2 Solid Japanese Stocks to Watch

With Warren Buffett boosting investments in Japan, these two companies - Yokogawa Bridge, and Fukui Computer - stand out as compelling opportunities.

MaxDividends Mission: Helping & Supporting Everyone in Building a Growing Passive Income, Retiring Early, and Living Off Dividends.

For dividend investors seeking opportunities with strong growth potential, MaxDividends Stock Ideas offers a daily, in-depth look at companies worth considering for a dividend portfolio.

Scroll Down to Read. No access yet? Check your status & upgrade to Premium to join the movement. Exclusive insights await inside!

With Warren Buffett boosting investments in Japan, these two companies—Yokogawa Bridge, and Fukui Computer—stand out as compelling opportunities.

Intro

Japan’s stock market is gaining renewed attention from global investors, especially after Warren Buffett’s Berkshire Hathaway increased its stakes in key Japanese firms. This shift highlights Japan’s unique mix of stability, innovation, and undervalued potential.

In this guest post, we examine three intriguing players on the Tokyo Stock Exchange:

Yokogawa Bridge Holdings (5911) – A leader in infrastructure and engineering.

Fukui Computer Holdings (9790) – A niche but growing software and IT services provider.

Each of these companies operates in different sectors but shares strong fundamentals and growth prospects. Let’s explore why they deserve a spot on your investment radar.

Why Japan? The Case for Japanese Stocks

💡 Invest in companies you believe in - W. Buffett

While global investors often focus on U.S. tech or emerging markets, Japan offers a unique blend of stability, innovation, and value. The country’s corporate reforms, weak yen (boosting exports), and high corporate cash reserves make its stocks increasingly attractive.

Warren Buffett’s growing bets—through Berkshire Hathaway’s investments in trading houses like Mitsubishi and Itochu—signal confidence in Japan’s market revival. Add in sectors like automation, healthcare tech, and infrastructure, and Japanese equities present both defensive resilience and growth potential.

Now may be the time to look beyond the usual suspects—and these three stocks could be a smart starting point.

#1 Yokogawa Bridge Holdings Corp (TSE: 5911)

Yokogawa Bridge Holdings Corp (TSE: 5911) is a pioneering Japanese engineering firm specializing in large-scale steel structures and infrastructure projects. With over a century of expertise since its founding in 1907, the company has established itself as a leader in designing and constructing some of Japan's most iconic bridges, towers and stadiums.

What sets Yokogawa Bridge apart is its combination of traditional craftsmanship and cutting-edge engineering solutions. The company has been involved in landmark projects including:

The record-breaking Akashi Kaikyo Bridge (world's longest suspension bridge)

The innovative Tokyo Skytree's steel framework

The earthquake-resistant roof structure for Japan National Stadium

Advanced cable-stayed bridges like Kurushima-Kaikyo Bridge

Beyond construction, Yokogawa Bridge has developed proprietary 3D modeling software and drone monitoring systems, positioning itself at the forefront of construction technology. The company's ability to handle complex steel structures in Japan's challenging seismic environment has made it a preferred partner for technically demanding infrastructure projects.

With Japan's ongoing infrastructure renewal and global demand for resilient bridges, Yokogawa Bridge's specialized expertise continues to be in high demand, making it a unique player in the construction sector.

Company History

Founded in 1907 as Yokogawa Steel Works, Yokogawa Bridge Holdings Corp began as a specialist in steel fabrication during Japan's rapid industrialization period. The company established its reputation in the 1930s by constructing some of Japan's first large-scale steel bridges, showcasing innovative techniques that would become industry standards.

A major turning point came in the postwar reconstruction era, when Yokogawa Bridge played a pivotal role in rebuilding Japan's infrastructure network. The company expanded its capabilities throughout the latter 20th century, undertaking increasingly complex projects like the iconic Rainbow Bridge (completed 1993) in Tokyo Bay.

Its crowning achievement came in 1998 with completion of the Akashi Kaikyo Bridge, then the world's longest suspension bridge, cementing Yokogawa's position as Japan's premier bridge engineering firm. In the 21st century, the company has diversified into seismic-resistant architecture and smart construction technologies while maintaining its core bridge business, evolving into a comprehensive infrastructure solutions provider listed on the Tokyo Stock Exchange's First Section.

Why Invest in Yokogawa Bridge Holdings Corp?

