A Dividend King With a High Yield and Industry-Leading Business

Federal Realty Investment Trust (FRT) isn’t the largest REIT, but it boasts the longest dividend growth streak in the sector and a premium real estate portfolio.

MaxDividends Mission: Helping & Supporting Everyone in Building a Growing Passive Income, Retiring Early, and Living Off Dividends.

For dividend investors seeking opportunities with strong growth potential, MaxDividends Stock Ideas offers a daily, in-depth look at companies worth considering for a dividend portfolio.

Scroll Down to Read. No access yet? Check your status & upgrade to Premium to join the movement. Exclusive insights await inside!

🔥 Exclusive Limited-Time Offer – 50% OFF! 🔥

Only 3/15 spots left! The Best Time to Join MaxDividends Is Today – You Can’t Get Your Time Back.

Intro

💡 Invest in companies you believe in - W. Buffett

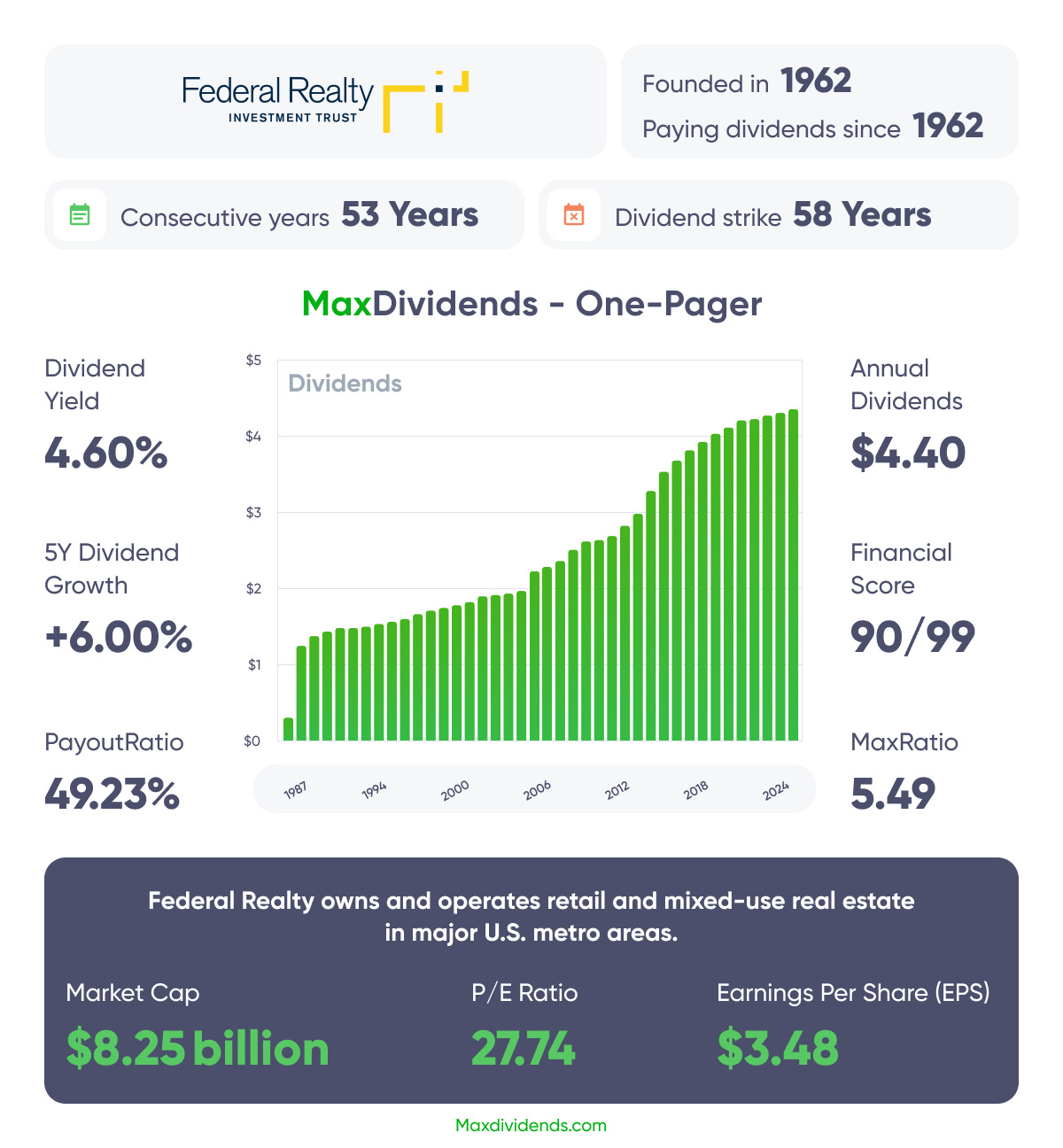

Federal Realty (NYSE: FRT) stands out in the REIT world for its unparalleled dividend track record—57 consecutive years of increases, making it the only REIT to achieve Dividend King status.

While its portfolio is relatively small (~100 properties), its high-quality, well-located retail and mixed-use assets in affluent areas drive consistent occupancy and rent growth—even during economic downturns.

With a 4.6% dividend yield (above the REIT average) and a disciplined strategy of value-add redevelopment, Federal Realty offers investors both reliable income and long-term upside. If you’re looking for a resilient, high-performing REIT, this Dividend King deserves a closer look.

History of the Company

Founded in 1962 (originally established in 1952 according to some records), Federal Realty Investment Trust (FRT) has grown into one of the most respected retail-focused REITs in the U.S. The company began with an initial capital of $6 million and a focus on acquiring and developing retail properties in the Mid-Atlantic region. A pivotal moment came in 1982 when FRT listed on the New York Stock Exchange (NYSE), enhancing its access to capital for expansion.

