A Regional Bank Paying ~4% — And Growing Dividends for 25 Straight Years

A Disciplined Regional Bank — The Kind That Actually Behaves Like a Compounding Machine

Hi friends — Max here.

Right now, there’s a dividend setup hiding in plain sight. Just a bank quietly doing something very few banks manage to do:

Pay a solid income today — and grow that income fast, year after year, for decades.

Here’s why this one stopped me.

A dividend yield around 4%.

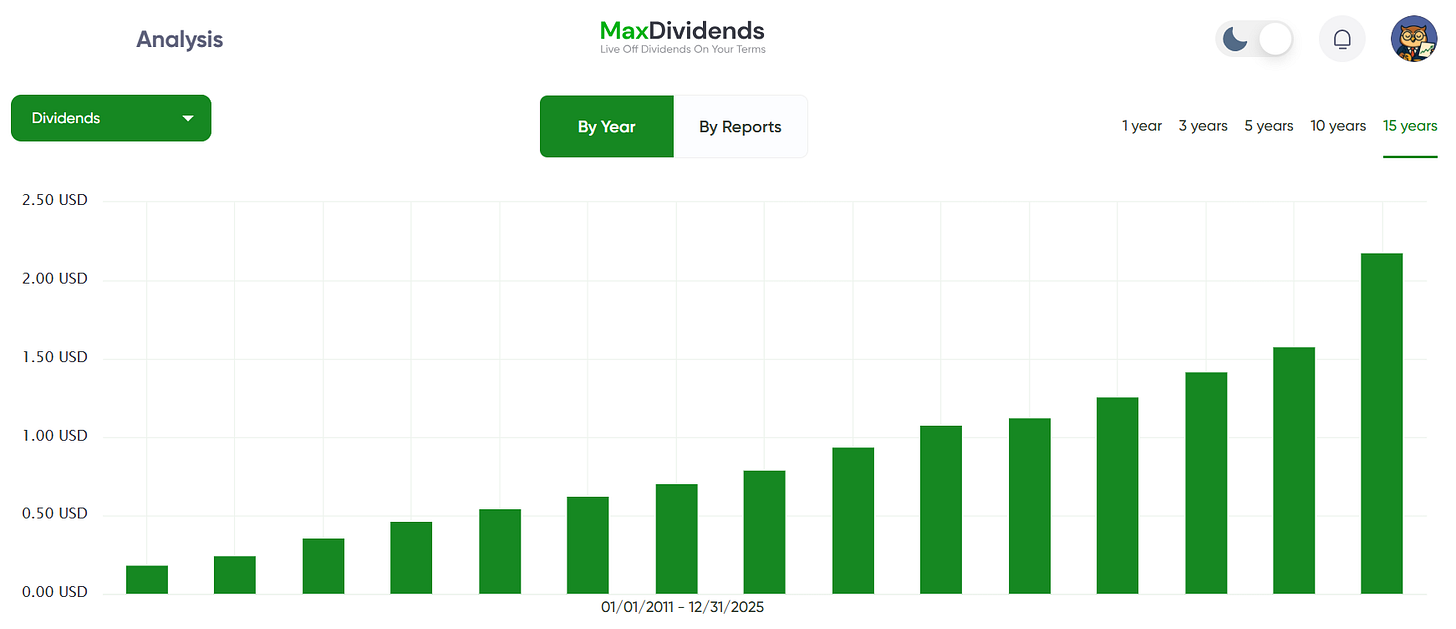

Dividend growth of 100%+ in just five years.

A 25-year dividend streak.

A double-digit long-term dividend growth rate.

And somehow… the market is still pricing it like nothing special. That combination almost never lasts. Because when you find a company that:

pays you real cash now,

raises that cash aggressively,

buys back its own shares,

keeps its balance sheet clean,

and trades close to book value…

you’re not looking at a “story.” You’re looking at a setup. That’s what today is about.

This is not a momentum play. Not a bet on rate cuts. Not a trade. Inside the MaxDividends framework, this shows up as a very specific tool — an Income Eagle designed to deliver cash today and compound it hard over time.