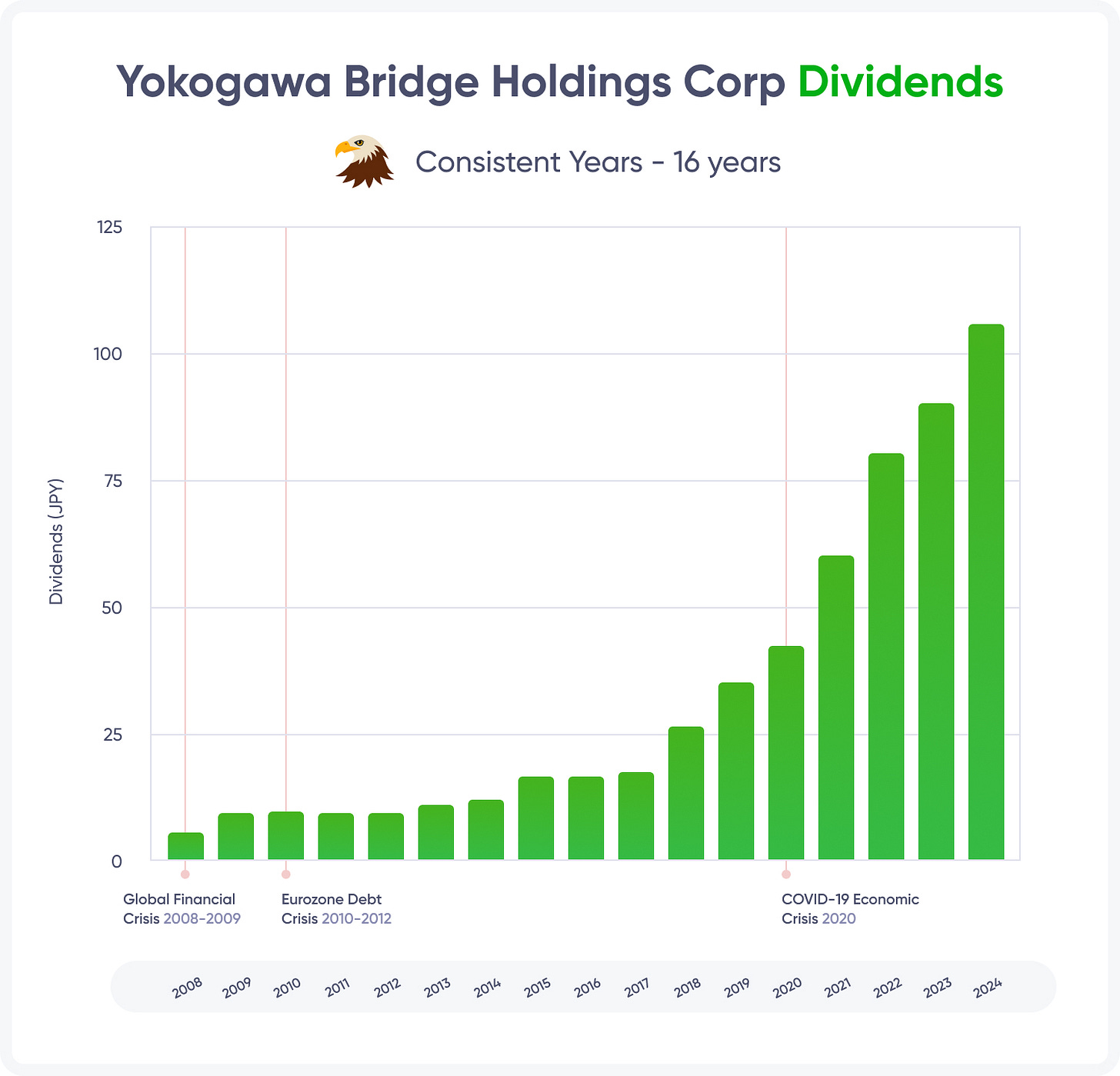

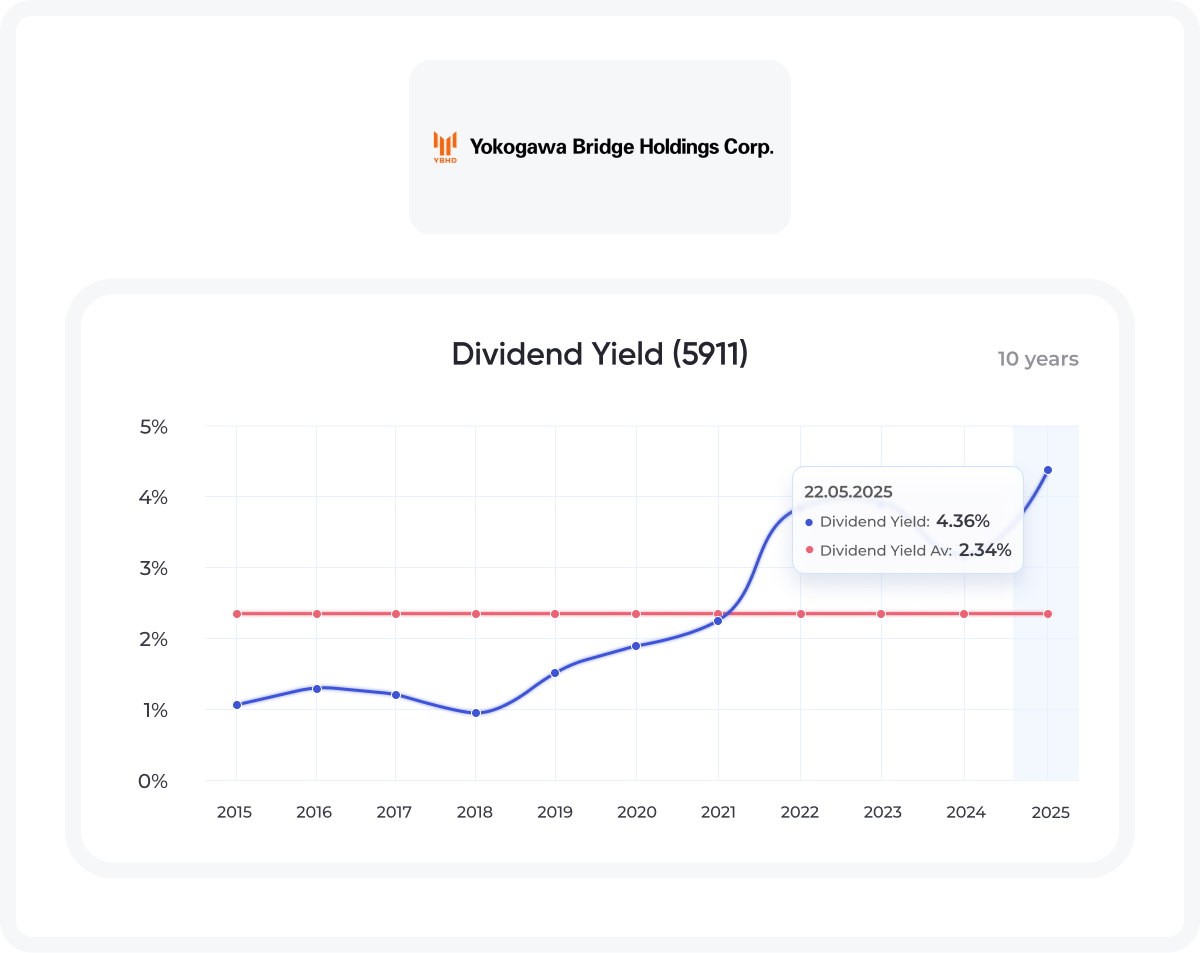

Yokogawa Bridge Holdings presents an attractive investment opportunity for income-focused investors, boasting an impressive 8 consecutive years of dividend growth and 15+ years of consistent payouts without reduction with a current yield of approximately 4.2% - significantly higher than the Japanese market average.

