🚨 Arrived! Inflation to erode the US public debt

Higher prices as the only way out of America's fiscal spiral

Dear all,

I’m always Alessandro - founder of Macro Mornings, already presented here by Max.

Today, I want to do something special for Max’s community.

Just for you, I’m sharing a letter I usually send only to my most advanced PRO subscribers - the investors who follow every macro shift, every market signal, in real-time.

Bond markets are sending distress signals. Deficits are widening faster than at any time outside war. Capital is rotating - not with urgency, but with intention.

It’s not panic. It’s positioning.

In this letter, I want to go far beyond the headlines and straight into the mechanics that matter. What’s driving this year’s outperformance in Europe.

Why gold is rising when money is flowing out. What Japanese bonds are warning about the system. And why the dollar may soon become the world’s problem again.

This isn’t a summary of what you already know. It’s a framework for what comes next. A lens through which investors can see with greater clarity - and act with more conviction.

⏳ A special message for Max community (24 Hours Offer)

I don’t do this often. Actually... I never do.

But just for today - only for the friends and readers of Max - I’m opening the doors to something unique and rare.

You can get annual access to my Macro Mornings PRO at 50% off.

It’s the package I created for the most dedicated investors.

Normally, this isn’t available.

But today, because you’re part of Max’s community - I wanted to give you this chance.

⏳ And yes, it’s only for the next 24 hours.

Or… here you can start a free 7-day trial on the monthly or annual plan. No pressure.

But if you already feel this is for you…

Don’t wait.

👉 [Unlock Annual Access - 50% Off Forever]

Sometimes, you can feel the shift before you fully understand it.

That’s what 2025 feels like to me.

I’ve spent most of my adult life analyzing global markets, diving into the data, looking for the patterns behind the noise.

I’ve seen euphoria and panic, bubbles inflate and burst, and policies that reshaped entire economies.

But what we’re experiencing right now is not just another cycle.

It’s something more profound.

It’s the ground beneath our feet shifting.

The signs are everywhere - quiet at first, then suddenly deafening.

And if you’re paying close attention, the story begins to tell itself in numbers, in behavior, and in the tremors moving through the global system.

Let me start with what the numbers are whispering - because they often speak before the headlines do.

Since the beginning of the year, Eurozone equities (EZU) have climbed +23.8%, their best start since 2009, when markets were clawing their way out of the wreckage of the Global Financial Crisis.

International equities outside the U.S. are up +14.0%, far ahead of their 10-year average.

Meanwhile, the S&P 500 - the icon of global equity investing - is quietly down -0.9%.

It’s not the percentage that’s so striking, but the contrast.

That’s a 15-point underperformance relative to global peers, and the worst start in more than 15 years.

It’s as if the world is reminding us: leadership rotates, regimes end.

If you’ve studied the early 2000s, this moment may feel oddly familiar.

After the dotcom bust, it wasn’t the U.S. that led the recovery.

It was the rest of the world.

But today, this isn’t just a story of rotation - it’s about structural forces rearranging the global chessboard.