Let’s break it down.

The Quick Snapshot (What Jumped Out Immediately)

Here’s what this bank looks like inside our MaxDividends lens:

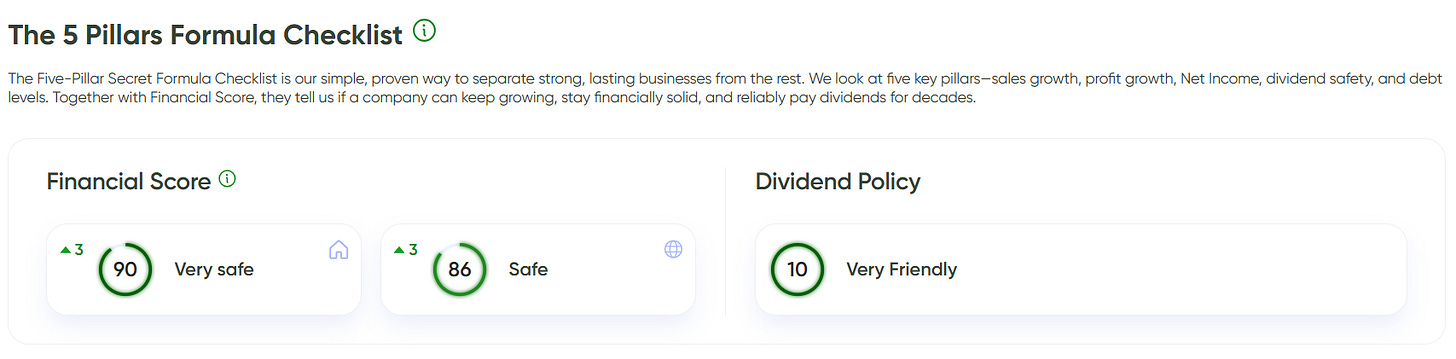

Financial Score: 90 (strong)

MaxRatio: 12.22 (this matters — more on it below)

Dividend yield: ~4%

Dividend growth: +102% over 5 years

Dividend streak: 25 consecutive years of dividends

10-year dividend CAGR: ~15%

Dividend Policy: 10/10 (very shareholder-friendly)

Buybacks: ~2% in 2025

Valuation: Undervalued, trading around / near book value (even close to below it)

If we’re building income that’s meant to grow, that mix is hard to ignore: a real streak + fast dividend growth + shareholder returns + cheap pricing.

What This bank Is

(in plain English)

This is a bank. Which means it does one core thing: it takes deposits, makes loans, and earns the spread.

So the question isn’t “is banking a good business?” The real question is:

Is this a bank that behaves like a disciplined dividend compounder… or a bank that looks good until the cycle turns?

The data points here — 25-year dividend record, 15% 10Y dividend CAGR, and a 10/10 dividend policy score — strongly suggest this management team treats shareholders like partners and has been consistent about it.

Why MaxRatio 10+ Is a Big Deal Here

Inside MaxDividends, MaxRatio tells us the job of the stock in the portfolio.

With MaxRatio at 12.22, this bank lands clearly in Income Eagle territory.

In real life, that means:

we’re getting meaningful cash flow now (~4% yield),

and the income stream has been growing aggressively (15% 10Y dividend CAGR),

while the business still screens as financially strong (Fin Score 90).

That combination is exactly how you get that “paid-now + paid-more-later” effect.

Dividend Behavior: Not Just “Paid” — Grown Aggressively

A lot of companies pay dividends. Fewer grow them consistently. Even fewer grow them fast for a long time.

The numbers here say:

25 straight years of dividends (culture and discipline)

+102% in 5 years (this is not slow growth)

~15% CAGR over 10 years (this is sustained compounding)

Add in buybacks (~2% in 2025) and you’re not just getting income — you’re getting a management team that’s actively working the per-share math in your favor.