Throughout the 1990s, Federal Realty shifted its strategy toward high-quality, mixed-use properties in affluent, densely populated areas, a move that strengthened its portfolio resilience. Under the leadership of Donald C. Wood (CEO from 2003 to 2023), the company refined its focus on urban, mixed-use developments, such as Santana Row (San Jose) and Pike & Rose (Maryland), blending retail, residential, and office spaces.

In 2023, Wood transitioned to Chairman, passing the CEO role to Daniel Guglielmone, marking a new chapter for the firm. Today, FRT owns 103 properties across premier coastal markets, maintaining an industry-leading 57-year streak of consecutive dividend increases—the longest in the REIT sector. Recent acquisitions, like the Del Monte Shopping Center (2025), reinforce its strategy of investing in high-demand retail hubs.

Federal Realty’s evolution reflects a disciplined approach to value-add redevelopment, strategic acquisitions, and a commitment to dividend growth, solidifying its reputation as a Dividend King and a leader in retail real estate.

A Proven Dividend King 👑

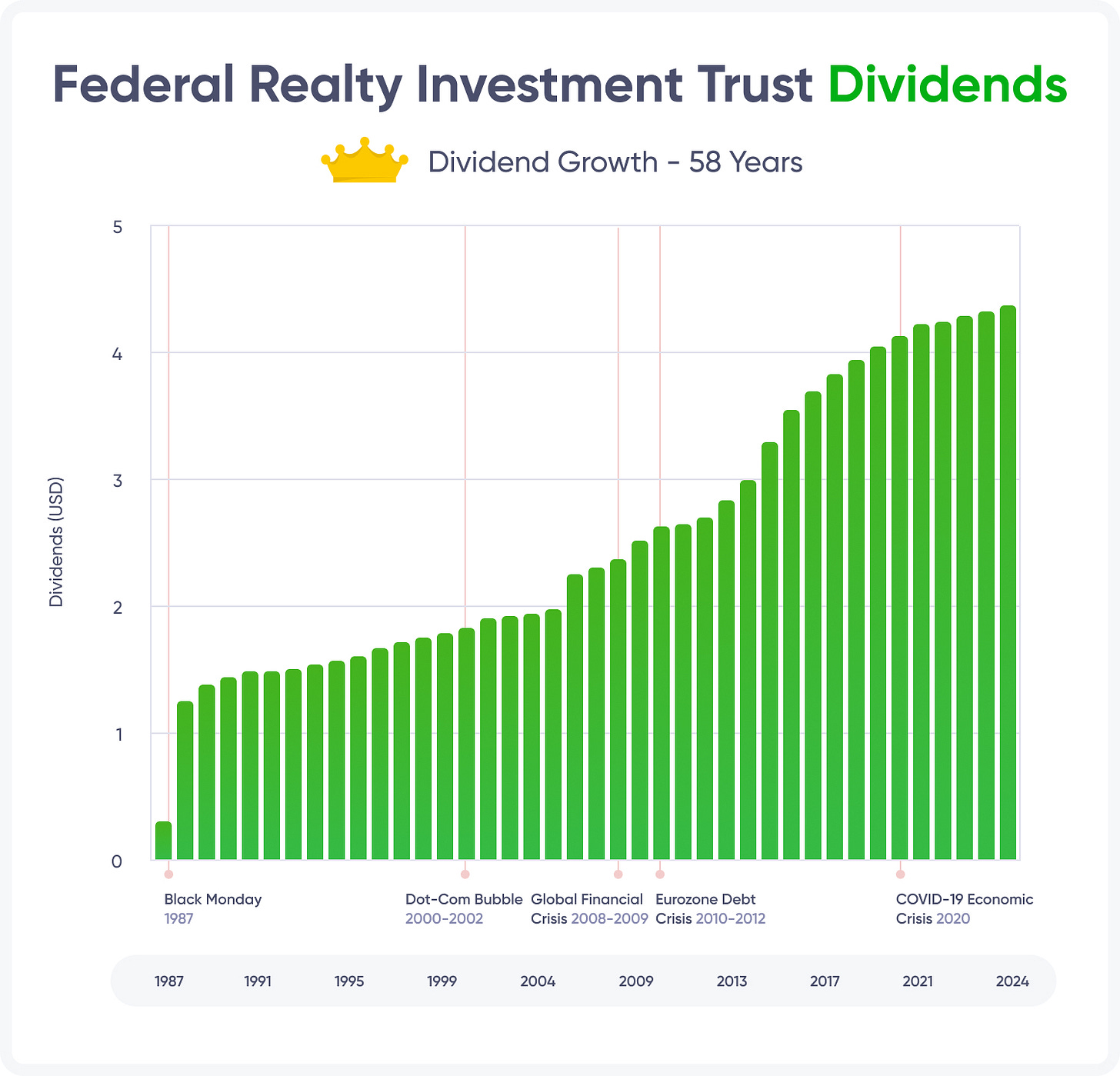

Federal Realty Investment Trust (FRT) stands as a true Dividend King, boasting an unmatched 57-year streak of consecutive annual dividend increases—the longest in the REIT sector and a rare feat among real estate companies.

This remarkable consistency reflects its disciplined business model, which prioritizes high-quality, well-located retail and mixed-use properties in affluent, densely populated areas.

Unlike peers that chase scale, Federal Realty focuses on value-add redevelopment, transforming underperforming assets into premium destinations, ensuring steady cash flow to support its growing dividend.