📉 The Empire of Bonds Is Cracking

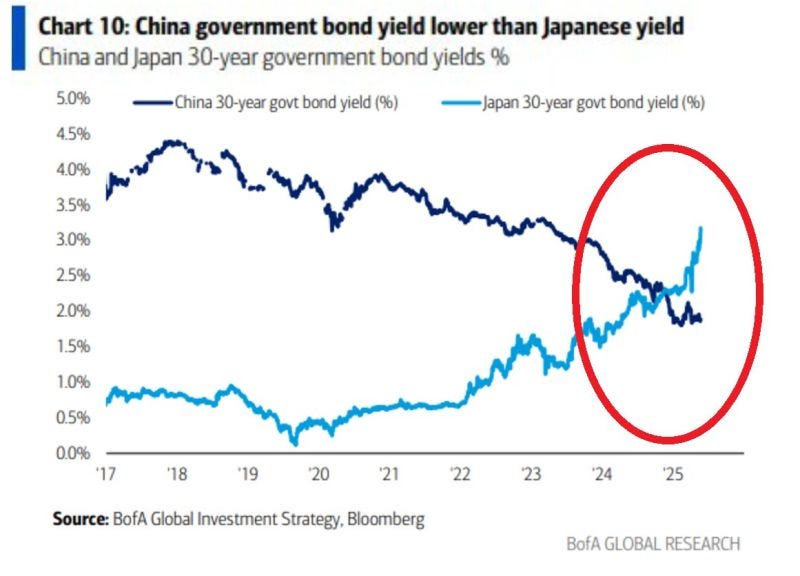

One of the clearest fault lines is forming in Japan.

For the first time ever, Japanese 30-year government bond yields are now higher than China’s - 3.1% versus 1.7%.

Just a year ago, the Japanese yield was 1.6%.

That’s a 150 basis point move in twelve months.

We haven’t seen that kind of movement since 1999, and it has enormous implications.

Japan has long been the anchor of global carry trades - the low-yield engine that allowed capital to flow to higher-yielding parts of the world.

But when yields rise at home, capital begins to come back.

And as it does, it doesn’t just reshape Japan’s economy.

It pulls threads out of the entire global financial tapestry.

The yen has responded.

In just three months, USD/JPY has moved +6.4%.

U.S. Treasuries, long considered a safe haven, have not been spared.

The 10-year yield has climbed from 4.10% to 4.53%.

Duration-heavy portfolios are feeling the pressure, and we may only be in the early innings.

What we’re witnessing is not just volatility - it’s the undoing of assumptions that have held for over a decade.

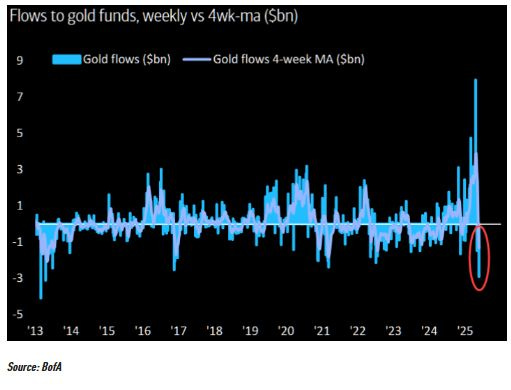

🥇 Gold Defies Gravity - And the Narrative

While capital flows and bond yields churn, another story is unfolding quietly in the realm of gold.

Last week, we saw a $2.9 billion outflow from gold funds - the third-largest weekly drop in more than a decade.

That should be bearish.

But gold isn’t listening.

Since April 2, it’s up +9.8%.

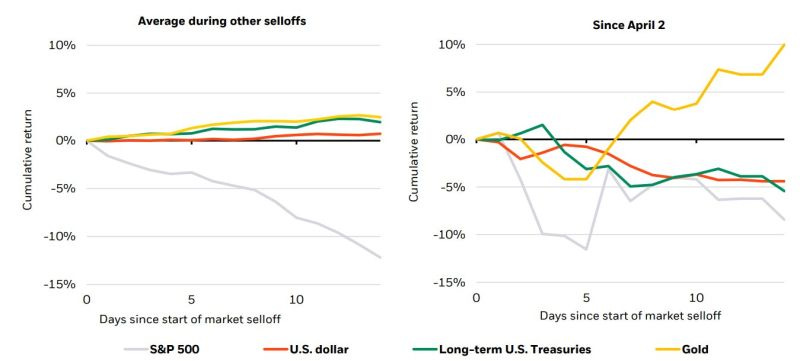

At the same time, the S&P 500 has fallen -7.1%, and long-term Treasuries have dropped -5.3%.

This is a break in the traditional narrative.

Normally, in periods of stress, we expect Treasuries to rally.

But this time, they're falling in lockstep with stocks.

That inverse correlation is crumbling.

Investors are waking up to the fact that fixed income no longer hedges equity risk the way it used to.

And so, they’re turning - slowly, but clearly - toward hard assets.

