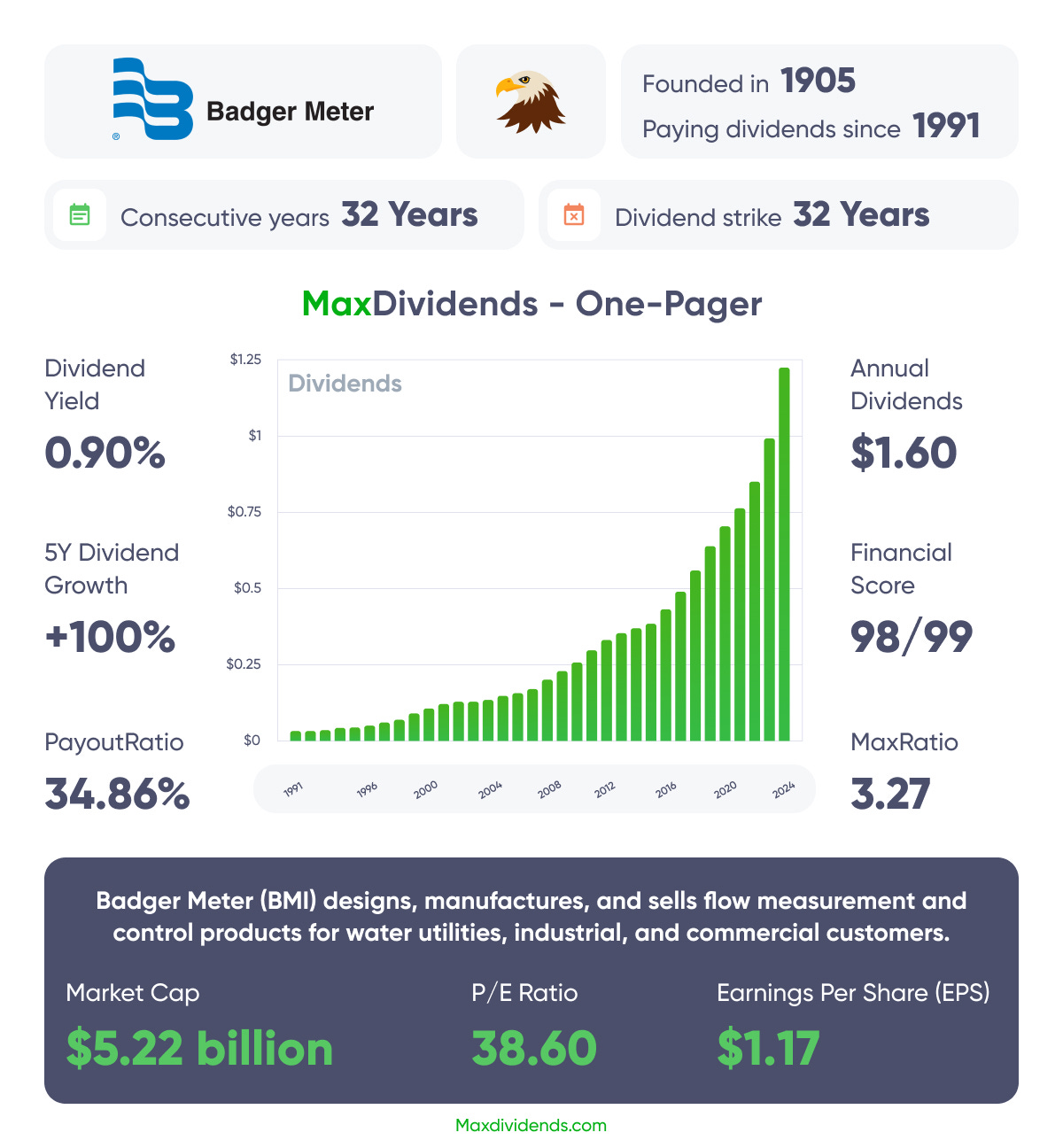

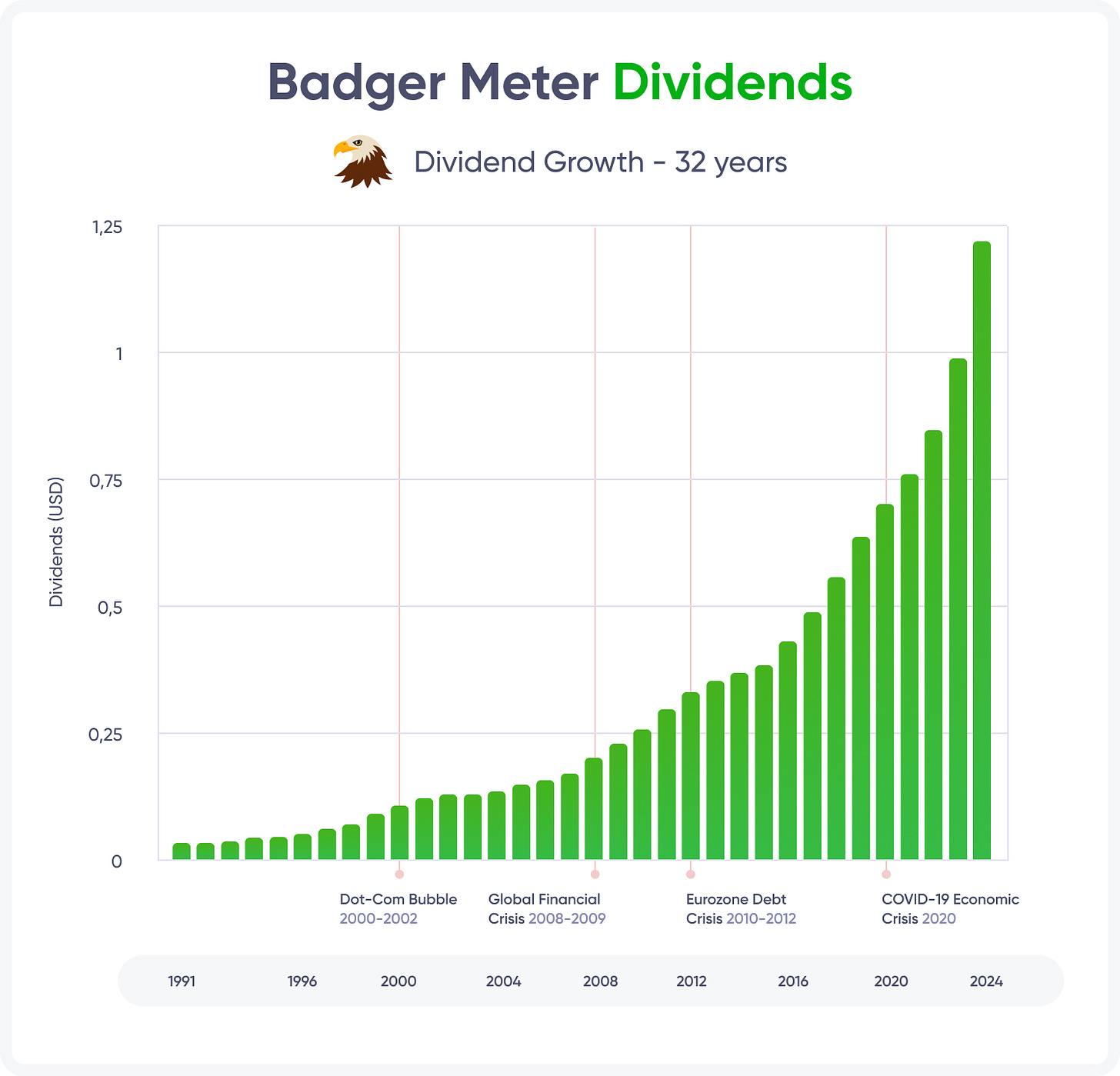

33 years in a row of dividend increases (Dividend Eagle 🦅).

Latest hike (Aug 2025): +18% to $0.40 a share quarterly ($1.60 annually).

Prior years: +26% in 2024, +18% in 2023.

That’s a three-year streak of double-digit raises. If you owned the stock for five or six years, your income likely doubled.

Yes, the yield looks small at ~0.9%. But here’s the kicker: with 15–20% annual growth, a “tiny” dividend becomes real money faster than most realize. And with a payout ratio of just 31% (well below its 10-year average), there’s plenty of room to keep hiking.

This isn’t about a fat check today — it’s about a reliable raise every single year.