The company maintains a stable payout ratio of around 50%, demonstrating its commitment to shareholder returns while retaining sufficient capital for growth. With ¥50 billion in cash reserves and consistent operating cash flows averaging ¥15 billion annually over the past five years, Yokogawa Bridge has demonstrated its ability to sustain and potentially increase dividends even during market downturns.

The MaxDividends Top Stocks List features ~100 of the most reliable dividend companies in the U.S. market, each with 15+ years of consecutive dividend increases. These stocks are carefully selected based on MaxDividends' strict criteria for consistency and reliability.

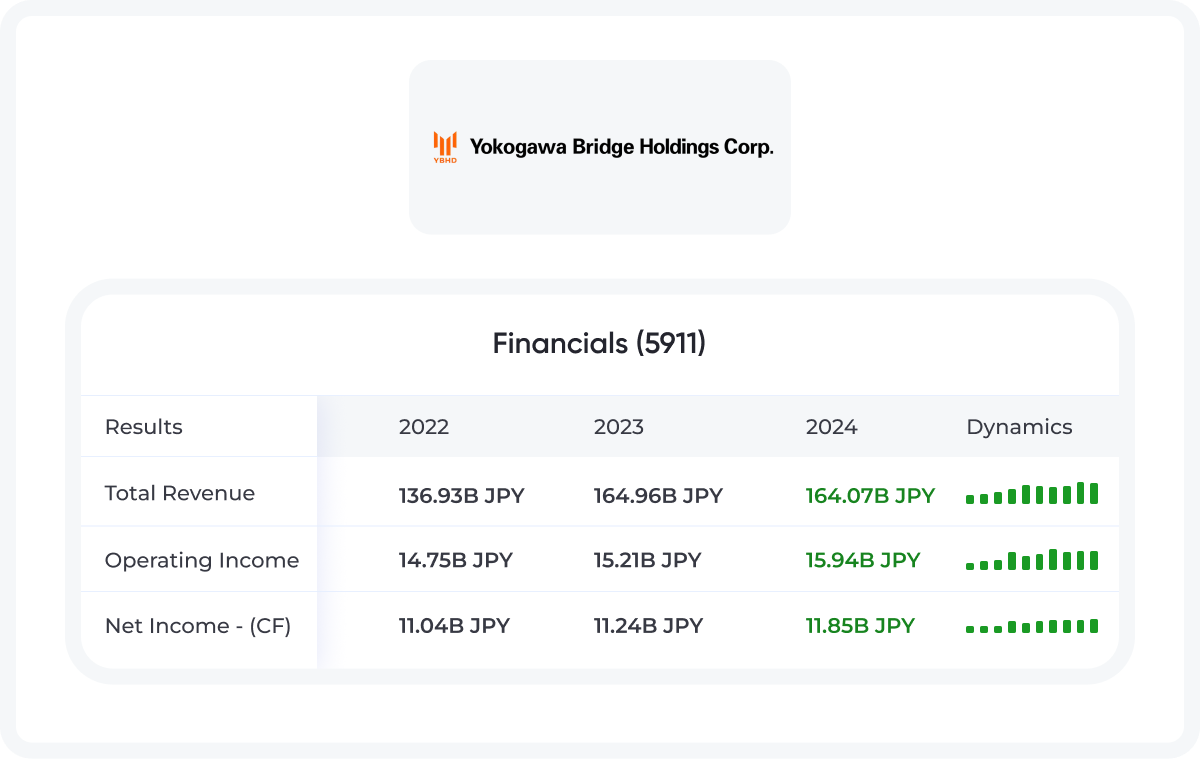

How do the Financials Stack Up?