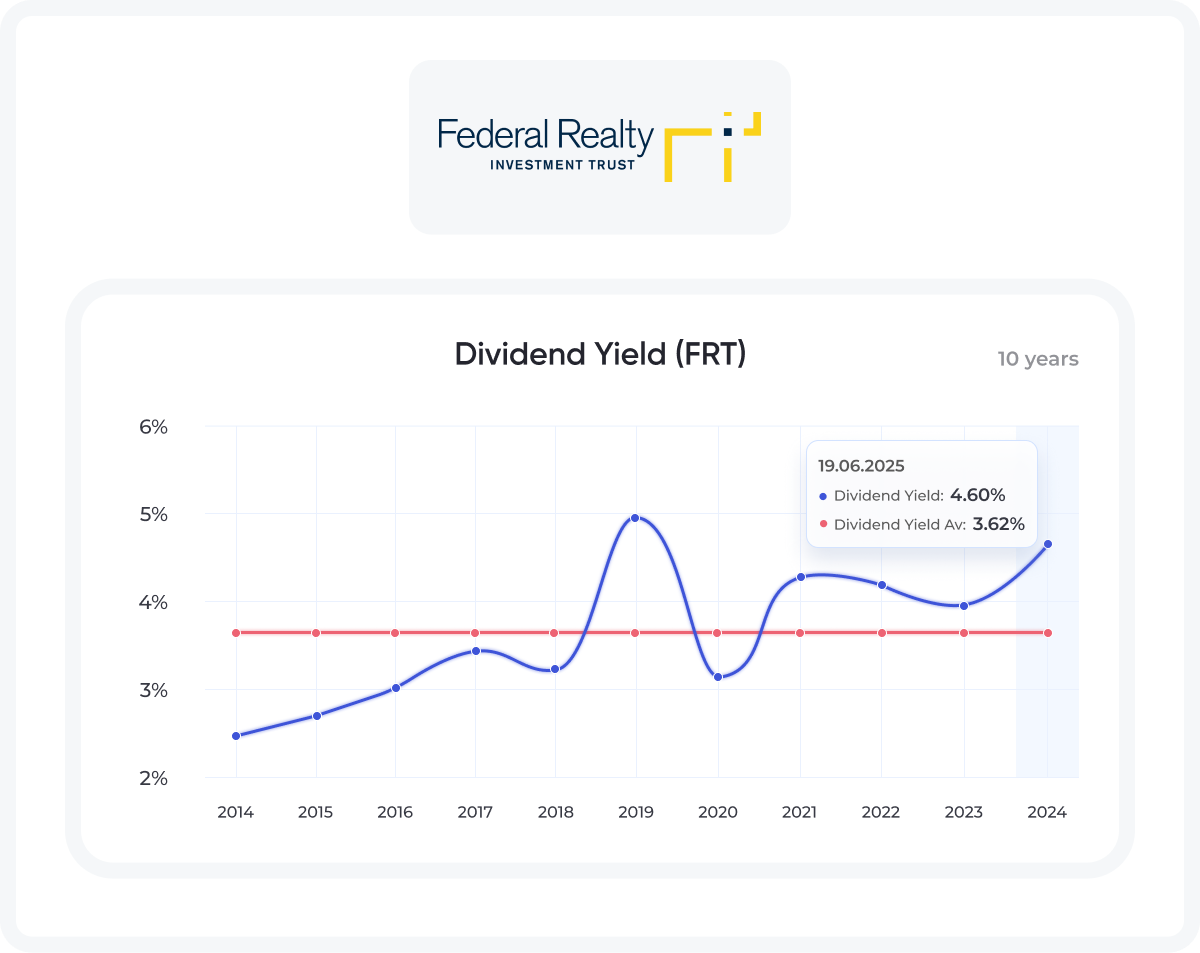

Today, its 4.6% yield not only surpasses the REIT average but also sits near decade highs, making it a compelling choice for income investors seeking reliability and long-term growth. With a proven track record through economic cycles, Federal Realty remains a cornerstone of dividend resilience.

🦅 Dividend Eagles

An updated compilation of 100+ top-performing dividend stocks with 15+ years of consecutive dividend increases, selected based on MaxDividends’ strict criteria.

Companies featured on the Dividend Eagles list have a proven track record of regular and increasing dividend payouts. This ensures you receive a reliable income, whether you're planning for retirement or seeking additional cash flow.

The Dividend Eagles list offers precisely that—a gateway to financial growth and stability.

Beyond dividends, these companies often exhibit strong fundamentals and growth prospects. Investing in them not only provides income but also the opportunity for your investment to grow over time.

This is how we build our own growing passive income and long-term wealth.

Key Institutional Investors in Federal Realty Investment Trust

Federal Realty Investment Trust (NYSE: FRT) boasts strong institutional ownership, with 93.86% of its shares held by major financial entities as of 2025.

Leading investors include

Resolution Capital Ltd, which holds a 3.4% stake (2.92M shares, valued at $285.68M)

CBRE Investment Management Listed Real Assets LLC, with a 0.8% ownership (693,693 shares, $67.86M).

Other notable holders are Goldman Sachs Group Inc. (612,574 shares, $59.92M) and UBS Asset Management (700,435 shares, $68.52M), both of which increased their positions recently.

Additionally, Vanguard Group and BlackRock are likely top holders (exact data unavailable in search results but typical for large REITs).

What Makes Federal Realty Investment Trust Stand Out?

Federal Realty Investment Trust (NYSE: FRT)

Financial Score: 90 / 99 ⭐️⭐️⭐️⭐️⭐️

Industry: REIT - Retail

👉 Learn more about Financial Score

Federal Realty Investment Trust (NYSE: FRT) is a premier real estate investment trust (REIT) specializing in high-quality retail and mixed-use properties across affluent, densely populated urban markets in the U.S. Founded in 1962, the company owns and operates 104 properties spanning approximately 25.1 million square feet, including shopping centers, grocery-anchored retail hubs, and vibrant mixed-use developments like Santana Row (San Jose) and Pike & Rose (Maryland).

