25 Years Without a Dividend Cut — Built on Steel, Roads, and Reality

Hi friends — Max here.

Every morning, somewhere in the U.S. or Europe, roadside crews roll out heavy equipment. Grass gets cut. Shoulders get cleared. Storm damage gets cleaned up. Municipal fleets go to work — quietly, routinely, without headlines.

That’s the world Alamo Group operates in. No “next big thing.”

Just steel, engines, and infrastructure that has to be maintained — year after year, in good times and bad. And that boring reality explains something remarkable.

25 consecutive years of dividend payments without a single reduction.

Not pauses. Not financial gymnastics. Not luck. Consistency.

Inside the MaxDividends Income System, this is exactly where we slow down and pay attention. Because dividends that survive decades are never accidental — they’re the byproduct of how a business is built and how management thinks.

👉 If you want to follow this type of real-world dividend analysis regularly, that’s what the system and the app are designed for.

Get instant full access to the MaxDividends Universe, MaxDividends Income System & App.

Alamo Group makes specialized equipment for vegetation management, road maintenance, and infrastructure upkeep. Its customers are municipalities, governments, and utility contractors.

These aren’t “nice-to-have” purchases. When budgets tighten, maintenance still happens. When storms hit, cleanup can’t wait. When infrastructure ages, equipment demand doesn’t disappear.

That creates something dividend investors care deeply about: non-optional demand.

This is why Alamo Group’s dividend story looks the way it does. Not aggressive. Not flashy. Just steadily paid and carefully protected. Management doesn’t stretch the payout. They don’t chase yield optics. They raise the dividend when the business earns it — and that discipline compounds over time.

Inside the MaxDividends App, this is where we connect dividend streaks with financial behavior — to see whether the past was earned or merely survived.

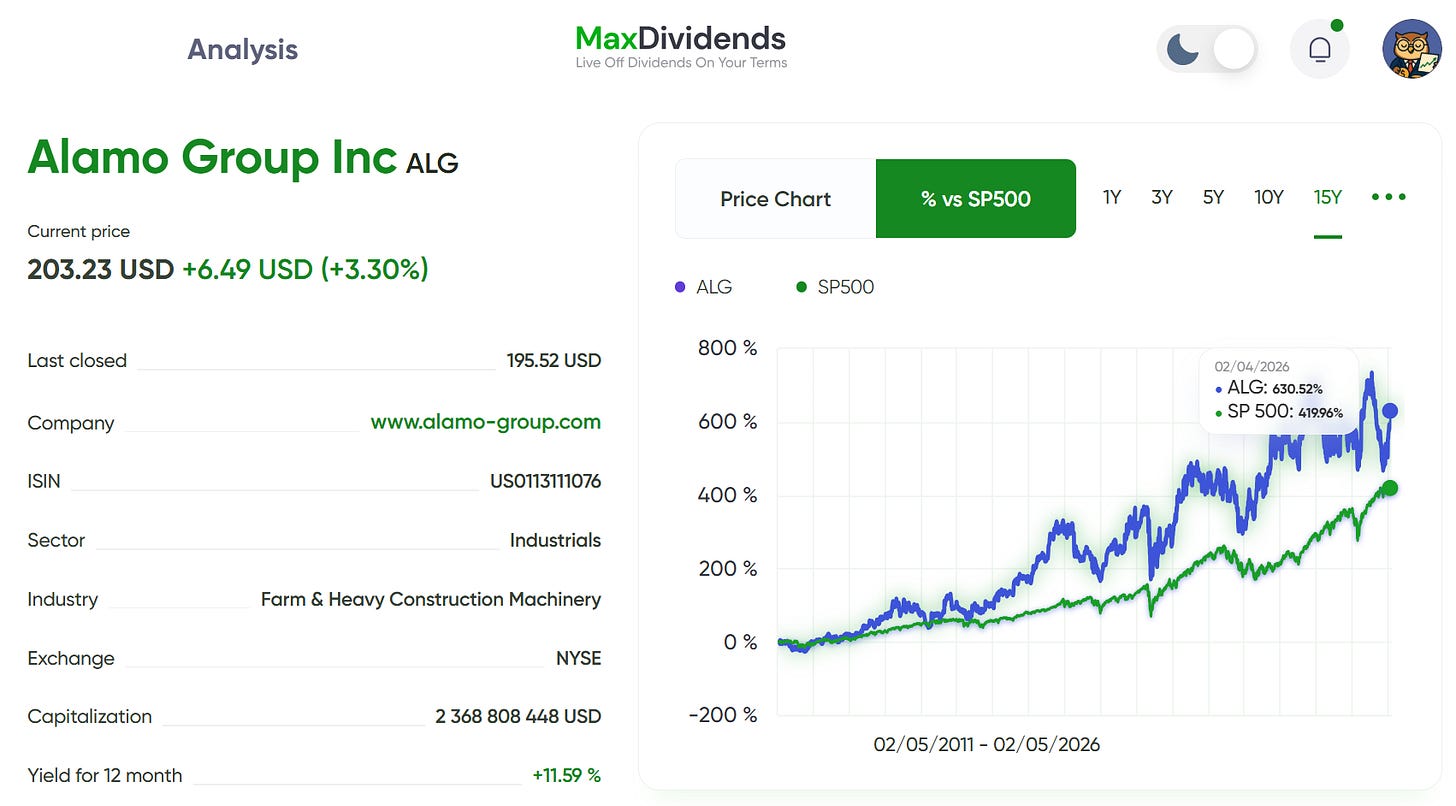

And ALG’s behavior stands out.

Strong balance sheet. Conservative payout. Cash flows tied to physical necessity, not consumer sentiment.

This is an industrial business that understands its role: stay profitable across cycles, reinvest prudently, and reward shareholders without ever putting the dividend at risk. That mindset is exactly how you end up with a 25-year record that includes recessions, inflation spikes, supply-chain disruptions, and rate shocks — without a cut.

Here’s the bigger point.

If you’re building an income portfolio meant to support real life — families, planning, long horizons — these are the businesses that quietly do the heavy lifting. They don’t excite the market. They serve it. And they pay you along the way.

This email only scratches the surface.

In the full premium analysis, we go deeper:

Does Alamo Group fit your plan right now — or is it one to watch and wait for?

How This Company Makes Money?

Is This a Good Stock to Buy Long Term?

Is the Stock Undervalued Today?

Does It Fit Your Plan?

And how it ranks inside our Dividend Income System framework

If you want that level of clarity and the same tools we use ourselves, that’s exactly what Premium and the MaxDividends App unlock.

Quiet businesses often build the loudest income streams — if you know where to look.

👉 Explore the MaxDividends Income System & App

Get instant full access to the MaxDividends Universe, MaxDividends Income System & App.

Talk soon,

Max