Here is a quick dive into Yokogawa Bridge Holdings over last 3 years

Growth Prospects

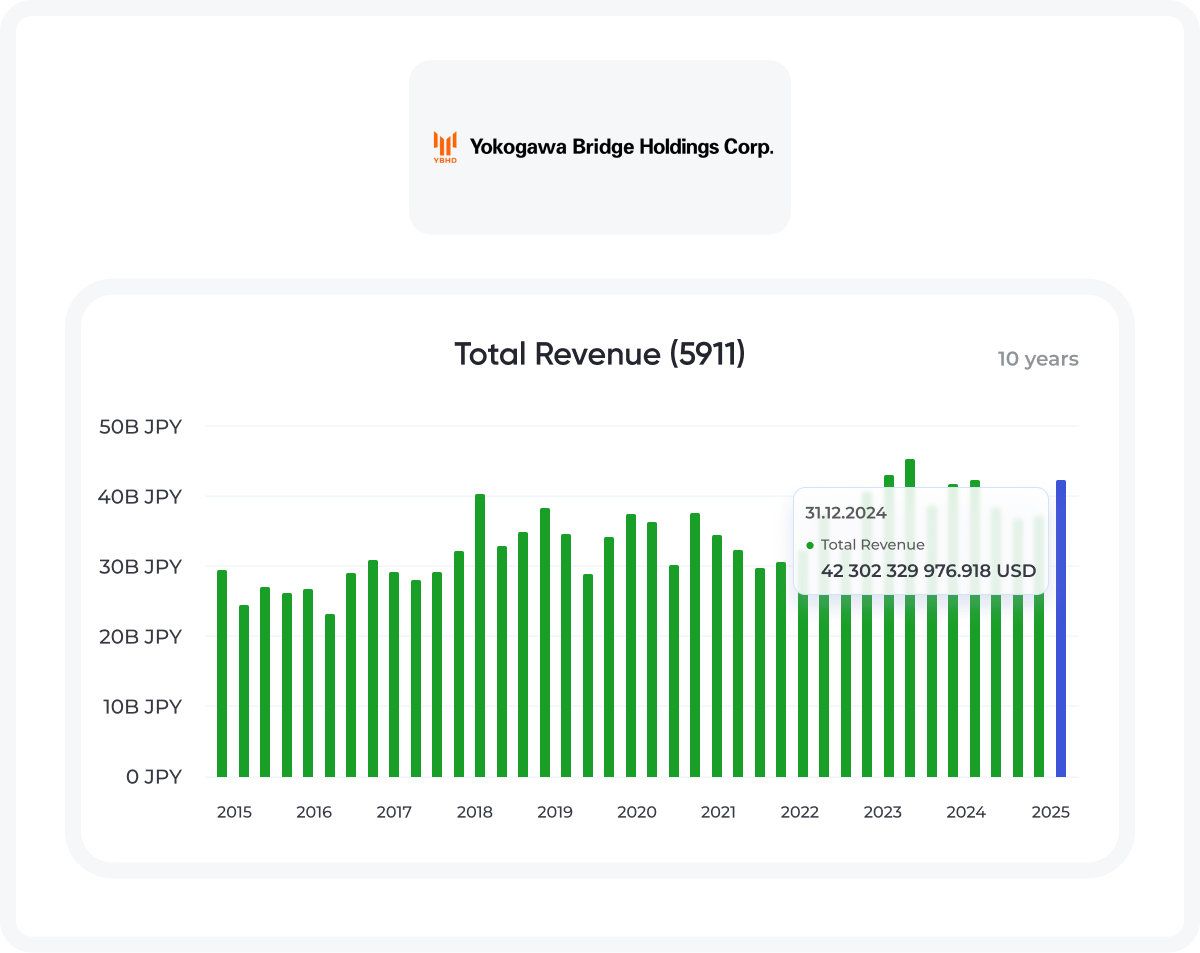

Yokogawa Bridge Holdings Corp (TSE: 5911) is well-positioned for steady growth, driven by Japan’s aging infrastructure needs and increasing demand for seismic-resistant construction.

The company’s maintenance and retrofitting business, which accounts for ~30% of bridge segment revenue, provides stable, recurring income as Japan prioritizes upgrades to existing structures.

Meanwhile, its engineering segment—focused on industrial facilities, ports, and offshore structures—is the primary growth driver, leveraging bridge technology for complex projects like pillar-free factories and movable building systems.

Overseas opportunities, particularly in Southeast Asia and Africa through ODA-funded projects (e.g., the Nile River Bridge in South Sudan), offer additional expansion potential, though geopolitical risks remain.

Technological investments in 3D modeling software and drone-based monitoring could further enhance efficiency and margins, while Japan’s push for infrastructure digitization aligns with Yokogawa’s expertise.

Analysts project modest revenue growth (~3–5% annually), with upside from government stimulus and disaster-resilient construction demand post-earthquakes. However, reliance on domestic public works and cyclical new-bridge contracts may cap near-term acceleration.