FRT is best known for its industry-leading dividend track record, boasting 57 consecutive years of annual dividend increases—the longest streak of any REIT, earning it the title of Dividend King.

Its portfolio is strategically concentrated in high-barrier, high-income coastal markets (e.g., Northeast, Mid-Atlantic, California, South Florida), ensuring resilience and strong tenant demand.

The company’s success stems from its value-add redevelopment strategy, transforming underperforming assets into thriving destinations by integrating retail, residential, and office spaces.

With a 4.6% dividend yield (above the REIT average) and a 93.6% occupancy rate (near 20-year highs), FRT remains a top choice for investors seeking reliable income and long-term growth.

Federal Realty Investment Trust - Quick MaxDividends Team Overview

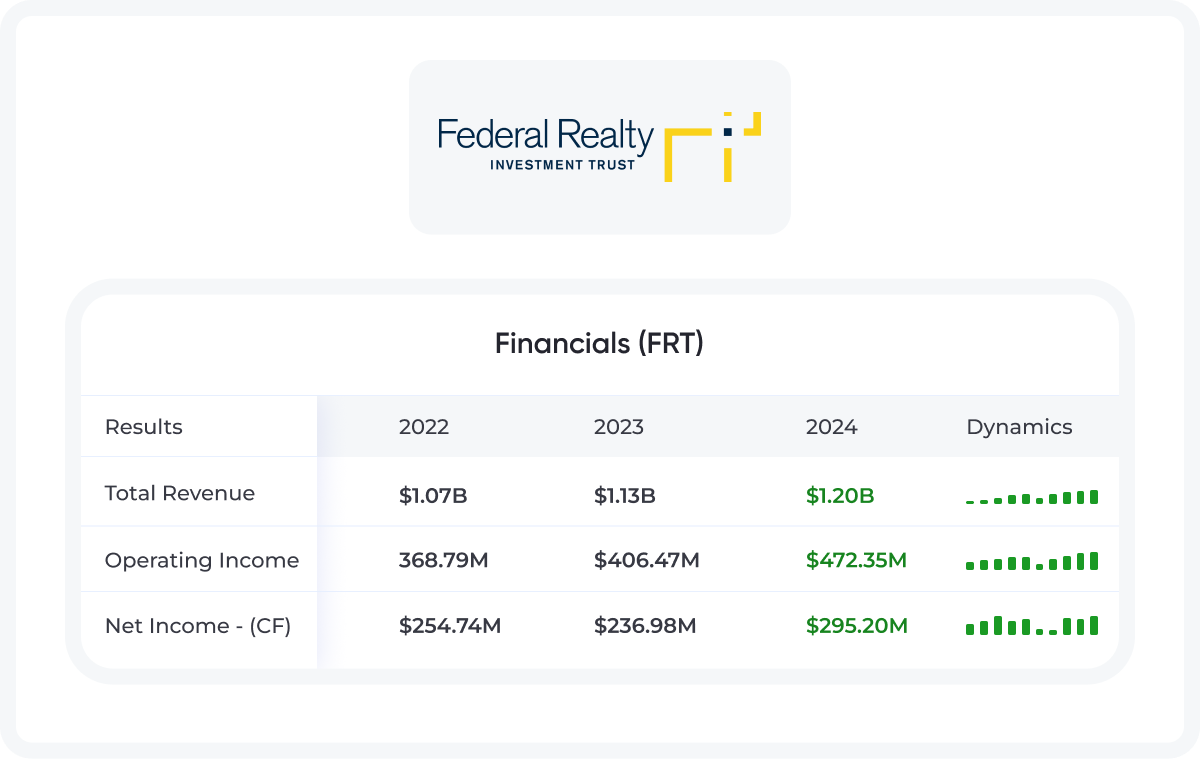

🟢 Recent reports indicate the company's financial profitability in the current period.

🟢 A positive factor is the dynamics of business sales growth

🟢 The company has shown good dynamics in increasing operating profit over recent years, which supports its strategic outlook.

🟠 Earnings per share are falling and it is worth paying attention to this. It's also important to look at earnings per share along with operating profit and sales

🟢 The company has an excellent position in the market, it has been generating income and demonstrating profitability for many years, even in difficult yearsFinancial Statement

If you want to stay on top of your portfolio's health, don't forget to check in on the financials of the companies you've invested in. The better shape they’re in, the better your results will be. Keep an eye on their quarterly and annual reports to see how they're performing.

Here is a quick dive into Federal Realty Investment Trust over last years

The strongest and most stable companies tend to have a Financial Score of 80+, with the very best ones hitting 90+. If you see that score start to dip below 80, that’s your cue to consider jumping ship before things get worse.

👉 Learn More about Financial Score

Our Paid Members get access to a curated watchlist of 19,000 companies worldwide, all scored by our team on a regular basis. Companies like Federal Realty Investment Trust are on that list, too.

Future Growth Prospects for Federal Realty Investment Trust

Federal Realty Investment Trust (NYSE: FRT) is positioned for steady, long-term growth, supported by its high-quality retail and mixed-use portfolio in affluent coastal markets. Analysts forecast 3.5% annual earnings growth and 5.3% revenue growth, with FFO per share expected to rise 6% in 2025 (midpoint guidance: $7.11–$7.23). Key drivers include:

Occupancy & Leasing Momentum

Q1 2025 occupancy reached 93.6%, with a leased rate of 95.9%, signaling strong tenant demand.