Gold, commodities, real estate proxies.

They’re no longer just stores of value; they’re becoming safe havens of confidence in a world where central banks and governments are losing credibility.

🚀 The Era of Nominal Growth Has Arrived

And then there’s the broader economic engine.

Elon Musk may not be a policymaker, but sometimes the outsider says what the insiders won’t.

In a tweet that felt half ironic and half prophetic, he stated that the U.S. needs to grow nominal GDP by 6-7% per year just to avoid a debt crisis.

On its face, that sounds provocative.

But it’s also true.

And historically, we’ve been here before.

In the aftermath of World War II, the U.S. ran nominal GDP growth of 7-8% for decades.

It wasn’t always clean growth - it was inflation, financial repression, investment, and real expansion.

But it worked.

Debt-to-GDP fell from 120% in 1946 to around 40% by 1970.

We may be entering a similar phase now, not by choice, but by necessity.

When debt is too high, the only way out is to inflate it away.

And in that kind of environment, history shows where capital flows.

During the 1970s, gold surged +2,300%.

The S&P 500?

Just +48%.

Commodities, infrastructure, tangible assets - these weren’t hedges; they were leaders.

We are seeing early echoes of this.

And if the market is moving back to a nominal-growth-first world, those echoes may become thunder.

Today, we see global markets reflecting this shift.

Spain is up +39.5% YTD.

Poland: +43.0%.

Austria and Greece are each posting gains above 30%.

These aren’t just small market rallies.

They’re powerful confirmations that the epicenter of performance is moving.

Slowly, methodically, capital is starting to trust other geographies, other currencies, other structures.

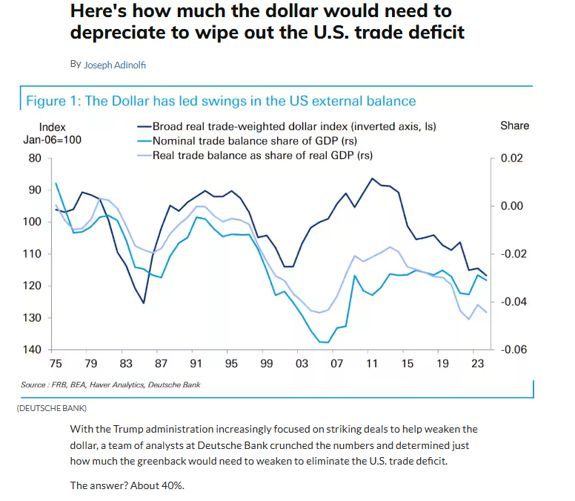

And the dollar?

Deutsche Bank has made the case that a 40% depreciation is required to eliminate the U.S. trade deficit.

That’s a bold number, but it speaks to the imbalance we’ve allowed to build over decades.

If even a portion of that correction happens, FX exposure will go from afterthought to cornerstone.

Currency diversification will no longer be optional.

This is not the time to cling to outdated assumptions.

This is not the time to rely on autopilot portfolios built for a world that no longer exists.

This is a moment that demands curiosity, agility, and a willingness to re-learn.

Everything I’ve shared here comes from hours of analysis, yes - but more than that, it comes from instinct.

That same instinct that told me to study in four different countries to understand markets more deeply.

That same instinct that built Macro Mornings into a global community of thinkers and doers.

Right now, that instinct tells me we are at the beginning of something very big.

Most people won’t see it yet.

But I believe those who do - who recognize the shift, who study it, who act on it - will be the ones writing the next chapter of financial success.

Alessandro

Founder of Macro Mornings

We came out of the Depression after WW2 because we ended numerous interventions in the economy, deregulated some things, etc. It was due to the return to normalcy, and the recovery happened in spite of the war, not because of it.

Wars cannot be productive, particularly the sort of wars America gets into where it’s one big favor for colonial powers & financiers we should rightfully hate and then we rebuild our enemies for no reason.

“War prosperity is like the prosperity that an earthquake or a plague brings.” - von Mises