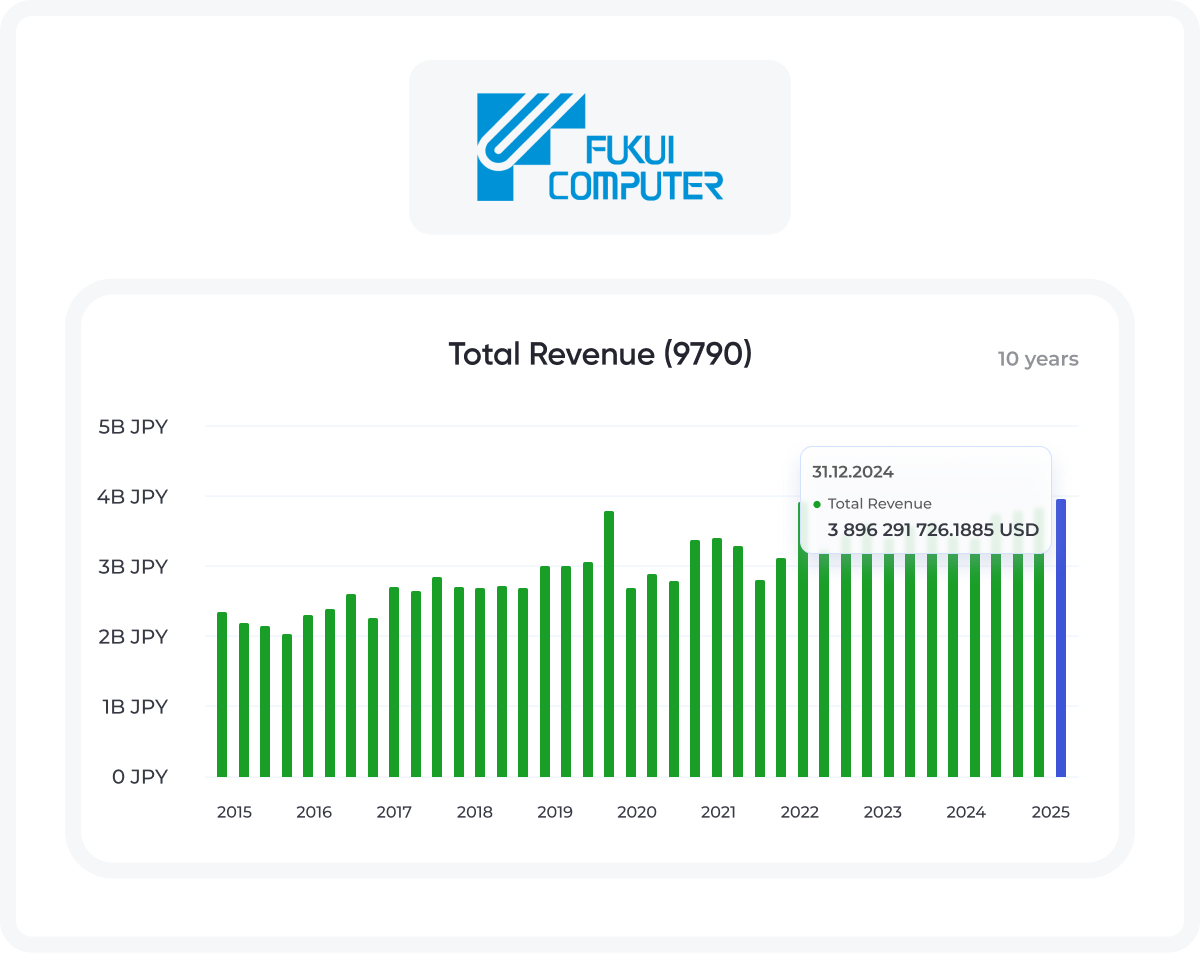

#2 Fukui Computer Holdings Inc (TSE: 9790)

Fukui Computer Holdings Inc (TSE: 9790) is a niche Japanese IT powerhouse specializing in customized enterprise software solutions, including ERP systems, healthcare IT platforms, and industrial IoT applications.

Founded in 1983 in Fukui Prefecture, the company has carved out a unique position by combining deep industry expertise with cutting-edge AI and cloud technologies.

Key Innovations and Signature Projects:

Smart Hospital Platform: Developed Japan's first integrated hospital management system with AI-powered diagnostic support, now deployed in 120+ medical institutions

Industrial IoT Solutions: Created proprietary monitoring systems for Toyota/Panasonic factories, reducing equipment downtime by 30% through predictive maintenance

Fukui Cloud ERP: Next-generation business management platform featuring AI-driven demand forecasting for SMEs

Smart City Infrastructure: Designed Fukui Prefecture's municipal digitalization system, including energy-saving sensor networks

The company stands out for its 25% operating margins and consistent growth in Japan's underserved regional IT markets. Its stock trades at a reasonable P/E of 14.7x (vs industry 16.3x), offering value given its 15% annual revenue growth in core segments.

Company History

Founded in 1983 as a local software vendor in Fukui Prefecture, Fukui Computer Holdings began by developing customized accounting systems for regional manufacturers.

The company's breakthrough came in 1995 with its first hospital information system, revolutionizing medical record-keeping in rural clinics. A pivotal 2002 partnership with Toyota transformed the business, as its factory monitoring software became the industry standard for lean manufacturing in central Japan.

The 2010s marked strategic expansion:

2014: Launched Japan's first cloud-based ERP for SMEs

2016: Developed AI diagnostic support for Fukui Medical University

2019: Established smart city division after winning Fukui Prefecture's "Digital Transformation Master Plan" contract

2021: Listed on Tokyo Stock Exchange (from JASDAQ), with 30% revenue growth year-on-year

Today, while maintaining its regional roots, the company's IoT solutions are used by 15% of Japanese manufacturers, and its medical AI assists 8,000+ physicians daily.