Financial Strength

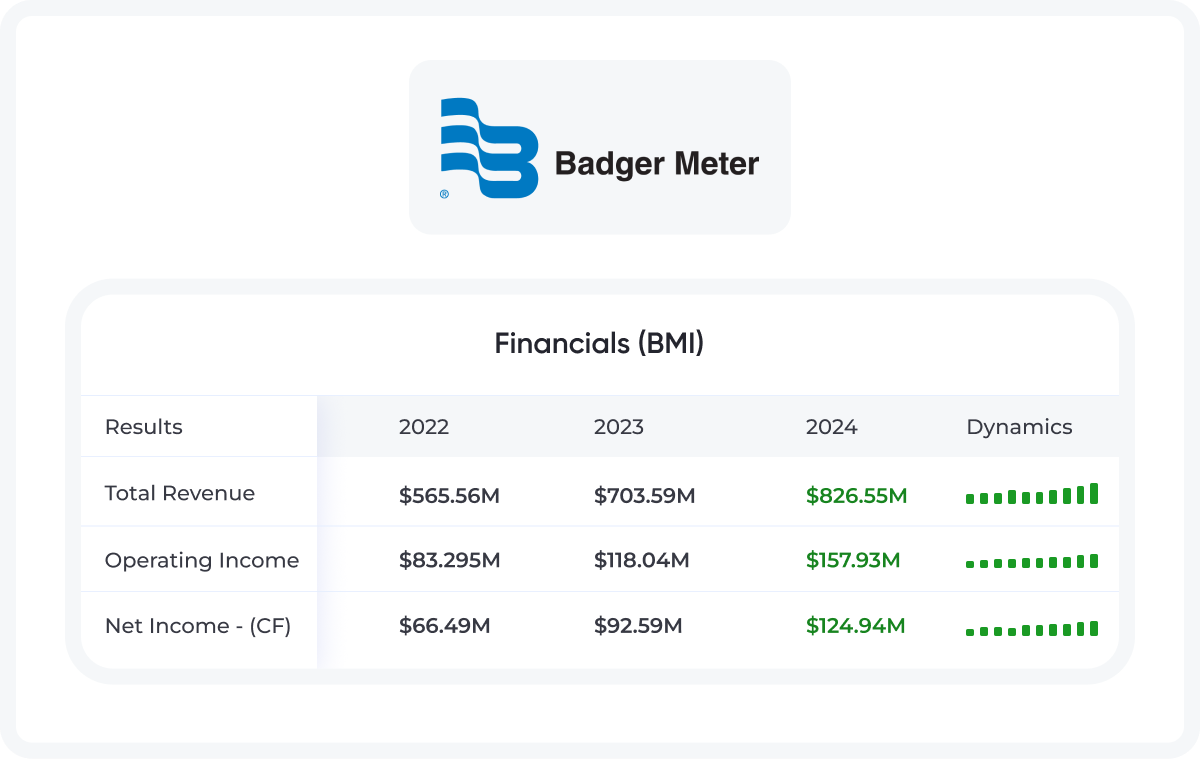

Flat sales, fatter profits.

In 2024, revenue stayed flat at $826.6M. Sounds boring, right? But Badger managed to grow net income by 31% anyway.

How? Efficiency. Management squeezed more profit out of the same sales. That’s the kind of discipline that protects dividends.

EPS: record high.

Payout ratio: 31% (safe).

Financial Score: 98 / 99 ⭐️⭐️⭐️⭐️⭐️+.

Institutional ownership: ~89% (with BlackRock, Vanguard, and State Street as top holders).

Big money trusts Badger. And when the giants hold nearly 9 out of 10 shares, that’s a strong vote of confidence.

What Makes BMI Stand Out

Essential product. You can delay buying a car. You can’t delay water.

Built-in demand. 85% of sales are replacements. When old meters wear out, new ones are mandatory.

Recurring SaaS revenue. Growing 28% annually since 2019, now ~7% of total sales.

Sustainability. Prevents waste of 5+ billion gallons annually.

Margin expansion. Software and efficiency are driving fatter profits.