Valuation: The Market Isn’t Pricing This Like a “Perfect Bank”

Two things matter here:

Undervalued

Trading around / near book value (even close to below it)

For banks, book value isn’t everything — but it’s not nothing either. When a bank with a strong dividend record and strong financial scoring trades around book, it usually means the market is either:

skeptical about the cycle,

skeptical about loan quality,

or just pricing the whole sector with a discount.

That’s often where the best income setups come from — when the business looks fine, dividends keep moving up, but sentiment stays cautious.

The Risks We Should Respect (Because It’s Still a Bank)

Let’s be adults about it. With banks, we always keep a short list of “what could break the story”:

Credit quality can change quickly

If losses spike, dividend growth can slow or pause. We watch loan performance and provisioning behavior closely.Funding costs / deposit competition

When deposit costs rise faster than loan yields, margins compress. That’s a big swing factor for banks.Rate-cycle sensitivity

Banks don’t move in a straight line. The business can look “fine” while profitability is quietly shifting under the hood.Commercial real estate / concentrated exposure

If this bank has specific concentration risk, that’s where we zoom in. A bank can be “great” and still have one pocket of trouble.

None of this means “don’t own it.” It just tells us what to monitor so we don’t get surprised.

Where This Fits Best In Our Portfolio Plan

Based on the data above, here’s the clean positioning - this bank fits best when we want:

a real yield today (~4%)

plus serious dividend compounding

from a business that screens as financially strong

and is priced at a level that implies low expectations

It’s less ideal if we want pure “sleep-well utility” stability or can’t tolerate normal banking cyclicality.

This is an Income Eagle that compounds like a growth stock on the dividend line — but we treat it like a bank and watch the credit and funding signals.

My Takeaway

If we’re choosing dividend ideas that can pay us now and raise that paycheck fast, this is exactly the type of setup that deserves attention.

A ~4% yield plus ~15% long-term dividend CAGR is how portfolios quietly change over a decade — especially when the stock looks undervalued and management is also buying back shares.

This is not about chasing headlines. It’s about owning a business that pays you, raises that payment aggressively, and does it with discipline.

👉 Want the ticker + full premium breakdown of this Income Eagle (buy zone, risks, what we track, and how it fits our portfolio)?

Top Undervalued Dividend Picks — powered by the proven Income System.

Full breakdowns. Clear roles. Clear signals.

Outgrow your passive income — one dividend business at a time.

And one important thing to be clear about

This isn’t a random company pulled from another analyst roundup. This is a business selected strictly by the rules of the MaxDividends system — the same type of business we invest our own money into.

The same kind of companies that actually sit in my personal portfolio.

And today, I want to show you the real system that’s feeding me and my family right now — the one that lets me sleep calmly while my savings do the work.

It’s also the system you can use to validate your own ideas — instead of guessing or relying on opinions.

The foundation: what I actually wanted (and why)

These principles aren’t “marketing.” They’re a reflection of how I’m wired, how I see life, and what I consider right investing at this stage.

I see investing as a partnership.

We put our capital into talented, honest, transparent businesses that build something real and useful. They grow. They create value. And they share that value with us.

The business wins. We win.

And we get to look at the future without that constant tight feeling in the chest.

So here’s the “ideal solution” I was looking for — very plainly:

Income starts today.

The dividend income I begin receiving right away — from the companies and funds I choose — covers a meaningful part of my family’s expenses (or even all of them). That changes everything. It means we can make decisions based on what we want, not what we fear.Income grows over time — even if I stop adding money.

Even if I don’t reinvest new savings or reinvest dividends, the income still rises year after year. We get wealthier. The checks get bigger.My capital is protected and grows.

I’m not slowly eating my savings. My capital is working intelligently and compounding. I’m building legacy and a stronger safety cushion over time.I don’t have to stare at the portfolio every day.

I can step away for 3–5 years and still know the system is doing its job. Of course, I’ll check in more often — but not because I’m anxious. Because I enjoy it. I like seeing the income climb and watching the dividend calendar fill up.

That’s the point. I didn’t just want to “live on dividends today.”