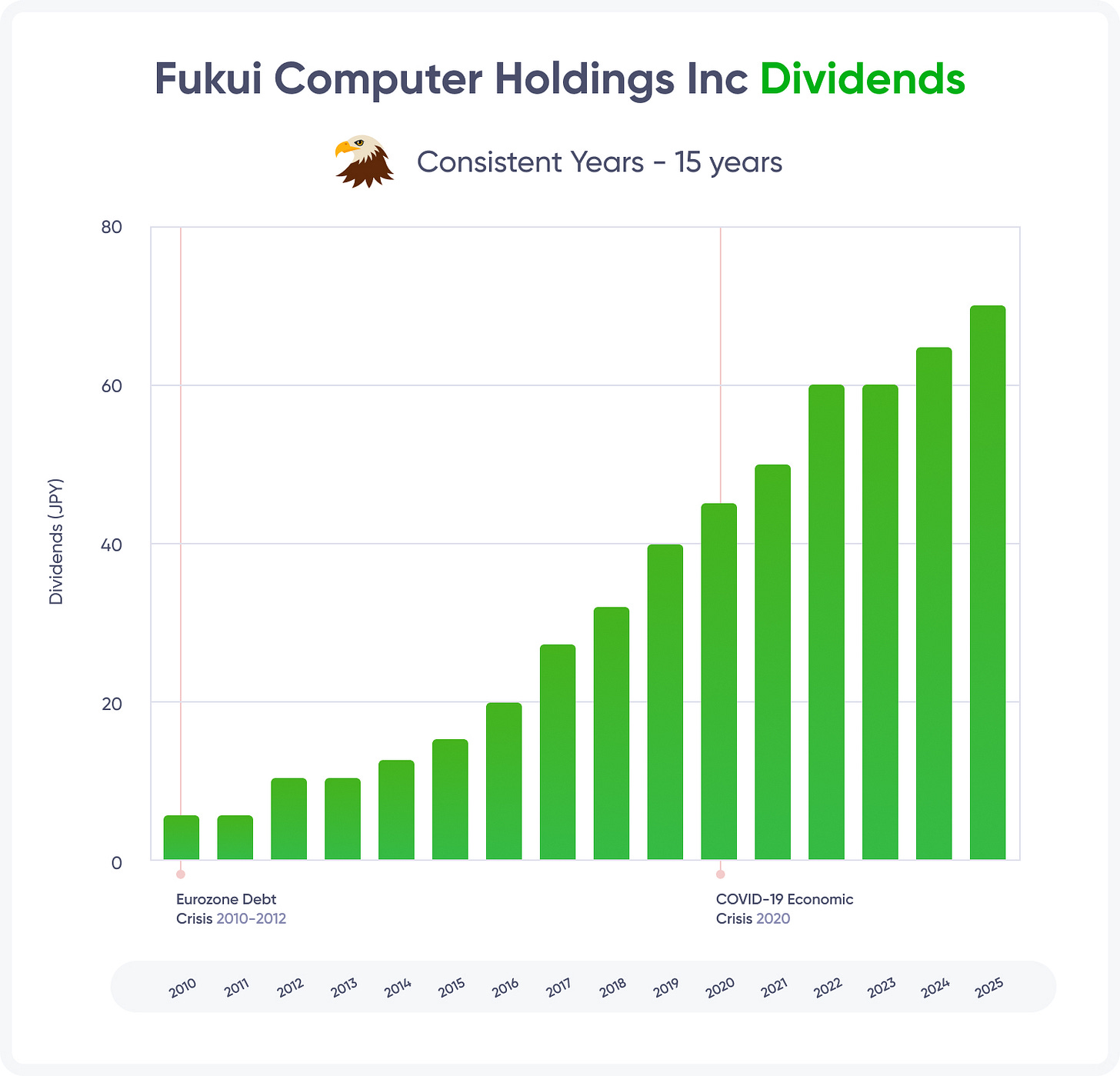

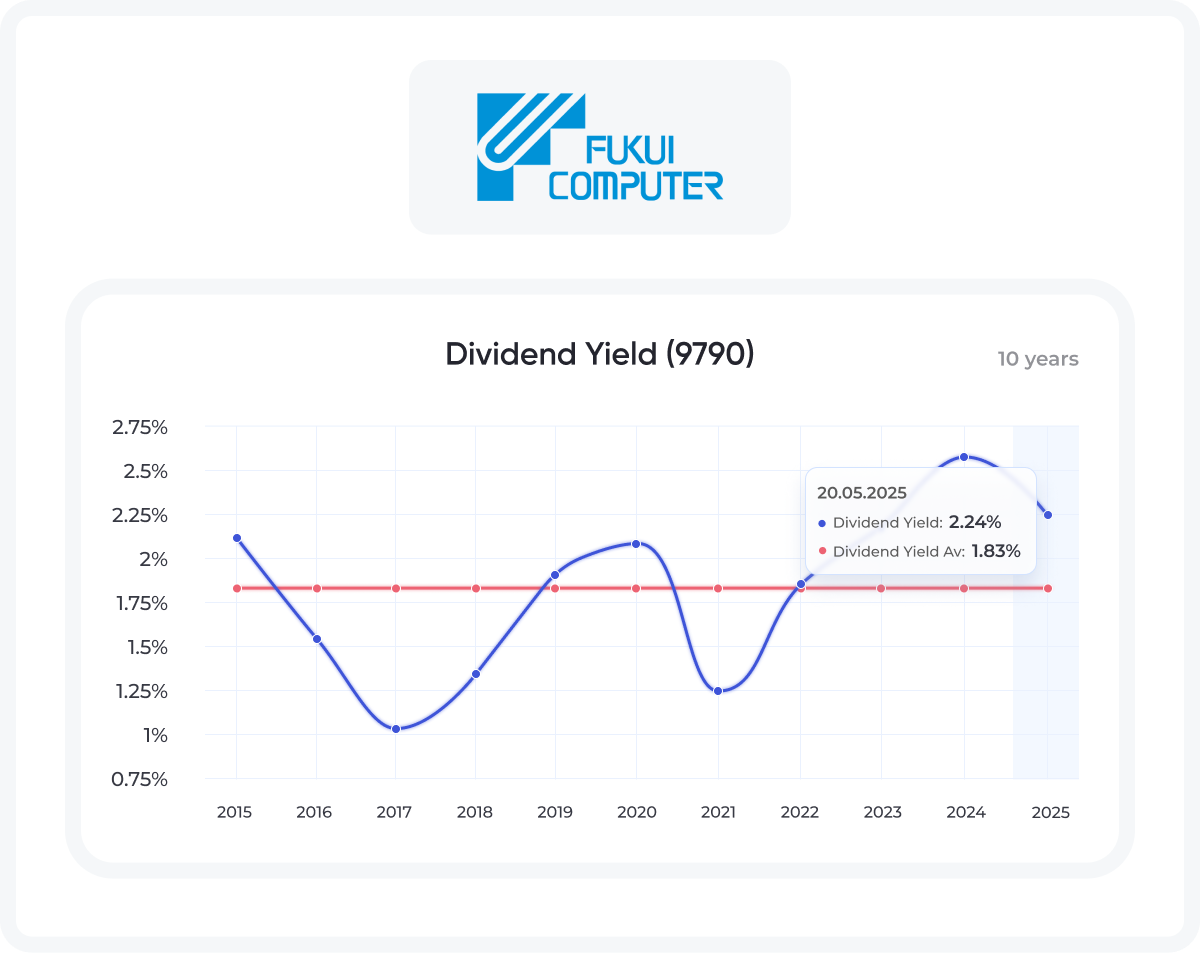

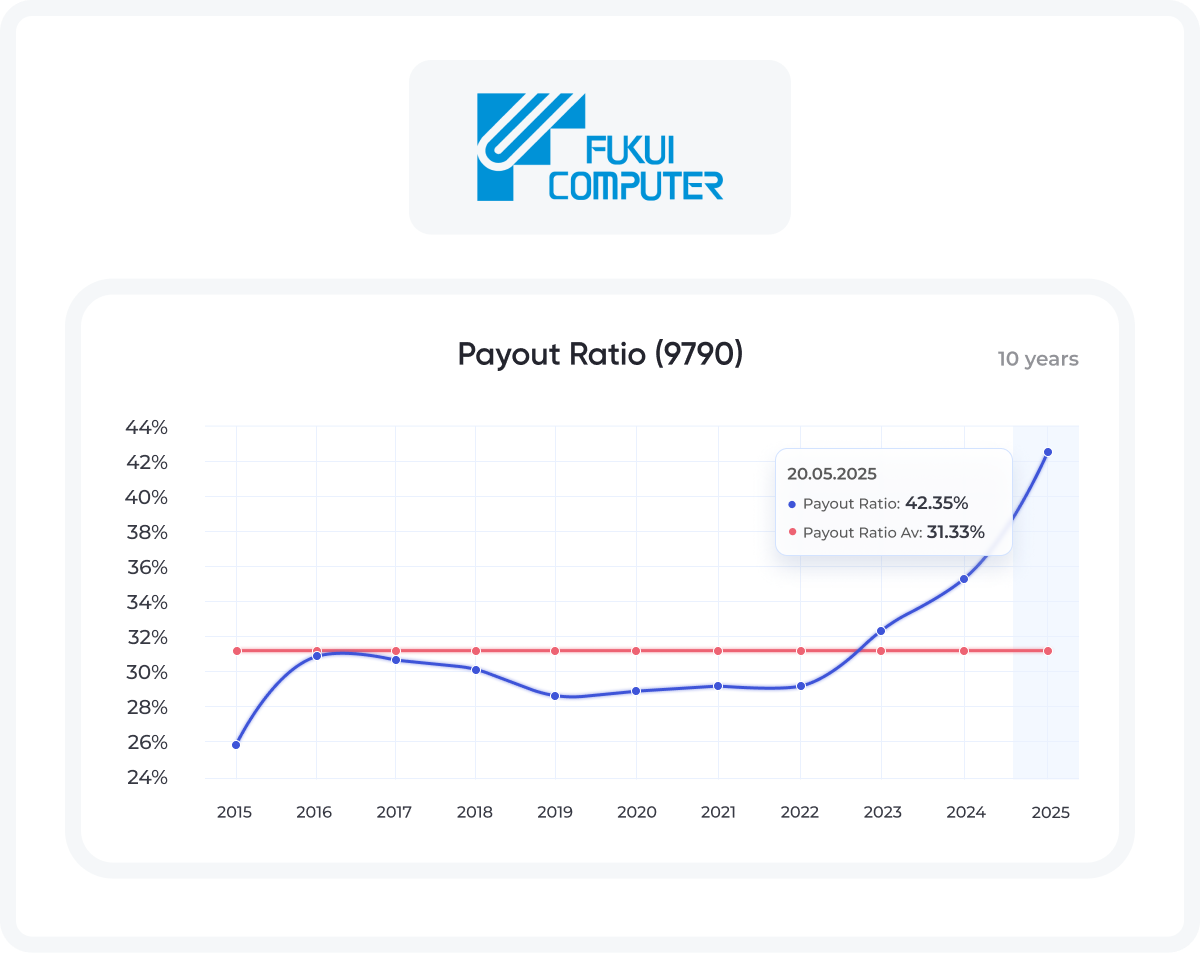

Why Invest in Fukui Computer Holdings Inc?

Fukui Computer (9790) offers rare exposure to Japan's growing niche IT sector with three compelling advantages: 1) Recurring revenue from mission-critical systems (70% of income from maintenance/upgrades), 2) AI leadership in healthcare/industrial IoT with 40+ patents, and 3) Regional monopoly as Fukui Prefecture's dominant IT provider now expanding nationwide.

The stock trades at just 14x P/E (below software peers at 25x) despite:

20%+ annual growth in cloud ERP/SME solutions

30% margins in high-demand medical AI tools

$50M+ cash reserves for strategic acquisitions

With Japan's push for regional digitalization and smart factories, Fukui's specialized expertise positions it for sustained 15-20% growth. Recent wins in Tokyo hospitals signal successful national expansion.