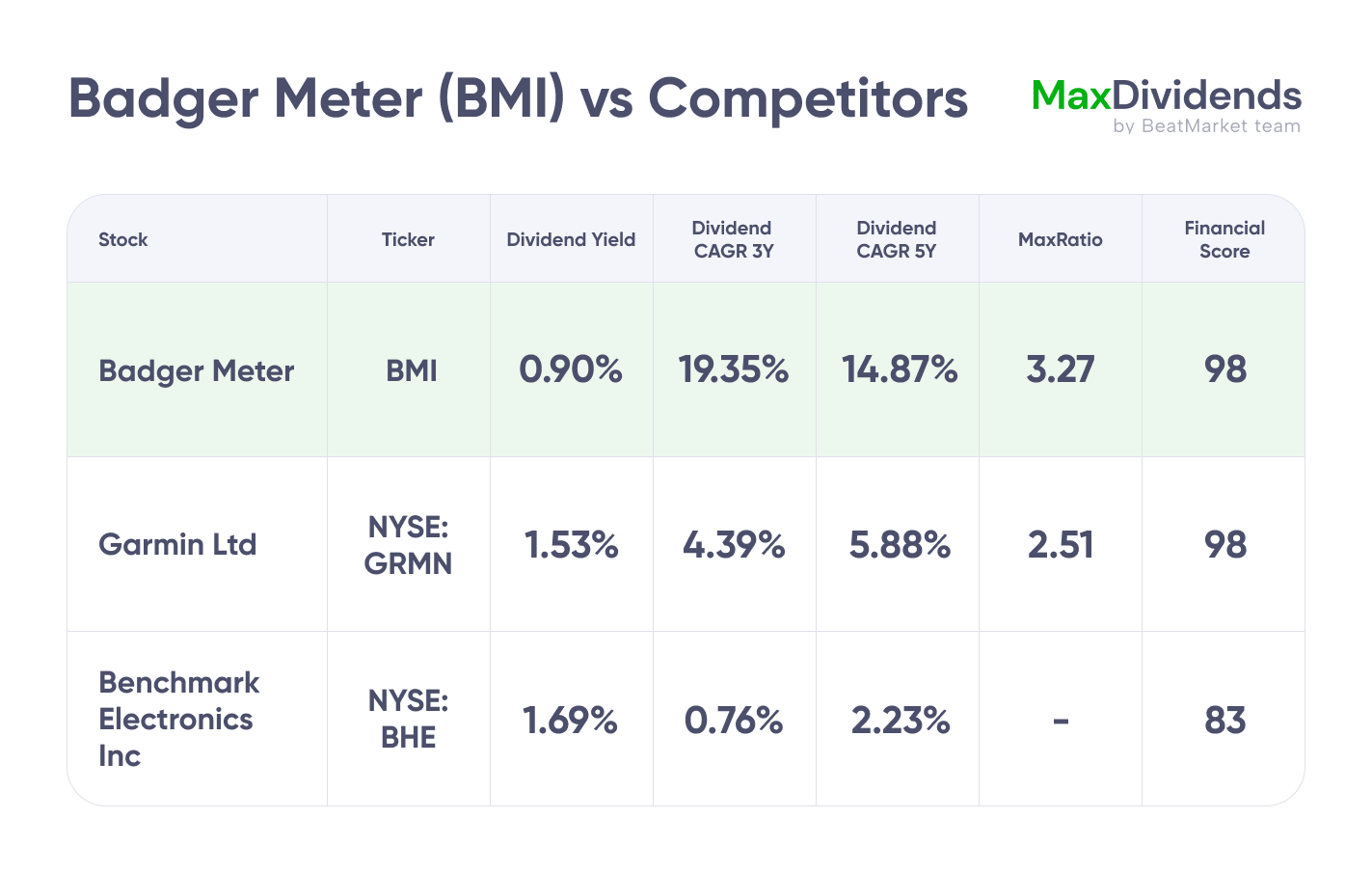

Competitors

Badger has neighbors in tech and electronics:

Garmin (GRMN): instrumentation giant, Financial Score 98.

Benchmark Electronics (BHE): electronics manufacturer, Financial Score 83.

They’re strong, but they’re spread across many industries. Badger? It’s stayed laser-focused on water for more than a century. That focus = consistency.

Yes, the stock trades at a premium compared to peers. But that’s the price of reliability.

Market Outlook

A wave of upgrades

The U.S. smart water market is worth about $2.1B and growing fast. Utilities have to modernize, and Badger is right at the center.

Regulation pushes demand

Water conservation isn’t optional — it’s mandated. That makes Badger’s solutions sticky.

Acquisitions add growth

Buying SmartCover expanded into wastewater monitoring, creating new cross-selling opportunities.

Global runway

Worldwide, water tech is a $100B+ market. From drought-stricken Europe to fast-growing Asian cities, demand is only increasing.

Management’s target: high single-digit sales growth plus margin gains from SaaS.