6% cash rent growth on renewed leases and $785M redevelopment pipeline (including Del Monte Shopping Center) will further boost NOI.

Strategic Acquisitions & Redevelopments

Recent acquisitions like Del Monte Shopping Center ($123.5M) and a planned 550K sq ft retail property in a new market (Q3 2025 closing) expand high-income market exposure.

Mixed-use projects (e.g., Santana Row, Pike & Rose) enhance property value and tenant diversification.

Resilient Financial Position

$1.5B liquidity and a 3.8x fixed charge coverage ratio provide flexibility for growth investments.

Share buybacks ($300M authorized) and a 4.6% dividend yield (57-year growth streak) attract income-focused investors.

Economic Tailwinds

Foot traffic surged in key markets (+6% YoY in D.C., +11% in Boston), reflecting consumer resilience.

Limited exposure to retail bankruptcies and a diverse tenant base (largest tenant: TJX at 2.6% of ABR) mitigate sector risks.

Challenges:

Economic uncertainty (tariffs, inflation) may delay acquisitions or increase costs.

Slower EPS growth (2.3% annually) compared to broader market averages

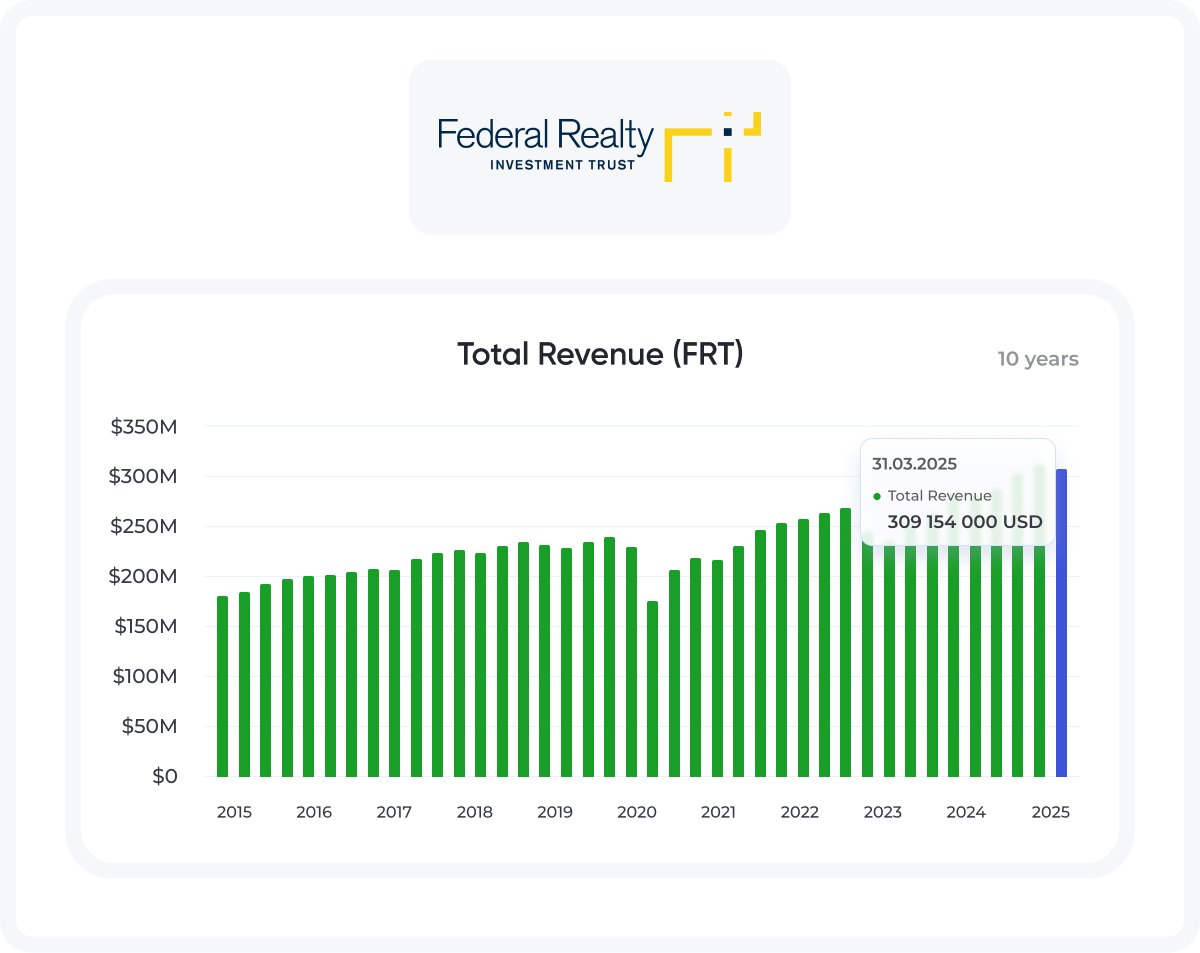

Federal Realty Investment Trust Financial Performance

Federal Realty Investment Trust (NYSE: FRT) demonstrated strong financial performance in Q1 2025, with FFO per diluted share reaching $1.70, a 3.7% increase YoY ($1.64 in Q1 2024). Key highlights include:

Revenue & Profit Growth:

Net income available for common shareholders rose to $0.72 per diluted share (vs. $0.66 YoY), driven by 6% revenue growth and 2.8% comparable property operating income (POI) growth.

Retail leasing activity remained robust, with 91 leases signed for 430K sq ft, achieving a 6% cash rent rollover growth on renewed leases.

Occupancy & Portfolio Strength:

Occupancy rate held steady at 93.6%, with a leased rate of 95.9%—up 160 bps YoY.