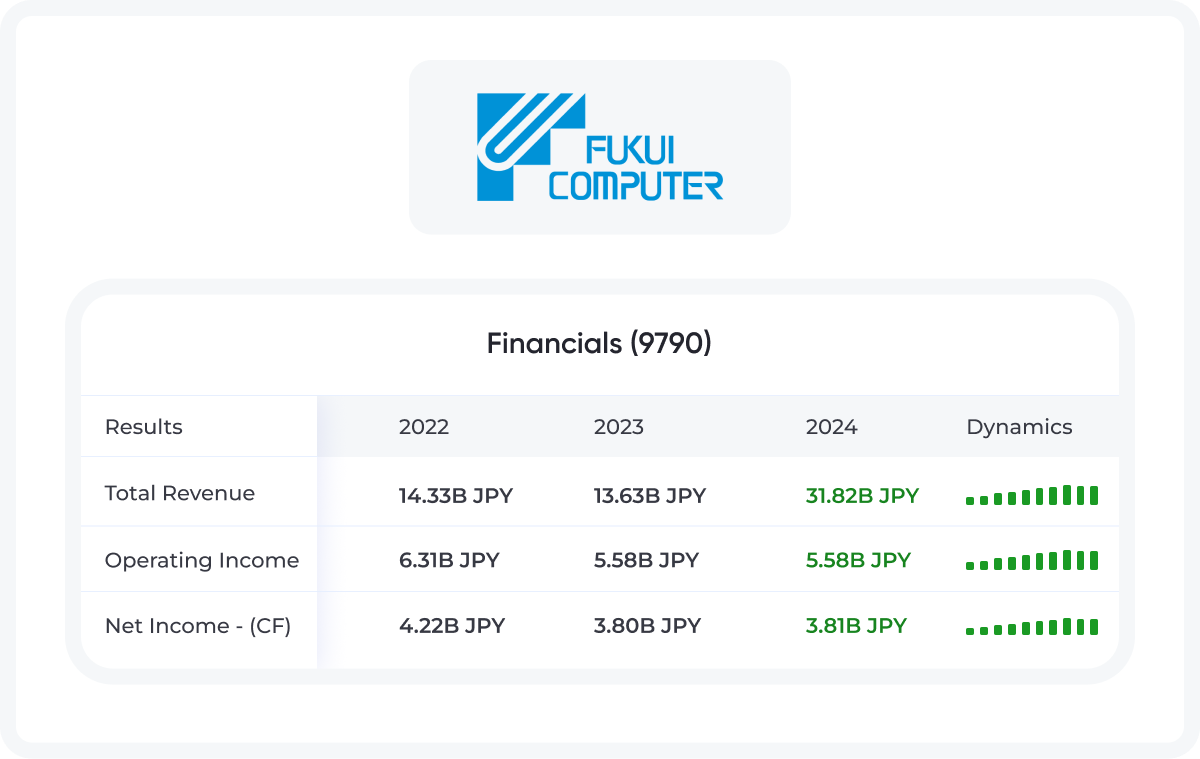

Financial Statement

Here is a quick dive into Fukui Computer over last 3 years

Growth Prospects

Fukui Computer Holdings is poised for accelerated growth as Japan's digital transformation wave reaches regional markets. The company's Smart Factory Solutions division is projected to grow 25% annually through 2025, driven by demand from mid-sized manufacturers adopting IoT (30% penetration gap remains).

Its Healthcare AI platform is expanding to 300+ hospitals nationwide under Japan's "AI-First" medical policy, representing a ¥15B opportunity.

New growth engines include:

5G-enabled Edge Computing for real-time factory analytics (pilot with NTT Docomo)

AI-as-a-Service for regional banks' credit risk assessment

Government DX Contracts (targeting 20+ prefectures by 2026)

With ¥8B allocated for R&D (20% of revenues) and partnerships with Tokyo University's AI lab, Fukui is transitioning from regional player to national tech contender. Analysts forecast 3-year revenue CAGR of 18-22%, with operating margins expanding to 28-30% as cloud solutions gain scale.

Final Thoughts

These two companies represent distinct yet complementary ways to capitalize on Japan's economic evolution:

Yokogawa Bridge (5911) offers stability through Japan's infrastructure renewal cycle, with unmatched expertise in seismic-resistant construction.

Fukui Computer (9790) provides hidden value as a regional tech champion scaling nationally with specialized IoT/AI solutions.

Together, they form a balanced exposure to:

Government-backed spending (infrastructure/DX)

Productivity solutions (smart factories/cloud)

While Buffett focuses on trading houses, these underfollowed innovators offer potentially greater upside with reasonable valuations. Yokogawa for dividends, Fukui for turnaround potential - together, they make a compelling Japanese equity duo.

Investor Takeaway: Consider weighting based on risk profile, but both deserve a look for Japan-focused portfolios.

To your wealth, MaxDividends Team

More Dividend Ideas

Scroll Down to Read. Don’t have access? Check Your Paid Status & Upgrade to Premium.

Don’t have access? Check Your Paid Status & Upgrade to Premium.

⭐️ ⭐️⭐️⭐️⭐️

MaxDividends is a Bestseller on Substack!

Hundreds of premium members have already discovered the benefits of the community and app, earning passive income through dividends with MaxDividends. Their passive income keeps growing!

We Are Already Recommended by Our Community

Russell - "Want to get caught up with your portfolio so far and follow along until we can all retire. "

Todd - "Just found this site --excited to get started!"

Vinny - "Helping retail investors retire early and comfortably "

And Many Others

“You are serious and trustwhorty”

“Developing an additional source of retirement income.”

Thought I would share - I was able to create an Ultra High Dividend portfolio w/15 companies today that would net me a $4,200+/month income. I just retired this month and have a current income of $10,230/mo., will be $12,500/mo. in '27 so another $4200/mo. would be nice! Love the app, had a lot of fun creating a portfolio today!

Thanks for all the hard work putting the MaxDividends! You guys have done all the heavy lifting.

And 230+ Financial Bloggers on Substack

Trusted by 55,000+ subscribers. Followed by 48,000+ dedicated readers

Alessandro MacroMornings ⭐️⭐️⭐️⭐️⭐️

“A useful substack for those that invest in stocks that pay dividends or are looking to get into such a strategy. Includes education and actionable ideas.

The European Value Investor ⭐️⭐️⭐️⭐️⭐️

“If you are interested in dividend strategies or passive income strategies, this Substack ia great! Its worth a visit“

The Long View ⭐️⭐️⭐️⭐️⭐️

“Practical dividend focus. Saving for retirement.“

The Astute Investor’s Calculus ⭐️⭐️⭐️⭐️⭐️

“Love the concept and the execution. If you are into building a portfolio that will generate ever growing income for you, subscribe to Max Dividends. I did.

Panic Drop ⭐️⭐️⭐️⭐️⭐️

“Great for helling you pick up high-yield dividend growth stocks“

We’re in the Top 3 Financial Blogs on Substack! 💪

MaxDividends continues to be recognized for its consistent effort, commitment to quality, and the loyalty of its growing community of partners.

If you have any questions, feel free to email me at: maxdividends@beatmarket.com

FAQ

I ❤️ Dividends: Why I Believe Dividend Investing Is the Best Strategy | PDF Book

How Effective is the MaxDividends Strategy for Building Growing Passive Income

Someone's sitting in the shade today because someone planted a tree a long time ago. ― Warren Buffett.