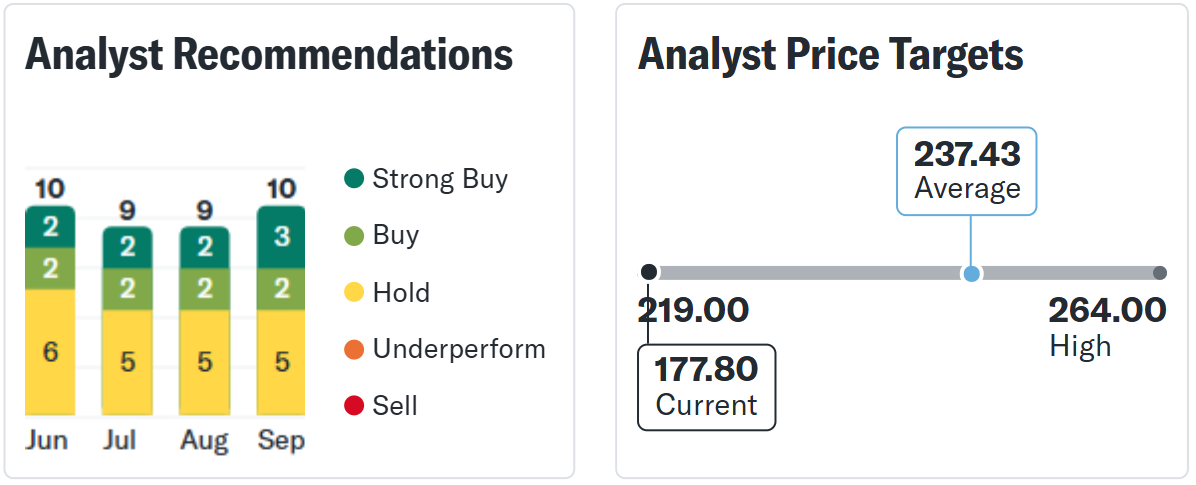

Valuation & Analysts

Yes, Badger trades at a premium P/E compared to peers. But that’s what happens when a company is trusted to deliver.

Wall Street’s verdict: mostly Buy to Strong Buy.

12-month price target: $237 (about +33% upside from $178).

High target: $264.

A few analysts call it a “Hold” — but that’s about valuation, not business strength.

Final Take

Badger Meter isn’t flashy, but that’s the point. For more than a century, it’s turned simple water meters into a business model that delivers stability, rising payouts, and long-term compounding.

33 years of dividend raises

Conservative 31% payout ratio

Essential, recurring business

A growing SaaS kicker on top

Analysts see +30% upside

That’s exactly the kind of stock you want quietly working in the background of your portfolio.

This Deep Dive is a free taste of the research we publish. But Premium members get the full picture:

Unlimited access to the MaxDividends App with 19,000 dividend stocks scored for safety and growth.

Our exclusive Dividend Eagles list — 100+ proven companies with 15+ years of straight raises.

Financial Score & Dividend Score tools to instantly judge stability and growth potential.

A private Partner Chat where you can ask questions, get answers, and share strategies with other dividend investors.

A ready-to-follow plan with simple steps to build your own portfolio.

Access to my real-money journey — the exact moves I make as I build a $12,000/month dividend income stream.

Exclusive deep dives into top companies — the ones I highlight only when they’re truly worth adding to a dividend portfolio.

And the Dividend Investor Academy — where I break down companies using my Secret Formula (sales growth, profit growth, payout safety, debt burden, business income). It shows you in plain language whether a stock deserves your money — or if it’s a trap to avoid.

Badger Meter shows how “boring” companies can quietly build wealth over decades. That’s the kind of long game we play at MaxDividends.

If you want more than the weekly taste, and you’re serious about building a portfolio that can one day pay your bills without touching your principal, Premium is where you belong.

👉 Join MaxDividends Premium today — before the next dividend raise slips by without you.

At MaxDividends, our mission is clear: help people build growing passive income, retire early, and live off dividends.

To your wealth,

MaxDividends Team

Learn the MaxDividends Way

Start Here

🔑 Explore the Premium Hub (exclusive — upgrade to unlock)

Guides & Step-by-Step

Deep Insights

📖 I ❤️ Dividends: Why I Believe Dividend Investing Is the Best Strategy | E-Book

How Effective is the MaxDividends Strategy for Building Growing Passive Income

Help & Support

Got a question about dividends? Ask Max, your AI Dividend Assistant!

Didn’t get the answer you need? Reach out: max@maxdividends.app or team@maxdividends.app — we’ll help you out.