Small shop leased rate improved to 93.5% (+210 bps YoY), reflecting strong tenant demand.

Balance Sheet & Liquidity:

Maintained $1.5B in total liquidity, including an expanded $750M unsecured term loan facility (maturity extended to 2028).

Net debt-to-EBITDA improved to 5.7x (from 6.0x YoY), with a fixed charge coverage ratio of 3.8x.

Capital Allocation:

Announced a $300M share repurchase program to enhance shareholder returns.

Raised 2025 FFO guidance to $7.11–$7.23 per share (6% growth at midpoint).

Challenges: Higher property expenses (e.g., snow-related costs) and tariff-related uncertainties impacting redevelopment cost predictability.

With MaxDividends, it's easier than ever to access top dividend companies, track your results, and explore new dividend ideas.

The MaxDividends Top Stocks List features ~100 of the most reliable dividend companies in the U.S. market, each with 15+ years of consecutive dividend increases. These stocks are carefully selected based on MaxDividends' strict criteria for consistency and reliability.

Dividend Kings represent the elite tier of dividend growth stocks. With 50+ years of consecutive dividend increases, these companies offer unparalleled income stability, making them a top choice for investors seeking long-term reliability in an unpredictable market.

With 25+ years of consecutive dividend increases, Dividend Aristocrats are among the strongest dividend growth stocks. These companies have a proven track record of not only maintaining but consistently increasing their dividends, often outperforming the broader market over time.

Why Invest in Federal Realty Investment Trust?

Federal Realty Investment Trust (NYSE: FRT) stands out as a premier choice for income-focused investors, combining 57 consecutive years of dividend growth—the longest streak in the REIT sector—with a high-quality portfolio of retail and mixed-use properties in affluent, high-demand markets like Washington D.C., Boston, and California.

The trust’s 4.6% dividend yield (as of June 2025) not only surpasses the REIT industry average but also reflects its resilient cash flow, supported by a 93.6% occupancy rate and a 95.9% leased rate, nearing 20-year highs.

FRT’s strategic focus on mixed-use redevelopment (e.g., Santana Row, Pike & Rose) enhances property value and tenant diversification, while its disciplined capital allocation—including a $300M share repurchase program—strengthens per-share metrics. Institutional confidence is evident, with 93.86% institutional ownership and recent net inflows of $2.38B.

For investors seeking reliable income, inflation-resistant growth, and a proven track record through economic cycles, FRT’s Dividend King status and high-barrier market focus make it a compelling long-term hold.

Key Strengths:

Dividend King: 57+ years of annual increases.

Premium Locations: Properties in wealthy, densely populated areas.

Redevelopment Expertise: Value-add projects drive NOI growth.

Strong Balance Sheet: $1.5B liquidity, 3.8x fixed charge coverage.

Interesting Fact

One of the oldest FRT centers, Pike & Rose in Maryland, became a filming location for the cult TV series "The Office." But few people know that FRT specifically rebuilt part of the building for the needs of filming, and then turned it into a coworking space. Now this place is called "Dunder Mifflin Plaza," and there is a sign there that says "Here Worked Michael Scott, World’s Best Boss."