I wanted a structure where every year I feel more freedom and more options — and my family gets wealthier and calmer along the way. So I built it. Here are the principles it’s built on.

Principle #1 — Business first

No business can pay dividends for long if there’s nothing behind them. If the cash register is empty, it can’t magically print money (unless you’re the Federal Reserve).

This has been true for hundreds of years, and it will always be true. So the first filter is always the same:

Is this a strong business? What does “strong” mean in practice?

growing sales

growing earnings

stable, positive fundamentals even in tough years

manageable debt

strong liquidity

a smart balance between reinvesting for growth and rewarding shareholders

That’s the type of business I want to partner with.

Principle #2 — Dividend DNA

This is what I call a company’s commitment to rewarding shareholders with dividends — not just paying them, but improving over time so it can pay more.

How do we know if that commitment is real? Time. There’s only one way to know if a marriage is strong: years.

If you’ve been together 15–20 years, you’ve probably been through enough storms that the next 20 years are much more likely too. Same with business behavior.

My family’s goal for investing is income. So I choose companies with dividend DNA — businesses that treat dividends as a core responsibility, a public promise, a form of partnership.

A long history of paying dividends tells me something important: This company has a culture of accountability to shareholders. Not perfection. Not “no bad years.” But a real, tested habit of rewarding owners.

Principle #3 — Champions only

Imagine this: You’re choosing partners from 10 basketball players. Nine are unknown. The tenth is Michael Jordan. Who do we pick? We pick the champion.

Because champions have already proven they can win at the highest level — again and again.

In dividend investing, “champions” are the businesses with an unusual record: they don’t just pay dividends… they refuse to fall backward.

They raise the bar over time. They protect their reputation. They operate with higher internal standards. They don’t just have dividend DNA. They have champion dividend DNA.

And when we own those companies, something beautiful happens: Our income grows on its own — like a tree we planted years ago. Quietly. Reliably. While we live our lives.

Principle #4 — The right moment

Even the best business is not a great buy at any price.

I’m not a “sales guy,” but let’s be honest: if a can of Coke suddenly costs 10 cents instead of a dollar… we’re probably grabbing a few. Timing matters because it’s not about owning great businesses.

It’s about owning great businesses on our terms. And our terms are simple:

Here are our real expenses. Here are the bills. Here is the life we want.

So we choose the best — at the best moments we can reasonably get. That creates a double advantage:

strong businesses (safety + durability)

favorable entry points (better yield, better long-term results, more margin of safety)

The result: we become the “director” of a dream team

When these principles come together, the system starts to feel very simple.

We become the director of a team of elite businesses — strong, durable companies with dividend DNA — and they do real work for us:

They pay our bills.

They grow our income.

They protect and build our capital.

They prepare the next quarter’s cash flow — while we live.

And because our expenses are already covered by the system, we don’t have to rush.

We can be patient. We can make calm decisions: who deserves more capital, who stays steady, and who needs to step aside. That’s the MaxDividends Income System — the structure I built for myself.

And yes… it can become your structure too.

At this point, you’ve seen how I think about income. You’ve seen why structure matters more than tactics. And you’ve seen how this works in real life — calmly, without constant pressure.

So today, I want to be very straightforward with you. You can keep doing what you’re doing now. For some people, that’s perfectly fine.

If your current income feels stable enough, if uncertainty doesn’t bother you much, and if you’re comfortable relying mainly on growth and future outcomes — you don’t need this. And that’s okay.

But if you’re reading this because something feels fragile — if you’ve built solid savings but still don’t feel calm about income — if you don’t want to wait another decade hoping everything works out — then this is exactly why I built the MaxDividends Income System.

Not as a product. As a structure I personally use. This isn’t about chasing yield. And it’s not about “beating the market.”

Get instant full access to the MaxDividends Universe, MaxDividends Income System & App.

Designed to replace your paycheck, not just supplement it.

It’s about building income you can actually live on — and doing it in a way that lets you sleep well at night.

— Max