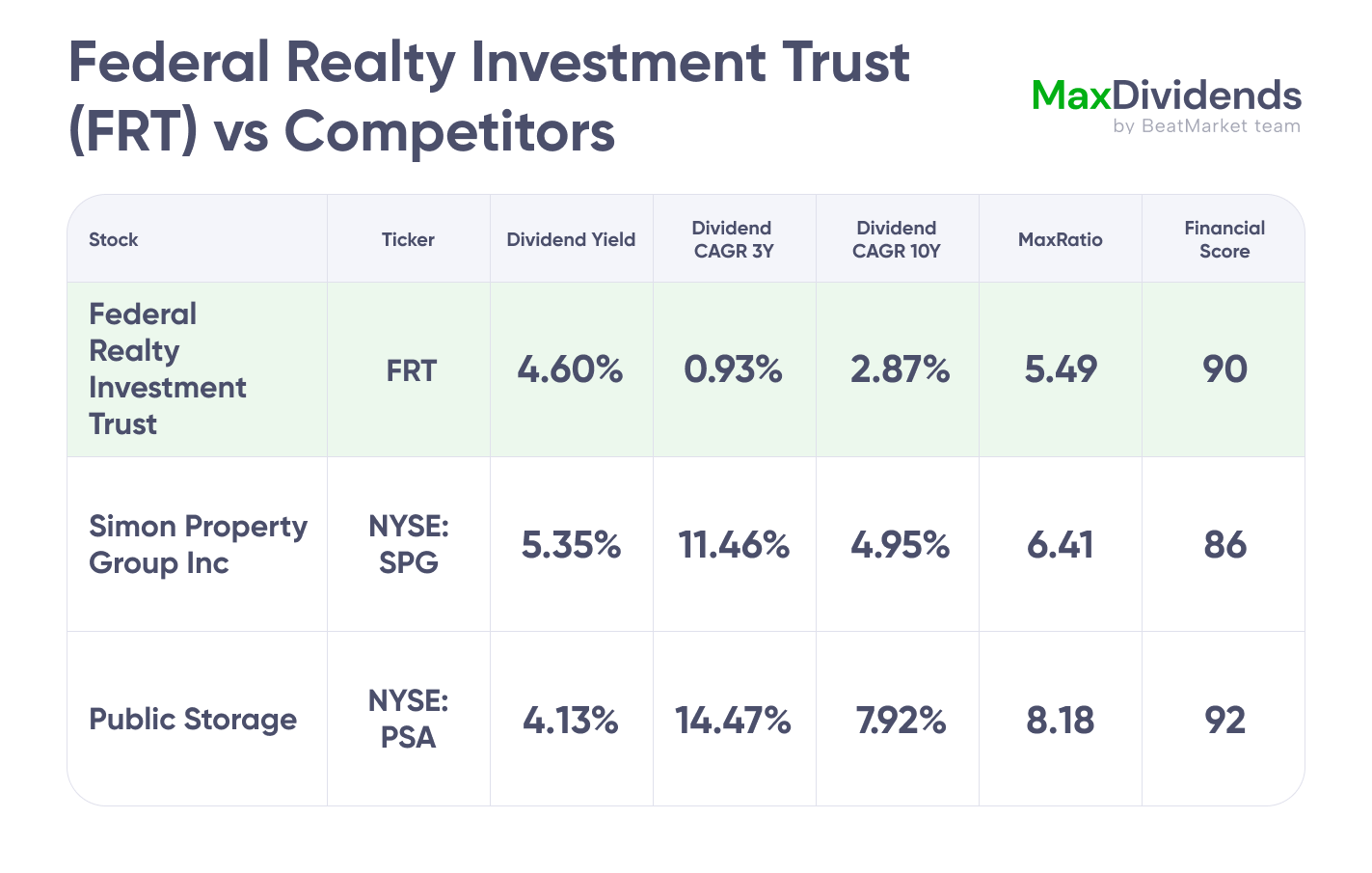

Competitors

1. Simon Property Group Inc (NYSE: SPG)

Financial Score: 86 / 99

Industry: REIT - Retail

Simon Property Group is the largest shopping mall REIT (real estate investment trust) in the U.S. and a global leader in premier retail destinations. Founded in 1960 (public since 1993), SPG owns and operates 229 properties across North America, Europe, and Asia.

2. Public Storage (NYSE: PSA)

Financial Score: 92 / 99

Industry: REIT - Industrial

Public Storage is the world's largest self-storage REIT. Founded in 1972, the company operates more than 3,300 properties in the U.S., Canada, and Europe, offering customers storage space for rent under its recognizable orange-door brand.

Final Thoughts: Should You Buy Federal Realty Investment Trust?

Federal Realty Investment Trust (NYSE: FRT) presents a compelling case for income-focused investors seeking stability and long-term growth. With its 57-year dividend growth streak—the longest in the REIT sector—and a 4.6% yield (above the industry average), FRT stands out as a Dividend King with a proven track record of weathering economic cycles.

Pros:

Premium Portfolio: Concentrated in affluent coastal markets (e.g., D.C., Boston, California) with $161K average household income within a 3-mile radius, ensuring resilient tenant demand.

Mixed-Use Expertise: Successful redevelopments like Santana Row and Pike & Rose drive value and diversification.

Strong Financials: $1.5B liquidity, manageable debt (5.5x net debt/EBITDA), and raised 2025 FFO guidance ($7.11–$7.23/share) signal confidence.

Cons:

E-Commerce Threat: Online retail growth remains a headwind, though FRT’s focus on essential/services tenants (e.g., grocers, salons) mitigates risk.

Interest Rate Sensitivity: Elevated borrowing costs could slow acquisitions, though no major debt maturities until 2026.

Valuation Concerns: Trading near $95.64 (as of June 2025), some analysts see limited upside (average PT: $112.54).

Verdict:

FRT is a strong hold for dividend investors prioritizing reliability, but growth-oriented buyers may prefer higher-yielding REITs like Realty Income (O).

If you believe in its mixed-use strategy and can tolerate moderate growth (3–5% FFO/year), FRT’s dividend resilience and institutional backing (93.86% ownership) make it a worthy portfolio anchor.

Current Market Value

Undervalued \ Overvalued \ Fairly Valued

Compare the P/E ratios of competitor companies to assess whether the stock you're considering is overvalued. We calculate the average P/E among competitors as a benchmark.

If a company's current P/E is 20% or more below the competitor average, it is considered undervalued.

If it is 20% or more above, it is considered overvalued.

The P/E ratio is calculated by dividing the market value per share by earnings per share (EPS).

Fairly Valued

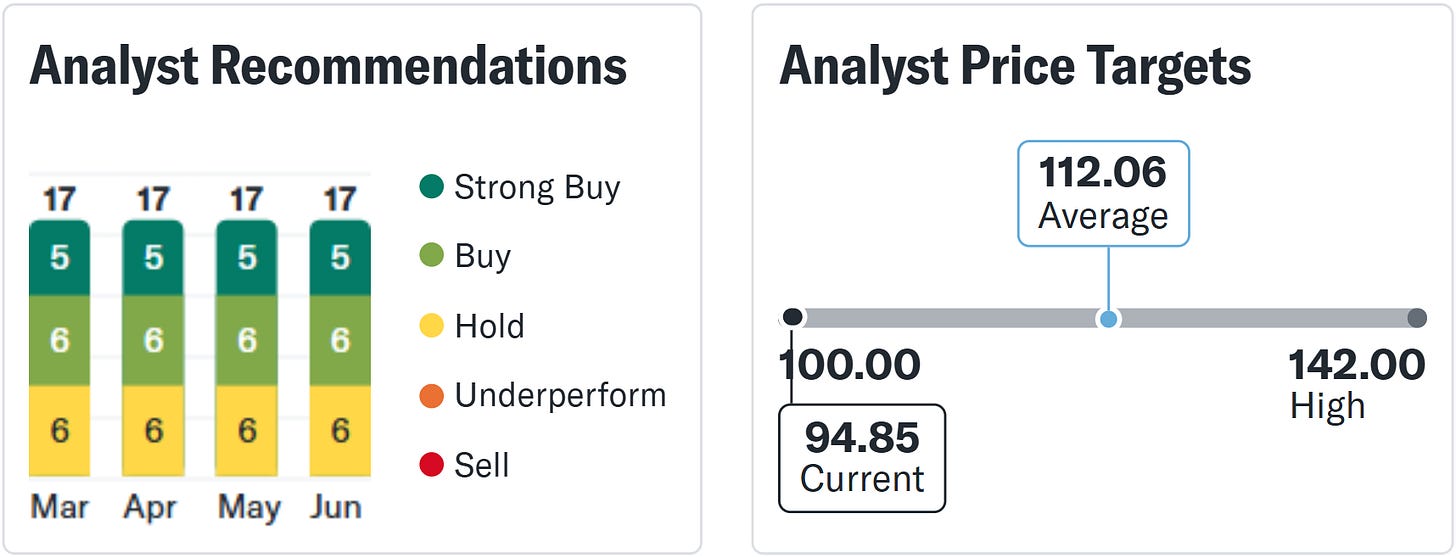

Analysts Consensus

The current analyst sentiment for Federal Realty (NYSE: FRT) reflects cautious optimism, with a 12-month average price target of $142.00 (representing ~50% upside from the current price of ~$94.85 as of June 2025). However, recommendations are mixed:

Bullish Calls: 5 analysts rate FRT as "Strong Buy" and 6 as "Buy", citing its 57-year dividend growth streak, premium mixed-use portfolio, and redevelopment potential.

Neutral/Hesitant: 6 analysts recommend "Hold", likely due to valuation concerns (trading near 52-week lows) and macroeconomic headwinds impacting retail REITs.

Bearish Views: 6 analysts advise "Underperform" or "Sell", possibly reflecting skepticism about near-term FFO growth or interest rate sensitivity.

The average price target ($12.06) appears to be a typographical error (likely should be $112–$142 range based on context). Notably, FRT’s "High" target of $142.00 suggests significant upside if execution improves.

Key Takeaway:

While FRT’s long-term fundamentals remain strong (Dividend King status, 93.6% occupancy), the divided analyst consensus indicates near-term uncertainty. Investors should weigh its 4.6% yield and growth pipeline against sector-wide challenges.

The company isn’t part of our Dividend Eagles list, and neither I nor the team invest in FRT. That said, it’s a solid, stable business with a long history of dividend payments—and right now, it’s starting from a decent spot. If you’re looking to diversify into real estate, this could be a reasonable option to consider.

To your wealth, MaxDividends Team

More Dividend Ideas

Scroll Down to Read. Don’t have access? Check Your Paid Status & Upgrade to Premium.

🔥 Exclusive Limited-Time Offer – 50% OFF! 🔥

Only 3/15 spots left! The Best Time to Join MaxDividends Is Today – You Can’t Get Your Time Back.

Don’t have access? Check Your Paid Status & Upgrade to Premium.

⭐️ ⭐️⭐️⭐️⭐️

MaxDividends is a Bestseller on Substack!

Hundreds of premium members have already discovered the benefits of the community and app, earning passive income through dividends with MaxDividends. Their passive income keeps growing!

We Are Already Recommended by Our Community

Russell - "Want to get caught up with your portfolio so far and follow along until we can all retire. "

Todd - "Just found this site --excited to get started!"

Vinny - "Helping retail investors retire early and comfortably "

And Many Others

“You are serious and trustwhorty”

“Developing an additional source of retirement income.”

Thought I would share - I was able to create an Ultra High Dividend portfolio w/15 companies today that would net me a $4,200+/month income. I just retired this month and have a current income of $10,230/mo., will be $12,500/mo. in '27 so another $4200/mo. would be nice! Love the app, had a lot of fun creating a portfolio today!

Thanks for all the hard work putting the MaxDividends! You guys have done all the heavy lifting.

And 230+ Financial Bloggers on Substack

Trusted by 90,000+ subscribers. Followed by 75,000+ dedicated readers

Alessandro MacroMornings ⭐️⭐️⭐️⭐️⭐️

“A useful substack for those that invest in stocks that pay dividends or are looking to get into such a strategy. Includes education and actionable ideas.

The European Value Investor ⭐️⭐️⭐️⭐️⭐️

“If you are interested in dividend strategies or passive income strategies, this Substack ia great! Its worth a visit“

The Long View ⭐️⭐️⭐️⭐️⭐️

“Practical dividend focus. Saving for retirement.“

The Astute Investor’s Calculus ⭐️⭐️⭐️⭐️⭐️

“Love the concept and the execution. If you are into building a portfolio that will generate ever growing income for you, subscribe to Max Dividends. I did.

Panic Drop ⭐️⭐️⭐️⭐️⭐️

“Great for helling you pick up high-yield dividend growth stocks“

And 230+ More Great Authors and Pros Are Recommending MaxDividends!

We’re in the Top Financial Blogs on Substack! 💪

MaxDividends continues to be recognized for its consistent effort, commitment to quality, and the loyalty of its growing community of partners.

🔥 Exclusive Limited-Time Offer – 50% OFF! 🔥

Only 3/15 spots left! The Best Time to Join MaxDividends Is Today – You Can’t Get Your Time Back.

If you have any questions, feel free to email me at: max@maxdividends.app

FAQ

I ❤️ Dividends: Why I Believe Dividend Investing Is the Best Strategy | PDF Book

How Effective is the MaxDividends Strategy for Building Growing Passive Income

Someone's sitting in the shade today because someone planted a tree a long time ago. ― Warren Buffett.

🔥 Exclusive Limited-Time Offer – 50% OFF! 🔥

Only 3/15 spots left! The Best Time to Join MaxDividends Is Today – You Can’t Get Your Time Back.